Car insurance cheap Florida? It’s a common search term, but finding the best rates requires navigating a complex market. Florida’s unique factors, like a high population density and frequent hurricanes, impact car insurance costs significantly. Understanding the market, comparing quotes, and knowing how to negotiate can make a big difference in your wallet.

This guide dives deep into the world of Florida car insurance, exploring factors that influence premiums, highlighting discounts and savings opportunities, and providing tips for choosing the right provider. Whether you’re a new driver or a seasoned Floridian, this comprehensive guide will equip you with the knowledge you need to secure affordable car insurance.

Understanding Florida Car Insurance

Florida’s car insurance market is distinct and complex, influenced by several unique factors that shape the cost of coverage. Understanding these factors and the state’s insurance landscape is crucial for Florida drivers seeking affordable and comprehensive car insurance.

Factors Influencing Car Insurance Costs in Florida

Florida’s car insurance market is heavily influenced by several factors that impact the cost of coverage. These factors include:

- High Number of Accidents: Florida has a higher-than-average number of car accidents, leading to increased claims and insurance costs. According to the Florida Department of Highway Safety and Motor Vehicles, there were over 400,000 car accidents in 2022, resulting in significant financial burdens on insurance companies.

- High Number of Uninsured Drivers: Florida has a large number of uninsured drivers, increasing the risk of accidents involving uninsured motorists. This risk is factored into insurance premiums, making coverage more expensive for insured drivers.

- High Cost of Living: Florida’s high cost of living, particularly in urban areas, contributes to higher repair costs for damaged vehicles, impacting insurance premiums.

- High Litigation Rates: Florida has a high rate of car accident litigation, with many drivers filing lawsuits after accidents. This legal activity drives up insurance costs as companies need to cover legal expenses and potential payouts.

- Impact of Hurricanes: Florida is prone to hurricanes, which can cause widespread damage to vehicles. Insurance companies factor in the risk of hurricane damage, potentially increasing premiums for drivers in hurricane-prone areas.

Overview of the Florida Car Insurance Market

Florida’s car insurance market is highly competitive, with numerous insurance companies vying for customers. The market is dominated by large national insurance companies, but several regional and smaller companies also operate in the state.

- State-Mandated Minimum Coverage: Florida law requires all drivers to carry a minimum level of liability insurance, known as “Personal Injury Protection” (PIP) and “Property Damage Liability” (PDL).

- Competitive Pricing: The competitive nature of the market leads to varying prices for similar coverage. Drivers can compare quotes from multiple insurers to find the most affordable options.

- Impact of Insurance Regulation: The Florida Office of Insurance Regulation (OIR) plays a crucial role in overseeing the state’s insurance market, ensuring fair pricing and consumer protection.

Types of Car Insurance Coverage Required by Florida Law

Florida law requires all drivers to carry a minimum level of car insurance coverage, including:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault in an accident. PIP coverage is capped at $10,000 per person.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s vehicle or property if the insured driver is at fault in an accident. The minimum PDL coverage requirement is $10,000.

Finding Affordable Car Insurance in Florida

Finding affordable car insurance in Florida can be a challenge, given the state’s high rates. However, by understanding the factors that influence premiums and implementing smart strategies, you can significantly reduce your costs.

Comparing Car Insurance Quotes

To find the best deal, it’s crucial to compare quotes from multiple insurance providers. Here are some tips for maximizing your comparison efforts:

- Use online comparison websites: Sites like Insurance.com, The Zebra, and Policygenius allow you to enter your information once and receive quotes from multiple insurers. This saves you time and effort compared to contacting each company individually.

- Contact insurance agents directly: While online comparison sites are convenient, contacting agents directly can provide more personalized service and help you understand the nuances of different policies.

- Consider your specific needs: Don’t just focus on the cheapest quote. Evaluate the coverage offered by each insurer to ensure it meets your specific needs and driving habits.

- Check for discounts: Many insurers offer discounts for good driving records, safety features, bundling policies, and other factors. Be sure to inquire about all available discounts.

Factors Affecting Car Insurance Premiums in Florida

Several factors determine the cost of your car insurance in Florida. Understanding these factors can help you make informed decisions to lower your premiums.

- Driving record: Your driving history, including accidents, traffic violations, and DUI convictions, significantly impacts your premiums. Maintaining a clean driving record is crucial for keeping costs down.

- Age and gender: Younger and inexperienced drivers generally pay higher premiums due to their higher risk of accidents. Similarly, gender can also influence rates, though this varies by insurer.

