- Understanding Miami’s Unique Car Insurance Landscape

- Key Considerations for Car Insurance in Miami: Car Insurance In Miami Florida

- Navigating the Insurance Provider Landscape

- Tips for Getting the Best Car Insurance Rates in Miami

- Managing Your Car Insurance Policy in Miami

- Concluding Remarks

- Commonly Asked Questions

Car insurance in Miami Florida is more than just a necessity; it’s a strategic maneuver in a city known for its high car theft rates, congested roads, and abundance of luxury vehicles. These factors contribute to a unique insurance market where premiums can vary significantly and coverage options are crucial. Understanding the nuances of Miami’s car insurance landscape is essential for securing the right protection and avoiding unexpected costs.

From the bustling streets of South Beach to the quiet residential neighborhoods of Coral Gables, Miami drivers face a complex mix of risks and challenges. This guide will delve into the intricacies of car insurance in Miami, providing insights into the key considerations, navigating the insurance provider landscape, and securing the best rates. We’ll also explore common questions and offer practical tips to ensure you’re well-prepared for the road ahead.

Understanding Miami’s Unique Car Insurance Landscape

Miami’s car insurance market is unlike any other in the United States, shaped by a unique combination of factors that significantly impact insurance premiums and coverage options. This dynamic landscape is a result of high car theft rates, traffic congestion, and a high concentration of luxury vehicles, all contributing to a higher risk environment for insurers.

Factors Influencing Car Insurance Premiums

Miami’s unique characteristics contribute to a higher risk environment for insurers, leading to increased premiums. Here’s a breakdown of these factors:

- High Car Theft Rates: Miami consistently ranks among the cities with the highest car theft rates in the country. This elevated risk forces insurers to charge higher premiums to cover potential losses.

- Traffic Congestion: Miami’s notorious traffic congestion increases the likelihood of accidents, which, in turn, leads to higher claim payouts for insurers. This elevated risk is reflected in higher insurance premiums.

- Luxury Vehicles: Miami boasts a large concentration of luxury vehicles, which are more expensive to repair or replace. Insurers account for this higher cost by charging higher premiums for luxury car owners.

Coverage Options in Miami

The high-risk environment in Miami influences the coverage options available to drivers. Insurers offer a range of coverage options to cater to the specific needs of Miami drivers:

- Comprehensive Coverage: This coverage protects against non-collision damages such as theft, vandalism, and natural disasters. It is highly recommended in Miami due to the high car theft rates and potential for natural disasters.

- Collision Coverage: This coverage covers damages to your vehicle in case of an accident. It is essential in Miami, considering the high traffic congestion and potential for accidents.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you are involved in an accident with a driver who is uninsured or underinsured. It is particularly important in Miami, where uninsured drivers are more common.

Historical Evolution of Car Insurance in Miami

The car insurance landscape in Miami has evolved over time, adapting to changing circumstances. Here’s a brief overview:

- Early Years: In the early days, car insurance in Miami was primarily focused on liability coverage, protecting drivers from lawsuits in case of accidents.

- Rise of Comprehensive Coverage: As Miami’s car theft rates increased, insurers began offering comprehensive coverage to protect against theft and other non-collision damages.

- Increased Focus on Risk Assessment: Over time, insurers have become more sophisticated in their risk assessment techniques, using factors like driving history, credit score, and vehicle type to determine premiums.

Key Considerations for Car Insurance in Miami: Car Insurance In Miami Florida

Navigating the car insurance landscape in Miami requires careful consideration of various factors to ensure you have adequate coverage at a reasonable price. Understanding the different types of insurance, the importance of specific coverages, and how various factors influence your premium are crucial steps in securing the right policy.

Required Car Insurance Coverage in Florida

Florida law mandates specific car insurance coverage for all drivers, including:

- Liability Insurance: This coverage protects you financially if you cause an accident that results in injury or damage to another person or their property. It covers the other driver’s medical expenses, lost wages, and property damage up to the policy limits. Florida requires a minimum liability coverage of $10,000 per person and $20,000 per accident for bodily injury, and $10,000 for property damage.

