- Understanding Pennsylvania Car Insurance Requirements

- Factors Influencing Car Insurance Rates in PA

- Choosing the Right Car Insurance Provider

- Understanding Car Insurance Policies in PA

- Filing a Car Insurance Claim in PA

- Navigating Car Insurance Changes in PA

- Outcome Summary

- Question & Answer Hub: Car Insurance In Pa

Car insurance in PA is a necessity for all drivers, and understanding its intricacies can save you time, money, and potential headaches. From mandatory coverages to rate-influencing factors, navigating the world of Pennsylvania car insurance can seem daunting. However, with the right information and resources, you can make informed decisions about your coverage and ensure you’re adequately protected on the road.

This guide delves into the key aspects of car insurance in PA, providing insights into required coverages, rate determinants, choosing the right provider, understanding policy types, filing claims, and staying informed about recent changes. Whether you’re a new driver or a seasoned motorist, this comprehensive overview will equip you with the knowledge to make smart choices about your car insurance.

Understanding Pennsylvania Car Insurance Requirements

Driving a car in Pennsylvania requires you to have car insurance. The Pennsylvania Department of Transportation (PennDOT) mandates certain types of coverage to ensure that drivers are financially responsible in case of accidents.

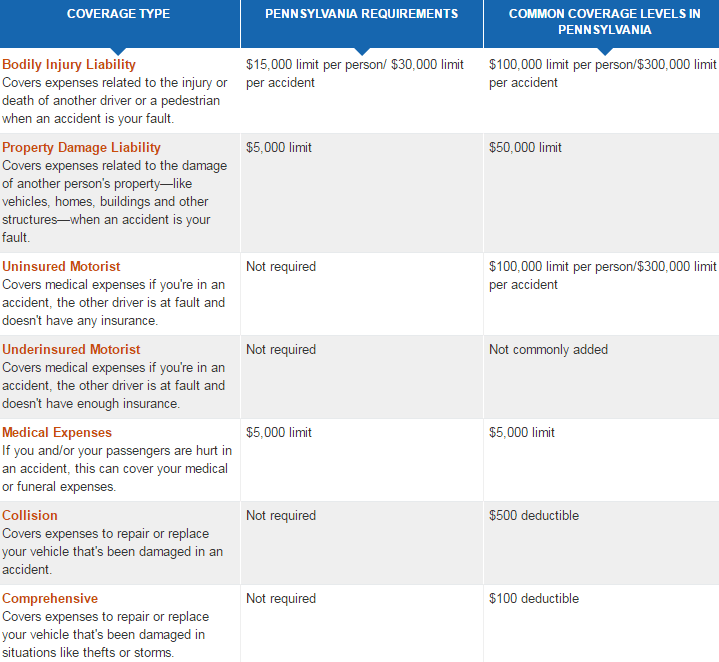

Required Car Insurance Coverages

Pennsylvania law requires all drivers to carry a minimum amount of liability insurance. Liability insurance covers damages caused to others in case of an accident. The mandatory coverages are:

- Bodily Injury Liability: This coverage protects you against financial responsibility for injuries to other people in an accident you caused. The minimum required limit is $15,000 per person and $30,000 per accident.

- Property Damage Liability: This coverage protects you against financial responsibility for damage to another person’s property in an accident you caused. The minimum required limit is $5,000.

Uninsured/Underinsured Motorist (UM/UIM) Coverage

While not mandatory, it’s highly recommended to have Uninsured/Underinsured Motorist (UM/UIM) coverage. This coverage protects you in case you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your damages.

- Uninsured Motorist (UM) Coverage: This coverage protects you if you are injured in an accident caused by a driver who does not have any insurance. It covers medical expenses, lost wages, and other damages.

- Underinsured Motorist (UIM) Coverage: This coverage protects you if you are injured in an accident caused by a driver who has insurance, but the coverage is insufficient to cover your damages. For example, if you are injured in an accident with a driver who has $15,000 in liability coverage, and your medical expenses exceed that amount, UIM coverage can help cover the difference.

Factors Influencing Car Insurance Rates in PA

Your car insurance premium in Pennsylvania is determined by a variety of factors, some of which you can control and some you can’t. Understanding these factors can help you make informed decisions that could save you money on your insurance.

Driver Age

The age of the driver is a significant factor in determining car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This increased risk translates to higher premiums. As drivers gain experience and age, their premiums tend to decrease.