- Vehicle type: The make, model, year, and safety features of your vehicle influence your insurance premiums. Luxury cars, high-performance vehicles, and vehicles with expensive repair costs typically have higher premiums.

- Location: Florida’s geographical location and crime rates influence insurance premiums. Areas with higher crime rates or more frequent accidents generally have higher rates.

- Coverage levels: The amount of coverage you choose, including liability, collision, and comprehensive, directly affects your premiums. Higher coverage levels mean higher premiums, but they also provide more financial protection in case of an accident.

- Credit score: In some states, including Florida, insurance companies use your credit score as a factor in determining your premiums. A higher credit score generally translates to lower premiums.

Negotiating Lower Car Insurance Rates, Car insurance cheap florida

While comparing quotes and understanding the factors that influence premiums are essential, you can also negotiate lower rates with your insurer.

- Shop around regularly: Don’t assume your current insurer is offering the best rate. Regularly compare quotes from other insurers to ensure you’re getting the best deal.

- Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

- Increase your deductible: Choosing a higher deductible means you’ll pay more out of pocket in case of an accident, but it can lead to lower premiums.

- Ask about discounts: Many insurers offer discounts for good driving records, safety features, and other factors. Be sure to inquire about all available discounts and provide any relevant documentation.

- Be prepared to switch insurers: If your current insurer isn’t willing to negotiate, don’t hesitate to switch to another provider offering a better rate.

Factors Influencing Car Insurance Premiums: Car Insurance Cheap Florida

In Florida, car insurance premiums are influenced by a variety of factors. These factors are considered by insurance companies to assess the risk associated with insuring a particular driver and vehicle. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history plays a significant role in determining your car insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

- Accidents: Insurance companies consider the number and severity of accidents you’ve been involved in. A major accident, such as a collision resulting in injuries or property damage, will likely lead to higher premiums than a minor fender bender.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations are seen as indicators of riskier driving behavior. Each violation can add points to your driving record, leading to increased premiums.

- DUI Convictions: Driving under the influence of alcohol or drugs is a serious offense that carries significant penalties, including higher car insurance rates. Insurance companies view DUI convictions as a major risk factor and often impose substantial rate increases.

Age

Your age is another important factor that influences car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies reflect this higher risk in their rates.

- Teenage Drivers: Teenage drivers have limited driving experience and are more prone to risky behaviors, leading to higher insurance premiums.

- Mature Drivers: Drivers over the age of 65 generally have lower insurance rates. This is because they tend to have more experience, drive fewer miles, and are less likely to be involved in accidents.

Vehicle Type

The type of vehicle you drive also affects your car insurance premiums. Insurance companies consider factors such as the vehicle’s value, safety features, and theft risk.

- Vehicle Value: More expensive vehicles are typically associated with higher insurance premiums. This is because the cost of repairs or replacement is higher in case of an accident.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, can qualify for lower premiums. These features reduce the risk of accidents and injuries, leading to lower insurance costs for the insurance company.

- Theft Risk: Certain vehicle models are more prone to theft than others. Vehicles with higher theft rates tend to have higher insurance premiums due to the increased risk of theft-related claims.

Credit Score

Surprisingly, your credit score can also impact your car insurance rates. Insurance companies argue that a good credit score is an indicator of financial responsibility, which is linked to responsible driving behavior.

- Credit Score as a Risk Indicator: Insurance companies use credit scores as a way to assess the likelihood that a policyholder will make timely premium payments. A lower credit score might indicate a higher risk of non-payment, leading to higher premiums.

- State-Specific Regulations: The use of credit scores in determining car insurance rates varies by state. Some states have regulations that restrict or prohibit the use of credit scores for insurance purposes.

Location

The location where you live can significantly influence your car insurance premiums. Insurance companies consider factors such as the density of traffic, crime rates, and the frequency of accidents in a particular area.

- Urban Areas: Urban areas with heavy traffic and higher crime rates generally have higher car insurance premiums due to the increased risk of accidents and theft.

- Rural Areas: Rural areas with lower population density and fewer traffic congestion typically have lower car insurance premiums.

Driving Habits

Your driving habits also play a role in determining your car insurance premiums. Insurance companies may offer discounts for safe driving practices.

- Commuting Distance: Driving longer distances increases the likelihood of being involved in an accident. Insurance companies may adjust premiums based on your average daily commute.

