Car insurance Florida, a state known for its sunshine and beaches, also presents a unique set of challenges for drivers. From the unpredictable weather patterns to the high population density, Florida’s driving landscape requires careful consideration of insurance needs. This guide delves into the intricacies of car insurance in Florida, exploring the various coverage options, factors affecting rates, and tips for choosing the right policy.

Understanding the specific requirements and complexities of Florida’s car insurance market is crucial for drivers seeking adequate protection. This guide aims to provide comprehensive information, empowering drivers to make informed decisions about their insurance needs.

Florida Car Insurance Landscape

Florida’s car insurance market is a complex and unique ecosystem shaped by several factors, including its weather patterns, high population density, and legal considerations. Understanding these factors is crucial for both drivers and insurance providers to navigate the intricacies of this market effectively.

Florida’s Weather Patterns

Florida’s subtropical climate makes it susceptible to hurricanes and other severe weather events, significantly impacting the car insurance landscape. Hurricanes can cause widespread damage to vehicles, leading to a higher frequency of claims. This increased risk translates to higher premiums for drivers in Florida compared to other states with less extreme weather conditions.

High Population Density

Florida is a densely populated state, with a high concentration of vehicles on the road. This increased traffic density can lead to a higher frequency of accidents, which, in turn, affects insurance premiums. As the number of vehicles and drivers increases, so does the likelihood of collisions, resulting in higher claims and ultimately higher insurance costs for drivers.

Legal Considerations

Florida’s legal system also plays a significant role in shaping the car insurance market. The state has a “no-fault” insurance system, where drivers are required to carry personal injury protection (PIP) coverage. PIP coverage pays for medical expenses and lost wages regardless of fault in an accident. While this system aims to simplify claims processing, it can also contribute to higher insurance premiums due to the potential for increased claims.

Demographics of Florida Drivers

Florida’s diverse population includes a significant number of retirees and tourists, impacting the car insurance market. Retirees often drive less frequently, which could lead to lower premiums. However, they might also be more likely to have pre-existing health conditions, potentially increasing their insurance costs. Tourists, on the other hand, often rent vehicles, which can contribute to a higher volume of accidents and, consequently, higher premiums for rental car companies.

Cost of Car Insurance in Florida

Florida has consistently ranked among the states with the highest average car insurance premiums in the United States. Several factors contribute to this high cost, including:

- The state’s high frequency of accidents and claims.

- The high cost of vehicle repairs and medical expenses.

- The presence of fraud and abuse in the insurance system.

A 2023 study by the Insurance Information Institute (III) found that the average annual premium for car insurance in Florida was $2,659, significantly higher than the national average of $1,721. This difference highlights the unique challenges faced by drivers in Florida when it comes to car insurance.

