Car insurance Florida cheapest is a hot topic for many residents, especially given the state’s unique insurance landscape. Florida’s high population density, frequent weather events, and litigious environment all contribute to higher car insurance costs. But, finding affordable coverage is possible with the right knowledge and strategies. This guide explores the factors that influence car insurance premiums in Florida, offers tips for finding the cheapest options, and helps you navigate the claims process.

Understanding the intricacies of Florida’s car insurance market is crucial for securing the best rates. Factors like your driving history, age, vehicle type, and location all play a significant role in determining your premium. Additionally, Florida’s no-fault insurance system and the mandatory personal injury protection (PIP) coverage add another layer of complexity to the equation.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance landscape is unique and complex, influenced by a combination of factors that drive up costs for drivers. The Sunshine State’s high population density, frequent weather events, and a litigious environment contribute to a higher-than-average cost of car insurance.

Florida’s Unique Insurance Factors

Florida’s high population density creates a higher risk of accidents, as more vehicles are on the road. This increased risk translates into higher insurance premiums for drivers. The state’s susceptibility to hurricanes, tropical storms, and other weather events also contributes to higher insurance costs. Insurance companies must factor in the potential for significant damage and payouts due to these events. Florida is known for its high number of lawsuits related to car accidents. This litigious environment leads to higher insurance premiums as companies account for the potential for large settlements.

The Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a crucial role in regulating the state’s car insurance market. The DFS oversees insurance companies, sets rates, and ensures fair and competitive practices. The DFS also investigates consumer complaints and enforces insurance laws.

Types of Car Insurance Coverage in Florida, Car insurance florida cheapest

Florida requires all drivers to carry certain types of car insurance coverage. Understanding the different types of coverage available is essential for making informed decisions about your insurance needs.

Liability Coverage

Liability coverage is mandatory in Florida and protects you financially if you cause an accident that injures another person or damages their property. This coverage pays for the other driver’s medical expenses, lost wages, and property damage up to the limits of your policy.

Collision Coverage

Collision coverage pays for repairs to your vehicle if you’re involved in an accident, regardless of who is at fault. This coverage is optional but highly recommended, especially if you have a financed or leased vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from non-collision events, such as theft, vandalism, fire, and natural disasters. This coverage is optional but can be beneficial if you live in an area prone to these events.

Personal Injury Protection (PIP)

PIP coverage is mandatory in Florida and covers your own medical expenses and lost wages after an accident, regardless of fault. This coverage is often referred to as “no-fault” insurance.

Factors Influencing Car Insurance Premiums

Car insurance premiums are calculated based on various factors that assess the risk associated with insuring a particular driver and vehicle. These factors are used to determine the likelihood of an accident and the potential cost of claims. By analyzing these factors, insurance companies can price premiums accordingly, ensuring a balance between covering potential risks and offering competitive rates.

Driving History

A driver’s past driving record is a significant factor in determining insurance premiums. This record includes information about accidents, traffic violations, and driving suspensions. Drivers with a clean driving history, free of accidents and violations, are considered lower risk and are likely to receive lower premiums. Conversely, drivers with a history of accidents or violations are considered higher risk and will typically pay higher premiums. For example, a driver with a DUI conviction will face significantly higher premiums compared to a driver with a clean record.

Age

Age plays a crucial role in car insurance premiums, as younger and older drivers are often considered higher risk. Younger drivers, especially those under 25, have less experience behind the wheel and are more likely to be involved in accidents. On the other hand, older drivers may have diminished physical abilities and reflexes, increasing their risk of accidents. However, drivers in their mid-thirties to fifties are often considered to be at the lowest risk due to their experience and physical capabilities.

Gender

Gender is another factor that insurance companies consider, although its influence has been declining in recent years. Historically, statistics have shown that men tend to have higher accident rates than women. However, this trend is not universally true and varies depending on factors like age and driving experience.

Credit Score

In many states, including Florida, insurance companies use credit scores as a proxy for risk assessment. This practice is based on the correlation between credit history and driving behavior. Studies have shown that individuals with poor credit scores are more likely to file insurance claims and engage in risky behavior.

Vehicle Type

The type of vehicle you drive also influences your car insurance premiums. Sports cars, luxury vehicles, and high-performance cars are generally considered more expensive to repair and replace, leading to higher insurance premiums. On the other hand, smaller, more fuel-efficient cars typically have lower premiums.