- Safe Driving Practices: Driving defensively, avoiding distractions, and maintaining a safe speed can qualify you for discounts on your car insurance.

Discounts and Savings Opportunities

Finding affordable car insurance in Florida can be challenging, but there are various discounts and savings opportunities available to help you lower your premiums. By understanding these discounts and how to qualify for them, you can significantly reduce your insurance costs.

Safety Feature Discounts

Safety features in your car can make a significant difference in your insurance premiums. These features help reduce the risk of accidents and injuries, leading to lower insurance costs.

- Anti-theft Devices: Installing anti-theft devices like alarms, immobilizers, or GPS tracking systems can deter theft and qualify you for a discount.

- Airbags and Seatbelts: Vehicles equipped with airbags and seatbelts provide additional safety and protection in case of an accident.

- Anti-lock Braking Systems (ABS): ABS helps prevent wheel lockup during braking, improving vehicle control and reducing the risk of accidents.

- Electronic Stability Control (ESC): ESC helps maintain vehicle stability during cornering or sudden maneuvers, reducing the likelihood of accidents.

Driving History Discounts

Your driving history is a major factor in determining your car insurance premiums. A clean driving record with no accidents or violations can earn you significant discounts.

- Good Driver Discounts: This discount is awarded to drivers with a proven history of safe driving, typically with no accidents or traffic violations within a specific timeframe.

- Safe Driver Discounts: Similar to good driver discounts, safe driver discounts reward drivers with a clean driving record and no claims within a specified period.

- Defensive Driving Course Discounts: Completing a defensive driving course can demonstrate your commitment to safe driving and qualify you for a discount.

Other Discounts

Beyond safety features and driving history, other factors can influence your car insurance premiums and qualify you for discounts.

- Multiple Policy Discounts: Bundling your car insurance with other policies like homeowners, renters, or life insurance can result in significant savings.

- Good Student Discounts: Students with good academic records may qualify for discounts as they are statistically less likely to be involved in accidents.

- Payment Plan Discounts: Paying your car insurance premiums in full or opting for a longer payment plan can sometimes result in a discount.

- Military Discounts: Active military personnel and veterans may qualify for discounts from certain insurance companies.

- Loyalty Discounts: Long-term customers with a consistent history of paying premiums on time may be eligible for loyalty discounts.

Benefits of Bundling Car Insurance

Bundling your car insurance with other policies offers several benefits, including:

- Cost Savings: Combining multiple policies under one insurer can result in significant discounts, as insurers often offer bundled packages at lower rates.

- Convenience: Managing multiple policies with a single insurer simplifies your insurance needs, with a single point of contact for billing, claims, and customer service.

- Simplified Claims Process: In case of an accident or claim, dealing with a single insurer streamlines the process and potentially reduces the time it takes to resolve the claim.

Choosing the Right Car Insurance Provider

Selecting the right car insurance provider in Florida is crucial for ensuring you have adequate coverage at a competitive price. This involves researching and comparing different insurance companies, considering their strengths and weaknesses, and evaluating their customer service and financial stability.

