Car insurance costs are a significant expense for most drivers, and understanding the factors that influence these costs is crucial for making informed decisions. From your driving history and age to the type of vehicle you drive and your location, numerous variables contribute to the price of your car insurance premiums.

This guide will explore the intricate world of car insurance, delving into the key factors that determine your rates, the different types of coverage available, and practical strategies for saving money on your premiums. We will also discuss how to obtain quotes, understand your policy, and navigate the process of filing a claim.

Factors Influencing Car Insurance Costs

Car insurance premiums are influenced by a variety of factors, ensuring that each policyholder pays a fair price based on their individual risk profile. These factors are carefully considered by insurance companies to determine the cost of coverage.

Driving History

Your driving history plays a crucial role in determining your car insurance premiums. A clean driving record with no accidents or violations translates to lower premiums, as you are perceived as a lower-risk driver. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely result in higher premiums. This is because your driving history provides valuable insights into your driving habits and potential for future claims. Insurance companies use this information to assess your risk of being involved in an accident and set premiums accordingly.

Age and Gender

Age and gender also influence car insurance costs. Younger drivers, especially those under 25, often face higher premiums due to their statistically higher risk of accidents. This is because young drivers have less experience on the road and are more likely to engage in risky driving behaviors. Gender can also play a role, with males generally paying higher premiums than females. This difference is attributed to historical data indicating that men tend to be involved in more accidents.

