Car insurance going up in Florida is a pressing issue for many residents. Premiums are climbing at an alarming rate, putting a strain on household budgets and forcing drivers to make tough choices. This trend is driven by a complex interplay of factors, including rising repair costs, increased accident claims, and legislative changes. Florida’s unique insurance landscape and the prevalence of fraud have also contributed to the problem.

The impact on drivers is significant. Many are struggling to afford the coverage they need, and some are even forced to cancel their policies altogether, leaving them vulnerable to financial ruin in the event of an accident. The rising cost of insurance is also impacting driving habits, as some drivers are opting to drive less or avoid certain areas to minimize their risk.

Rising Car Insurance Premiums in Florida

Florida residents are facing a significant increase in car insurance premiums, adding to their financial burdens. This upward trend has become a growing concern for many, prompting investigations into the underlying factors driving these price hikes.

Factors Contributing to Rising Premiums

The rising cost of car insurance in Florida is attributed to several factors, including:

- Increased Claims Costs: Florida has witnessed a surge in the number and severity of car accidents, leading to higher claims payouts by insurance companies. This rise in claims costs is directly reflected in increased premiums for policyholders.

- Fraudulent Claims: Florida is notorious for its high rate of insurance fraud, particularly in the realm of auto insurance. This fraudulent activity inflates claims costs, ultimately pushing up premiums for legitimate policyholders.

- High Litigation Costs: Florida’s legal system is known for its high volume of lawsuits, including those related to car accidents. This translates to higher legal fees for insurance companies, which are passed on to policyholders in the form of increased premiums.

- Hurricane Risk: Florida’s vulnerability to hurricanes is a major factor in determining car insurance rates. As the state faces an increased risk of catastrophic weather events, insurance companies adjust premiums to cover potential losses.

- High Cost of Repairs: The cost of car repairs, particularly for newer vehicles, has been rising steadily. This increased repair cost is factored into insurance premiums, as insurers need to cover the expense of fixing damaged vehicles.

