- Understanding Florida Car Insurance

- Top Car Insurance Companies in Florida

- Factors Influencing Car Insurance Rates

- Getting the Best Car Insurance Deal in Florida

- Understanding Florida’s No-Fault System: Car Insurance Florida Companies

- Tips for Saving on Car Insurance in Florida

- Understanding Florida’s Insurance Regulations

- Closing Notes

- Questions and Answers

Car insurance Florida companies offer a wide range of coverage options, but navigating the complex landscape can be challenging. Understanding the unique factors that influence insurance costs in the Sunshine State is crucial for finding the best deal. From Florida’s no-fault insurance system to the impact of your driving history, numerous factors play a role in determining your premium.

This guide delves into the intricacies of Florida car insurance, providing insights into the top companies, key factors influencing rates, and strategies for securing the most affordable coverage. We’ll explore the pros and cons of different insurers, helping you make an informed decision that fits your needs and budget.

Understanding Florida Car Insurance

Florida’s car insurance landscape is unique, shaped by factors that influence the cost of coverage. Understanding these factors is crucial for Florida residents seeking affordable and adequate car insurance.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, where drivers are required to carry Personal Injury Protection (PIP) coverage. This coverage pays for medical expenses and lost wages, regardless of fault in an accident.

- PIP Coverage: PIP coverage is mandatory in Florida and covers medical expenses and lost wages for the insured driver and passengers, regardless of fault. It’s a significant factor in determining car insurance premiums.

- Impact on Premiums: The no-fault system has a direct impact on premiums. While it simplifies the claims process, the high usage of PIP coverage contributes to higher premiums compared to states with traditional fault-based systems.

- Limited Coverage: PIP coverage is capped at $10,000 per person. In cases of serious injuries, this limit may not be sufficient, leading to additional costs for drivers.

Factors Influencing Car Insurance Costs in Florida

Several factors beyond the no-fault system influence car insurance costs in Florida. Understanding these factors can help drivers make informed decisions about their coverage.

- Driving Record: Drivers with a history of accidents, speeding tickets, or DUI convictions face higher premiums. Insurance companies consider this data to assess the risk associated with insuring a driver.

- Vehicle Type and Age: The type and age of a vehicle significantly impact insurance costs. Newer, more expensive vehicles are generally more expensive to insure.

- Location: Car insurance rates vary based on geographic location. Areas with higher accident rates or crime rates tend to have higher premiums.