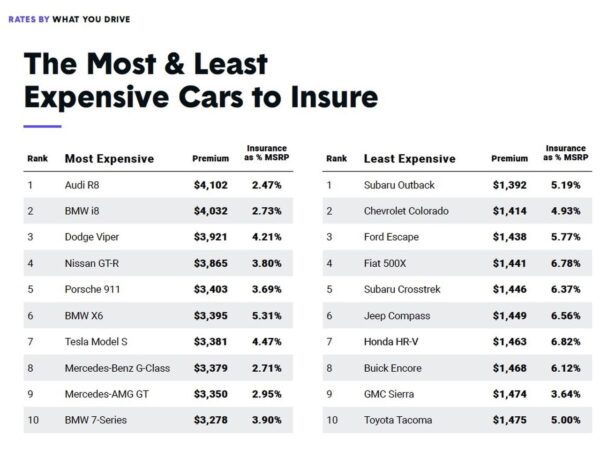

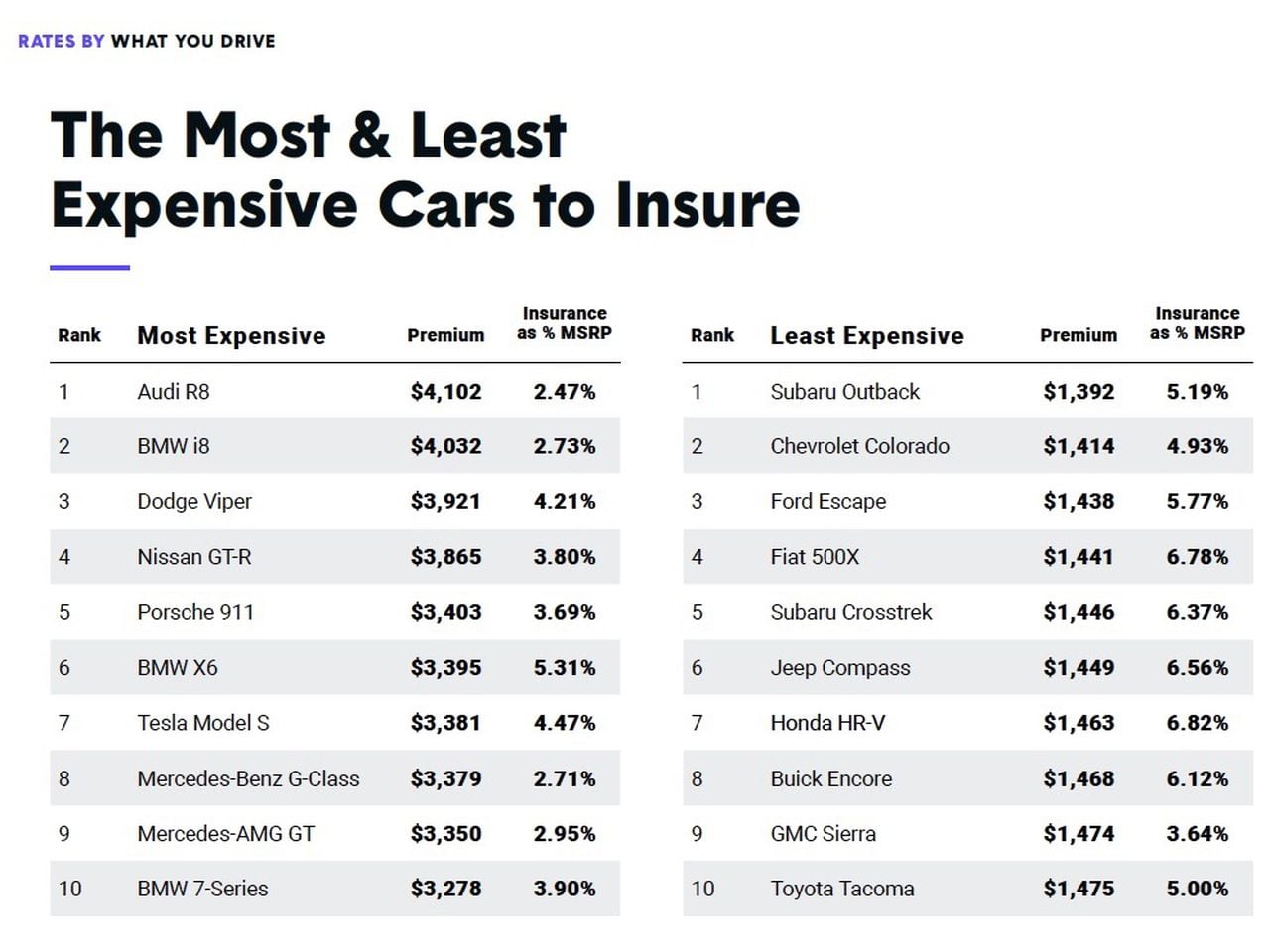

Vehicle Type and Value

The type and value of your vehicle significantly impact your car insurance premiums. Luxury cars and high-performance vehicles are typically more expensive to insure due to their higher repair costs and greater risk of theft. Conversely, older, less expensive vehicles often have lower premiums. Insurance companies consider factors such as the vehicle’s safety features, its repair costs, and its likelihood of being stolen when determining your premium.

Location and Driving Habits

Where you live and how you drive also influence your car insurance costs. Drivers residing in urban areas with high traffic density and more frequent accidents may face higher premiums. Insurance companies also consider factors such as the crime rate and the prevalence of weather-related events in your area. Your driving habits, such as the number of miles you drive annually and your driving patterns, also play a role. For example, drivers who commute long distances or frequently drive at night may face higher premiums due to their increased exposure to potential risks.

Types of Car Insurance Coverage: Car Insurance Costs

Car insurance policies offer various types of coverage to protect you financially in case of an accident or other unforeseen events. Understanding these different coverages and their benefits is crucial in choosing the right policy that meets your specific needs and budget.

Liability Coverage

Liability coverage is a fundamental part of car insurance. It provides financial protection to you if you are at fault in an accident that causes injury or damage to another person or their property. It’s essential to have sufficient liability coverage as it can shield you from significant financial losses.

Liability coverage typically comprises two components:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other driver or passengers in an accident if you are found at fault.

- Property Damage Liability: This coverage pays for repairs or replacement costs of the other driver’s vehicle or any damaged property if you are responsible for the accident.