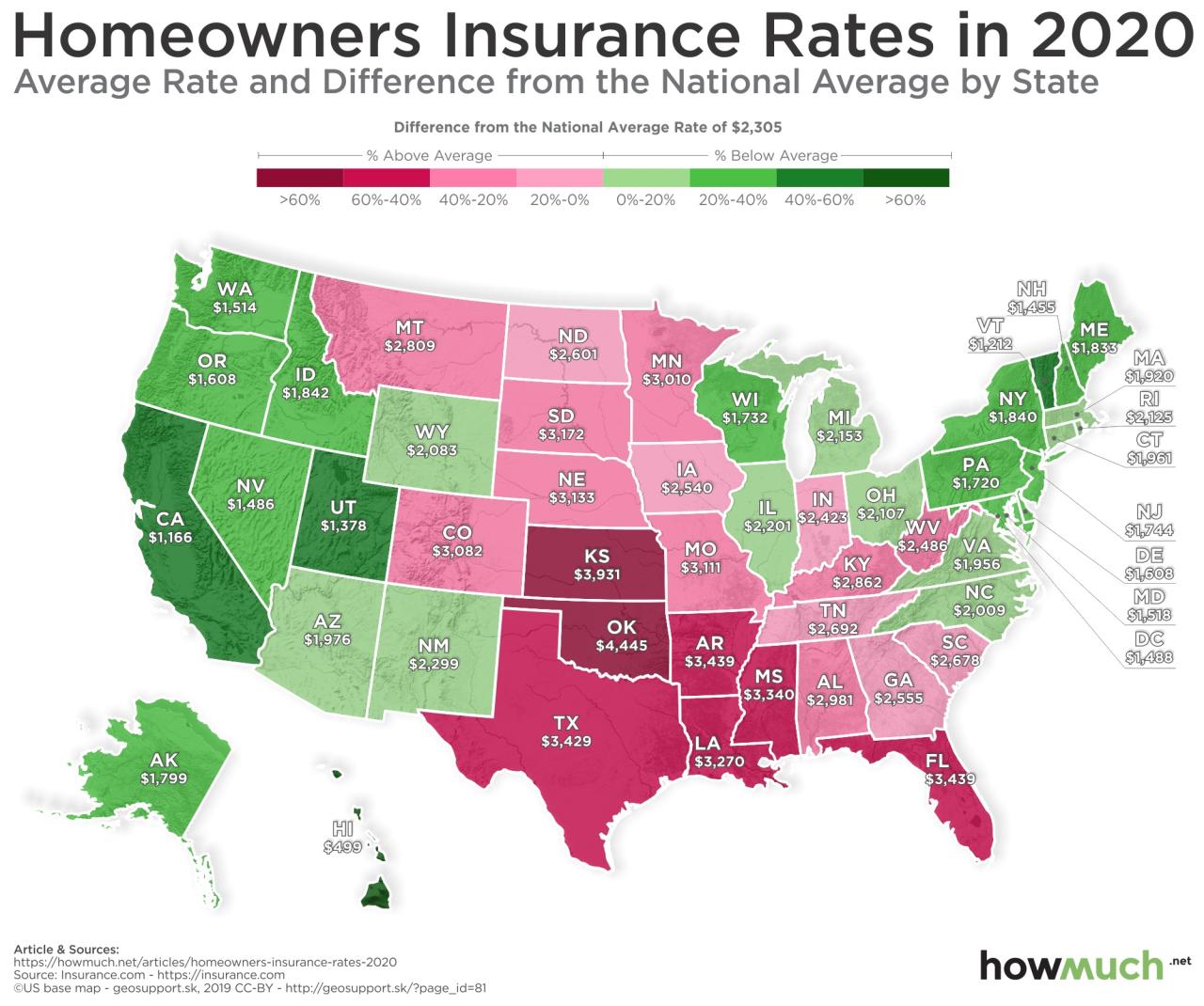

Comparison to National Averages

While car insurance premiums are rising across the country, Florida’s increases are significantly higher than the national average. According to the Insurance Information Institute, the average annual premium for car insurance in Florida is approximately $2,800, compared to the national average of around $1,700. This stark difference highlights the unique challenges facing Florida’s insurance market.

Impact on Florida Drivers

The surge in car insurance premiums is placing a significant financial strain on Florida residents, impacting their budgets and everyday lives. The rising costs are forcing drivers to make difficult choices, from reconsidering their driving habits to finding alternative transportation options.

Financial Burden

The rising cost of car insurance is a major financial burden for Florida residents. Many drivers are struggling to keep up with the increasing premiums, especially those who are already facing financial difficulties. For example, a recent study by the Insurance Information Institute found that the average annual car insurance premium in Florida is now over $2,000, a significant increase from previous years. This financial burden is forcing many drivers to make difficult choices, such as cutting back on other expenses or taking on additional debt.

Driver Perspectives

Drivers in Florida are expressing growing concerns about the affordability of car insurance. Many drivers are feeling frustrated and overwhelmed by the constant increases in premiums. They are also concerned about the impact these increases will have on their ability to afford other necessities, such as food, housing, and healthcare. Some drivers are even considering giving up driving altogether, which could have a significant impact on their ability to get to work, school, and other important destinations.

Impact on Driving Habits

The rising cost of car insurance is also impacting driving habits in Florida. Many drivers are now driving less frequently to reduce their insurance premiums. Others are choosing to drive older, less expensive cars to lower their insurance costs. Some drivers are even considering switching to public transportation or carpooling to reduce their expenses. These changes in driving habits can have a ripple effect on the state’s economy and transportation system.

Insurance Company Practices and Regulations

Insurance companies play a significant role in the rising car insurance premiums in Florida. Their practices and the regulatory environment influence the cost of insurance for Floridian drivers. This section examines specific insurance practices and regulatory changes that have contributed to the problem and evaluates the effectiveness of current regulations in addressing the issue.

Insurance Company Practices

Insurance companies employ various strategies to manage their risk and profitability. These practices can sometimes lead to higher premiums for consumers.

- Aggressive Rate Increases: Insurance companies have been increasing rates more frequently and by larger margins in Florida. This practice is driven by factors like increased claims costs, reinsurance costs, and a desire to improve profitability.

- Limited Competition: The Florida insurance market is dominated by a few large companies, which can limit competition and potentially lead to higher premiums.

