Car insurance Illinois is a crucial aspect of responsible driving, ensuring financial protection in case of accidents. Understanding the state’s mandatory requirements, available coverage options, and factors influencing premiums is essential for securing the right policy. This guide delves into the intricacies of car insurance in Illinois, empowering drivers to make informed decisions and navigate the insurance landscape with confidence.

From exploring the different types of coverage, like liability, collision, and comprehensive, to learning how to compare providers and negotiate the best rates, this guide provides a comprehensive overview of everything you need to know about car insurance in Illinois.

Understanding Car Insurance in Illinois

Driving a car in Illinois is a privilege that comes with responsibilities, including having the right car insurance coverage. Illinois law mandates that all drivers carry certain types of car insurance to protect themselves and others on the road. Understanding your insurance options is crucial for ensuring you have the right coverage and financial protection in case of an accident.

Mandatory Car Insurance Requirements

Illinois requires all drivers to have the following minimum car insurance coverage:

- Liability Coverage: This protects you financially if you cause an accident that injures someone or damages their property. Illinois requires a minimum of $25,000 per person/$50,000 per accident for bodily injury liability and $20,000 for property damage liability.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance. Illinois requires a minimum of $25,000 per person/$50,000 per accident for UM/UIM coverage.

Types of Car Insurance Coverage

While Illinois mandates liability and UM/UIM coverage, you can choose to purchase additional coverage to provide greater financial protection. Some common types of car insurance coverage in Illinois include:

- Collision Coverage: This covers damage to your vehicle if you are involved in an accident, regardless of who is at fault. Collision coverage is typically optional, but it may be required if you have a car loan or lease.

- Comprehensive Coverage: This protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, hail, or fire. Comprehensive coverage is also optional, but it can be beneficial if you have a newer or more expensive vehicle.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. Med Pay is optional and can be a valuable addition to your insurance policy.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related expenses for you and your passengers, regardless of who is at fault in an accident. PIP is optional in Illinois, but it is required for drivers in no-fault states.

- Rental Car Coverage: This coverage pays for a rental car if your vehicle is damaged in an accident and is being repaired. Rental car coverage is optional and can be helpful if you rely on your vehicle for transportation.

Factors Affecting Car Insurance Premiums, Car insurance illinois

Several factors can affect the cost of your car insurance premiums in Illinois, including:

- Age: Younger drivers are statistically more likely to be involved in accidents, so they typically pay higher premiums. As you age and gain more driving experience, your premiums may decrease.

- Driving History: Your driving record is a significant factor in determining your premiums. Drivers with a history of accidents, traffic violations, or DUI convictions will generally pay higher premiums.

- Vehicle Type: The type of vehicle you drive can affect your premiums. Sports cars, luxury vehicles, and high-performance vehicles are often considered riskier to insure and may have higher premiums.

- Location: Your location can also impact your premiums. Areas with higher rates of accidents or theft tend to have higher insurance premiums.

- Credit Score: In some states, including Illinois, insurance companies may use your credit score to help determine your premiums. Drivers with good credit scores typically pay lower premiums.

- Coverage Levels: The amount of coverage you choose will also affect your premiums. Higher coverage limits generally result in higher premiums.

- Deductible: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically means lower premiums.

Finding the Right Car Insurance Policy

Finding the right car insurance policy in Illinois can seem overwhelming, but with the right approach, you can secure a policy that provides adequate coverage at a competitive price. This section explores various factors to consider when choosing car insurance, including comparing providers, getting the best rates, and understanding the process of obtaining a quote.