Location

The location where you live and drive can significantly impact your car insurance rates. Areas with high traffic density, crime rates, and accident rates tend to have higher insurance premiums. This is because the risk of accidents and claims is greater in these locations.

Table Comparing Average Car Insurance Premiums

| Factor | Age Group | Vehicle Type | Driving History | Average Premium |

|—|—|—|—|—|

| Age | Under 25 | Sedan | Clean | $1,500 |

| | Under 25 | Sports Car | Clean | $2,000 |

| | 25-35 | Sedan | Clean | $1,200 |

| | 25-35 | Sports Car | Clean | $1,600 |

| | Over 35 | Sedan | Clean | $1,000 |

| | Over 35 | Sports Car | Clean | $1,400 |

| Vehicle Type | Sedan | Under 25 | Clean | $1,500 |

| | Sports Car | Under 25 | Clean | $2,000 |

| | Sedan | 25-35 | Clean | $1,200 |

| | Sports Car | 25-35 | Clean | $1,600 |

| | Sedan | Over 35 | Clean | $1,000 |

| | Sports Car | Over 35 | Clean | $1,400 |

| Driving History | Clean | Under 25 | Sedan | $1,500 |

| | Clean | Under 25 | Sports Car | $2,000 |

| | Clean | 25-35 | Sedan | $1,200 |

| | Clean | 25-35 | Sports Car | $1,600 |

| | Clean | Over 35 | Sedan | $1,000 |

| | Clean | Over 35 | Sports Car | $1,400 |

| | At-fault accident | Under 25 | Sedan | $2,000 |

| | At-fault accident | Under 25 | Sports Car | $2,500 |

| | At-fault accident | 25-35 | Sedan | $1,600 |

| | At-fault accident | 25-35 | Sports Car | $2,000 |

| | At-fault accident | Over 35 | Sedan | $1,400 |

| | At-fault accident | Over 35 | Sports Car | $1,800 |

Finding the Cheapest Car Insurance Options

Finding the most affordable car insurance in Florida requires a strategic approach. This involves comparing quotes from multiple insurers, negotiating discounts, and exploring options like bundling policies. Understanding the factors influencing car insurance premiums and leveraging available discounts can significantly reduce your overall cost.

Discounts Available in Florida

Florida car insurance companies offer various discounts to policyholders, which can significantly reduce your premiums. These discounts are based on factors like your driving record, vehicle features, and other personal characteristics.

- Safe Driver Discounts: Drivers with a clean driving record, free of accidents and traffic violations, are eligible for significant discounts. This discount reflects the lower risk associated with such drivers.

- Good Student Discounts: Students with good academic records, typically a GPA of 3.0 or higher, qualify for this discount. It reflects the responsible nature associated with good students and their lower risk profile.

- Multi-Car Discounts: Insuring multiple vehicles with the same insurer often leads to a multi-car discount. This reflects the insurer’s reduced administrative costs and potentially lower risk associated with multiple policies from the same customer.

- Other Discounts: Other common discounts include:

- Anti-theft Device Discounts: Installing anti-theft devices, such as alarms or GPS trackers, can reduce your premiums. This is due to the reduced risk of theft and the associated costs for the insurer.

- Loyalty Discounts: Long-term customers often receive loyalty discounts for their continued business. This reflects the insurer’s appreciation for your loyalty and potentially lower risk associated with established customers.

- Defensive Driving Course Discounts: Completing a defensive driving course can lead to discounts, demonstrating your commitment to safe driving practices and lower risk profile.

- Military Discounts: Active military personnel and veterans often receive discounts, reflecting their service and potentially lower risk profile.

- Group Discounts: Certain organizations or affiliations may offer group discounts to their members. This can reflect a shared characteristic or potentially lower risk profile associated with the group.

