- Understanding Florida’s Car Insurance Landscape

- Navigating the Car Insurance Comparison Process

- Factors Influencing Car Insurance Rates in Florida: Car Insurance Comparison Florida

- Discounts and Savings Opportunities

- Understanding Florida’s No-Fault System

- Resources and Tips for Florida Drivers

- Concluding Remarks

- Clarifying Questions

Car insurance comparison Florida is essential for finding the best rates and coverage. Florida’s unique driving environment, with its high population density, frequent storms, and litigious nature, makes finding affordable car insurance a priority. From understanding Florida’s no-fault system to navigating the comparison process, this guide will help you find the right insurance for your needs.

Navigating the car insurance landscape in Florida can be overwhelming, but it doesn’t have to be. By understanding the key factors influencing insurance rates, exploring available discounts, and utilizing comparison tools, you can make informed decisions and secure the best possible coverage for your vehicle.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance landscape is a complex one, shaped by several unique factors. Understanding these factors is crucial for drivers seeking the best coverage at the most affordable rates.

Florida’s Unique Factors

The Sunshine State’s car insurance rates are influenced by a combination of factors, including:

- Weather Patterns: Florida’s frequent hurricanes and severe storms lead to increased car accidents and damage, driving up insurance premiums.

- High Population Density: The state’s large and growing population contributes to heavy traffic congestion, increasing the likelihood of accidents.

- Prevalence of Lawsuits: Florida is known for its high number of lawsuits related to car accidents, which adds to insurance costs.

Comparing Florida’s Car Insurance Requirements with Other States

Florida’s car insurance requirements are relatively strict compared to other states. All drivers must carry a minimum level of coverage, known as the “Financial Responsibility Law.” This includes:

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault, up to $10,000 per person.

- Property Damage Liability (PDL): Covers damage to another person’s property, up to $10,000.

- Bodily Injury Liability (BIL): Covers injuries to others in an accident, up to $10,000 per person and $20,000 per accident.

While these requirements are relatively high, they are designed to protect drivers and ensure financial responsibility in the event of an accident.

Types of Car Insurance Coverage in Florida

Florida offers a range of car insurance coverage options beyond the mandatory requirements. These include:

- Collision Coverage: Covers damage to your vehicle caused by a collision, regardless of fault.

- Comprehensive Coverage: Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Provides coverage for injuries or damage caused by a driver without insurance or insufficient insurance.

- Medical Payments Coverage (Med Pay): Covers medical expenses for you and your passengers, regardless of fault, in addition to PIP coverage.

- Rental Reimbursement Coverage: Covers the cost of renting a vehicle while yours is being repaired.

- Roadside Assistance Coverage: Provides assistance with services such as towing, flat tire changes, and jump starts.

Understanding the different types of coverage available and their benefits is essential for making informed decisions about your car insurance needs.

Navigating the Car Insurance Comparison Process

Finding the best car insurance deal in Florida can feel overwhelming, but it doesn’t have to be. With a little planning and the right approach, you can compare rates, coverage options, and discounts to secure a policy that fits your needs and budget. This section will guide you through the process, outlining key factors to consider and strategies to find the most competitive rates.

Key Factors to Consider When Comparing Car Insurance Quotes

When evaluating car insurance quotes, it’s crucial to compare apples to apples. This means considering the same coverage levels, deductibles, and discounts across different insurance providers. Below is a table outlining essential factors to compare:

| Factor | Description |

|---|---|

| Coverage Options | This refers to the types of protection your policy offers, such as liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. |

| Deductibles | This is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible typically results in lower premiums. |

| Discounts | Insurance companies offer various discounts, such as safe driving, good student, multi-car, and bundling discounts. |

| Customer Service | Consider the insurer’s reputation for responsiveness, claim handling, and overall customer satisfaction. |

Comparing Quotes: Online Tools vs. Insurance Agents

There are two primary ways to compare car insurance quotes: using online comparison tools or working directly with insurance agents.