Types of Car Insurance Coverage in Florida: Car Insurance Florida

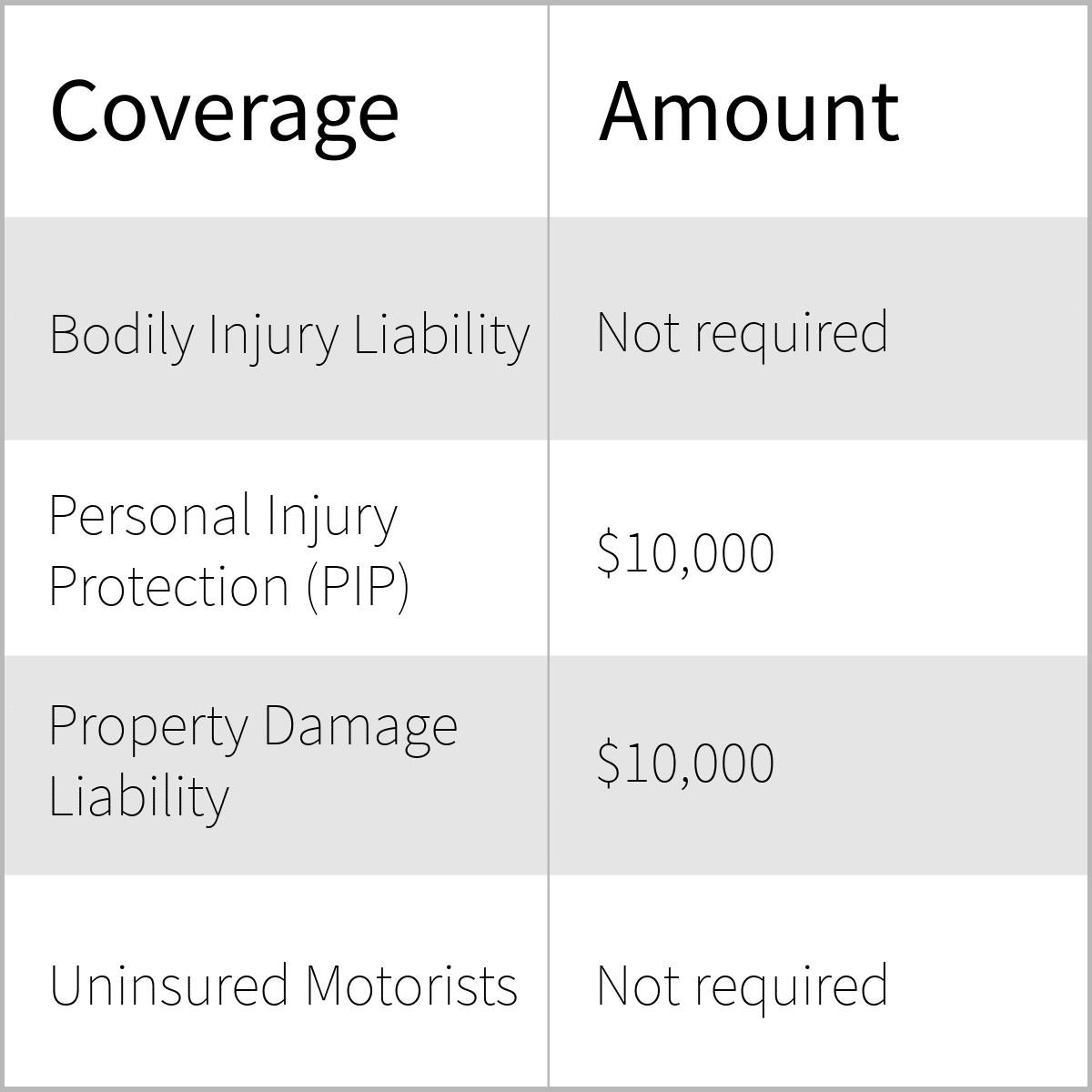

Florida law mandates certain car insurance coverages to protect drivers and their passengers. These coverages are designed to provide financial compensation for injuries and property damage resulting from car accidents.

Mandatory Car Insurance Coverages

In Florida, all drivers must have the following two mandatory car insurance coverages:

- Personal Injury Protection (PIP): PIP covers medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault. The coverage limit is typically $10,000 per person.

- Property Damage Liability (PDL): PDL covers damages to another person’s property, such as their vehicle, if you are at fault in an accident. The minimum coverage required is $10,000.

Optional Car Insurance Coverages

While PIP and PDL are mandatory, Florida drivers can choose to purchase additional optional coverage options to enhance their protection. These include:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. It is typically advisable for newer or more expensive vehicles.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by non-collision events such as theft, vandalism, fire, or natural disasters. It is generally recommended for vehicles with significant value.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This coverage protects you and your passengers if you are involved in an accident with a driver who is uninsured or underinsured. It covers medical expenses, lost wages, and other related costs.

Comparison of Car Insurance Coverage, Car insurance florida

The following table compares the different types of car insurance coverage in Florida, highlighting their benefits and estimated costs:

| Coverage Type | Benefits | Estimated Cost |

|---|---|---|

| PIP | Covers medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault. | $100-$200 per year |

| PDL | Covers damages to another person’s property, such as their vehicle, if you are at fault in an accident. | $100-$200 per year |

| Collision | Pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. | $200-$500 per year |

| Comprehensive | Protects your vehicle from damages caused by non-collision events such as theft, vandalism, fire, or natural disasters. | $100-$300 per year |

| UM/UIM | Protects you and your passengers if you are involved in an accident with a driver who is uninsured or underinsured. | $50-$150 per year |

Factors Affecting Car Insurance Rates in Florida

Several factors influence the cost of car insurance in Florida, impacting the premium you pay. These factors are considered by insurance companies to assess your risk profile and determine the appropriate insurance rate.