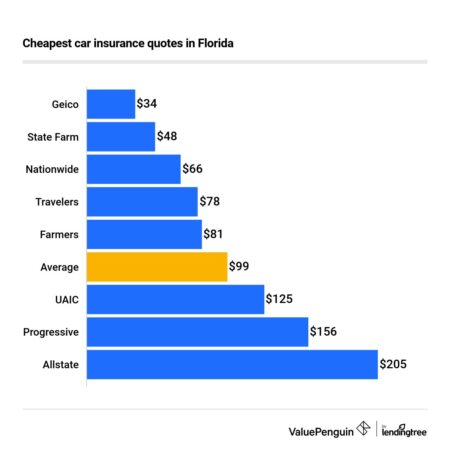

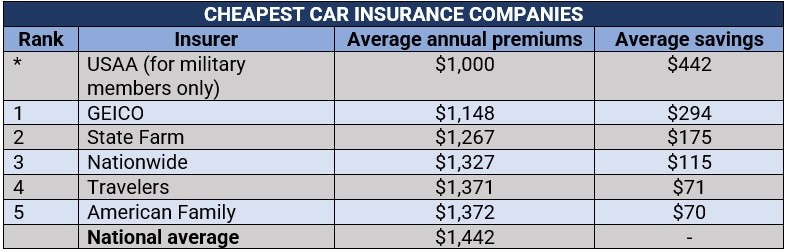

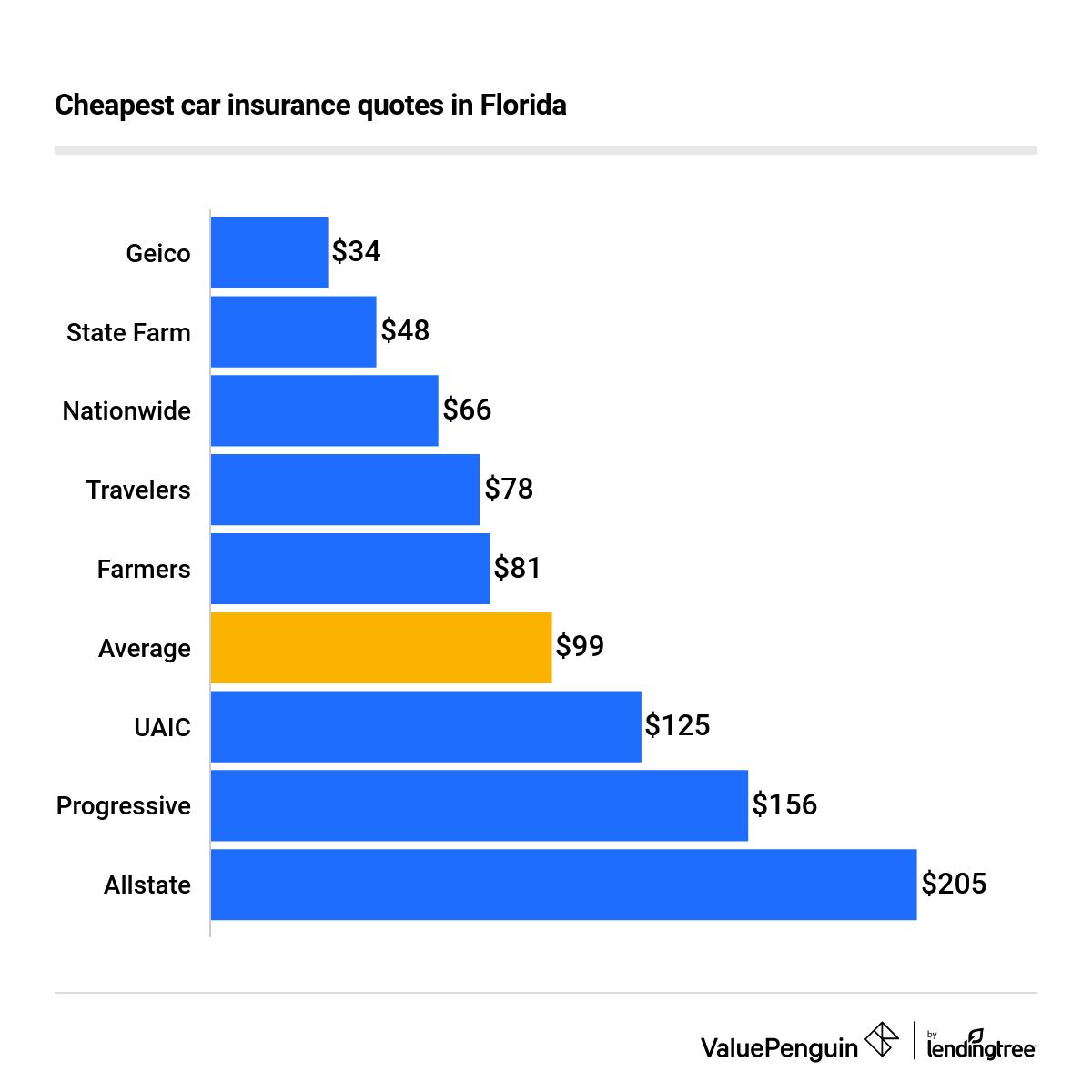

Reputable Car Insurance Companies in Florida

Several reputable car insurance companies operate in Florida, each with its strengths and weaknesses in terms of pricing and customer service.

- State Farm: State Farm is a well-known and highly-rated insurance company, often recognized for its competitive pricing and excellent customer service. It offers a wide range of coverage options and discounts, making it a popular choice for many Floridians.

- Strengths: Extensive network of agents, competitive pricing, comprehensive coverage options, strong customer service reputation.

- Weaknesses: May not always offer the absolute lowest rates, customer service experiences can vary depending on the agent.

- Geico: Geico is another leading insurer known for its competitive rates and user-friendly online platform. It’s often praised for its straightforward policies and quick claim processing.

- Strengths: Competitive pricing, convenient online platform, fast claim processing, excellent customer service reputation.

- Weaknesses: Limited agent network, may not offer as many coverage options as some other insurers.

- Progressive: Progressive is known for its personalized insurance options and its innovative “Name Your Price” tool. It offers a wide range of coverage choices and discounts, allowing you to customize your policy to meet your specific needs.

- Strengths: Personalized insurance options, “Name Your Price” tool, comprehensive coverage options, extensive discount program.

- Weaknesses: May not always offer the lowest rates, customer service experiences can vary.

- Allstate: Allstate is a well-established insurance company with a strong reputation for customer service. It offers a wide range of coverage options and discounts, and its “Drive Safe & Save” program allows you to earn discounts based on your driving habits.

- Strengths: Strong customer service reputation, comprehensive coverage options, “Drive Safe & Save” program, extensive discount program.

- Weaknesses: Pricing can be higher than some other insurers, customer service experiences can vary.

- USAA: USAA is a highly-rated insurance company that primarily serves military personnel and their families. It’s known for its excellent customer service, competitive pricing, and a wide range of coverage options.

