Car insurance cheap Georgia? You betcha! Finding affordable car insurance in the Peach State can feel like a mission impossible, but it doesn’t have to be. From understanding Georgia’s mandatory coverage to navigating the world of discounts and comparing quotes, we’re here to help you score the best deals on your car insurance.

We’ll break down the factors that influence your car insurance premiums, like your driving history, age, vehicle type, and even your credit score. We’ll also share tips on how to negotiate lower rates and highlight some of the top insurance providers in Georgia known for their competitive prices.

Understanding Car Insurance in Georgia

Driving a car in Georgia is a privilege, but it comes with responsibility. Just like you need a driver’s license to hit the road, you also need car insurance to protect yourself and others. In this guide, we’ll break down the basics of car insurance in Georgia, so you can drive confidently and avoid any legal troubles.

Mandatory Car Insurance Requirements in Georgia

Georgia law requires all drivers to have at least the following types of car insurance:

- Liability Coverage: This covers damages to other people’s property or injuries you cause in an accident. Georgia requires a minimum of $25,000 per person and $50,000 per accident for bodily injury liability, and $25,000 for property damage liability.

- Personal Injury Protection (PIP): This covers your medical expenses and lost wages if you’re injured in an accident, regardless of who’s at fault. Georgia requires a minimum of $5,000 in PIP coverage.

- Uninsured Motorist Coverage: This protects you if you’re in an accident with someone who doesn’t have insurance. Georgia requires a minimum of $25,000 per person and $50,000 per accident for uninsured motorist bodily injury coverage, and $25,000 for uninsured motorist property damage coverage.

These minimum requirements are the bare minimum to stay legal. However, they might not be enough to cover all your potential expenses in a serious accident.

Types of Car Insurance Coverage Available in Georgia

Georgia offers a variety of car insurance coverage options, in addition to the mandatory requirements. Understanding these options can help you tailor your policy to your specific needs and budget. Here’s a rundown of common types of car insurance coverage:

- Collision Coverage: This covers damage to your car if you’re involved in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This covers damage to your car from non-accident events, such as theft, vandalism, fire, or natural disasters.

- Underinsured Motorist Coverage: This protects you if you’re in an accident with someone who has insurance, but their coverage isn’t enough to cover your damages.

- Medical Payments Coverage (Med Pay): This covers your medical expenses, regardless of who’s at fault, even if you’re not at fault.

- Rental Reimbursement Coverage: This covers the cost of renting a car while your car is being repaired after an accident.

- Roadside Assistance Coverage: This provides assistance in case of a breakdown, flat tire, or other roadside emergencies.

Georgia Department of Insurance

The Georgia Department of Insurance (DOI) is the state agency responsible for regulating the insurance industry in Georgia. The DOI ensures that insurance companies operate fairly and responsibly, and protects consumers from unfair or deceptive practices.

- Consumer Protection: The DOI investigates complaints from consumers who believe they’ve been treated unfairly by an insurance company.

- Market Oversight: The DOI monitors the insurance market to ensure that there’s adequate competition and that prices are fair.

- Licensing and Regulation: The DOI licenses and regulates insurance companies and agents, setting standards for their operations.

If you have any questions or concerns about car insurance in Georgia, you can contact the DOI for assistance.

Factors Influencing Car Insurance Costs in Georgia

In Georgia, like most states, car insurance rates are determined by a variety of factors. Understanding these factors can help you make informed decisions that may lead to lower premiums.

Driving History

Your driving history is a significant factor in determining your car insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely increase your rates.

Age

Your age is another important factor. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. As you age and gain more driving experience, your rates tend to decrease.

Vehicle Type

The type of vehicle you drive also influences your car insurance costs. Sports cars and luxury vehicles are generally more expensive to insure due to their higher repair costs and potential for greater damage in accidents. Conversely, smaller, less expensive cars often have lower insurance premiums.

Location

Where you live in Georgia can impact your car insurance rates. Areas with higher crime rates or more traffic congestion tend to have higher insurance premiums due to the increased risk of accidents.

Credit Score

In Georgia, your credit score can play a role in determining your car insurance rates. Insurance companies often use credit score as a proxy for risk assessment, believing that individuals with good credit are more likely to be responsible drivers. However, this practice is not without controversy, and some states have banned it.

Insurance Company Pricing Strategies

Different insurance companies in Georgia have varying pricing strategies. Some companies may offer lower premiums to drivers with good driving records and high credit scores, while others may focus on offering competitive rates for specific vehicle types or demographics. It’s essential to compare quotes from multiple insurance companies to find the best rates for your individual needs.