Driving History

Your driving history is a crucial factor in determining your car insurance rates. A clean driving record with no accidents or violations will result in lower premiums. However, if you have a history of accidents, traffic violations, or DUI convictions, your insurance rates will likely be higher. This is because insurance companies view drivers with poor driving records as a higher risk.

Vehicle Type

The type of vehicle you drive also plays a role in your insurance premiums. Cars that are considered more expensive to repair or replace, such as luxury vehicles or sports cars, generally have higher insurance rates. On the other hand, smaller, less expensive vehicles typically have lower premiums.

Location

The location where you live can also influence your car insurance rates. Areas with higher crime rates or a greater number of accidents tend to have higher insurance premiums. This is because insurance companies are more likely to have to pay out claims in these areas.

Credit History

In Pennsylvania, insurance companies can use your credit history to determine your car insurance rates. This practice is based on the idea that people with good credit are more financially responsible and therefore less likely to file fraudulent claims. However, this practice has been criticized for its potential to unfairly penalize people with poor credit histories, even if they are good drivers.

Discounts

Insurance companies offer a variety of discounts to help lower your premiums. Some common discounts include:

- Safe Driver Discount: This discount is offered to drivers with a clean driving record and no accidents or violations.

- Good Student Discount: This discount is available to students who maintain a certain GPA.

- Multi-Car Discount: This discount is offered to policyholders who insure multiple vehicles with the same company.

Choosing the Right Car Insurance Provider

In Pennsylvania, you have several options when it comes to securing car insurance. Each provider offers distinct advantages and disadvantages, and finding the right fit for your individual needs and budget is crucial. Understanding the different types of providers available can help you make an informed decision.

Types of Car Insurance Providers in PA

Pennsylvania’s car insurance market offers a diverse range of providers, each with its unique characteristics. It’s essential to understand the differences between these providers to make an informed decision:

- Major Insurance Companies: These are large, national companies with extensive networks and a wide range of coverage options. They often offer competitive rates and comprehensive customer service. Examples include State Farm, Geico, and Allstate.

- Regional Insurers: These companies operate in specific geographic areas, often offering more localized expertise and personalized service. They may have lower overhead costs, potentially translating into more competitive rates. Examples include Erie Insurance and Penn National Insurance.

- Independent Agents: These agents work with multiple insurance companies, allowing them to shop around for the best rates and coverage options for their clients. They often have a deep understanding of the local market and can provide personalized advice.

Comparing Key Features of Prominent Insurance Companies

To help you evaluate different providers, the table below compares key features, coverage options, and customer service ratings of some prominent insurance companies operating in Pennsylvania:

| Company | Key Features | Coverage Options | Customer Service Rating (J.D. Power) |

|---|---|---|---|

| State Farm | Wide range of coverage options, strong financial stability, extensive agent network | Liability, collision, comprehensive, uninsured/underinsured motorist, personal injury protection (PIP) | 4 out of 5 stars |

| Geico | Known for competitive rates, convenient online and mobile tools, 24/7 customer service | Liability, collision, comprehensive, uninsured/underinsured motorist, PIP | 3.5 out of 5 stars |

| Allstate | Offers a variety of discounts, strong financial stability, 24/7 roadside assistance | Liability, collision, comprehensive, uninsured/underinsured motorist, PIP | 3 out of 5 stars |

| Erie Insurance | Regional focus, strong customer service reputation, competitive rates in certain areas | Liability, collision, comprehensive, uninsured/underinsured motorist, PIP | 4.5 out of 5 stars |

| Penn National Insurance | Regional focus, strong financial stability, offers discounts for good drivers | Liability, collision, comprehensive, uninsured/underinsured motorist, PIP | 4 out of 5 stars |

Tips for Researching and Selecting a Car Insurance Provider

When choosing a car insurance provider, it’s essential to consider your individual needs and budget. Here are some tips for researching and selecting the right provider for you:

- Get multiple quotes: Contact several insurance companies or independent agents to obtain quotes. This allows you to compare rates and coverage options.

- Review coverage options: Understand the different types of coverage available, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Choose the coverage that best suits your needs and risk tolerance.

- Consider discounts: Ask about available discounts, such as good driver discounts, multi-policy discounts, and safety feature discounts. These can significantly reduce your premium.

