Car insurance cost in Florida can be a significant expense, influenced by a complex interplay of factors. From your driving history to the type of vehicle you own, a multitude of variables determine how much you’ll pay for coverage. Understanding these factors is crucial for securing the right insurance policy at a price that fits your budget.

This guide delves into the intricacies of car insurance costs in Florida, providing insights into the key elements that shape your premiums, strategies for lowering your expenses, and an overview of the state’s unique no-fault insurance system. Whether you’re a new driver or a seasoned motorist, navigating the world of Florida car insurance can feel daunting. This comprehensive resource aims to demystify the process, empowering you to make informed decisions about your coverage and ensure you’re adequately protected on the road.

Factors Influencing Car Insurance Costs in Florida

Car insurance premiums in Florida are influenced by a multitude of factors, each playing a significant role in determining the final cost. Understanding these factors can help you make informed decisions to potentially reduce your premiums.

Driving History

Your driving history is a crucial factor in determining your car insurance rates. Insurance companies assess your risk based on past driving behavior, including accidents, traffic violations, and claims. A clean driving record with no accidents or violations generally translates to lower premiums. Conversely, a history of accidents or violations can significantly increase your rates. For instance, a DUI conviction can lead to a substantial increase in your insurance premiums.

Vehicle Type

The type of vehicle you drive also influences your insurance costs. Luxury cars, sports cars, and high-performance vehicles tend to be more expensive to insure due to their higher repair costs and increased risk of theft. On the other hand, smaller, less expensive vehicles generally have lower insurance premiums. Additionally, the safety features of your vehicle, such as anti-theft devices and advanced safety technologies, can influence your rates.

Age, Car insurance cost in florida

Your age is a significant factor in determining your car insurance rates. Younger drivers, particularly those under the age of 25, are statistically more likely to be involved in accidents. Insurance companies consider this increased risk and often charge higher premiums for young drivers. As you age and gain more driving experience, your premiums may decrease.

Location

The location where you live also impacts your car insurance rates. Florida’s diverse geography and population density contribute to varying insurance costs. Areas with higher crime rates, traffic congestion, and a higher frequency of accidents typically have higher insurance premiums. Conversely, areas with lower crime rates and less traffic may have lower premiums.

Florida’s Unique Insurance Laws and Regulations

Florida has unique insurance laws and regulations that significantly impact car insurance costs. The state’s no-fault insurance system requires all drivers to carry Personal Injury Protection (PIP) coverage, which covers medical expenses regardless of fault. While PIP coverage provides benefits, it can also contribute to higher premiums. Additionally, Florida’s “tort threshold” limits the ability of drivers to sue for pain and suffering unless they meet specific criteria. This regulation can affect the cost of liability coverage.

Types of Coverage

The types of coverage you choose can significantly impact your car insurance premiums.

- Liability Coverage: This coverage is mandatory in Florida and protects you financially if you are at fault in an accident. It covers the other driver’s medical expenses, property damage, and lost wages. Higher liability limits generally result in higher premiums.

- Collision Coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of fault. Choosing a higher deductible can lower your premiums.

- Comprehensive Coverage: This coverage protects you from damages to your vehicle caused by non-collision events, such as theft, vandalism, or natural disasters. Like collision coverage, a higher deductible can reduce your premiums.

Average Car Insurance Costs in Florida

Car insurance costs in Florida are influenced by several factors, including vehicle type, age, driving history, and location. This section provides a comprehensive overview of average car insurance premiums in Florida, considering these factors.

Average Car Insurance Premiums by Vehicle Type

Understanding average car insurance costs for different vehicle types is crucial for making informed decisions. The cost of insuring a vehicle varies based on its make, model, year, and safety features.

- Sedans: Sedans are generally considered less expensive to insure than SUVs or trucks due to their lower risk of accidents and repairs. The average annual premium for a sedan in Florida is around $1,500.

- SUVs: SUVs are often more expensive to insure than sedans because they are larger and heavier, increasing the potential for damage in accidents. The average annual premium for an SUV in Florida is approximately $1,800.

- Trucks: Trucks are typically the most expensive to insure due to their size, weight, and increased risk of accidents. The average annual premium for a truck in Florida is around $2,000.

- Sports Cars: Sports cars are also expensive to insure because of their performance capabilities and higher risk of accidents. The average annual premium for a sports car in Florida is estimated to be around $2,500.

Average Car Insurance Premiums by Age Group

Age is another significant factor influencing car insurance premiums. Younger drivers are generally considered riskier than older drivers, leading to higher premiums.