Online Comparison Tools

- Benefits: Online comparison tools offer a quick and convenient way to gather quotes from multiple insurers simultaneously. They often provide a comprehensive overview of different coverage options, deductibles, and discounts.

- Drawbacks: While convenient, online tools may not provide personalized advice or detailed explanations of coverage options. They may also not always display all available discounts or consider factors specific to your situation, such as driving history or credit score.

Insurance Agents

- Benefits: Insurance agents can provide personalized guidance and answer your questions about coverage options and discounts. They can also help you tailor a policy that meets your specific needs.

- Drawbacks: Working with an insurance agent may require more time and effort. You may need to schedule appointments and gather information before meeting with them. Additionally, some agents may represent only a limited number of insurance companies.

Factors Influencing Car Insurance Rates in Florida: Car Insurance Comparison Florida

Car insurance rates in Florida are influenced by a variety of factors that insurance companies consider when assessing risk. These factors are designed to reflect the likelihood of a driver causing an accident or filing a claim. Understanding these factors can help you make informed decisions that may lower your premiums.

Driving History

Your driving history is one of the most significant factors affecting your car insurance rates. This includes your driving record, which reflects your past driving behavior.

- Accidents: Any accidents you’ve been involved in, even if you weren’t at fault, can increase your insurance premiums. This is because insurance companies perceive you as a higher risk.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations also increase your rates. These violations indicate a higher risk of future accidents.