- Personal Injury Protection (PIP): This coverage covers your own medical expenses, lost wages, and other related costs, regardless of who caused the accident. Florida requires a minimum PIP coverage of $10,000. It’s important to note that PIP benefits are subject to a deductible, and the coverage may not fully compensate you for all your losses.

- Collision Coverage: This optional coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. If you choose not to have collision coverage, you’ll be responsible for the repair costs yourself.

- Comprehensive Coverage: This optional coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Like collision coverage, it’s not mandatory but can be beneficial for protecting your investment.

Uninsured/Underinsured Motorist Coverage in Miami

Miami’s high volume of traffic and diverse driver population can increase the risk of accidents involving uninsured or underinsured drivers. Uninsured/underinsured motorist (UM/UIM) coverage is crucial in such situations. This coverage protects you if you’re involved in an accident with a driver who has insufficient or no liability insurance. UM/UIM coverage can help pay for your medical expenses, lost wages, and property damage, even if the other driver is at fault.

Factors Affecting Car Insurance Premiums

Your car insurance premium is determined by various factors, including:

- Driving Record: A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates. In Florida, your driving record is accessible through the Florida Department of Motor Vehicles (FLHSMV).

- Credit Score: While not legal in all states, Florida insurers can use your credit score as a factor in determining your premium. A good credit score generally leads to lower premiums, while a poor credit score can result in higher rates. This practice is based on the assumption that individuals with good credit history are more likely to be responsible drivers.

- Vehicle Type: The type of vehicle you drive plays a significant role in your premium. Sports cars, luxury vehicles, and high-performance cars are generally considered riskier and cost more to insure due to their higher repair costs and increased likelihood of accidents.

Navigating the Insurance Provider Landscape

Miami’s car insurance market is diverse, offering a range of insurance providers to cater to different needs and preferences. Understanding the types of providers available and their respective strengths and weaknesses is crucial for making an informed decision.

Types of Insurance Providers in Miami

The insurance provider landscape in Miami can be broadly categorized into three main types:

- Major National Companies: These are large, well-established companies with a national presence, such as State Farm, Geico, and Progressive. They offer standardized coverage options and often have a strong reputation for customer service.

- Regional Insurers: These companies focus on specific geographic regions, such as Florida or the Southeast. They may offer more localized coverage options and have a deeper understanding of regional risks. Examples include Florida Peninsula Insurance Company and Universal Insurance.

- Smaller Independent Agencies: These agencies typically represent multiple insurance companies and can offer a wider range of coverage options and personalized service. They often have a strong local presence and may be more familiar with the specific needs of Miami drivers.

Advantages and Disadvantages of Each Type of Provider

- Major National Companies:

- Advantages: Wide availability, standardized coverage options, strong brand recognition, and often competitive pricing.

- Disadvantages: May lack local expertise, potentially less personalized service, and may not offer specialized coverage options tailored to specific Miami risks.

- Regional Insurers:

- Advantages: Deeper understanding of regional risks, potentially more competitive pricing for Florida residents, and may offer specialized coverage options for Miami drivers.

- Disadvantages: Limited availability outside of their geographic focus, may have fewer resources than national companies, and potentially less brand recognition.

- Smaller Independent Agencies:

- Advantages: Wider range of coverage options, personalized service, strong local presence, and potentially more competitive pricing due to their ability to compare quotes from multiple insurers.

- Disadvantages: May have limited resources compared to larger companies, potentially less brand recognition, and may require more effort to find the right agency for your needs.