- Read reviews and ratings: Check online reviews and ratings from reputable sources, such as J.D. Power, to get an idea of customer satisfaction and company reputation.

- Compare customer service: Consider the availability of 24/7 customer service, online tools, and mobile apps. Choose a provider that offers convenient and responsive customer service.

- Review policy details: Carefully read the policy documents before signing up to ensure you understand the coverage, exclusions, and limitations.

Understanding Car Insurance Policies in PA

Pennsylvania requires drivers to have specific types of car insurance to protect themselves and others on the road. Understanding the different types of car insurance policies and the coverage they provide is essential for making informed decisions about your car insurance needs.

Liability Coverage

Liability insurance is mandatory in Pennsylvania. It protects you financially if you cause an accident that injures another person or damages their property.

- Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for people injured in an accident you caused.

- Property Damage Liability: This covers repairs or replacement costs for damaged property, such as another vehicle or a building.

Pennsylvania’s minimum liability coverage requirements are $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage per accident. However, it is highly recommended to have higher limits to protect yourself from potentially significant financial losses.

“Pennsylvania requires drivers to carry at least $15,000 in bodily injury liability coverage per person, $30,000 per accident, and $5,000 in property damage liability coverage.”

Collision Coverage

Collision coverage protects you from financial losses if your car is damaged in an accident, regardless of who is at fault.

- It covers the cost of repairs or replacement of your vehicle after an accident.

- You pay a deductible, which is a fixed amount you are responsible for paying before your insurance company covers the remaining costs.

Collision coverage is optional in Pennsylvania, but it is essential if you want to protect yourself from the significant financial burden of repairing or replacing your car after an accident.

Comprehensive Coverage

Comprehensive coverage protects you from financial losses if your car is damaged by events other than an accident.

- It covers damage caused by theft, vandalism, fire, hail, flood, and other natural disasters.

- You pay a deductible, which is a fixed amount you are responsible for paying before your insurance company covers the remaining costs.

Comprehensive coverage is optional in Pennsylvania, but it is a good idea if you want to protect your investment in your car.

Personal Injury Protection (PIP), Car insurance in pa

PIP coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault.

- It covers medical expenses, lost wages, and other related expenses, such as rehabilitation and childcare.

- You pay a deductible, which is a fixed amount you are responsible for paying before your insurance company covers the remaining costs.

PIP coverage is mandatory in Pennsylvania, but you can choose the amount of coverage you want. It is important to have enough PIP coverage to cover your potential medical expenses and lost wages in the event of an accident.

Reading and Understanding Your Policy Documents

Once you have chosen your car insurance policy, it is crucial to read and understand the policy documents.

- This includes understanding the coverage provided, the exclusions, the deductibles, and the premium amount.

- If you have any questions about your policy, do not hesitate to contact your insurance agent or company.

Filing a Car Insurance Claim in PA

In the unfortunate event of a car accident, navigating the claims process can feel overwhelming. However, understanding your rights and responsibilities as a policyholder in Pennsylvania is crucial for a smooth and successful claim.

The Claims Process

The claims process begins when you report the accident to your insurance company. This should be done as soon as possible, ideally within 24 hours of the incident. You will need to provide details about the accident, including the date, time, location, and any injuries sustained. Your insurance company will then assign a claims adjuster to your case.

Role of the Claims Adjuster

The claims adjuster is responsible for investigating the accident and determining the extent of the damage. They will review the police report, speak with witnesses, and inspect the vehicle. They will also assess the severity of any injuries and determine the amount of compensation you are entitled to.

Policyholder Rights and Responsibilities

As a policyholder, you have certain rights and responsibilities during the claims process. You have the right to:

- Be informed about the claims process and your rights and responsibilities.

- Receive prompt and fair treatment from your insurance company.

- Negotiate the settlement amount with the claims adjuster.

- File a complaint with the Pennsylvania Insurance Department if you are dissatisfied with your insurance company’s handling of your claim.

Your responsibilities as a policyholder include:

- Reporting the accident to your insurance company promptly.

- Cooperating with the claims adjuster by providing all necessary documentation and information.

- Following the instructions of your insurance company.

- Seeking medical attention for any injuries sustained in the accident.

