- What is a Car Insurance Card?

- Obtaining a Car Insurance Card

- Importance of Car Insurance Cards

- Car Insurance Card vs. Proof of Insurance

- Digital Car Insurance Cards

- Car Insurance Card Updates and Renewals

- Common Car Insurance Card Misconceptions

- Car Insurance Card Security Features

- Summary

- Detailed FAQs

Car insurance card, a small but crucial piece of paper, is your ticket to peace of mind on the road. It’s a compact document that holds vital information about your insurance policy, proving your financial responsibility as a driver. This simple card acts as a lifeline in case of an accident, traffic stop, or any unforeseen event, ensuring you’re protected from potential legal and financial burdens.

Understanding the importance of a car insurance card is paramount for every driver. It’s more than just a piece of paper; it’s a legal requirement, a safety net, and a testament to your commitment to responsible driving. This guide will delve into the intricacies of car insurance cards, exploring their purpose, acquisition, significance, and the crucial role they play in safeguarding you on the road.

What is a Car Insurance Card?

A car insurance card is a small, wallet-sized document that provides proof of your vehicle’s insurance coverage. It’s a crucial piece of paper that you must always carry with you while driving.

Purpose of a Car Insurance Card

The primary purpose of a car insurance card is to serve as immediate proof of insurance coverage. It allows law enforcement officers, insurance adjusters, or other officials to quickly verify that your vehicle is insured in case of an accident or traffic stop.

Essential Information on a Car Insurance Card

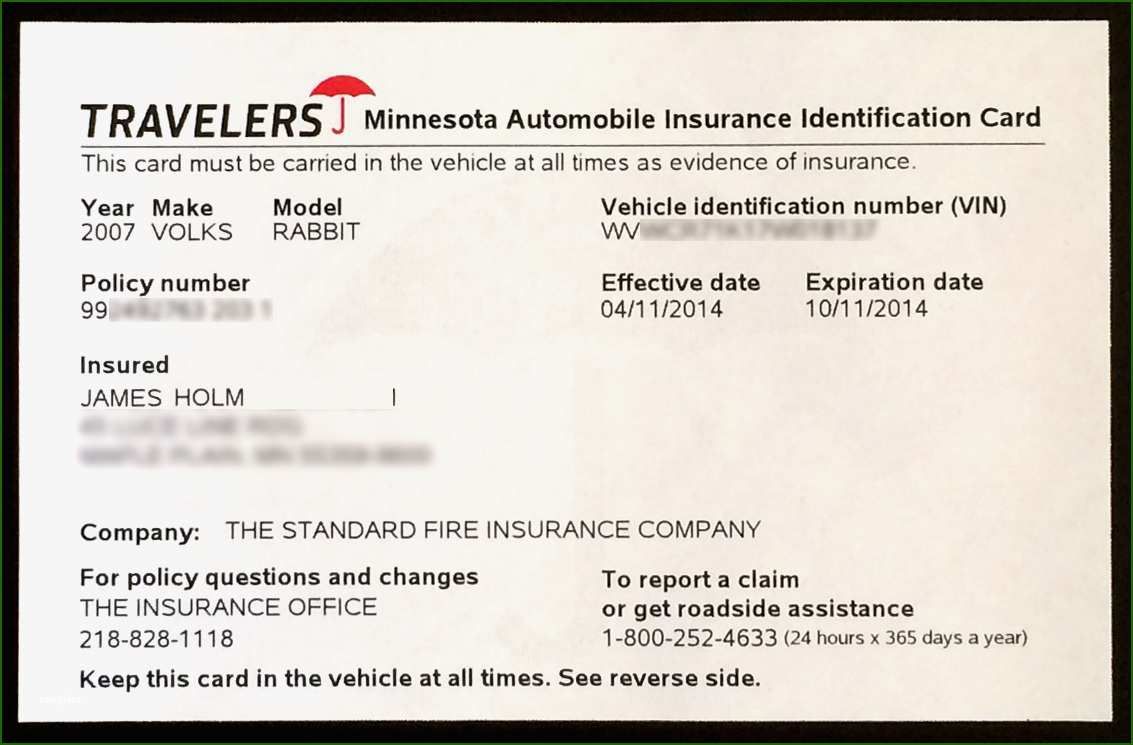

A standard car insurance card typically contains the following essential information:

- Policyholder’s Name: The name of the person or entity who owns the insurance policy.