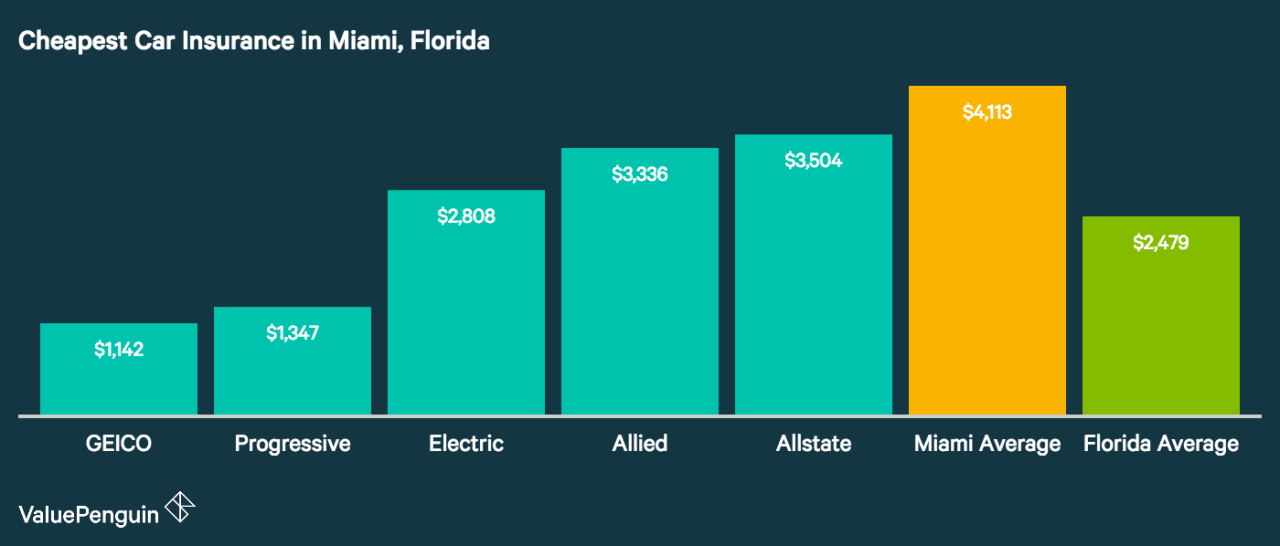

Top 5 Car Insurance Providers in Miami

The following table compares the top 5 car insurance providers in Miami based on average premium, customer satisfaction ratings, and available coverage options.

| Provider | Average Premium | Customer Satisfaction | Coverage Options |

|—|—|—|—|

| State Farm | $1,200 | 4.5/5 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP) |

| Geico | $1,150 | 4.2/5 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, PIP, Rental Car Coverage |

| Progressive | $1,100 | 4.0/5 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, PIP, Accident Forgiveness |

| Florida Peninsula Insurance Company | $1,050 | 4.3/5 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, PIP, Flood Coverage |

| Universal Insurance | $1,000 | 3.8/5 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, PIP, Windstorm Coverage |

Note: Average premiums are estimates and may vary based on individual factors such as driving history, vehicle type, and coverage options. Customer satisfaction ratings are based on independent reviews and may fluctuate.

Tips for Getting the Best Car Insurance Rates in Miami

Finding affordable car insurance in Miami can be a challenge, but with a strategic approach, you can secure competitive rates and protect your vehicle.

Comparing Quotes from Different Insurers

Comparing quotes from multiple insurance providers is crucial for finding the best rates. Utilize online comparison tools, which allow you to enter your information once and receive quotes from various companies.

Negotiating Lower Premiums

- Bundling Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to significant discounts. This strategy demonstrates loyalty and reduces administrative costs for insurers, making you a more attractive customer.

- Maintaining a Clean Driving Record: A clean driving record is a significant factor in determining your premium. Avoiding traffic violations, accidents, and DUI charges can lower your rates.

- Taking Advantage of Discounts: Many insurers offer discounts for various factors, including:

- Good Student Discount: This discount is available for students with good grades.