- Strengths: Excellent customer service reputation, competitive pricing, comprehensive coverage options, specialized services for military members.

- Weaknesses: Eligibility limited to military personnel and their families, may not be available in all areas.

Navigating the Insurance Claims Process: Car Insurance Florida Cheapest

In the unfortunate event of an accident, navigating the car insurance claims process in Florida can feel overwhelming. However, understanding the steps involved and your policy’s provisions can help you navigate this process smoothly.

Filing a Car Insurance Claim

Filing a claim promptly after an accident is crucial. The following steps will guide you through the process:

- Report the Accident to Your Insurance Company: Contact your insurance company immediately after the accident, providing details like the date, time, location, and involved parties.

- File a Police Report: In Florida, you are required to file a police report if the accident involves injuries, property damage exceeding $500, or a hit-and-run.

- Gather Necessary Documentation: Collect relevant documentation, including:

- Copy of your driver’s license

- Vehicle registration

- Insurance policy information

- Photos of the accident scene and vehicle damage

- Contact information of all involved parties

- Submit a Claim Form: Your insurance company will provide a claim form that you need to complete and submit with the supporting documentation.

- Cooperate with the Insurance Company: Be prepared to answer questions from your insurance company’s claims adjuster and provide any additional information requested.

Understanding Your Insurance Policy

Thoroughly reading and understanding your insurance policy is crucial. It Artikels your coverage, deductibles, and limitations.

- Coverage Limits: Your policy specifies the maximum amount your insurer will pay for covered damages or losses.

- Deductible: This is the amount you are responsible for paying before your insurance coverage kicks in.

- Exclusions: The policy details situations or events not covered by your insurance.

Resolving Disputes with Your Insurance Company

Disputes with your insurance company can arise. Understanding your options for resolution is essential:

- Internal Review: If you disagree with the insurance company’s decision, you can request an internal review by a higher-level representative within the company.