- Policy Number: A unique identifier for your insurance policy.

- Vehicle Identification Number (VIN): A 17-character code that uniquely identifies your vehicle.

- Insurance Company Name and Contact Information: The name of the insurance company and their contact details, including phone number and address.

- Effective Dates of Coverage: The start and end dates of your insurance policy.

- Type of Coverage: The specific types of coverage included in your policy, such as liability, collision, comprehensive, and uninsured motorist coverage.

- Policy Limits: The maximum amount of money your insurance company will pay for covered losses.

Legal Requirements for Carrying a Car Insurance Card

Most states and jurisdictions have laws requiring drivers to carry proof of insurance while operating a vehicle. This proof can be in the form of a car insurance card, a digital copy on your phone, or another official document issued by your insurance company. Failure to carry proof of insurance can result in fines, penalties, or even suspension of your driver’s license.

Obtaining a Car Insurance Card

After purchasing car insurance, you’ll receive a car insurance card, a vital document that proves you have insurance coverage. This card acts as your proof of insurance, which you must carry in your vehicle at all times.

Methods for Obtaining a Car Insurance Card

The method of receiving your car insurance card depends on your insurance provider and your preferences. Here are common ways to obtain your card:

- Digital Delivery: Many insurance companies offer digital car insurance cards that can be accessed through their mobile app or online portal. These digital cards are convenient and readily available on your phone.

- Physical Mailing: Some insurance companies still send physical car insurance cards by mail. This option may take a few days to arrive, depending on your location and the postal service’s efficiency.

Potential Delays or Issues

While obtaining a car insurance card is usually straightforward, certain situations can cause delays or issues:

- Incorrect Information: If your contact information is incorrect, the insurance company might not be able to reach you to deliver your card.

- Technical Issues: Digital delivery systems can sometimes experience glitches or outages, delaying the delivery of your card.

- Mail Delays: Physical cards mailed through the postal service can be delayed due to weather conditions, holiday seasons, or other unforeseen circumstances.

Importance of Car Insurance Cards

Your car insurance card is more than just a piece of paper; it’s a vital document that can safeguard you in various situations. It serves as proof of your insurance coverage, which is essential for legal compliance and protection in case of an accident or traffic stop.

Protecting Drivers from Legal Liabilities

A car insurance card acts as a crucial piece of evidence in the event of an accident. It demonstrates that you have the necessary insurance coverage to cover potential damages or injuries. This can significantly reduce your legal liabilities and prevent costly lawsuits.

- For instance, if you’re involved in an accident, the other driver or their insurance company will likely request your insurance card. This allows them to verify your coverage and initiate the claims process.

- If you don’t have valid insurance, you could face severe consequences, including fines, license suspension, or even imprisonment.

Car Insurance Card vs. Proof of Insurance

A car insurance card is a handy tool for quick verification of your insurance coverage, but it’s not the only way to prove you’re insured. Understanding the difference between a car insurance card and other forms of proof of insurance is crucial for navigating various situations.

Validity and Acceptance of Different Proof of Insurance Options

The validity and acceptance of different proof of insurance options vary depending on the situation. For example, a car insurance card might be sufficient for a routine traffic stop, but a more comprehensive document might be required in case of an accident or when registering your vehicle.