Comparing Car Insurance Companies in Florida

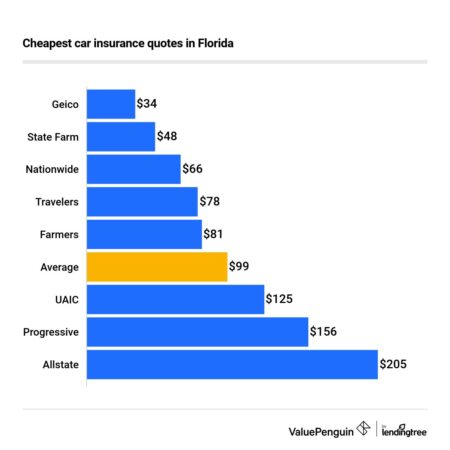

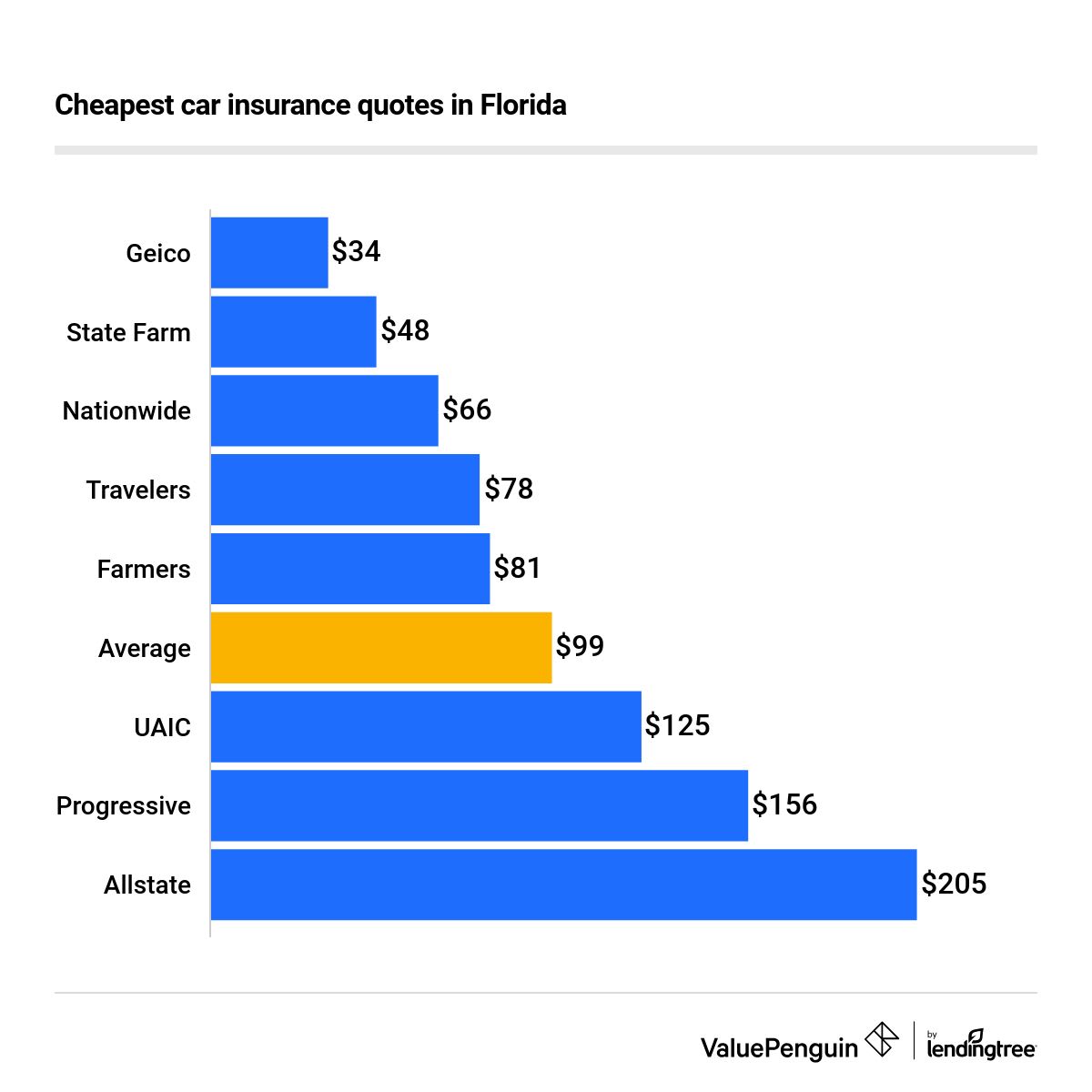

It is essential to compare the strengths and weaknesses of various car insurance companies in Florida to find the best fit for your needs. This comparison should encompass factors like coverage options, pricing, customer service, and financial stability.

- Coverage Options: Compare the different types of coverage offered by each company, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP).

- Pricing: Obtain quotes from multiple companies to compare their rates for your specific needs. Consider factors like your driving history, vehicle type, and coverage levels.

- Customer Service: Review customer reviews and ratings to gauge the quality of customer service provided by each company. Consider factors like responsiveness, accessibility, and problem-solving capabilities.

- Financial Stability: Evaluate the financial strength of each company by checking their ratings from organizations like AM Best or Standard & Poor’s. This ensures they can meet their financial obligations in the event of a claim.