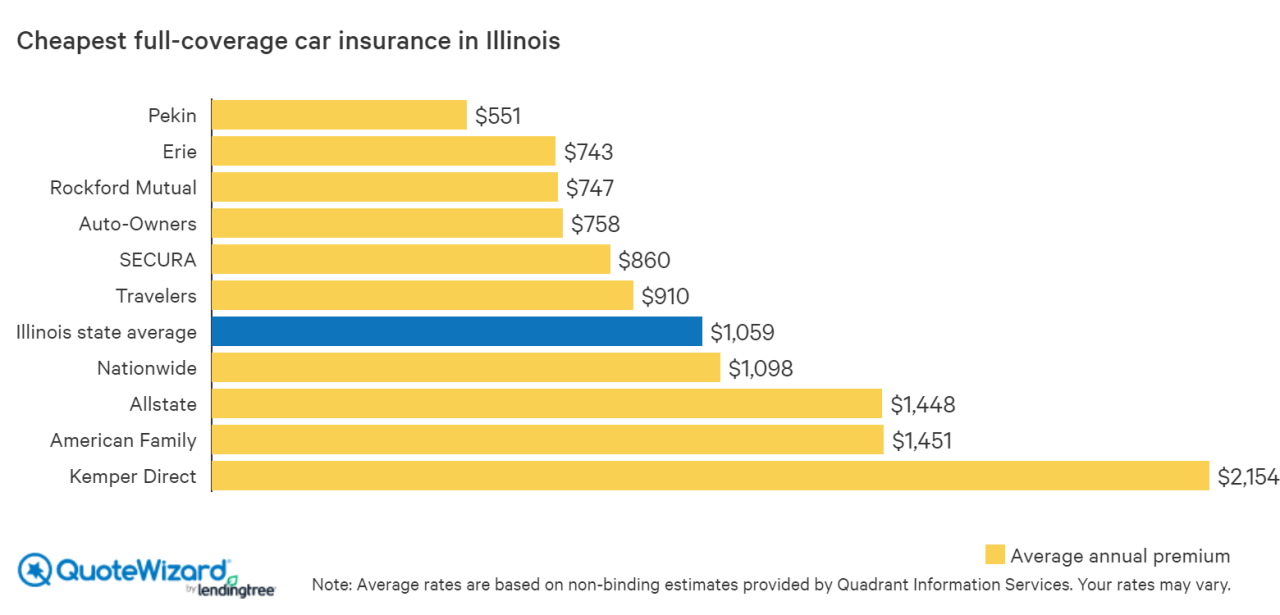

Comparing Car Insurance Providers in Illinois

When searching for car insurance in Illinois, comparing different providers is crucial. Here’s a table outlining key features, coverage options, and pricing for some of the leading insurance companies in the state:

| Provider | Key Features | Coverage Options | Pricing |

|---|---|---|---|

| State Farm | Wide range of discounts, strong customer service | Comprehensive, collision, liability, uninsured/underinsured motorist | Competitive rates, often ranked among the most affordable |

| Allstate | Digital-focused platform, Drive Safe & Save program | Comprehensive, collision, liability, uninsured/underinsured motorist | Rates vary based on driving history and risk factors |

| Geico | Known for its advertising, online quote process | Comprehensive, collision, liability, uninsured/underinsured motorist | Often offers competitive rates, particularly for good drivers |

| Progressive | Name Your Price tool, personalized coverage options | Comprehensive, collision, liability, uninsured/underinsured motorist | Rates can vary significantly based on individual factors |

Tips for Getting the Best Car Insurance Rates in Illinois

Securing the most favorable car insurance rates in Illinois requires a strategic approach. Here are some tips to consider:

- Use Comparison Websites: Websites like Policygenius, Insurify, and NerdWallet allow you to compare quotes from multiple insurers simultaneously, saving time and effort.

- Negotiate with Insurers: Don’t be afraid to negotiate with insurers, especially if you have a clean driving record and multiple policies with them. They may be willing to offer discounts or adjust your premium.

- Explore Discounts: Many insurers offer discounts for various factors, including safe driving, good grades, bundling multiple policies, and installing safety features in your car. Make sure you inquire about and qualify for all applicable discounts.

Obtaining a Car Insurance Quote in Illinois

Getting a car insurance quote in Illinois typically involves the following steps:

- Gather Required Information: Insurers will need basic information about you and your vehicle, including your name, address, driving history, vehicle details, and desired coverage levels.

- Contact Insurers: You can obtain quotes through various channels, including phone calls, online forms, or visiting an insurance agent’s office.

- Compare Quotes: After receiving quotes from multiple insurers, carefully compare them based on coverage, pricing, and customer service ratings.

- Choose a Policy: Once you’ve identified the most suitable policy, provide the insurer with the necessary information and pay the premium.

Managing Your Car Insurance Policy: Car Insurance Illinois

Once you’ve secured the right car insurance policy for your needs, it’s crucial to understand how to manage it effectively. This includes knowing how to file a claim if you’re in an accident, the consequences of driving without insurance, and the process for making changes to your policy.

Filing a Car Insurance Claim in Illinois

In the unfortunate event of an accident, you’ll need to file a claim with your insurance company. Here’s a step-by-step guide to ensure a smooth process:

- Report the accident promptly: Contact your insurance company as soon as possible after the accident. They’ll provide instructions on how to proceed and may require you to file a police report, especially if there are injuries or significant property damage.

- Gather necessary documentation: This includes your driver’s license, vehicle registration, insurance information, and any relevant photos or videos of the accident scene and damages. If you have any witnesses, get their contact information as well.

- Complete a claim form: Your insurance company will provide a claim form that you’ll need to fill out and submit. Be accurate and detailed in your descriptions of the accident.

- Cooperate with the insurance company: Respond to their requests for information promptly and honestly. This will help expedite the claims process.