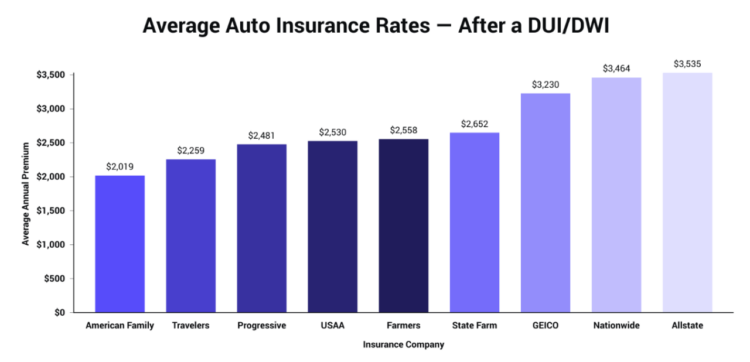

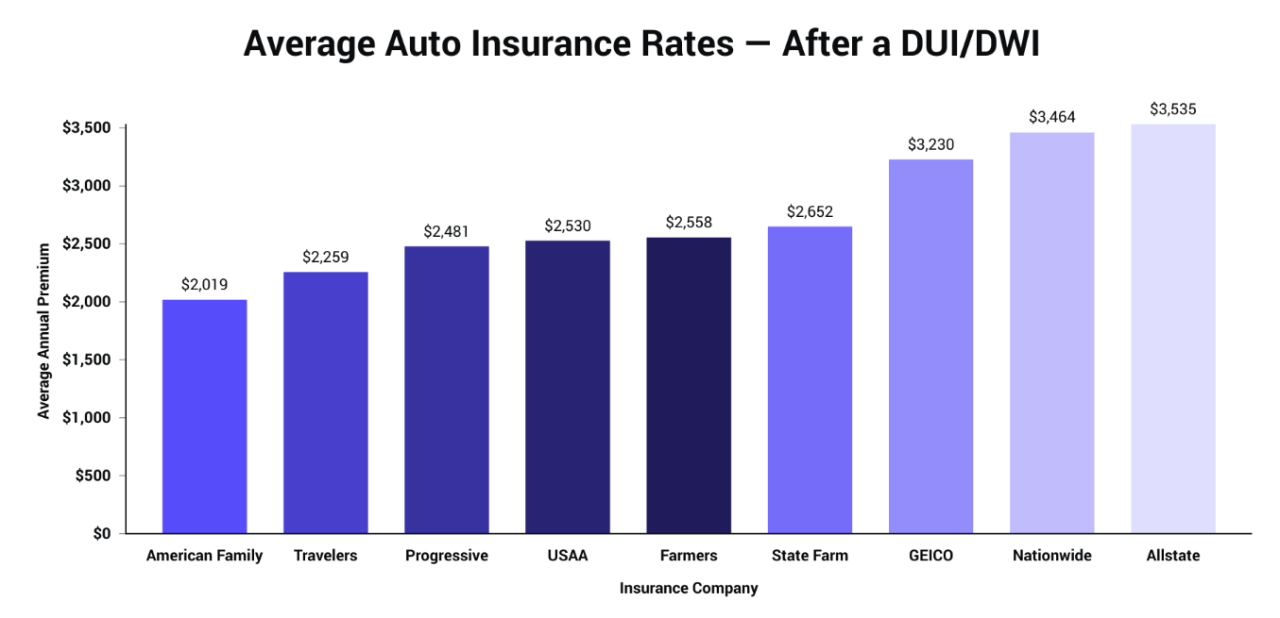

- DUI/DWI Convictions: Driving under the influence of alcohol or drugs is a serious offense that significantly increases your insurance premiums. This is because DUI/DWI convictions indicate a higher risk of future accidents and legal issues.

Age

Your age is another important factor that influences your car insurance rates. This is because younger and older drivers are statistically more likely to be involved in accidents.

- Young Drivers: Drivers under the age of 25 are often considered higher risk due to their lack of experience and higher likelihood of engaging in risky driving behaviors.

- Older Drivers: Drivers over the age of 65 may also face higher premiums due to potential health issues or declining driving abilities. However, some insurers offer discounts for older drivers with clean driving records.

Vehicle Type

The type of vehicle you drive also plays a role in determining your car insurance rates.

- Vehicle Value: Expensive cars are more costly to repair or replace, leading to higher insurance premiums.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, are often considered safer and may qualify for discounts.

- Performance: High-performance vehicles, such as sports cars, are often associated with higher risk due to their speed and power, resulting in higher premiums.

Location

Your location in Florida can significantly impact your car insurance rates. This is because insurance companies consider factors like:

- Traffic Density: Areas with heavy traffic and congestion are associated with a higher risk of accidents, leading to higher premiums.

- Crime Rates: Areas with high crime rates may have higher premiums due to the risk of car theft or vandalism.

- Natural Disasters: Coastal areas prone to hurricanes or other natural disasters may face higher premiums due to the risk of damage to vehicles.

Credit Score

In many states, including Florida, insurance companies use your credit score as a factor in determining your car insurance rates.

- Credit Score and Risk: Insurers believe that individuals with good credit scores are more financially responsible and less likely to file claims.

- Credit-Based Insurance Scores: These scores are used to assess your risk based on your credit history.

- Impact on Premiums: Drivers with lower credit scores may face higher premiums, while those with good credit may qualify for discounts.

Driving Habits

While not always directly considered in rate calculations, your driving habits can indirectly influence your insurance premiums.

- Safe Driving Practices: Maintaining safe driving habits, such as avoiding speeding, distracted driving, and driving under the influence, can help reduce your risk of accidents and potentially lower your premiums in the long run.

- Telematics Devices: Some insurers offer discounts for drivers who use telematics devices, which track their driving habits and provide data on their driving behavior. This data can help insurers assess your risk and potentially lower your premiums if you demonstrate safe driving practices.

Discounts and Savings Opportunities

In the competitive Florida car insurance market, securing the best rates involves exploring available discounts and savings opportunities. Understanding these options can significantly reduce your premiums and make car insurance more affordable.

Common Car Insurance Discounts in Florida

Florida insurance companies offer a wide range of discounts to incentivize safe driving practices, responsible behavior, and loyalty.

- Safe Driving Discounts: These rewards safe drivers with lower premiums.

- Accident-Free Discount: Drivers with a clean driving record, free of accidents or violations, qualify for this discount.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can earn you a discount, demonstrating your commitment to safe driving.

- Good Driver Discount: This discount is typically awarded to drivers with a proven history of safe driving, often based on years of driving experience without accidents or violations.

