Car insurance Florida comparison is essential for finding the best rates in a state known for its unique insurance landscape. Florida’s high population density, hurricane risk, and frequent litigation contribute to higher premiums than in many other states. Understanding the factors influencing car insurance costs and exploring available options is crucial for securing affordable coverage.

Florida mandates Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage, while additional optional coverages, such as collision, comprehensive, and uninsured/underinsured motorist coverage, offer further protection. The cost of car insurance in Florida varies based on factors like driving history, age, credit score, vehicle type, and location.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance market is unique, characterized by several factors that influence costs and coverage options. This guide explores the key elements of Florida’s car insurance landscape, providing insights into its complexities and helping you navigate the process of finding the best coverage for your needs.

Factors Influencing Car Insurance Costs

Several factors contribute to the relatively high cost of car insurance in Florida. These include:

- High Population Density: Florida’s densely populated areas, particularly in major cities like Miami and Orlando, lead to increased traffic congestion and a higher likelihood of accidents. This translates to higher insurance claims and, consequently, higher premiums.

- Hurricane Risk: Florida is highly susceptible to hurricanes, which can cause significant damage to vehicles. Insurers factor in this risk by charging higher premiums to cover potential losses from natural disasters.

- Litigation Frequency: Florida has a high rate of car accident lawsuits, leading to increased costs for insurers. The state’s “no-fault” insurance system, which allows drivers to sue for pain and suffering even in minor accidents, further contributes to litigation frequency.

Mandatory Coverage Requirements

Florida law mandates specific car insurance coverages for all drivers:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for injuries sustained in an accident, regardless of fault. Florida requires a minimum PIP coverage of $10,000.

- Property Damage Liability (PDL): This coverage protects you financially if you cause damage to another person’s property in an accident. Florida requires a minimum PDL coverage of $10,000.

Optional Coverages

In addition to mandatory coverages, drivers can choose to purchase optional coverages to enhance their protection:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. It’s often required if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged due to non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and other damages that the at-fault driver’s insurance doesn’t cover.

Key Factors Affecting Car Insurance Rates

In Florida, several factors influence your car insurance premiums. Understanding these factors can help you make informed decisions to potentially lower your costs.

Driving History

Your driving history is a significant factor in determining your car insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will increase your rates.

- Accidents: Each accident you’ve been involved in, regardless of fault, can increase your insurance premiums. The severity of the accident, such as the amount of damage or injuries, can further impact your rates.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations can significantly raise your insurance rates. The severity of the violation and the frequency of offenses play a role in determining the impact on your premiums.

- DUI Convictions: A DUI conviction can lead to a substantial increase in your insurance rates, often for several years. Insurance companies consider DUI convictions a significant risk factor.

Age

Your age is another key factor in car insurance pricing. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Therefore, they often face higher premiums. As drivers gain experience and age, their insurance rates tend to decrease.

- Young Drivers: Insurance companies often charge higher premiums for young drivers due to their inexperience and higher risk of accidents. This is especially true for drivers under 25, who have a higher accident rate compared to older drivers.

- Mature Drivers: Drivers over the age of 55 or 65 often receive lower insurance rates because they tend to have a lower accident rate. Some insurance companies offer discounts for senior drivers.

Credit Score

Surprisingly, your credit score can also affect your car insurance rates in Florida. Insurance companies use credit scores as an indicator of financial responsibility, believing that individuals with good credit are more likely to pay their premiums on time.

- Credit-Based Insurance Scores: Insurance companies use credit-based insurance scores (CBIS) to assess risk. These scores are based on your credit history and can influence your car insurance premiums.

- Higher Credit Scores: Drivers with good credit scores generally receive lower insurance premiums, as they are perceived as less risky.

- Lower Credit Scores: Individuals with lower credit scores may face higher insurance premiums due to their perceived higher risk of not paying their premiums on time.