- Stricter Underwriting: Insurance companies are increasingly scrutinizing applications and setting higher rates for drivers deemed higher risk, such as younger drivers, drivers with poor driving records, or those residing in areas with higher claim frequencies.

- Marketing and Advertising Costs: The insurance industry invests heavily in marketing and advertising, which can contribute to higher premiums.

Regulatory Changes

Changes in Florida’s regulatory environment have also impacted insurance premiums.

- Changes to the Florida Hurricane Catastrophe Fund: The Florida Hurricane Catastrophe Fund (FHCF) is a state-run reinsurance program that provides financial protection to insurance companies in the event of a hurricane. Changes to the FHCF, such as reduced coverage or increased assessments on insurance companies, have contributed to higher premiums.

- Tort Reform: Florida’s tort reform laws, which limit the amount of damages that can be awarded in personal injury lawsuits, have had a mixed impact on insurance premiums. Some argue that these reforms have reduced premiums, while others contend that they have had a limited impact.

Effectiveness of Current Regulations

Current regulations in Florida are aimed at protecting consumers and ensuring a stable insurance market. However, their effectiveness in addressing the issue of rising premiums is debated.

- Florida Office of Insurance Regulation (OIR): The OIR has the authority to approve rate increases and investigate insurance company practices. However, critics argue that the OIR is not sufficiently proactive in controlling rate increases.

- Consumer Protection Laws: Florida has consumer protection laws in place to prevent unfair or deceptive insurance practices. However, these laws are sometimes difficult to enforce, and insurance companies may find loopholes.

Solutions and Mitigation Strategies

The escalating cost of car insurance in Florida presents a significant challenge for drivers, impacting their finances and mobility. Addressing this issue requires a multifaceted approach involving both individual and collective efforts. This section explores potential solutions and mitigation strategies aimed at alleviating the burden of rising premiums.

Strategies for Mitigating Rising Premiums, Car insurance going up in florida

Various strategies can be employed to mitigate the impact of rising car insurance premiums. These strategies can be categorized into individual, regulatory, and market-driven approaches, each offering distinct benefits and drawbacks.

| Strategy | Benefits | Drawbacks |

|---|---|---|

| Individual Strategies | ||

| Improve Driving Record | Reduced premiums due to lower risk profile. | Requires significant effort and time to achieve. |

| Increase Deductible | Lower premiums by accepting greater financial responsibility in case of an accident. | Higher out-of-pocket expenses in case of a claim. |

| Shop Around for Insurance | Comparison of rates from different insurers can lead to lower premiums. | Time-consuming process requiring research and negotiation. |

| Bundle Insurance Policies | Discounts offered by insurers for bundling multiple policies (e.g., home, auto). | May not be beneficial if individual policies are already discounted. |

| Maintain a Good Credit Score | Some insurers use credit scores as a factor in determining premiums, with good scores potentially leading to lower rates. | Requires responsible financial management and may not be a significant factor for all insurers. |

| Consider Usage-Based Insurance | Potential for lower premiums based on driving habits and mileage. | Requires installation of a telematics device and may raise privacy concerns. |

| Regulatory Strategies | ||

| Strengthening Consumer Protections | Increased transparency and accountability for insurance companies, leading to fairer pricing practices. | Potential for increased regulatory burden on insurers, potentially affecting their ability to offer competitive rates. |

| Promoting Competition in the Insurance Market | Increased competition can drive down premiums as insurers strive to attract customers. | May not be effective in markets with limited competition. |

| Addressing Fraud and Abuse | Reduced costs associated with fraudulent claims, leading to lower premiums for honest drivers. | Requires robust enforcement mechanisms and may face challenges in detecting and prosecuting fraudsters. |

| Market-Driven Strategies | ||

| Encouraging Innovation in Insurance Products | Development of new products and services that cater to specific needs and driving behaviors, potentially leading to lower premiums for certain groups. | May require significant investment and time to develop and implement. |

| Promoting Safety and Risk Mitigation | Lower accident rates can lead to reduced premiums for all drivers. | Requires comprehensive efforts involving education, infrastructure improvements, and technological advancements. |

| Improving Transparency in Rate Setting | Greater transparency in how premiums are calculated can help consumers understand the factors influencing their rates. | May require complex data analysis and reporting, potentially increasing costs for insurers. |

Successful Initiatives in Other States

Several states have implemented successful initiatives to address rising car insurance premiums. These initiatives offer valuable lessons for Florida.

