Car insurance companies in miami florida – Car insurance companies in Miami, Florida, are a diverse lot, each offering unique coverage options and pricing structures. The Sunshine State’s unique blend of demographics, traffic patterns, and weather conditions creates a complex car insurance market, making it crucial for drivers to find the right policy that fits their individual needs.

From the bustling streets of downtown Miami to the tranquil suburbs, navigating the roads of Miami comes with its own set of challenges. Understanding the factors that influence car insurance premiums in this dynamic city is essential for making informed decisions. This guide delves into the intricacies of the Miami car insurance market, helping you find the best coverage at the most competitive price.

Car Insurance Market in Miami, Florida

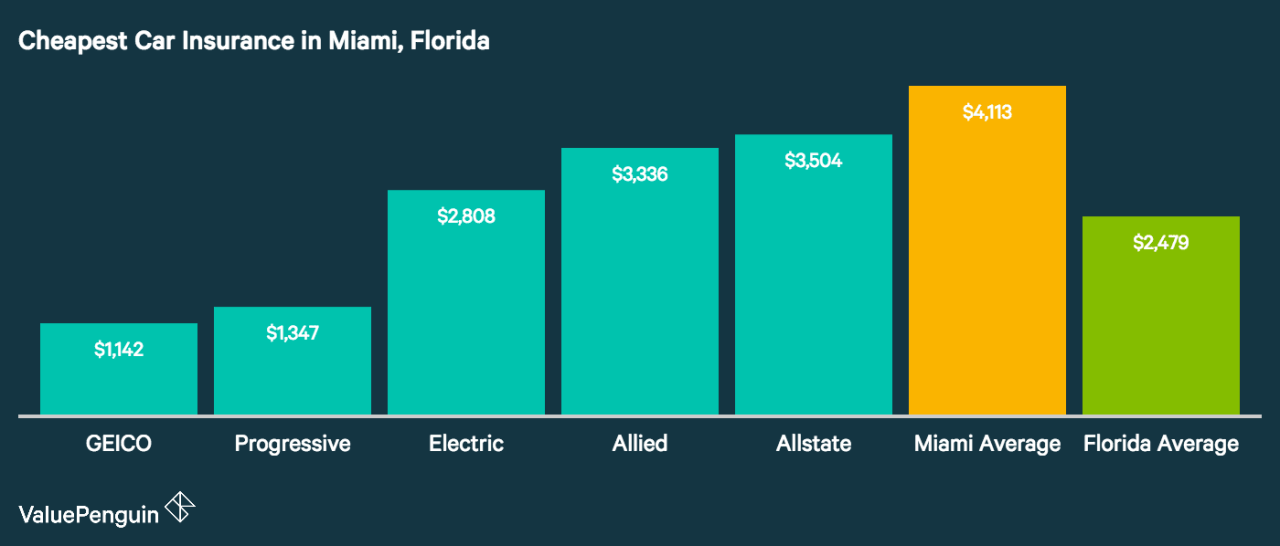

Miami, Florida, is a vibrant city with a diverse population and a bustling economy. This unique combination creates a complex and dynamic car insurance market. The high concentration of vehicles, combined with factors like traffic congestion, weather conditions, and a high crime rate, influences the cost of car insurance in Miami.

Key Characteristics of the Miami Car Insurance Market

Miami’s car insurance market is characterized by:

* High insurance premiums: The combination of factors mentioned above drives up the cost of car insurance in Miami.

* High demand for insurance: The city’s large population and high vehicle ownership rate create a significant demand for car insurance.

* Competitive landscape: Numerous car insurance companies operate in Miami, offering a wide range of coverage options and pricing.

* Importance of comparison shopping: Due to the competitive nature of the market, drivers can benefit significantly from comparing quotes from multiple insurers.

Factors Influencing Car Insurance Premiums in Miami

Several factors contribute to the cost of car insurance in Miami, including:

* Demographics: The city’s diverse population, with a significant number of young drivers and high-income earners, influences insurance rates.

* Traffic patterns: Miami’s heavy traffic congestion and high number of accidents contribute to higher insurance premiums.

* Crime rates: Miami’s crime rate, including vehicle theft and vandalism, is a significant factor in determining insurance costs.