Collision Coverage, Car insurance costs

Collision coverage protects you from financial losses if your vehicle is damaged in an accident, regardless of who is at fault. It covers the cost of repairs or replacement of your vehicle, minus your deductible.

This coverage is particularly beneficial if you have a newer vehicle or a vehicle with a high value. It allows you to get your car repaired or replaced without having to pay for the entire cost out of pocket.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damages caused by events other than accidents. This includes:

- Theft: If your vehicle is stolen, comprehensive coverage helps cover the cost of replacement or repair.

- Vandalism: If your vehicle is damaged due to vandalism, comprehensive coverage can help pay for repairs.

- Natural Disasters: Coverage can extend to damage caused by events like hail, floods, earthquakes, and wildfires.

- Animal Collisions: If your vehicle is damaged by a collision with an animal, comprehensive coverage can help with the repair costs.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) is essential, as it provides financial protection if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your losses.

This coverage helps pay for your medical expenses, lost wages, and property damage if the other driver is uninsured or underinsured. It’s important to note that UM/UIM coverage is separate from liability coverage and is not mandatory in all states.

Comparison of Coverage Types

| Coverage Type | Description | Benefits | Who Needs It |

|---|---|---|---|

| Liability Coverage | Protects you from financial losses if you cause an accident that injures another person or damages their property. | Shields you from significant financial liabilities, including medical expenses, lost wages, and property damage costs. | All drivers, as it is a legal requirement in most states. |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of who is at fault. | Provides financial protection for repairs or replacement of your vehicle, reducing out-of-pocket expenses. | Drivers with newer or high-value vehicles, as well as those who want comprehensive protection. |

| Comprehensive Coverage | Covers damage to your vehicle caused by events other than accidents, such as theft, vandalism, and natural disasters. | Protects you from financial losses due to various events, providing peace of mind for your vehicle’s safety. | Drivers who want protection against a wide range of risks, including theft, vandalism, and natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Provides financial protection if you are involved in an accident with an uninsured or underinsured driver. | Covers your medical expenses, lost wages, and property damage if the other driver lacks sufficient insurance. | All drivers, as it provides a safety net in case of an accident with an uninsured or underinsured driver. |

Getting Car Insurance Quotes

Getting the best car insurance rates requires research and comparison. By understanding the factors influencing insurance costs and exploring various options, you can find the most suitable coverage at a price that fits your budget.

Comparing Insurance Quotes

It’s crucial to compare quotes from multiple insurance companies to find the best rates. Here’s a step-by-step guide:

- Gather Your Information: Before starting, have your driving history, vehicle information, and desired coverage details ready. This includes your driver’s license number, vehicle identification number (VIN), and any relevant details about your car, such as its make, model, year, and mileage.

- Use Online Comparison Tools: Many websites offer online comparison tools that allow you to enter your information and receive quotes from various insurance companies simultaneously. These tools can save you time and effort by streamlining the process.

- Contact Insurance Companies Directly: Besides using comparison websites, reach out to insurance companies directly to get personalized quotes. You can call, email, or visit their websites to obtain a quote. This allows you to ask specific questions and discuss your individual needs with an agent.

- Review Quotes Carefully: Once you receive quotes from different companies, compare them carefully. Pay attention to the coverage offered, deductibles, premiums, and any additional fees or discounts. Make sure you understand what each quote covers and what it doesn’t.

Factors to Consider When Comparing Quotes

When comparing insurance quotes, consider the following factors:

- Coverage: Ensure the coverage offered matches your needs and legal requirements. Different companies may have varying levels of coverage, such as liability, collision, comprehensive, and uninsured motorist coverage. Choose the coverage that provides the best protection for you and your vehicle.

- Deductibles: A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums. Consider your risk tolerance and financial situation when deciding on your deductible.