- Teenagers: Teenagers have limited driving experience and are more likely to be involved in accidents. Their average annual premium can be as high as $4,000 or more.

- Young Adults: Young adults (ages 18-25) are still considered relatively high-risk drivers, but their premiums are generally lower than those of teenagers. Their average annual premium is around $2,000.

- Mature Drivers: Mature drivers (over 25) have more experience and a lower risk of accidents, resulting in lower premiums. Their average annual premium is approximately $1,500.

- Senior Drivers: Senior drivers (over 65) may face higher premiums due to potential health concerns and reduced reaction times. Their average annual premium is around $1,800.

Average Car Insurance Costs by Geographic Location

Car insurance costs vary significantly across different regions of Florida due to factors such as traffic density, crime rates, and weather conditions.

| City | Average Annual Premium |

|---|---|

| Miami | $2,200 |

| Tampa | $1,800 |

| Orlando | $1,700 |

| Jacksonville | $1,600 |

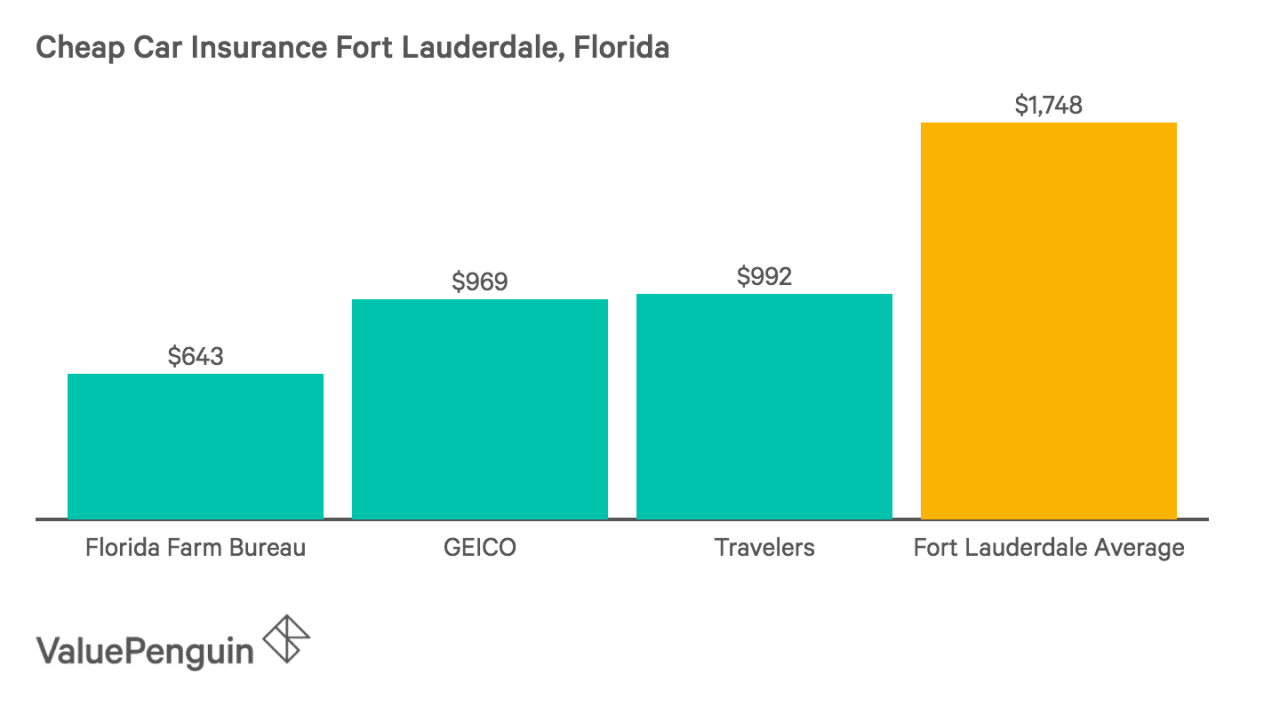

| Fort Lauderdale | $2,000 |

Strategies for Reducing Car Insurance Costs in Florida: Car Insurance Cost In Florida

Car insurance in Florida can be expensive, but there are several strategies you can use to lower your premiums. By taking advantage of discounts, practicing safe driving, and making smart policy choices, you can significantly reduce your insurance costs.

Discounts

Discounts are a great way to save money on your car insurance. Many insurance companies offer a variety of discounts to their policyholders.