Step-by-Step Guide to Filing a Car Insurance Claim

Here is a step-by-step guide to filing a car insurance claim in Pennsylvania:

- Report the accident to your insurance company. This can usually be done by phone or online. Be sure to provide all the necessary details about the accident, including the date, time, location, and any injuries sustained.

- Gather documentation. This includes the police report, photographs of the damage, and any medical bills or other related expenses. You may also need to obtain statements from witnesses.

- Contact your insurance company’s claims adjuster. They will guide you through the claims process and answer any questions you may have.

- Cooperate with the claims adjuster. Provide them with all the necessary documentation and information, and answer any questions they may have.

- Negotiate the settlement amount. The claims adjuster will determine the amount of compensation you are entitled to. You have the right to negotiate this amount with them.

- File a complaint with the Pennsylvania Insurance Department if you are dissatisfied with your insurance company’s handling of your claim. The Pennsylvania Insurance Department can help resolve disputes between policyholders and insurance companies.

Documentation Required

You will need to provide your insurance company with the following documentation:

- Police report: This document details the circumstances of the accident and is essential for processing your claim.

- Photographs of the damage: These images help your insurance company assess the extent of the damage to your vehicle.

- Medical bills: If you sustained injuries in the accident, you will need to provide your insurance company with copies of your medical bills.

- Other related expenses: This may include receipts for car repairs, rental car fees, or lost wages.

- Witness statements: If any witnesses were present at the accident, you may need to obtain statements from them.

Contact Information

To report a car insurance claim in Pennsylvania, you can contact your insurance company directly. You can find their contact information on your insurance policy or on their website.

Important: It is crucial to act promptly and keep detailed records throughout the claims process. This will help ensure that your claim is processed smoothly and that you receive the compensation you deserve.

Navigating Car Insurance Changes in PA

Pennsylvania’s car insurance landscape is constantly evolving, with new regulations and updates impacting how insurance is priced and offered. Understanding these changes is crucial for Pennsylvania drivers to ensure they have adequate coverage at a reasonable price.

Impact of Changes on Premiums and Coverage

The Pennsylvania Department of Insurance (DOI) regularly updates regulations to improve the car insurance market and protect consumers. These changes can affect insurance premiums and coverage options in various ways. For instance, new regulations may introduce new coverage requirements, adjust the calculation of premium rates, or alter the availability of certain discounts.

Staying Informed About Car Insurance Updates

Keeping abreast of car insurance updates is essential for making informed decisions about your coverage. Here are some ways to stay informed:

- Visit the Pennsylvania Department of Insurance website: The DOI website is a valuable resource for accessing the latest regulations, news, and consumer guides related to car insurance.

- Subscribe to industry newsletters and publications: Several organizations publish newsletters and articles covering car insurance updates and trends. Subscribing to these resources can provide insights into upcoming changes and their potential impact.

- Contact your insurance agent or broker: Your insurance agent or broker is a valuable source of information about changes affecting your policy. They can explain how new regulations might impact your coverage and premiums.

Seeking Professional Advice

Navigating car insurance changes can be complex. If you’re unsure about how new regulations might affect your coverage or premiums, seeking professional advice is highly recommended. An insurance agent or broker can help you:

- Review your current policy: They can assess your existing coverage and determine if it meets your needs under the new regulations.

- Explore alternative coverage options: They can present you with different coverage options that might be more suitable based on your specific circumstances.

- Negotiate rates and discounts: They can help you negotiate better rates and secure available discounts.

Outcome Summary

Ultimately, understanding car insurance in PA is crucial for responsible driving and financial security. By familiarizing yourself with the required coverages, factors influencing rates, and available options, you can confidently choose a policy that meets your individual needs and budget. Remember to regularly review your coverage and seek professional advice when needed to ensure you’re adequately protected and prepared for any unexpected events on the road.

Question & Answer Hub: Car Insurance In Pa

What are the penalties for driving without car insurance in PA?

Driving without the minimum required car insurance in Pennsylvania can result in fines, license suspension, and even vehicle impoundment.

How often should I review my car insurance policy?

It’s generally recommended to review your car insurance policy at least annually, or whenever there are significant life changes, such as a new vehicle, change in driving habits, or a change in your financial situation.

Can I get car insurance if I have a poor driving record?

Yes, but it may be more expensive. Insurance companies consider your driving history when setting rates, and a poor record can lead to higher premiums. You may need to explore options with specialized insurance providers who cater to high-risk drivers.