Driving History

Your driving history is a significant factor in determining your car insurance rates. A clean driving record with no accidents or traffic violations will typically result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely increase your rates. Insurance companies view these incidents as indicators of higher risk and adjust your premium accordingly.

Choosing the Right Car Insurance Policy in Florida

Navigating the world of car insurance in Florida can feel overwhelming, but with careful consideration and the right approach, you can find a policy that meets your needs and budget. By understanding your options, comparing quotes, and asking the right questions, you can secure the best car insurance protection for yourself and your vehicle.

Comparing Car Insurance Quotes

To find the most competitive car insurance rates, it’s essential to compare quotes from multiple providers.

- Use online comparison websites: Sites like Insurance.com, The Zebra, and Policygenius allow you to enter your information once and receive quotes from various insurance companies. This streamlines the comparison process and saves you time.

- Contact insurance companies directly: Reach out to insurance providers you’re interested in and request quotes. This allows you to ask specific questions and gather more detailed information about their policies.

- Consider your needs and budget: When comparing quotes, prioritize coverage that aligns with your specific circumstances. If you have a high-value vehicle or a history of accidents, you may need more comprehensive coverage. If you’re on a tight budget, you may opt for minimum liability coverage, but ensure it meets Florida’s legal requirements.

Asking the Right Questions

Before committing to a policy, it’s crucial to have a clear understanding of the coverage details.

- What are the policy’s deductibles and coverage limits? Deductibles represent the amount you pay out-of-pocket before your insurance kicks in. Coverage limits determine the maximum amount your insurance will pay for specific claims.

- What are the policy’s exclusions and limitations? Understand what situations are not covered by your insurance, such as certain types of accidents or damage. This helps you avoid surprises and ensures you’re adequately protected.

- What discounts are available? Many insurance companies offer discounts for factors like safe driving records, good credit scores, multiple vehicle insurance, and safety features in your car. Ask about available discounts and how to qualify for them.

- What is the claims process like? Understanding the claims process, including reporting procedures and timelines, can help you navigate any future incidents smoothly. Ask about the company’s customer service availability and responsiveness.

Understanding Policy Terms and Conditions

Carefully reviewing the policy’s terms and conditions is essential before signing.

- Read the policy carefully: Don’t just skim the document. Pay attention to every detail, including definitions, exclusions, and limitations. If you have any questions, don’t hesitate to ask your insurance agent for clarification.

- Understand the coverage details: Ensure you fully grasp what is and isn’t covered by the policy. This includes understanding the different types of coverage, such as liability, collision, comprehensive, and personal injury protection (PIP).

- Consider the policy’s renewal terms: Understand how the policy renews, including the renewal process, potential rate increases, and any changes to coverage or terms.

Summary

Navigating the world of car insurance in Florida can seem daunting, but with the right information and a proactive approach, drivers can find the coverage that best suits their needs. By understanding the unique factors influencing insurance rates, exploring the available coverage options, and comparing quotes from different providers, drivers can secure the protection they deserve while navigating the Sunshine State’s roads.

FAQ Resource

What are the minimum car insurance requirements in Florida?

Florida law requires all drivers to carry Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage.

How can I get a discount on my car insurance in Florida?

Several discounts are available, including good driver discounts, safe driving courses, multi-car discounts, and discounts for safety features in your vehicle.

What should I do if I get into a car accident in Florida?

First, ensure everyone is safe. Then, call the police and exchange information with the other driver(s) involved. Take pictures of the damage and gather witness information.

How do I file a car insurance claim in Florida?

Contact your insurance company as soon as possible after the accident. They will guide you through the claims process and provide instructions for documenting the incident.