- Good Driver Discount: This discount is available to drivers with a clean driving record, typically for three to five years without any accidents or traffic violations.

- Safe Driver Discount: Similar to the good driver discount, this discount rewards drivers who have completed defensive driving courses or have a history of safe driving.

- Multi-Policy Discount: Many insurance companies offer a discount for bundling your car insurance with other types of insurance, such as homeowners or renters insurance.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can make your car less attractive to thieves and qualify you for a discount.

- Student Discount: If you are a full-time student with good grades, you may be eligible for a discount on your car insurance.

- Senior Citizen Discount: Drivers over a certain age, typically 55 or 65, may qualify for a discount due to their lower risk of accidents.

- Military Discount: Some insurance companies offer discounts to active-duty military personnel and veterans.

- Loyalty Discount: Many insurance companies reward long-term customers with loyalty discounts.

Safe Driving Practices

Maintaining a safe driving record is crucial for keeping your car insurance premiums low.

- Avoid Accidents and Violations: Accidents and traffic violations can significantly increase your insurance premiums. Driving defensively and following traffic laws can help you avoid these incidents.

- Maintain a Clean Driving Record: A clean driving record is a key factor in determining your insurance rates.

- Consider a Defensive Driving Course: Completing a defensive driving course can demonstrate your commitment to safe driving and may earn you a discount.

Policy Adjustments

Making adjustments to your car insurance policy can also help you save money.

- Increase Your Deductible: A higher deductible means you will pay more out of pocket in case of an accident, but it can lower your premium.

- Reduce Your Coverage: If you have an older car with a lower value, you may be able to reduce your coverage, such as collision or comprehensive, to lower your premium.

- Shop Around for Quotes: Getting quotes from multiple insurance companies can help you find the best rates.

Obtaining Car Insurance Quotes

It’s essential to compare quotes from different insurance providers to find the best rates.

- Online Comparison Websites: Several websites allow you to compare quotes from multiple insurance companies simultaneously.

- Direct Contact with Insurance Companies: Contact insurance companies directly to request quotes.

- Insurance Brokers: Insurance brokers can help you compare quotes from different companies and find the best policy for your needs.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, meaning drivers are primarily responsible for covering their own medical expenses and lost wages following an accident, regardless of who caused it. This system aims to expedite the claims process and reduce litigation.

Personal Injury Protection (PIP) Coverage

In Florida’s no-fault system, Personal Injury Protection (PIP) coverage plays a crucial role. It is mandatory for all drivers in the state and provides coverage for medical expenses, lost wages, and other related costs incurred by the policyholder and passengers in their vehicle, regardless of fault. PIP coverage typically covers 80% of reasonable and necessary medical expenses up to $10,000, and 60% of lost wages up to $2,500.

Filing a Claim Under Florida’s No-Fault System

The process of filing a claim under Florida’s no-fault system involves the following steps:

- Report the accident to your insurance company: As soon as possible, contact your insurance company and report the accident. Provide them with all the necessary details, including the date, time, location, and parties involved.

- Seek medical attention: If you or your passengers have sustained injuries, seek medical attention promptly. Your PIP coverage will cover the cost of these medical expenses.

- Submit your claim to your insurance company: Once you have received medical treatment, submit your claim to your insurance company. You will need to provide them with documentation, including medical bills, lost wage statements, and a police report.

- Receive payment for your claim: Your insurance company will review your claim and, if approved, issue payment for your covered expenses.

Final Conclusion

Navigating car insurance in Florida requires a thorough understanding of the factors that influence your premiums, the state’s unique insurance system, and strategies for finding affordable coverage. By taking the time to learn about these elements, you can make informed decisions about your insurance needs and ensure you’re adequately protected on the road while staying within your budget. Armed with this knowledge, you can confidently navigate the complexities of Florida’s car insurance landscape and find the right policy for your individual needs.

Helpful Answers

What are some common discounts available in Florida?

Florida offers a variety of discounts, including safe driver discounts, good student discounts, multi-car discounts, and discounts for anti-theft devices.

How often should I review my car insurance policy?

It’s generally recommended to review your policy annually to ensure you’re still getting the best rates and coverage. Life circumstances can change, and your insurance needs may evolve over time.

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage, $10,000 in Property Damage Liability (PDL) coverage, and $10,000 in Bodily Injury Liability (BIL) coverage per person and $20,000 per accident.

What is the difference between collision and comprehensive coverage?

Collision coverage protects you from damage to your vehicle caused by an accident, while comprehensive coverage covers damage from events like theft, vandalism, or natural disasters.