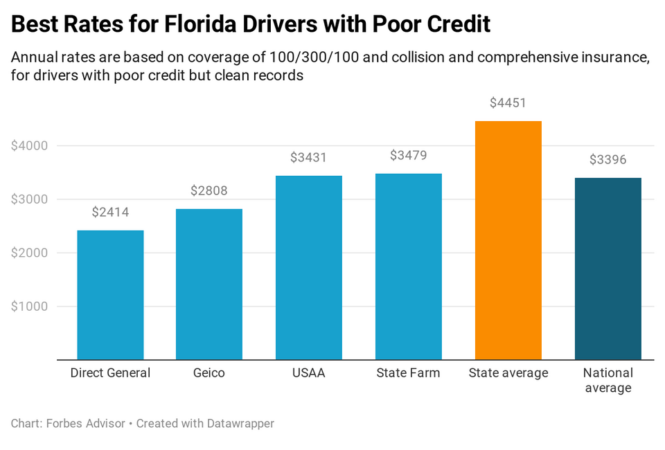

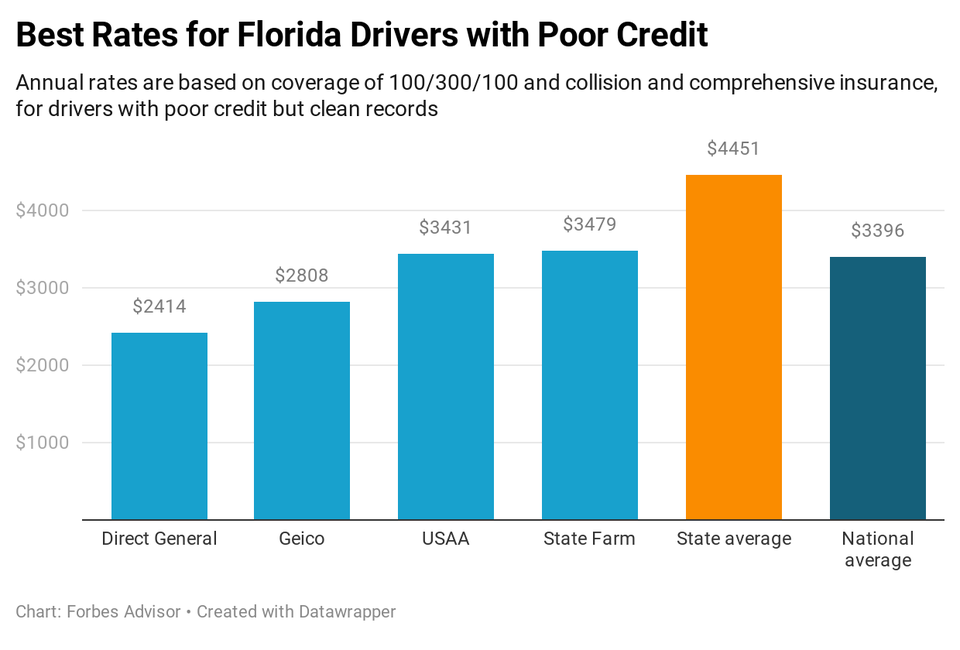

- Credit History: Insurance companies use credit history as a proxy for risk assessment. Drivers with good credit scores often receive lower premiums.

- Coverage Levels: The amount of coverage chosen affects the cost of insurance. Higher coverage limits, such as liability and comprehensive coverage, result in higher premiums.

Types of Car Insurance Coverage in Florida

Florida law mandates certain types of car insurance coverage for all drivers. Understanding these requirements is crucial for compliance and financial protection.

- Personal Injury Protection (PIP): As mentioned earlier, PIP coverage is mandatory in Florida. It covers medical expenses and lost wages for the insured and passengers, regardless of fault.

- Property Damage Liability: This coverage protects the insured driver from financial liability if they cause damage to another person’s property in an accident.

- Bodily Injury Liability: This coverage protects the insured driver from financial liability if they cause injuries to another person in an accident.

- Uninsured Motorist Coverage: This coverage protects the insured driver from financial losses if they are involved in an accident with an uninsured or underinsured driver.

Average Car Insurance Rates in Florida

Florida’s car insurance rates are generally higher than the national average. This is due to several factors, including the no-fault system, high population density, and a significant number of uninsured drivers.

Average car insurance rates in Florida can vary based on factors such as driving history, vehicle type, and coverage levels. It’s important to compare quotes from multiple insurers to find the best rates for your specific needs.

Top Car Insurance Companies in Florida

Choosing the right car insurance company in Florida can be a daunting task, given the plethora of options available. However, some companies consistently stand out for their comprehensive coverage, competitive pricing, and exceptional customer service. This section delves into the top 5 car insurance companies in Florida, providing a comparative analysis to aid your decision-making process.

Comparison of Top 5 Car Insurance Companies in Florida

To assist you in making an informed choice, we’ve compiled a table comparing the top 5 car insurance companies in Florida based on key factors:

| Company | Average Premium Costs | Customer Satisfaction Ratings | Coverage Options | Claims Handling Processes |

|---|---|---|---|---|

| State Farm | $1,800 – $2,200 per year | 4.5 out of 5 stars | Comprehensive, collision, liability, personal injury protection (PIP), uninsured/underinsured motorist (UM/UIM) | Fast and efficient claims handling, online and mobile claims filing options |

| GEICO | $1,600 – $2,000 per year | 4.0 out of 5 stars | Similar to State Farm, with additional options like roadside assistance and rental car coverage | Streamlined claims process, 24/7 claims reporting |

| Progressive | $1,700 – $2,100 per year | 3.8 out of 5 stars | Wide range of coverage options, including accident forgiveness and customized coverage plans | User-friendly online claims portal, dedicated claims representatives |

| Allstate | $1,900 – $2,300 per year | 4.2 out of 5 stars | Comprehensive coverage options, including accident forgiveness and roadside assistance | Prompt claims handling, 24/7 claims support |

| USAA | $1,500 – $1,900 per year | 4.8 out of 5 stars | Extensive coverage options, including military-specific benefits | Highly-rated claims handling, dedicated military support |

Strengths and Weaknesses of Top Car Insurance Companies in Florida

It’s crucial to understand the strengths and weaknesses of each company to determine which aligns best with your needs and preferences. Here’s a breakdown:

| Company | Strengths | Weaknesses |

|---|---|---|

| State Farm |

|

|

| GEICO |

|

|

| Progressive |

|

|

| Allstate |

|

|

| USAA |

|

|

Factors Influencing Car Insurance Rates

Car insurance premiums in Florida, like in other states, are determined by a complex interplay of factors. These factors are carefully assessed by insurance companies to evaluate the risk associated with insuring a particular driver and vehicle. Understanding these factors can help you make informed decisions about your car insurance and potentially lower your premiums.