- Mediation: This involves a neutral third party facilitating a discussion between you and the insurance company to reach a mutually acceptable resolution.

- Arbitration: This is a formal process where a neutral third party hears evidence from both sides and issues a binding decision.

- Litigation: If all other options fail, you can file a lawsuit against the insurance company in court.

Additional Considerations for Florida Drivers

Florida’s unique car insurance landscape presents several additional considerations for drivers. Understanding these factors can help you make informed decisions and secure the most suitable coverage for your needs.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, meaning drivers are primarily responsible for covering their own medical expenses after an accident, regardless of fault. This system is designed to streamline the claims process and reduce litigation. However, it’s crucial to understand the role of Personal Injury Protection (PIP) coverage in this system.

PIP coverage is mandatory in Florida and provides benefits for medical expenses, lost wages, and other related costs. It typically covers up to $10,000 per person, but drivers can opt for higher limits. If your injuries exceed the PIP limit, you may have to pursue claims against the at-fault driver’s liability insurance.

It’s important to note that Florida’s no-fault system doesn’t eliminate the possibility of lawsuits. If your injuries are severe, you can still pursue a claim against the at-fault driver for pain and suffering, lost earning capacity, and other damages beyond the PIP limit. However, proving negligence in a no-fault system can be complex and challenging.

Car Insurance Rates in High-Risk Areas

Florida’s car insurance rates are influenced by a variety of factors, including the risk of accidents in specific areas. High-risk areas, often characterized by high traffic density, frequent accidents, or other factors contributing to a higher likelihood of claims, typically experience higher insurance premiums.

For example, cities like Miami, Orlando, and Tampa, known for their bustling urban environments and heavy traffic, tend to have higher insurance rates compared to more rural areas. Drivers in these areas may need to explore options like increasing their deductibles, improving their driving records, or opting for lower coverage limits to potentially reduce their premiums.

Hurricane-Prone Regions

Florida’s coastal regions are particularly vulnerable to hurricanes, which can cause significant damage to vehicles and lead to increased insurance claims. This risk is reflected in higher car insurance premiums for drivers in these areas.

Drivers in hurricane-prone regions should consider additional coverage options, such as comprehensive and collision coverage, which can protect against damage from natural disasters. They should also carefully review their policy’s coverage limits and deductibles to ensure adequate protection against potential losses.

Impact of Recent Legislative Changes

Recent legislative changes in Florida have significantly impacted car insurance rates. These changes have aimed to address concerns about rising premiums and promote competition in the insurance market. The impact of these changes is still unfolding, but some key elements have already been observed.

One notable change is the introduction of a new rate-setting system, designed to increase transparency and reduce the influence of certain factors, such as credit scores, on premium calculations. This change could potentially lead to more equitable rates for drivers.

Another significant change involves limitations on the use of non-economic damages in personal injury lawsuits. This change aims to reduce the frequency and severity of lawsuits, potentially lowering insurance costs. However, the long-term impact of this change remains to be seen.

Outcome Summary

Securing car insurance Florida cheapest requires a proactive approach. By comparing quotes from multiple insurers, negotiating discounts, and understanding the various coverage options available, you can find a policy that fits your budget and provides the protection you need. Remember, it’s crucial to read your policy carefully, understand its terms and conditions, and be prepared to navigate the claims process should the need arise. By taking these steps, you can ensure you’re adequately insured and protected on Florida’s roads.

Essential FAQs

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to carry a minimum of $10,000 in personal injury protection (PIP) coverage and $10,000 in property damage liability coverage per person. However, it’s highly recommended to purchase additional coverage to protect yourself financially in case of an accident.

How often can I get a car insurance quote in Florida?

You can get a car insurance quote as often as you like. It’s recommended to compare quotes from multiple insurers at least annually to ensure you’re getting the best rate. You may also want to request a quote if your driving situation changes, such as a new car purchase, a change in your driving history, or a move to a new location.

What are some common car insurance discounts available in Florida?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and bundling discounts for combining auto and home insurance. Ask your insurer about any discounts you may be eligible for.

What happens if I get into an accident in Florida?

Florida is a no-fault state, meaning you file a claim with your own insurance company, regardless of who caused the accident. Your PIP coverage will cover your medical expenses, while your property damage liability coverage will cover damage to the other vehicle.