- Good Student Discount: This discount is offered to students who maintain a certain GPA or academic standing, recognizing their responsible behavior and commitment to education.

- Multi-Policy Discount: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant savings.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can reduce your insurance premium, as it demonstrates your commitment to protecting your vehicle from theft.

- Loyalty Discount: Insurance companies often reward long-term customers with discounts for their continued business.

- Pay-in-Full Discount: Paying your annual premium upfront can sometimes earn you a discount, as it eliminates the administrative costs associated with installment payments.

- Paperless Billing Discount: Opting for electronic billing and communication can lead to a discount, as it reduces the company’s printing and mailing costs.

- Vehicle Safety Features Discount: Cars equipped with safety features like airbags, anti-lock brakes, and electronic stability control often qualify for discounts, as they contribute to safer driving conditions.

Qualifying for Discounts and Maximizing Savings

To maximize your savings, it’s essential to understand the specific requirements and eligibility criteria for each discount offered by your insurer.

- Review your policy documents: Carefully review your policy documents to identify all available discounts and their eligibility requirements.

- Contact your insurer: Reach out to your insurance company to inquire about specific discounts you may qualify for and the necessary documentation or actions required.

- Maintain a clean driving record: Avoid traffic violations and accidents, as a clean driving record is crucial for many discounts, especially safe driving discounts.

- Bundle your policies: Consider bundling your car insurance with other insurance policies, such as homeowners or renters insurance, to take advantage of multi-policy discounts.

- Invest in safety features: When purchasing a new vehicle, consider models with advanced safety features, as these can qualify for discounts.

- Shop around for quotes: Compare quotes from multiple insurance companies to identify the best rates and available discounts.

Negotiating Lower Car Insurance Premiums

While discounts can significantly reduce your premiums, negotiating directly with your insurance company can sometimes yield even better results.

- Be prepared: Before contacting your insurer, gather information about your driving history, vehicle details, and available discounts.

- Highlight your positive factors: Emphasize your clean driving record, years of driving experience, and any safety features your vehicle has.

- Be polite and respectful: Maintain a professional and courteous tone throughout the negotiation process.

- Be willing to compromise: While you may not always get your desired rate, be open to compromise and explore alternative options, such as increasing your deductible or reducing your coverage.

- Consider switching insurers: If you’re unable to negotiate a satisfactory rate with your current insurer, consider shopping around for quotes from other companies.

Understanding Florida’s No-Fault System

Florida operates under a no-fault insurance system, meaning that after an accident, each driver involved is primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. This system aims to streamline the claims process and reduce litigation, but it has significant implications for drivers involved in accidents.

Personal Injury Protection (PIP) Coverage

Florida’s no-fault system mandates that all drivers carry Personal Injury Protection (PIP) coverage, which provides benefits for medical expenses and lost wages incurred due to an accident, regardless of fault. PIP coverage acts as a first-party benefit, meaning it covers the policyholder’s own expenses, regardless of whether another driver was at fault.

- PIP Coverage Requirements: Florida law requires a minimum PIP coverage of $10,000, which is the amount of benefits payable for medical expenses and lost wages. Drivers can opt for higher coverage limits, but the minimum requirement is mandatory.

- PIP Coverage Benefits: PIP benefits typically cover 80% of reasonable and necessary medical expenses, including hospital bills, doctor’s visits, and prescription drugs. The remaining 20% is the responsibility of the injured party. PIP coverage also provides lost wage benefits, typically up to 80% of the injured party’s average weekly wage, subject to a maximum limit.

- PIP Coverage Limitations: PIP benefits are subject to certain limitations, such as a maximum amount of coverage, a time limit for filing claims, and a requirement for seeking medical treatment within 14 days of the accident.

Implications of the No-Fault System for Drivers Involved in Accidents, Car insurance comparison florida

Florida’s no-fault system significantly impacts drivers involved in accidents, particularly in terms of their ability to sue for damages.

- Limited Right to Sue: Under Florida’s no-fault system, drivers generally have a limited right to sue the other driver for pain and suffering, lost wages, and other damages. This limitation applies unless the injuries meet certain thresholds, such as “serious injury” or “permanent injury.”