Finding Cheap Car Insurance in Georgia

Finding the right car insurance in Georgia doesn’t have to be a stressful experience. You can snag a great deal by being a savvy shopper and knowing the ins and outs of the insurance game.

Steps to Finding Affordable Car Insurance in Georgia

Getting the best car insurance rates in Georgia involves a few key steps. Think of it like a game plan for a winning touchdown. Here’s your playbook:

- Compare Quotes: This is the ultimate power move. Get quotes from multiple insurance companies, like you’re comparing prices at different stores. This helps you find the best deal. Use online comparison websites or contact insurance companies directly.

- Shop Around: Don’t settle for the first quote you get. It’s like trying on clothes – you want to find the perfect fit. Get quotes from several companies to see who offers the best rates for your specific needs.

- Bundle Your Policies: This is like getting a combo meal at your favorite restaurant – it’s cheaper than ordering everything separately. Bundling your car insurance with other policies like homeowners or renters insurance can save you money.

- Improve Your Driving Record: This is your chance to shine! A clean driving record, like a flawless resume, will impress insurance companies. Avoiding accidents and traffic violations can earn you lower premiums.

- Consider Increasing Your Deductible: This is like deciding how much you want to contribute to a potluck. A higher deductible means you pay more out of pocket in case of an accident, but it can lower your monthly premiums.

- Ask About Discounts: It’s like getting a secret menu at a restaurant – some insurance companies offer discounts for things like good grades, safe driving courses, or being a member of certain organizations. Don’t be afraid to ask about these.

- Review Your Coverage Regularly: Just like you review your wardrobe to make sure it still fits, you should review your car insurance coverage periodically to make sure it still meets your needs. Maybe you’ve paid off your car loan, or your driving habits have changed. This is a good time to adjust your coverage.