* Weather conditions: Miami’s hurricane season and frequent storms can lead to higher insurance premiums, as insurers consider the risk of damage to vehicles.

Competitive Landscape of Car Insurance Companies in Miami

Miami’s car insurance market is highly competitive, with numerous national and regional insurers vying for customers. This competition benefits consumers, as it drives down prices and leads to innovation in coverage options.

* Major national insurers: Nationwide, State Farm, Geico, Progressive, and Allstate are some of the major national insurers with a strong presence in Miami.

* Regional insurers: Several regional insurers, such as Florida Peninsula Insurance and United Automobile Insurance, cater specifically to the Florida market.

* Specialty insurers: Companies like USAA and American Family Insurance offer specialized insurance products for military personnel and families, respectively.

Top Car Insurance Companies in Miami

Miami, Florida, is a vibrant city with a diverse population and a bustling economy. This also translates to a high volume of vehicles on the road, making car insurance a necessity for residents. With so many insurance companies vying for your business, choosing the right one can be overwhelming. This section will guide you through the top car insurance providers in Miami, offering insights into their coverage options, pricing, and customer service.

Leading Car Insurance Providers in Miami

Several insurance companies are well-established in the Miami market, each offering unique benefits and competitive pricing. Here are some of the leading providers:

- State Farm: State Farm is one of the largest insurance companies in the United States, known for its extensive network of agents and comprehensive coverage options. In Miami, State Farm offers a wide range of discounts, including safe driver, good student, and multi-policy discounts. They also provide roadside assistance and accident forgiveness. State Farm is known for its strong customer service and claims handling process.

- Geico: Geico is another major player in the insurance market, known for its affordable rates and convenient online and mobile services. In Miami, Geico offers a variety of coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. They also offer discounts for good drivers, multiple vehicles, and military personnel. Geico is known for its quick and efficient claims process.

- Progressive: Progressive is a leading innovator in the insurance industry, known for its personalized pricing and flexible coverage options. In Miami, Progressive offers a variety of discounts, including safe driver, good student, and multi-policy discounts. They also offer unique features like Snapshot, a telematics program that rewards safe driving habits with lower premiums. Progressive is known for its user-friendly online platform and mobile app.

- Allstate: Allstate is a well-known insurance company with a strong reputation for customer service. In Miami, Allstate offers a variety of coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. They also offer discounts for good drivers, multiple vehicles, and homeowners. Allstate is known for its 24/7 customer support and claims handling process.

- USAA: USAA is a military-focused insurance company that offers competitive rates and excellent customer service to active-duty military personnel, veterans, and their families. In Miami, USAA offers a variety of coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. They also offer discounts for good drivers, multiple vehicles, and military personnel. USAA is known for its commitment to serving the military community.