Age and Driving History

Your age and driving history significantly influence your car insurance rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher premiums. Similarly, drivers with a history of accidents, traffic violations, or DUI convictions face higher premiums due to their higher risk profile.

For instance, a young driver with a clean driving record might pay a lower premium compared to an older driver with multiple speeding tickets.

Vehicle Type and Value

The type and value of your vehicle also play a significant role in determining your car insurance rates. Cars with powerful engines, high performance, or a history of theft are generally considered riskier to insure and thus have higher premiums. Similarly, luxury cars and expensive vehicles require more expensive repairs, leading to higher insurance costs.

For example, a high-performance sports car will likely have a higher insurance premium compared to a basic sedan.

Location and Driving Habits

Your location and driving habits are also taken into account by insurance companies. Areas with higher crime rates or heavy traffic congestion are generally associated with a higher risk of accidents, leading to higher premiums. Driving habits like commuting long distances, driving at night, or frequently driving in urban areas can also impact your rates.

For instance, a driver living in a densely populated city with a high accident rate might pay a higher premium than someone residing in a rural area with lower traffic volume.

Credit Score

Surprisingly, your credit score can also influence your car insurance premiums. Insurance companies use credit score as a proxy for financial responsibility. Drivers with good credit scores are often considered less risky to insure, leading to lower premiums.

For example, a driver with an excellent credit score might qualify for a lower premium compared to someone with a poor credit history.

| Factor | Impact on Premium |

|---|---|

| Age and Driving History | Younger drivers and drivers with poor driving records generally pay higher premiums. |

| Vehicle Type and Value | Expensive, high-performance, or high-theft vehicles typically have higher premiums. |

| Location and Driving Habits | Drivers in high-risk areas or with risky driving habits often pay higher premiums. |

| Credit Score | Drivers with good credit scores typically qualify for lower premiums. |

Getting the Best Car Insurance Deal in Florida

Finding the best car insurance deal in Florida involves more than just choosing the first company you see. It’s about actively comparing prices and features to ensure you get the coverage you need at a price that fits your budget.

Comparing Quotes from Multiple Companies

Comparing quotes from multiple companies is crucial to securing the most favorable car insurance deal. Each insurer has its own pricing structure and coverage options, so comparing quotes allows you to identify the best value for your specific needs.

- Different companies might offer different rates for the same coverage, making it essential to compare and contrast their offerings.

- By comparing quotes, you can identify companies that offer discounts and promotions that align with your individual circumstances, potentially leading to significant savings.

Steps to Obtain Accurate Quotes

To obtain accurate car insurance quotes from different insurers, follow these steps:

- Gather your information: Before contacting insurance companies, compile your driver’s license information, vehicle registration details, driving history, and any relevant details about your car, such as its make, model, and year.

- Contact multiple insurers: Reach out to several insurance companies, both online and offline, to request quotes. Be sure to provide accurate information to ensure the quotes are reliable.

- Compare the quotes: Carefully review each quote, paying attention to the coverage provided, the premium amount, and any additional fees or discounts. Compare apples to apples, ensuring the coverage levels are consistent across all quotes.

- Ask questions: If you have any questions or need clarification on specific aspects of the quotes, don’t hesitate to contact the insurance company directly.

Using Online Comparison Tools and Brokers

Online comparison tools and insurance brokers can streamline the process of obtaining quotes from multiple insurers.

- Online comparison tools: These platforms allow you to enter your information once and receive quotes from multiple insurers simultaneously. This saves you time and effort compared to contacting each company individually.

- Insurance brokers: Brokers act as intermediaries between you and insurance companies. They can help you find the best deals based on your specific needs and preferences. Brokers typically have access to a wider range of insurance companies than you might find on your own.

Negotiating Lower Car Insurance Premiums

Once you have compared quotes and identified potential insurers, you can negotiate lower premiums by:

- Bundling policies: Consider bundling your car insurance with other policies, such as home or renter’s insurance, to qualify for multi-policy discounts.

- Increasing your deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can lead to lower premiums. Carefully consider your risk tolerance and financial capacity when deciding on your deductible.

- Improving your credit score: Some insurance companies consider your credit score when determining your premium. Improving your credit score can lead to lower premiums.