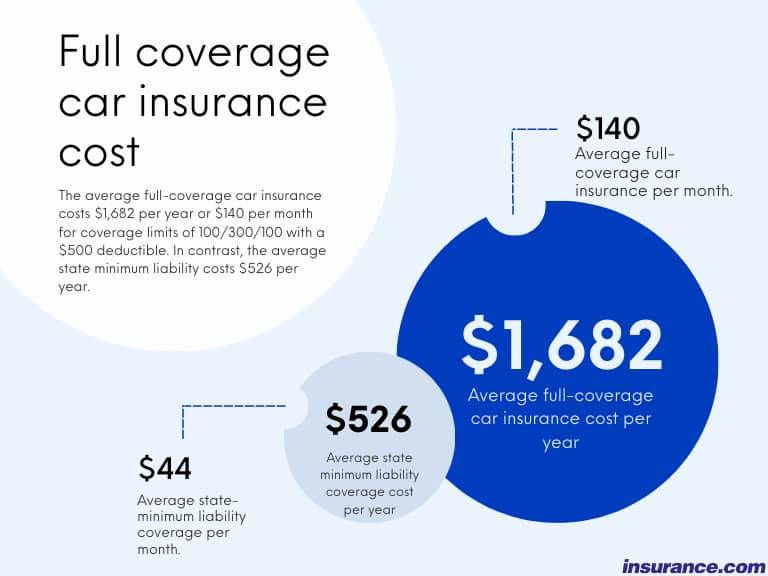

- Premiums: Premiums are the monthly or annual payments you make for your insurance policy. Compare premiums from different companies and choose the one that offers the best value for your coverage.

- Discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features in your vehicle, and bundling multiple insurance policies. Inquire about available discounts and see if you qualify.

- Customer Service: Consider the reputation and customer service of the insurance company. Read online reviews, check ratings from independent organizations, and contact the company to inquire about their customer service policies. A reliable and responsive insurer can be crucial in case of an accident or claim.

Understanding Policy Terms and Conditions

Once you’ve chosen an insurance company, carefully review the policy terms and conditions. Pay close attention to:

- Exclusions: Understand what situations are not covered by your policy. For example, some policies may exclude certain types of accidents, such as those involving driving under the influence of alcohol or drugs.

- Limits: Be aware of the maximum amount your insurance company will pay for specific types of claims. This information is usually Artikeld in the policy document.

- Renewal Process: Understand how your policy is renewed and whether premiums are subject to change. Familiarize yourself with the renewal process and any potential changes in coverage or rates.

Saving Money on Car Insurance

Car insurance is a necessity for most car owners, but it can also be a significant expense. Fortunately, there are several ways to save money on your car insurance premiums. By understanding the factors that influence your rates and implementing some smart strategies, you can potentially lower your costs and keep more money in your pocket.

Common Discounts Available

Discounts can significantly reduce your car insurance premiums. Here are some common discounts offered by insurance companies:

- Good Student Discount: This discount is available to students who maintain a certain GPA or academic standing. For example, a student with a 3.0 GPA or higher might qualify for a 10% discount.

- Safe Driver Discount: This discount is offered to drivers with a clean driving record, free of accidents and traffic violations. Insurance companies recognize that drivers with a history of safe driving are less likely to file claims, leading to lower premiums.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you may be eligible for a multi-car discount. This discount typically applies to all vehicles on your policy.

- Multi-Policy Discount: Insurance companies often offer discounts for bundling multiple insurance policies, such as car insurance, homeowners insurance, or renters insurance.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as an alarm system or GPS tracking device, can make your car less attractive to thieves, leading to a lower insurance premium.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices and earn you a discount on your insurance.

- Loyalty Discount: Some insurance companies offer discounts to long-term customers who have maintained their policy for a certain period.

Strategies for Reducing Insurance Premiums

Safe driving habits can have a positive impact on your insurance premiums. Here are some strategies for reducing your insurance costs:

- Maintain a Clean Driving Record: Avoid traffic violations and accidents, as these can significantly increase your premiums.

- Practice Defensive Driving: Be aware of your surroundings, anticipate potential hazards, and maintain a safe distance from other vehicles.