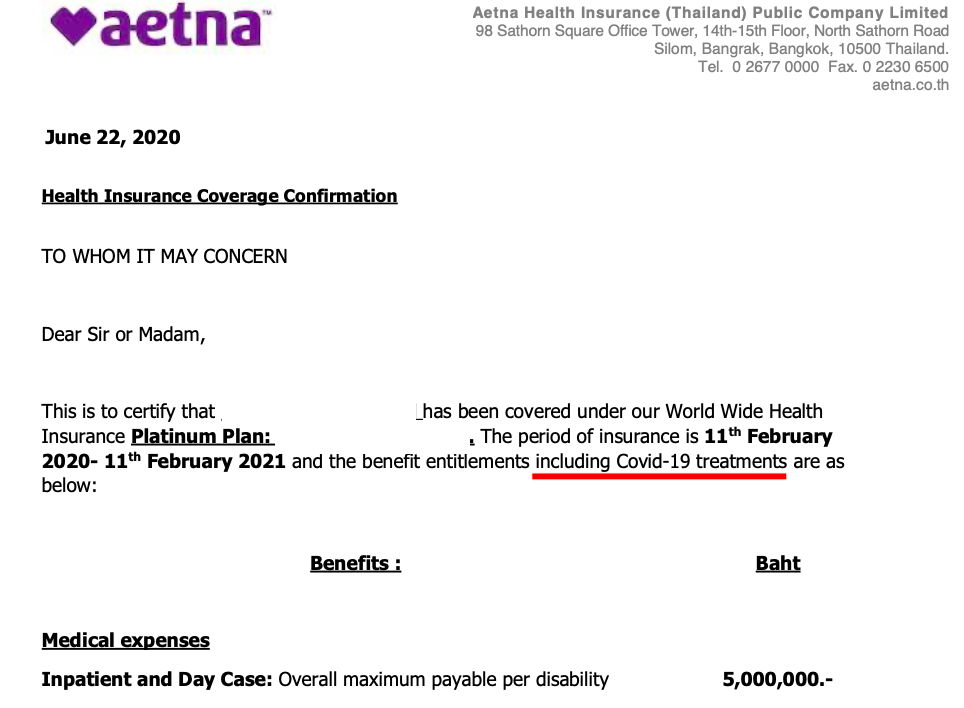

- Car Insurance Card: This card, often referred to as an insurance ID card, is a small, convenient document that provides basic information about your insurance policy. It typically includes your name, policy number, coverage limits, and the insurance company’s contact details. While widely accepted, it’s important to remember that a car insurance card may not be sufficient in all situations.

- Insurance Policy Declarations Page: This document, also known as a policy summary, provides a detailed overview of your insurance policy. It includes all the key information, such as coverage details, premium amounts, and effective dates. This document is more comprehensive than a car insurance card and is often required for vehicle registration or insurance-related transactions.

- Electronic Proof of Insurance: Many insurance companies offer electronic proof of insurance options, allowing you to access and display your insurance information on your smartphone or tablet. This digital format is becoming increasingly common and is often accepted as valid proof of insurance. It offers convenience and portability, allowing you to readily access your insurance information anytime, anywhere.

Situations Where a Car Insurance Card Might Be Insufficient

While a car insurance card can be useful for quick verification, it may not be sufficient in certain situations. For instance, it may not be accepted as proof of insurance during a serious accident or when registering your vehicle.

- Accident Scene: In case of an accident, law enforcement officials or insurance adjusters might require more comprehensive proof of insurance than a car insurance card. A policy declarations page or electronic proof of insurance might be necessary to provide all the required details about your coverage.

- Vehicle Registration: When registering your vehicle, many states require proof of insurance that goes beyond a simple car insurance card. A policy declarations page or electronic proof of insurance is often required to demonstrate that you have the necessary coverage for the vehicle.

- Insurance-Related Transactions: For certain insurance-related transactions, such as making a claim or requesting a policy change, you might need to provide a more detailed proof of insurance than a car insurance card. A policy declarations page or electronic proof of insurance can provide the necessary information for these transactions.

Digital Car Insurance Cards

In today’s digital age, paper-based documents are becoming increasingly obsolete, and car insurance cards are no exception. Digital car insurance cards offer a convenient and secure alternative to traditional paper cards, providing numerous benefits for both drivers and insurance companies.

Benefits of Digital Car Insurance Cards

Digital car insurance cards offer several advantages over their physical counterparts, making them a more practical and efficient option for modern drivers.

- Convenience: Digital car insurance cards are easily accessible on your smartphone or tablet, eliminating the need to carry a physical card in your wallet. You can access your insurance information anytime, anywhere, as long as you have an internet connection.

- Environmentally Friendly: By eliminating the need for paper cards, digital car insurance cards contribute to a more sustainable environment by reducing paper consumption and waste.

- Security: Digital car insurance cards can be secured with passwords, PINs, or biometric authentication, making them more difficult to counterfeit or misuse than physical cards.