- Exploring discounts: Many insurance companies offer discounts for safe driving, good student records, and other factors. Ask about available discounts and make sure you qualify for all applicable ones.

Understanding Florida’s No-Fault System: Car Insurance Florida Companies

Florida operates under a no-fault insurance system, meaning that drivers involved in accidents are primarily responsible for covering their own medical expenses and lost wages, regardless of fault. This system relies on Personal Injury Protection (PIP) coverage, a mandatory component of Florida car insurance policies.

Personal Injury Protection (PIP) Coverage

PIP coverage in Florida provides financial assistance to policyholders for medical expenses and lost wages following a car accident, regardless of who is at fault. It’s designed to cover the immediate costs associated with injuries, allowing individuals to focus on recovery without worrying about the financial burden.

Limits and Benefits of PIP Coverage

PIP coverage in Florida has specific limits and benefits:

* Coverage Limit: The minimum PIP coverage required in Florida is $10,000. However, drivers can choose higher coverage limits, which offer greater financial protection.

* Medical Expenses: PIP coverage pays for reasonable and necessary medical expenses incurred due to the accident, including doctor’s visits, hospital stays, and rehabilitation services.

* Lost Wages: PIP coverage also provides benefits for lost wages, up to 80% of the insured’s average weekly wage, for a maximum of 52 weeks.

* Death Benefits: In the unfortunate event of a fatality, PIP coverage may provide death benefits to the deceased’s beneficiaries.

Situations Where PIP Coverage May Not Be Sufficient

While PIP coverage offers significant financial assistance, there are situations where it may not be enough to cover all the costs associated with an accident:

* High Medical Expenses: If your medical bills exceed your PIP coverage limit, you may be responsible for the remaining costs.

* Significant Lost Wages: The 80% of average weekly wage limit may not be enough to cover all your lost income, especially if you have a high-paying job.

* Pain and Suffering: PIP coverage does not cover pain and suffering, emotional distress, or other non-economic damages.

Filing a Claim Under Florida’s No-Fault System

To file a claim under Florida’s no-fault system, follow these steps:

* Notify Your Insurance Company: Contact your insurance company as soon as possible after the accident.

* Provide Necessary Information: Your insurer will require details about the accident, including the date, time, location, and any other involved parties.

* Submit Medical Bills and Lost Wage Documentation: Provide documentation of your medical expenses and lost wages to support your claim.

* Cooperate with the Insurance Company: Be prepared to answer questions from your insurance company and provide any necessary documentation.

Tips for Saving on Car Insurance in Florida

Car insurance is a necessity in Florida, but it doesn’t have to break the bank. There are several strategies you can employ to lower your premiums and keep more money in your pocket. By understanding the factors that influence your rates and taking proactive steps, you can significantly reduce your insurance costs.

Maintaining a Good Driving Record

A clean driving record is the cornerstone of affordable car insurance. Every traffic violation, accident, or DUI conviction can lead to higher premiums.

- Avoid Traffic Violations: Speeding tickets, reckless driving, and other traffic violations are major factors in determining your insurance rates. Even minor offenses can significantly increase your premiums.

- Defensive Driving: Taking a defensive driving course can not only improve your driving skills but also earn you discounts on your insurance premiums. These courses teach you how to avoid accidents and handle challenging driving situations.

- Maintain a Clean Driving Record: This means avoiding accidents and traffic violations. If you do get a ticket, consider taking a defensive driving course to potentially lower your insurance premiums.

Choosing a Safe Vehicle

The type of car you drive plays a significant role in your insurance rates.

- Safety Features: Vehicles with advanced safety features like anti-lock brakes, airbags, and electronic stability control are generally considered safer and can qualify for discounts.

- Vehicle Theft Rates: Cars with higher theft rates tend to have higher insurance premiums. Consider researching the theft rates of different car models before making a purchase.

- Vehicle Value: Expensive cars often come with higher insurance premiums due to their replacement cost.

Bundling Insurance Policies

Many insurance companies offer discounts for bundling multiple policies, such as car insurance, homeowners insurance, and renters insurance.

- Bundling Benefits: Bundling your policies with the same insurer can often lead to significant savings. Insurance companies often offer discounts for bundling, as they are able to streamline their processes and reduce administrative costs.

- Comparing Quotes: It’s essential to compare quotes from multiple insurers to find the best deals for bundled policies.

Taking Advantage of Discounts

Car insurance companies offer a variety of discounts to lower premiums.