- Avoid Distracted Driving: Put away your phone, avoid eating or drinking while driving, and focus on the road.

- Drive Less: If you can reduce your mileage by carpooling, using public transportation, or working from home, you may be eligible for a lower premium.

Benefits of Bundling Insurance Policies

Bundling insurance policies can lead to significant savings on your premiums. Here are the key benefits of bundling:

- Lower Premiums: Insurance companies often offer discounts for bundling multiple policies, such as car insurance, homeowners insurance, or renters insurance.

- Convenience: Managing multiple policies with one insurance company can be more convenient than dealing with multiple insurers.

- Simplified Billing: You’ll receive a single bill for all your bundled policies, simplifying your payment process.

Negotiating Car Insurance Rates

You can often negotiate lower car insurance rates by following these tips:

- Shop Around: Get quotes from multiple insurance companies to compare rates and coverage options.

- Review Your Coverage: Ensure you have the right amount of coverage for your needs.

- Ask About Discounts: Inquire about all available discounts and make sure you’re receiving them.

- Be Willing to Negotiate: Don’t be afraid to negotiate your rate with the insurance company.

- Consider a Higher Deductible: A higher deductible can result in lower premiums, but you’ll have to pay more out of pocket if you need to file a claim.

Understanding Your Car Insurance Policy

Your car insurance policy is a legally binding contract that Artikels the terms and conditions of your coverage. It’s essential to understand the details of your policy to ensure you have the protection you need in case of an accident or other covered event.

Policy Coverage Limits

Your policy’s coverage limits specify the maximum amount your insurer will pay for covered losses. These limits are typically expressed in dollar amounts or per-incident limits. Understanding your coverage limits is crucial to determine whether you have sufficient protection for your needs. For example, if you have a $100,000 liability limit and cause an accident resulting in $150,000 in damages, you’ll be responsible for the remaining $50,000.

Filing a Claim

Filing a claim is the process of notifying your insurer about a covered event and requesting compensation for losses. The process typically involves:

- Contacting your insurer promptly after the incident.

- Providing detailed information about the incident, including date, time, location, and parties involved.

- Submitting any relevant documentation, such as police reports, medical bills, or repair estimates.

- Cooperating with your insurer’s investigation and providing any requested information or documentation.

Policy Exclusions and Limitations

While your car insurance policy provides coverage for certain events, it also has exclusions and limitations. These are specific circumstances or situations that are not covered by your policy. Understanding these exclusions and limitations is vital to avoid surprises when you need to file a claim.

For example, most policies exclude coverage for damages caused by wear and tear, intentional acts, or driving under the influence of alcohol or drugs.

Common Policy Provisions

| Provision | Implications |

|---|---|

| Deductible | The amount you pay out-of-pocket before your insurance coverage kicks in. |

| Premium | The amount you pay for your car insurance coverage. |

| Co-insurance | The percentage of covered costs you share with your insurer after your deductible is met. |

| Coverage Limits | The maximum amount your insurer will pay for covered losses. |

Closing Notes

By understanding the intricacies of car insurance costs, you can make informed decisions that protect your financial well-being and ensure you have the right coverage to meet your needs. Whether you are a new driver or a seasoned motorist, this comprehensive guide provides valuable insights and practical advice to help you navigate the complex world of car insurance.

Commonly Asked Questions

What is the difference between liability and collision coverage?

Liability coverage protects you financially if you cause an accident, while collision coverage covers damage to your own vehicle in an accident, regardless of fault.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy annually to ensure it still meets your needs and to see if you qualify for any new discounts.

Can I get car insurance if I have a poor driving record?

Yes, but it will likely be more expensive. You may need to consider a high-risk insurance provider or explore options like defensive driving courses to improve your rates.

What is a deductible, and how does it affect my car insurance costs?

A deductible is the amount you pay out of pocket for a claim before your insurance coverage kicks in. A higher deductible generally means lower premiums.