- Updates and Notifications: Digital car insurance cards can be updated in real-time, ensuring that you always have the latest information about your coverage. You can also receive notifications about policy changes, renewals, and other important information directly on your device.

Security and Reliability of Digital Car Insurance Card Applications

The security and reliability of digital car insurance card applications are crucial for ensuring the integrity and trustworthiness of the information they provide.

- Data Encryption: Reputable digital car insurance card applications employ strong encryption protocols to protect your sensitive insurance information from unauthorized access. This ensures that your data is secure during transmission and storage.

- Two-Factor Authentication: Many applications implement two-factor authentication, requiring you to enter a code sent to your phone or email in addition to your password, providing an extra layer of security.

- Compliance with Industry Standards: Digital car insurance card applications should comply with industry standards and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), to ensure the security and integrity of your data.

- Regular Security Audits: Reputable app developers conduct regular security audits to identify and address potential vulnerabilities, ensuring the ongoing security of the application and your data.

Accessing and Presenting a Digital Car Insurance Card

Presenting a digital car insurance card is simple and straightforward, and most applications offer various ways to display your information.

- Direct Access: Most applications allow you to access your digital car insurance card directly within the app, providing a clear and readily available view of your insurance information.

- Shareable Links: Some applications provide shareable links that can be sent to law enforcement or other authorities, allowing them to quickly access your insurance information.

- Digital Wallet Integration: Many applications integrate with digital wallets, such as Apple Pay or Google Pay, allowing you to store and present your digital car insurance card directly within your wallet app.

- Printing: Some applications offer the option to print a physical copy of your digital car insurance card, which can be useful for situations where electronic access is not available.

Car Insurance Card Updates and Renewals

Your car insurance card is a vital document that reflects the current status of your insurance policy. Changes to your policy, such as vehicle ownership, address, or coverage details, require updates to your insurance card. Keeping your car insurance card up-to-date ensures you have the proper coverage in case of an accident or other incident.

Updating Car Insurance Cards

When you make changes to your car insurance policy, you must update your car insurance card to reflect these changes. This is essential to ensure you have the correct coverage information.

Here are the steps involved in updating your car insurance card:

- Contact your insurance company: Inform your insurance company about the changes you’ve made to your policy. This could include adding a new driver, changing your address, or modifying your coverage.

- Request a new car insurance card: Once you’ve informed your insurance company, request a new car insurance card with the updated information. You can usually do this online, by phone, or through your insurance agent.

- Receive and keep the updated card: Your insurance company will mail you a new car insurance card with the updated information. Make sure to keep this card in your vehicle at all times.

Importance of Keeping Car Insurance Cards Current

Maintaining a current car insurance card is crucial for several reasons:

- Legal compliance: In most jurisdictions, it’s mandatory to carry proof of insurance while driving. An outdated card can result in fines and penalties.

- Accident claims: If you’re involved in an accident, having a current car insurance card will help you file a claim smoothly. It ensures your coverage details are accurate and valid.

- Peace of mind: Knowing that your car insurance card is up-to-date provides peace of mind, knowing you’re adequately covered in case of an accident or other incident.

Renewing Car Insurance Cards

When your car insurance policy expires, you’ll need to renew it. This usually involves a renewal process where you pay your premium and update any necessary information. Your insurance company will then issue a new car insurance card with the renewed policy details.

Here are some steps involved in renewing your car insurance card:

- Review your policy: Before renewing, carefully review your existing policy to ensure it still meets your needs. Consider any changes to your driving habits, vehicle usage, or coverage requirements.

- Contact your insurance company: Contact your insurance company to discuss renewal options. They can provide you with a quote for your renewed policy.

- Make payment: Pay your premium for the renewed policy. You can usually do this online, by phone, or through your insurance agent.

- Receive your new car insurance card: Your insurance company will send you a new car insurance card with the renewed policy details.

Common Car Insurance Card Misconceptions

Car insurance cards are essential documents for drivers, but misconceptions about them can lead to confusion and potential legal issues. It’s crucial to understand the truth behind these common myths to ensure you’re properly protected on the road.