Vehicle Type

The type of vehicle you drive plays a crucial role in determining your insurance premiums. Some vehicles are more expensive to repair or replace, and insurance companies adjust premiums accordingly.

- High-Performance Vehicles: Sports cars, luxury vehicles, and other high-performance cars often have higher insurance rates due to their higher repair costs, potential for theft, and higher risk of accidents.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, may qualify for discounts on insurance premiums.

- Vehicle Value: The value of your vehicle, including its make, model, and year, also influences your insurance premiums. More expensive vehicles generally have higher insurance costs.

Location

Where you live in Florida significantly impacts your car insurance rates. Insurance companies consider the risk of accidents, theft, and other factors in different areas.

- Urban Areas: Cities and densely populated areas often have higher car insurance rates due to higher traffic congestion, increased risk of accidents, and higher theft rates.

- Rural Areas: Rural areas with lower population density and less traffic congestion may have lower car insurance rates.

- Weather Conditions: Areas prone to hurricanes, floods, or other severe weather events can also see higher insurance premiums.

Insurance Company Rating Systems

Insurance companies use sophisticated rating systems to assess individual risk profiles and determine premiums. These systems consider various factors, including your driving history, age, credit score, vehicle type, and location.

- Risk Assessment: Insurance companies analyze your driving history, age, credit score, vehicle type, and location to determine your risk of being involved in an accident or making a claim.

- Premium Calculation: Based on your risk profile, insurance companies calculate your premiums. Higher-risk individuals are typically assigned higher premiums, while lower-risk individuals may qualify for discounts.

- Rating Factors: The specific rating factors and their weightings can vary among insurance companies. Some companies may give more emphasis to driving history, while others may place greater importance on credit score.

Driving Habits, Car insurance florida comparison

Your driving habits, such as mileage and driving patterns, can also influence your insurance costs.

- Mileage: Drivers who drive fewer miles generally pay lower insurance premiums, as they have a lower risk of being involved in an accident. Some insurance companies offer discounts for low-mileage drivers.

- Driving Patterns: Drivers who commute long distances or drive frequently during peak hours may face higher insurance premiums due to increased exposure to traffic and potential accidents.

- Commuting Distance: If you have a long commute to work, your insurance premiums may be higher, as you are driving more miles and have a greater risk of accidents.

Closing Summary: Car Insurance Florida Comparison

By comparing car insurance companies, utilizing online tools, and implementing cost-saving strategies, Florida residents can find the best rates and ensure they have the coverage they need. Remember to review your policy regularly and make adjustments as necessary to stay protected and financially secure.