- Texas: The Texas Department of Insurance implemented a “Rate Review” program, requiring insurers to justify their rate increases. This program has helped to ensure that rate increases are reasonable and supported by data.

- California: California’s “Consumer Bill of Rights” for insurance provides consumers with greater transparency and access to information about their insurance policies. This bill has helped to empower consumers and promote fair pricing practices.

- Pennsylvania: Pennsylvania has a “Fair Rate” program that requires insurers to file their rates with the state, allowing for greater oversight and control over rate increases.

Consumer Advocacy and Resources

Navigating the complexities of rising car insurance premiums can be daunting for Florida drivers. Fortunately, several organizations and resources exist to help consumers understand their rights and find affordable coverage.

Consumer Advocacy Organizations

Consumer advocacy organizations play a crucial role in protecting the interests of Florida drivers by providing information, resources, and support. These organizations work to ensure that consumers have access to fair and transparent insurance practices.

- Florida Office of Insurance Regulation (OIR): The OIR is the state agency responsible for regulating the insurance industry in Florida. They provide information on consumer rights, insurance policies, and complaints. They also investigate consumer complaints and enforce insurance laws. The OIR website offers a wealth of resources, including guides, FAQs, and consumer complaint forms.

- Florida Department of Financial Services (DFS): The DFS is responsible for overseeing the financial services industry in Florida, including insurance. They offer consumer protection resources, including information on insurance fraud, scams, and how to file complaints. The DFS website provides a directory of licensed insurance companies and agents in Florida.

- Consumer Federation of America (CFA): The CFA is a national non-profit organization that advocates for consumer rights in various areas, including insurance. They provide research and resources on insurance issues, including consumer guides, tips, and advocacy resources. The CFA website offers information on car insurance, including tips for finding affordable coverage and avoiding common scams.

Comparing Rates and Negotiating Premiums

Consumers have several options to compare rates and negotiate premiums, empowering them to find the best possible coverage at a reasonable price.

- Online Comparison Websites: Websites like Policygenius, The Zebra, and Insurance.com allow consumers to compare quotes from multiple insurance companies simultaneously. This helps consumers find the best rates and coverage options based on their individual needs.

- Directly Contact Insurance Companies: Consumers can directly contact insurance companies to obtain quotes and discuss their coverage options. This allows for personalized conversations and the opportunity to negotiate premiums based on their individual circumstances.

- Shop Around Regularly: Insurance rates can fluctuate over time, so it’s essential to shop around regularly, at least once a year, to ensure you’re getting the best possible rate. This involves comparing quotes from different insurance companies and negotiating with your current provider to see if they can match or beat the competition.

- Consider Discounts: Many insurance companies offer discounts for safe driving, good credit, bundling multiple policies, or having safety features in your car. Explore these options to see if you qualify for any discounts that can lower your premium.

End of Discussion: Car Insurance Going Up In Florida

The rising cost of car insurance in Florida is a complex issue with no easy solutions. However, by understanding the factors driving this trend, drivers can take steps to mitigate the impact on their wallets. Advocacy groups and consumer resources can provide valuable information and support to help drivers navigate the insurance landscape and find the most affordable coverage.

Helpful Answers

Why is car insurance going up so much in Florida?

Several factors contribute to rising car insurance premiums in Florida, including increased accident claims, rising repair costs, and fraud. The state’s unique insurance landscape and legislative changes also play a role.

What can I do to lower my car insurance rates in Florida?

There are several strategies to reduce your car insurance costs, such as improving your driving record, increasing your deductible, comparing quotes from different insurers, and considering discounts for safety features or good driving habits.

Is there a way to avoid paying higher car insurance premiums in Florida?

Unfortunately, there’s no guaranteed way to avoid higher car insurance premiums. However, you can mitigate the impact by being a safe and responsible driver, maintaining a good driving record, and shopping around for the best rates.