The Card Is Your Proof of Insurance

It’s a common misconception that the car insurance card itself is proof of insurance. While it’s a handy reminder of your coverage details, it’s not a legal document that guarantees your insurance is active. The actual proof of insurance is the policy document issued by your insurance company. This document contains all the vital details of your coverage, including policy number, coverage limits, and effective dates. Always carry a copy of your policy document with you, as it provides the official evidence of your insurance.

The Card Covers All Your Vehicles, Car insurance card

If you own multiple vehicles, you might assume that a single insurance card covers all of them. This is incorrect. Each vehicle should have its own separate insurance card, reflecting its specific coverage details. It’s important to ensure that every vehicle you drive has its own valid insurance card, as you could face legal consequences if you’re stopped by law enforcement and can’t present a card for each vehicle.

You Only Need the Card If You’re in an Accident

Many drivers believe they only need their car insurance card if they’re involved in an accident. This is not entirely true. While it’s essential to have your card available in case of an accident, it’s also crucial to carry it with you at all times when driving. Police officers can request your insurance card during routine traffic stops. Failure to present a valid card can result in fines or even license suspension.

The Card Never Needs to Be Updated

It’s important to remember that your car insurance card needs to be updated regularly, especially when your policy is renewed or if you make changes to your coverage. Always check your insurance card for the expiration date and contact your insurance company to request an updated card if necessary. Driving with an expired insurance card can lead to legal trouble.

You Can Use a Digital Car Insurance Card

While some states accept digital proof of insurance, it’s not universally recognized. It’s always best to carry a physical car insurance card in your vehicle, as it’s the most widely accepted form of proof of insurance. If you do choose to use a digital card, ensure it’s easily accessible and readily available in case you need to show it to law enforcement.

Car Insurance Card Security Features

Car insurance cards, like any important document, are susceptible to counterfeiting and fraudulent use. To prevent such misuse, insurance companies incorporate security features into their cards to make them more difficult to replicate and to ensure authenticity. These features are designed to be visible to the naked eye and can be easily verified by anyone.

Types of Security Features

Security features are designed to make it difficult for fraudsters to create convincing counterfeit copies of car insurance cards. These features can include:

- Holograms: These are images that change when viewed from different angles, making it difficult to reproduce them accurately. Holograms are often incorporated into the design of the card, such as in the company logo or in the background pattern.

- Watermarks: Watermarks are faint images embedded in the paper of the card, visible when held up to a light source. They are often a subtle design element, such as the company logo or a pattern, that is only visible when the card is held up to a light.

- Microprinting: This involves printing very small text on the card, which is difficult to replicate without specialized equipment. Microprinting can be found in various parts of the card, such as the company name or policy number.

- Unique Identification Numbers: Each insurance card has a unique identification number, which can be used to verify the authenticity of the card. This number is usually printed on the card and can be cross-referenced with the insurance company’s database.

- Security Threads: These are thin, embedded threads woven into the paper of the card. They are often visible when the card is held up to a light source. These threads can be embedded with security features such as color-shifting ink or micro-text.

- UV Reactive Ink: Some car insurance cards use UV reactive ink, which glows under ultraviolet light. This makes it difficult to reproduce the card accurately without specialized equipment.

- Raised Printing: Raised printing, also known as embossing, creates a raised texture on the card. This can be used for the company logo, policy details, or other key information.

- Sequential Numbering: Each card is assigned a unique sequential number, which can be used to track the card and identify any potential counterfeits.

Summary

In conclusion, your car insurance card is more than just a document; it’s your shield against unforeseen events on the road. By understanding its importance, staying informed about its requirements, and keeping it readily accessible, you can drive with confidence, knowing that you’re protected in case of any mishap. Embrace the peace of mind that comes with a valid car insurance card and enjoy your journey with the assurance of financial and legal protection.

Detailed FAQs

How often should I update my car insurance card?

It’s essential to update your car insurance card whenever there are changes to your policy, such as a new vehicle, address change, or policy renewal.

Can I use a digital car insurance card?

Yes, many insurance companies offer digital car insurance cards through mobile apps. These are often accepted as valid proof of insurance.

What happens if I don’t have a car insurance card?

Driving without a valid car insurance card can result in fines, penalties, and even the suspension of your driving privileges.