Reputable Car Insurance Providers in Georgia

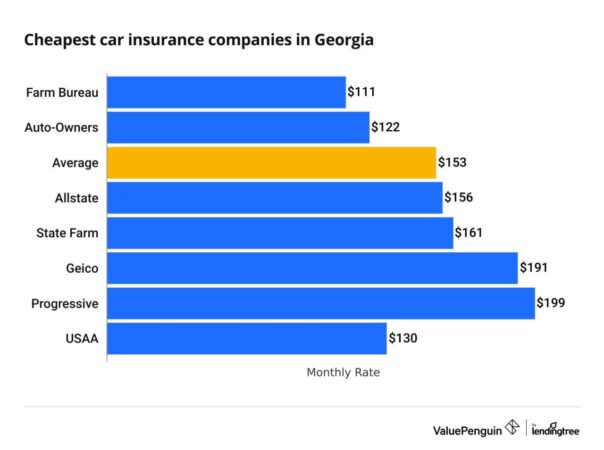

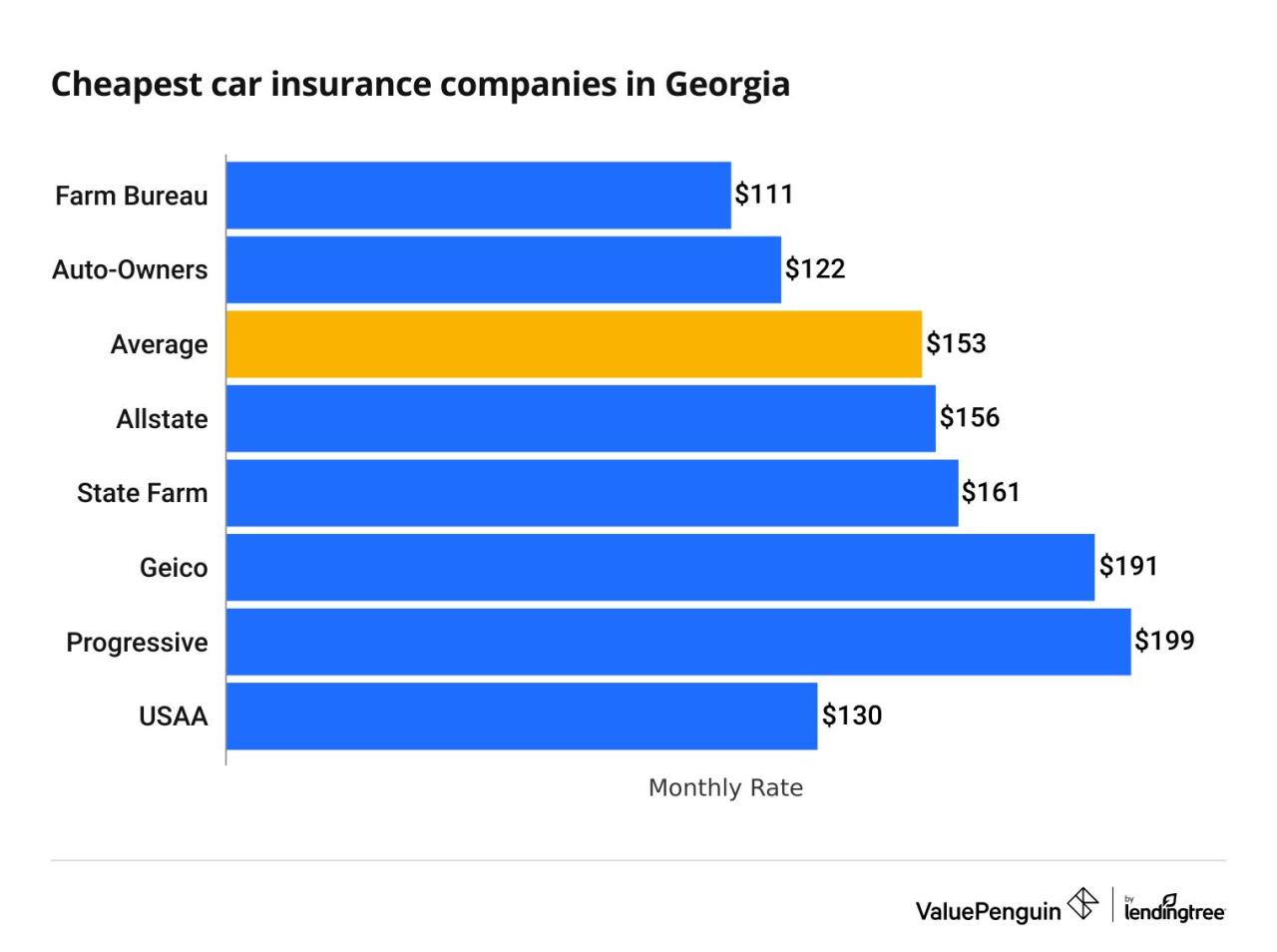

Finding a reliable insurance company in Georgia is like choosing the right team for your fantasy football league. You want players with a winning track record. Here are some top contenders known for their competitive rates:

- State Farm: This is a well-known company with a wide range of insurance products and a strong reputation for customer service. They are often known for their competitive rates and discounts.

- GEICO: Known for their catchy commercials, GEICO is another big player in the insurance world. They often offer competitive rates, especially for good drivers.

- Progressive: Progressive is known for its innovative features, like their “Name Your Price” tool, which lets you set your desired premium and find coverage options that fit your budget.

- Allstate: Allstate is another major insurance company with a wide range of coverage options and discounts. They’re known for their strong customer service and commitment to helping policyholders.

- USAA: USAA is a military-focused insurance company that offers competitive rates and excellent customer service. If you’re a military member or a family member of a military member, USAA is worth checking out.

Negotiating Lower Car Insurance Premiums

Negotiating with insurance companies is like haggling at a flea market. You want to get the best deal possible, but you need to be smart and respectful. Here are some tips:

- Be Prepared: This is like studying for a test. Before you start negotiating, gather all your relevant information, like your driving record, vehicle information, and quotes from other companies. This will give you leverage.

- Be Polite: Remember, you’re not trying to fight, you’re trying to find a solution. Be polite and respectful when talking to insurance agents. A good attitude can go a long way.

- Highlight Your Strengths: This is like showcasing your best qualities in a job interview. Emphasize your positive attributes, like a clean driving record, good credit score, or safe driving habits.

- Don’t Be Afraid to Walk Away: If you’re not happy with the offer, don’t be afraid to walk away. This is like saying “no” to a bad date. You have options and you don’t have to settle for something that doesn’t work for you.

Discounts and Savings Opportunities

Saving money on your car insurance is a top priority for most Georgia drivers, and luckily, there are several ways to do just that. Insurance companies offer a variety of discounts, and some even have programs specifically designed to help those with limited financial resources.

Discounts Offered by Insurance Companies

Insurance companies in Georgia offer various discounts to help you save on your premiums. These discounts can significantly reduce your overall cost, so it’s essential to explore all the options available to you.

- Good Driver Discount: This is one of the most common discounts and is awarded to drivers with a clean driving record, free from accidents and traffic violations. In Georgia, this discount can be substantial, sometimes reaching up to 20% off your premium.