Key Features and Customer Satisfaction Ratings of Leading Insurers

A comprehensive comparison of leading car insurance companies in Florida can be achieved by examining their key features and customer satisfaction ratings. This table highlights some of the prominent insurers in Florida, their key features, and their customer satisfaction ratings.

| Insurance Company | Key Features | Customer Satisfaction Rating |

|---|---|---|

| State Farm | Wide coverage options, competitive pricing, strong financial stability, excellent customer service | 4.5 out of 5 stars |

| Geico | Affordable rates, user-friendly online platform, 24/7 customer service, extensive network of repair shops | 4.3 out of 5 stars |

| Progressive | Personalized pricing, discounts for good drivers, innovative features like Name Your Price tool, comprehensive coverage options | 4.2 out of 5 stars |

| Allstate | Strong financial stability, comprehensive coverage options, personalized customer service, reliable claims handling | 4.1 out of 5 stars |

| USAA | Exclusive service for military members and their families, competitive rates, excellent customer service, strong financial stability | 4.8 out of 5 stars |

Selecting a Car Insurance Provider

A structured approach is recommended for selecting the right car insurance provider in Florida. This flowchart provides a step-by-step guide to assist consumers in making an informed decision.

Step 1: Determine your car insurance needs, including coverage levels and desired features.

Step 2: Research and compare different car insurance companies based on factors like pricing, coverage options, customer service, and financial stability.

Step 3: Obtain quotes from multiple companies to compare their rates for your specific needs.

Step 4: Review customer reviews and ratings to gauge the quality of customer service provided by each company.

Step 5: Evaluate the financial strength of each company by checking their ratings from organizations like AM Best or Standard & Poor’s.

Step 6: Choose the insurance company that best meets your needs and preferences.

Important Considerations for Florida Drivers

Florida’s unique insurance landscape presents specific considerations for drivers. Understanding the intricacies of the state’s no-fault system and the implications of your coverage is crucial for navigating the road ahead.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, meaning that after an accident, drivers are typically required to file claims with their own insurance company, regardless of who caused the accident. This system aims to expedite the claims process and reduce litigation.

Key Features of Florida’s No-Fault System:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the policyholder and passengers in their vehicle, regardless of fault. PIP coverage is mandatory in Florida, with a minimum coverage limit of $10,000.

- Property Damage Liability: This coverage protects the policyholder against financial responsibility for damages caused to another person’s vehicle or property. The minimum coverage limit for property damage liability in Florida is $10,000.

- Uninsured Motorist Coverage (UM): This coverage provides protection against damages caused by an uninsured or hit-and-run driver. UM coverage is optional but highly recommended, especially given the high number of uninsured drivers in Florida.

Understanding Your Insurance Policy’s Coverage and Limitations

It is essential to thoroughly review your insurance policy and understand the specific coverage you have purchased. This includes knowing the limits of your coverage, deductibles, and exclusions.

Essential Points to Understand:

- Coverage Limits: Your policy will specify the maximum amount your insurer will pay for different types of claims, such as medical expenses, lost wages, and property damage. Understanding these limits is crucial for knowing the extent of your financial protection.

- Deductibles: This is the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, but you will need to pay more in the event of a claim.

- Exclusions: Your policy will list specific events or situations that are not covered by your insurance. Understanding these exclusions is crucial for avoiding unexpected costs and ensuring you have adequate protection.

Navigating the Claims Process in Florida

Florida’s no-fault system can sometimes make the claims process more complex. It is crucial to understand the steps involved and to communicate effectively with your insurance company.

Important Steps in the Claims Process:

- Report the Accident Promptly: Contact your insurance company immediately after an accident to report the incident. Provide accurate details about the accident, including the date, time, location, and involved parties.

- Gather Evidence: Collect evidence related to the accident, such as photographs, witness statements, and police reports. This documentation will be crucial for supporting your claim.

- Seek Medical Attention: If you have sustained injuries, seek medical attention promptly and keep detailed records of your treatment.

- Follow Up with Your Insurance Company: Regularly check in with your insurance company to track the status of your claim and address any questions or concerns.

Last Word

Finding cheap car insurance in Florida is a journey that involves research, comparison, and negotiation. By understanding the factors that influence premiums, utilizing discounts, and choosing the right provider, you can secure affordable coverage that protects you and your vehicle. Don’t settle for the first quote you find – take the time to explore your options and find the best value for your needs.

FAQ Summary

What are the minimum car insurance requirements in Florida?

Florida requires drivers to have Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage. PIP covers medical expenses for you and your passengers, while PDL covers damages to other vehicles or property.

How can I lower my car insurance premiums in Florida?

Consider factors like your driving history, vehicle type, credit score, and bundling policies. You can also explore discounts for safety features, good driving records, and more.

What is Florida’s no-fault insurance system?

Florida’s no-fault system requires drivers to file claims with their own insurance company, regardless of who caused the accident. This can simplify the claims process but may limit your ability to sue the other driver.