Comparative Analysis of Coverage Options, Pricing, and Customer Service

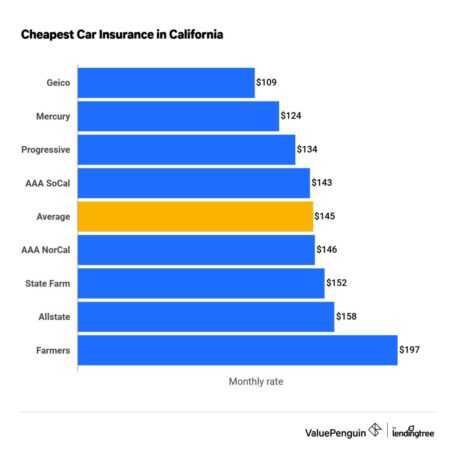

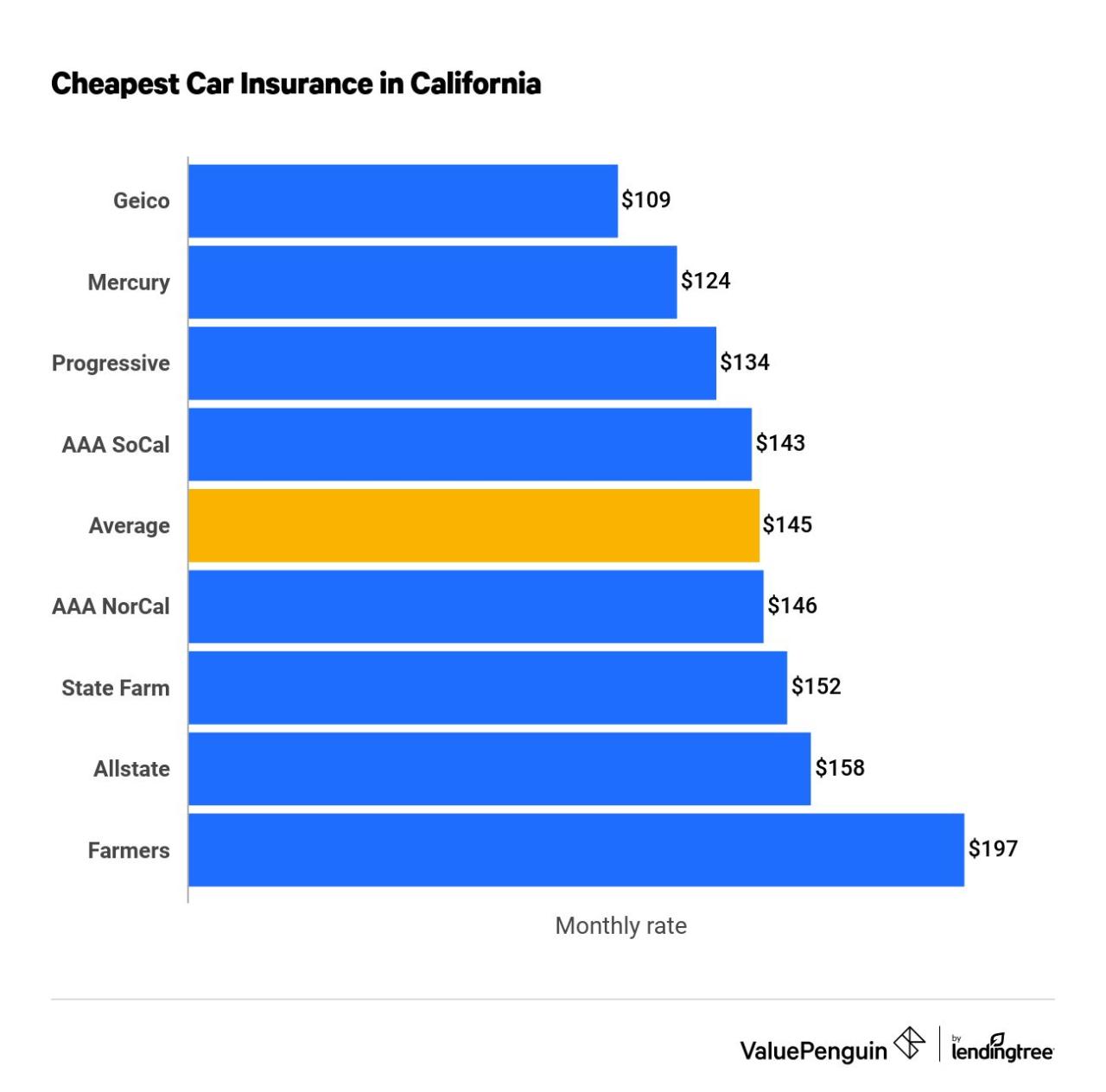

It’s important to compare coverage options, pricing, and customer service when choosing a car insurance company. Here’s a breakdown of how the top providers in Miami stack up:

| Provider | Coverage Options | Pricing | Customer Service |

|---|---|---|---|

| State Farm | Comprehensive, offering a wide range of coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. | Competitive pricing, with discounts for safe drivers, good students, and multi-policy holders. | Strong customer service, known for its responsiveness and efficiency in claims handling. |

| Geico | Comprehensive, offering a variety of coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. | Known for its affordable rates, often offering lower premiums than other providers. | Convenient online and mobile services, with a quick and efficient claims process. |

| Progressive | Flexible, offering a variety of coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. | Personalized pricing, with discounts for safe drivers, good students, and multi-policy holders. | User-friendly online platform and mobile app, with a focus on customer satisfaction. |

| Allstate | Comprehensive, offering a variety of coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. | Competitive pricing, with discounts for good drivers, multiple vehicles, and homeowners. | 24/7 customer support, known for its commitment to resolving customer issues. |

| USAA | Comprehensive, offering a variety of coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. | Competitive rates, with discounts for good drivers, multiple vehicles, and military personnel. | Excellent customer service, with a focus on serving the military community. |

Unique Features and Benefits

Each insurance company offers unique features and benefits that can make a difference in your decision-making process. Here are some examples:

- State Farm: Offers discounts for safe drivers, good students, and multi-policy holders. They also provide roadside assistance and accident forgiveness.