- Safe Driving Course Discount: Completing a defensive driving course can also earn you a discount. These courses teach safe driving techniques and can help you avoid accidents. The discount you receive depends on the course you complete and the insurance company.

- Bundling Discount: Combining your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in a significant discount. This is a popular option for many drivers, as it simplifies your insurance needs and saves you money.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount. This discount can be substantial, especially if you have several cars in your household.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as alarms or tracking systems, can help deter theft and lower your insurance premium.

- Good Student Discount: If you have a student in your household with good grades, some insurance companies offer a discount on your car insurance. This discount recognizes that good students are often responsible drivers.

- Military Discount: Active military personnel and veterans may be eligible for a discount on their car insurance. This discount is a way to show appreciation for their service.

Comparison of Discounts Offered by Major Insurance Companies

Here is a table comparing the different types of discounts offered by some of the major insurance companies in Georgia:

| Insurance Company | Good Driver Discount | Safe Driving Course Discount | Bundling Discount | Multi-Car Discount | Anti-theft Device Discount | Good Student Discount | Military Discount |

|---|---|---|---|---|---|---|---|

| State Farm | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Geico | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Progressive | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Allstate | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| USAA | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Government Programs and Initiatives

The Georgia government offers various programs and initiatives to help drivers with limited financial resources obtain affordable car insurance.

- Low-Cost Auto Insurance Program (LCAIP): This program is designed to provide affordable car insurance to low-income Georgia residents. It offers reduced premiums and flexible payment options.

- Georgia Insurance Commissioner’s Office: The Georgia Insurance Commissioner’s Office provides resources and information to help consumers understand their insurance options and find affordable coverage.

Important Considerations for Choosing Car Insurance: Car Insurance Cheap Georgia

Choosing the right car insurance policy in Georgia can be a bit like navigating a maze. You want to find a policy that offers the coverage you need at a price that fits your budget. But with so many options available, it can be overwhelming to know where to start. To make sure you’re making the right choice, there are a few important things to consider.

Comparing Quotes from Multiple Insurance Providers, Car insurance cheap georgia

Comparing quotes from multiple insurance providers is crucial to finding the best deal. Don’t just settle for the first quote you get. Instead, take the time to shop around and see what different companies have to offer.

- You can use online comparison websites to get quotes from multiple insurers at once. This can save you a lot of time and effort.

- Make sure you’re comparing apples to apples when you’re comparing quotes. This means that you should be comparing quotes for the same coverage levels and deductibles.

- Don’t be afraid to negotiate with insurance companies. If you’re a good driver with a clean driving record, you may be able to get a lower rate.

Understanding Policy Terms and Conditions

Once you’ve received a few quotes, it’s important to take the time to understand the terms and conditions of each policy. This will help you make an informed decision about which policy is right for you.

- Pay close attention to the coverage limits, deductibles, and exclusions. These factors can have a big impact on the cost of your insurance and the amount of coverage you receive.

- Read the fine print carefully. This is where you’ll find important information about the policy, such as the conditions under which your coverage may be denied.

- If you’re unsure about anything, don’t hesitate to ask an insurance agent for clarification. They’re there to help you understand your policy and make sure you’re getting the coverage you need.

Reviewing and Adjusting Car Insurance Coverage Periodically

Your car insurance needs may change over time. As your life changes, so should your car insurance policy.

- For example, if you get a new car, you may need to increase your coverage limits. Or, if you start driving less, you may be able to lower your premiums.

- It’s a good idea to review your car insurance policy at least once a year to make sure it still meets your needs.

- You may also want to review your policy after a major life event, such as a marriage, divorce, or the birth of a child.

Epilogue

So, buckle up and get ready to navigate the world of car insurance in Georgia with confidence. By understanding the ins and outs of the process, you can find the best coverage at the best price. Remember, you’re not alone in this journey – we’re here to guide you every step of the way.

FAQ

What are the minimum car insurance requirements in Georgia?

Georgia requires you to have liability coverage, which includes bodily injury liability and property damage liability. You’ll also need uninsured/underinsured motorist coverage and personal injury protection (PIP).

How can I get a free car insurance quote?

Most insurance companies offer free online quotes. Simply enter your information and they’ll generate a personalized quote based on your needs and risk factors.

What are some common car insurance discounts in Georgia?

Common discounts include good driver discounts, safe driving courses, bundling discounts, and discounts for anti-theft devices.

What is the role of the Georgia Department of Insurance?

The Georgia Department of Insurance regulates the insurance industry in the state, ensuring fair practices and protecting consumers’ rights.