- Safe Driver Discount: This discount rewards drivers with a proven record of safe driving habits.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can reduce your premium.

- Loyalty Discount: Staying with the same insurer for an extended period can earn you a loyalty discount.

Understanding Policy Terms and Conditions

Thoroughly reading your policy’s terms and conditions is essential to avoid unexpected costs or coverage limitations. Pay close attention to:

- Deductibles: This is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums.

- Coverage Limits: This refers to the maximum amount your insurance will pay for specific types of claims, such as bodily injury or property damage.

- Exclusions: These are specific events or situations that are not covered by your policy. For example, your policy may exclude coverage for certain types of accidents or driving under the influence.

Managing Your Car Insurance Policy in Miami

Navigating your car insurance policy in Miami can be simplified with a proactive approach. Understanding the procedures for filing claims, making changes, and protecting your information ensures a smoother experience in case of unexpected events.

Filing a Claim After an Accident

After an accident, it’s crucial to act quickly and correctly to ensure a smooth claims process.

- Contact Your Insurance Company: Immediately report the accident to your insurance company, providing details about the incident, including the date, time, location, and involved parties.

- Gather Information: Collect contact information from all parties involved, including names, addresses, phone numbers, and insurance details. Note any witness information as well.

- Document the Accident: Take photographs of the damage to your vehicle, the other vehicles involved, and the accident scene. If possible, obtain a police report.

- Seek Medical Attention: If you’ve been injured, seek medical attention immediately. Report any injuries to your insurance company.

- Follow Instructions: Your insurance company will guide you through the claims process, providing specific instructions on how to proceed.

Making Changes to Your Policy

Adjustments to your car insurance policy, such as adding a new driver or changing coverage, are easily made with your insurance company.

- Contact Your Agent: Reach out to your insurance agent or company representative to discuss the desired changes. Provide all necessary information, such as the new driver’s details or the coverage adjustments you require.

- Review Updated Policy: Carefully review the updated policy document to ensure the changes are accurately reflected and understand any potential impact on your premiums.

- Make Necessary Payments: Update your payment information if required, ensuring you’re aware of any changes in your premium amount.

Preventing Fraud and Protecting Your Information, Car insurance in miami florida

Safeguarding your personal information and preventing insurance fraud is crucial for maintaining the integrity of your policy.

- Be Cautious with Personal Information: Avoid sharing sensitive details like your Social Security number or policy information with unknown individuals or websites.

- Verify Communication: Be wary of unsolicited phone calls or emails requesting personal information related to your insurance policy. Always verify communication through official channels.

- Report Suspicious Activity: If you suspect fraudulent activity or encounter any suspicious requests, report it immediately to your insurance company.

Concluding Remarks

Navigating the world of car insurance in Miami can feel overwhelming, but by understanding the key factors, comparing providers, and taking advantage of available discounts, you can find the right coverage at a competitive price. Remember, a well-informed approach is crucial for securing the protection you need while managing your insurance costs effectively. As you drive through the vibrant streets of Miami, knowing you have the right car insurance policy can provide peace of mind and financial security.

Commonly Asked Questions

What are the minimum car insurance requirements in Florida?

Florida requires all drivers to have a minimum amount of liability insurance, including personal injury protection (PIP) and property damage liability. The specific amounts vary, but generally, you’ll need at least $10,000 in PIP coverage and $10,000 in property damage liability.

How does my driving record affect my car insurance premiums in Miami?

Your driving record plays a significant role in determining your car insurance rates. Accidents, traffic violations, and even speeding tickets can lead to higher premiums. Maintaining a clean driving record is essential for keeping your insurance costs low.

What is uninsured/underinsured motorist coverage, and why is it important in Miami?

Uninsured/underinsured motorist coverage protects you in the event of an accident with a driver who doesn’t have enough insurance or no insurance at all. This coverage is crucial in Miami, where a significant number of drivers may be uninsured or underinsured.