- Geico: Offers discounts for good drivers, multiple vehicles, and military personnel. They also provide a convenient online and mobile experience.

- Progressive: Offers personalized pricing through its Snapshot program, which rewards safe driving habits with lower premiums. They also provide a user-friendly online platform and mobile app.

- Allstate: Offers discounts for good drivers, multiple vehicles, and homeowners. They also provide 24/7 customer support and a comprehensive claims handling process.

- USAA: Offers discounts for good drivers, multiple vehicles, and military personnel. They also provide excellent customer service and a focus on serving the military community.

Choosing the Right Car Insurance in Miami

Navigating the car insurance market in Miami can be a daunting task, with numerous companies offering a wide range of coverage options. To ensure you secure the best policy for your needs and budget, it’s crucial to understand the key factors involved in making an informed decision. This guide will help Miami residents navigate the complexities of car insurance and choose a policy that provides adequate protection without breaking the bank.

Factors to Consider When Choosing Car Insurance, Car insurance companies in miami florida

Choosing the right car insurance policy involves considering various factors, including your individual needs, driving history, and financial situation. These factors play a crucial role in determining the type of coverage you require and the premium you’ll pay.

- Coverage Needs: The first step is to assess your specific coverage needs. Consider factors such as the value of your vehicle, your driving habits, and your financial situation. If you have a new car or a high-value vehicle, comprehensive and collision coverage may be essential. If you have a lower-value vehicle or a tight budget, liability coverage might be sufficient.

- Budget: Your budget plays a crucial role in determining the type of coverage you can afford. Balancing coverage needs with affordability is essential. Consider factors such as your monthly expenses and your overall financial situation.

- Driving History: Your driving history, including accidents, tickets, and driving violations, significantly impacts your insurance premiums. A clean driving record generally translates to lower premiums, while a history of accidents or violations can lead to higher rates.

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is essential for making an informed decision. Each type of coverage offers specific protection and comes with its own cost.

| Coverage Type | Description | Cost |

|---|---|---|

| Liability Coverage | Covers damages to other vehicles or property caused by you in an accident. | Varying based on state minimum requirements, coverage limits, and other factors. |

| Collision Coverage | Covers damages to your vehicle in an accident, regardless of fault. | Higher cost due to comprehensive coverage of vehicle damage. |

| Comprehensive Coverage | Covers damages to your vehicle from non-accident events, such as theft, vandalism, or natural disasters. | Cost depends on the value of the vehicle and the level of coverage. |

| Uninsured/Underinsured Motorist Coverage | Protects you in case of an accident with a driver who is uninsured or underinsured. | Additional cost, but crucial for protection against financially irresponsible drivers. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers in an accident. | Varies based on state requirements and coverage limits. |

Final Summary: Car Insurance Companies In Miami Florida

Finding the right car insurance in Miami requires a thorough understanding of your needs, budget, and driving history. By researching top providers, comparing quotes, and leveraging online tools, you can navigate the complexities of the Miami car insurance market and secure a policy that offers peace of mind and financial protection. Remember, choosing the right car insurance isn’t just about getting the lowest price, it’s about ensuring you have the coverage you need when you need it most.

Question & Answer Hub

What are the mandatory car insurance coverages in Florida?

Florida law requires drivers to carry a minimum amount of liability coverage, including bodily injury liability, property damage liability, and personal injury protection (PIP).

How do I file a car insurance claim in Miami?

Most insurance companies offer online claim filing options, mobile apps, and 24/7 customer service lines. You’ll need to provide details about the accident, including date, time, location, and any injuries or damages.

What factors affect car insurance premiums in Miami?

Factors like your driving history, age, vehicle type, location, and credit score can all influence your car insurance premiums.