Common Queries

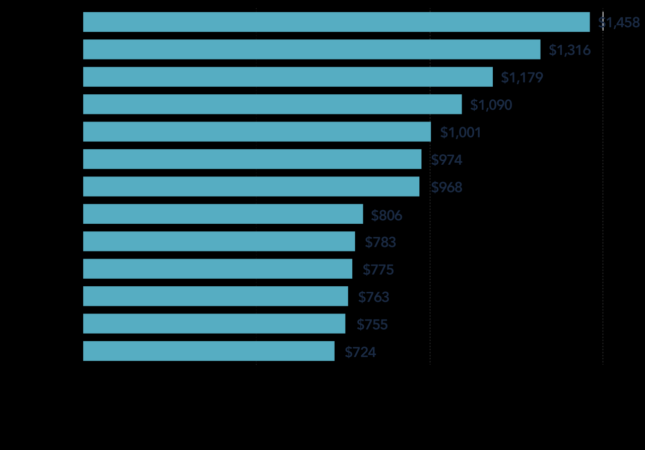

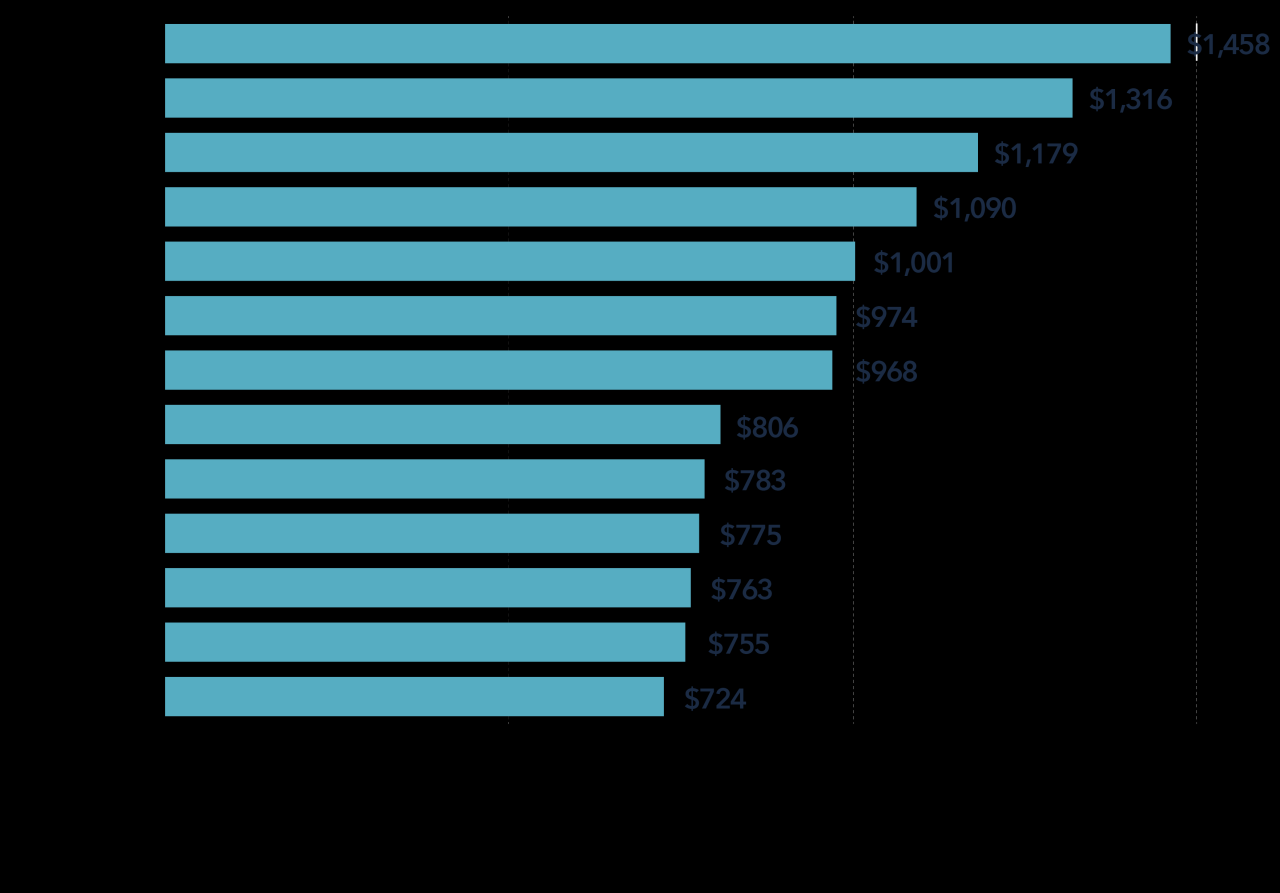

What is the average car insurance cost in Florida?

The average car insurance cost in Florida varies depending on factors like vehicle type, driver profile, and location. It’s best to use online comparison tools to get personalized quotes.

What discounts are available for car insurance in Florida?

Florida insurance companies offer a range of discounts, including good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts.

How does Florida’s no-fault insurance system work?

Florida’s no-fault insurance system requires drivers to file claims with their own insurance company, regardless of who caused the accident. PIP coverage covers medical expenses, while PDL covers property damage.