- Threshold for Filing Lawsuits: To file a lawsuit against another driver, the injured party must demonstrate that their injuries meet the “serious injury” or “permanent injury” threshold. This typically requires a significant impairment, such as disfigurement, a fracture, or a disability that prevents the injured party from performing their usual daily activities.

- Importance of PIP Coverage: PIP coverage is crucial for drivers involved in accidents, as it provides essential financial protection for medical expenses and lost wages. Even if the injured party is not at fault, PIP coverage will cover their own expenses, regardless of the other driver’s liability.

Resources and Tips for Florida Drivers

Navigating the complex world of car insurance in Florida can be overwhelming. This section provides valuable resources and practical tips to help you make informed decisions and ensure you’re adequately protected on the road.

Reputable Resources for Obtaining Car Insurance Quotes and Comparing Policies

Several reputable online platforms and resources can assist you in obtaining car insurance quotes and comparing policies. These platforms allow you to enter your information once and receive multiple quotes from various insurers, simplifying the comparison process.

- Insurance Comparison Websites: Websites like Policygenius, The Zebra, and Insurance.com offer comprehensive comparisons of car insurance rates from multiple providers.

- Florida Department of Financial Services: The Florida Department of Financial Services (DFS) provides valuable information about insurance companies, including financial stability ratings and consumer complaints. You can access this information on their website: https://www.fldfs.com/

- Independent Insurance Agents: Independent insurance agents work with multiple insurance companies and can help you find the best coverage and price for your needs. They can also provide personalized advice and support throughout the process.

Negotiating with Insurance Companies and Resolving Disputes

Negotiating with insurance companies can be challenging, but knowing your rights and employing effective communication strategies can help you achieve favorable outcomes.

- Understand Your Policy: Thoroughly review your policy to understand your coverage limits, deductibles, and exclusions. This knowledge empowers you to negotiate effectively.

- Be Prepared to Negotiate: Gather all relevant documentation, such as repair estimates, police reports, and medical bills, to support your claim. Be prepared to present your case clearly and calmly.

- Don’t Be Afraid to Ask for More: Insurance companies often offer initial settlements that are lower than what you may be entitled to. Don’t hesitate to ask for a higher settlement if you believe it’s justified.

- Consider Mediation: If you’re unable to reach an agreement with the insurance company, consider mediation. A neutral third party can help facilitate communication and reach a mutually acceptable resolution.

Maintaining a Good Driving Record and Reducing the Risk of Accidents

A clean driving record is essential for obtaining affordable car insurance rates. Here are some tips for maintaining a good driving record and reducing the risk of accidents:

- Follow Traffic Laws: Always obey traffic laws and speed limits. Avoid distractions while driving, such as using your cell phone or eating.

- Be Defensive: Practice defensive driving techniques, such as maintaining a safe following distance, scanning for potential hazards, and being aware of your surroundings.

- Get Regular Vehicle Maintenance: Ensure your vehicle is properly maintained by performing regular oil changes, tire rotations, and brake inspections. Well-maintained vehicles are less likely to break down or malfunction.

- Avoid Driving Under the Influence: Never drive under the influence of alcohol or drugs. Always designate a sober driver or use a ride-sharing service.

Concluding Remarks

Finding the right car insurance in Florida involves careful research, comparison, and negotiation. By taking the time to understand your options and leverage available resources, you can find a policy that provides adequate coverage at a competitive price. Remember to regularly review your policy and explore discounts to ensure you’re getting the best value for your money.

Clarifying Questions

What are the minimum car insurance requirements in Florida?

Florida requires drivers to have at least $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person and $20,000 per accident.

What are some common discounts available in Florida?

Common discounts include safe driver discounts, good student discounts, multi-policy discounts, and discounts for anti-theft devices.

How does credit score affect my car insurance rate?

Florida allows insurance companies to consider credit scores when setting rates, although this is not always the case. It’s advisable to check with individual insurers to understand their policies.