The time it takes to process a claim varies depending on the complexity of the accident and the amount of damage. Generally, you can expect a response within a few weeks. However, it’s important to keep in mind that claims involving serious injuries or significant property damage may take longer.

Driving Without Car Insurance in Illinois

Driving without car insurance in Illinois is illegal and can lead to serious consequences. You risk facing:

- Fines and penalties: The minimum fine for driving without insurance is $500. You may also face additional penalties, such as license suspension or vehicle impoundment.

- Financial responsibility: If you’re involved in an accident without insurance, you’ll be personally liable for all damages and injuries, which can lead to significant financial hardship.

- Legal issues: Driving without insurance can also result in legal issues, including lawsuits from the other party involved in the accident.

It’s crucial to remember that driving without insurance in Illinois is a serious offense with significant consequences.

Canceling or Modifying Your Car Insurance Policy

To cancel or modify your car insurance policy, you’ll need to contact your insurance company directly. Here’s what you need to know:

- Cancellation: You can cancel your policy at any time, but you may be subject to cancellation fees. You’ll need to provide your insurance company with written notice of your cancellation.

- Modifications: You can also modify your existing policy to reflect changes in your driving habits, vehicle, or coverage needs. For example, if you’re adding a new driver to your policy, you’ll need to notify your insurance company so they can update your coverage.

It’s essential to understand the terms and conditions of your policy before making any changes. This will help you avoid unexpected fees or coverage gaps.

Additional Considerations for Illinois Drivers

Navigating the world of car insurance in Illinois involves more than just choosing the right policy. There are several important aspects of Illinois’s insurance system that drivers should be aware of to ensure they have adequate coverage and are protected in case of an accident. Understanding these nuances can help you make informed decisions and avoid potential pitfalls.

Illinois’s “No-Fault” System

Illinois operates under a “no-fault” insurance system, meaning that drivers are typically responsible for covering their own medical expenses and lost wages after an accident, regardless of who is at fault. This system is designed to expedite the claims process and reduce litigation. However, it’s crucial to understand the implications of this system.

Under Illinois’s no-fault system, drivers are required to carry Personal Injury Protection (PIP) coverage, which helps pay for medical expenses and lost wages for the policyholder and passengers in their vehicle, regardless of who caused the accident. This coverage is typically limited to a certain amount, which varies depending on the policy. If the cost of medical expenses or lost wages exceeds the PIP coverage limit, the driver may be able to file a claim against the other driver’s insurance policy if the other driver was at fault. However, this process can be complex and may require legal assistance.

The Role of the Illinois Department of Insurance

The Illinois Department of Insurance (DOI) plays a vital role in regulating the state’s car insurance market. The DOI is responsible for:

- Licensing and supervising insurance companies operating in Illinois

- Ensuring that insurance companies comply with state laws and regulations

- Investigating consumer complaints and resolving disputes between consumers and insurance companies

- Educating consumers about their insurance rights and responsibilities

The DOI provides various resources for Illinois drivers, including information about insurance requirements, consumer rights, and how to file a complaint. It’s essential to be familiar with the DOI’s role and the resources it offers, as they can be invaluable in navigating the insurance landscape.

Resources for Illinois Drivers

In addition to the DOI, there are other resources available to Illinois drivers seeking information about car insurance. These include:

- Insurance Information Institute (III): This national organization provides a wealth of information about insurance topics, including car insurance. The III’s website offers resources on various aspects of car insurance, including coverage options, rates, and consumer rights.

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization of state insurance regulators. The NAIC’s website provides information about insurance regulations and consumer protection issues. The NAIC also offers resources for consumers to compare insurance rates and find insurance companies in their state.

- Illinois Insurance Marketplace: This online marketplace allows consumers to compare insurance quotes from multiple companies. The marketplace provides a convenient way to shop for insurance and find the best rates.

Last Point

Navigating the world of car insurance in Illinois can seem daunting, but with the right knowledge and resources, finding the perfect policy becomes a straightforward process. By understanding the state’s regulations, exploring coverage options, and utilizing available tools, drivers can ensure they are adequately protected on the road. This guide provides a solid foundation for making informed decisions and securing the most suitable car insurance policy for your needs.

FAQs

What are the minimum car insurance requirements in Illinois?

Illinois requires drivers to carry at least the following coverage: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, and $20,000 property damage liability.

What factors affect car insurance premiums in Illinois?

Factors that influence premiums include age, driving history, vehicle type, location, credit score, and coverage level.

How can I find the best car insurance rates in Illinois?

Use comparison websites, contact multiple insurers directly, and explore discounts like safe driver, good student, or multi-car discounts.

What are the penalties for driving without car insurance in Illinois?

Driving without insurance can result in fines, license suspension, and even jail time. You may also be held personally liable for damages caused in an accident.