- Good Student Discount: If you are a student with good grades, you may qualify for a good student discount. This discount recognizes that students with good grades are generally more responsible drivers.

- Safe Driver Discount: This discount is often offered to drivers who have a clean driving record and haven’t been involved in any accidents.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or GPS tracking systems, can lower your premiums.

- Loyalty Discount: Some insurers offer discounts to customers who have been with them for a certain period of time.

- Other Discounts: There are many other potential discounts, including discounts for military personnel, seniors, and those who work in certain professions. Be sure to ask your insurer about all available discounts.

Additional Tips for Saving on Car Insurance in Florida

- Increase Your Deductible: A higher deductible means you’ll pay more out of pocket if you have an accident, but it can also lead to lower premiums.

- Shop Around for Quotes: Get quotes from multiple insurance companies to compare prices and coverage options.

- Review Your Coverage Regularly: Make sure you have the right coverage for your needs and that you’re not paying for unnecessary coverage.

- Consider a Usage-Based Insurance Program: These programs track your driving habits and can offer discounts based on safe driving behavior.

Understanding Florida’s Insurance Regulations

Navigating the world of car insurance in Florida can be complex, but understanding the state’s regulations can empower you to make informed decisions. The Florida Office of Insurance Regulation (OIR) plays a crucial role in overseeing the state’s insurance market, ensuring fair practices and protecting consumers.

The Role of the Florida Office of Insurance Regulation (OIR), Car insurance florida companies

The OIR is responsible for overseeing all aspects of insurance in Florida, including car insurance. Its primary functions include:

- Licensing and regulating insurance companies operating in the state.

- Setting rates and ensuring they are fair and reasonable.

- Investigating and resolving consumer complaints against insurance companies.

- Promoting consumer education and awareness about insurance issues.

- Enforcing state insurance laws and regulations.

The OIR’s website provides valuable resources for consumers, including information on insurance rates, consumer rights, and complaint procedures.

Filing Complaints Against Insurance Companies

If you have a complaint against an insurance company in Florida, you can file a complaint with the OIR. You can do this online, by phone, or by mail. The OIR will investigate your complaint and attempt to resolve it. If the OIR cannot resolve the issue, you may have to file a lawsuit.

Consumer Protection Laws and Regulations

Florida has a number of consumer protection laws and regulations related to car insurance. These laws aim to protect consumers from unfair or deceptive practices by insurance companies. Some key consumer protection provisions include:

- The Florida Insurance Code: This comprehensive code Artikels the rules and regulations governing the insurance industry in Florida. It covers topics such as rate setting, claims handling, and consumer protection.

- The Florida Unfair Insurance Trade Practices Act: This law prohibits insurance companies from engaging in unfair or deceptive practices. It defines specific prohibited practices, such as making false or misleading statements, refusing to pay claims without reasonable cause, and engaging in unfair discrimination.

- The Florida Consumer Protection Act: This law provides broad consumer protection against unfair or deceptive business practices, including those related to insurance.

Resources for Obtaining Information About Florida’s Car Insurance Regulations

To stay informed about Florida’s car insurance regulations, you can consult the following resources:

- The Florida Office of Insurance Regulation (OIR) website: This website provides comprehensive information on insurance regulations, consumer rights, and complaint procedures. You can find information on specific topics, such as rate setting, claims handling, and consumer protection.

- The Florida Department of Financial Services website: This website provides information on insurance-related issues, including consumer protection and fraud prevention.

- The Florida Bar website: This website provides information on legal issues related to insurance, including consumer rights and legal remedies.

Closing Notes

Finding the right car insurance in Florida requires careful consideration of your individual circumstances and preferences. By understanding the intricacies of the state’s insurance system, comparing quotes from multiple companies, and leveraging available discounts, you can secure the best coverage at a price that works for you. Remember, a little research can go a long way in saving you money and ensuring you’re adequately protected on the road.

Questions and Answers

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP) coverage, $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person and $20,000 per accident. However, it’s generally recommended to have higher coverage limits for greater financial protection.

How can I get a discount on my car insurance in Florida?

Many car insurance companies offer discounts for safe driving, good credit scores, bundling multiple insurance policies, and having safety features in your vehicle. It’s worth asking about available discounts and ensuring you’re taking advantage of all eligible options.

What is the role of the Florida Office of Insurance Regulation (OIR)?

The OIR is responsible for overseeing the insurance industry in Florida, ensuring fair and competitive practices. They investigate complaints against insurance companies, enforce consumer protection laws, and provide information and resources to consumers.