Car insurance Indiana is a vital aspect of responsible driving in the Hoosier State. It ensures you are protected financially in case of accidents or other unforeseen events. Indiana law requires all drivers to have liability insurance, but there are other types of coverage available to provide comprehensive protection.

This guide will delve into the complexities of car insurance in Indiana, covering everything from legal requirements to finding the right insurance provider, essential coverage options, and strategies for saving on premiums. We will also explore the process of filing a claim and provide valuable resources to help you navigate the insurance landscape in Indiana.

Understanding Indiana Car Insurance

Driving a car in Indiana comes with certain responsibilities, including having adequate car insurance. This is a legal requirement in the state and ensures financial protection in case of accidents or other incidents involving your vehicle. This guide will delve into the specifics of Indiana car insurance, including legal requirements, types of coverage, and factors that influence premiums.

Indiana’s Legal Requirements for Car Insurance

Indiana mandates that all drivers have at least the minimum amount of liability insurance to cover potential damages or injuries to others in case of an accident. This minimum coverage is referred to as “Financial Responsibility Coverage” and consists of:

- Bodily Injury Liability: This covers medical expenses and other damages for injuries sustained by another person in an accident caused by you. The minimum required coverage is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This covers damages to another person’s property, such as their vehicle, in an accident caused by you. The minimum required coverage is $10,000.

It’s crucial to understand that these minimum requirements are just the bare minimum. In case of significant damages or injuries, your minimum coverage might not be enough to cover the expenses. Therefore, it’s recommended to consider higher coverage limits to ensure adequate financial protection.

Types of Car Insurance Available in Indiana

Beyond the legally mandated liability insurance, there are several other types of car insurance available in Indiana that can provide comprehensive protection. These optional coverages offer financial protection for various situations and can help mitigate potential financial burdens:

- Collision Coverage: This covers damages to your vehicle in case of a collision with another vehicle or object, regardless of fault. It helps pay for repairs or replacement of your vehicle after an accident.

- Comprehensive Coverage: This covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It helps pay for repairs or replacement of your vehicle in such incidents.

- Uninsured/Underinsured Motorist Coverage: This protects you in case you are involved in an accident with an uninsured or underinsured driver. It covers your medical expenses and property damage if the other driver doesn’t have enough insurance to cover the losses.

- Personal Injury Protection (PIP): This covers your medical expenses, lost wages, and other related costs in case of an accident, regardless of fault. It’s optional in Indiana, but it can be a valuable addition to your insurance policy.

- Medical Payments Coverage (Med Pay): This provides coverage for medical expenses for you and your passengers, regardless of fault. It’s a smaller coverage than PIP and typically has a lower limit.

The choice of car insurance coverage depends on your individual needs and financial situation. It’s advisable to consult with an insurance agent to determine the right combination of coverage for your specific circumstances.

Factors Influencing Car Insurance Premiums in Indiana

The cost of car insurance in Indiana is influenced by several factors. Understanding these factors can help you make informed decisions and potentially lower your premiums:

- Driving History: Your driving record, including accidents, violations, and DUI convictions, significantly impacts your insurance premiums. A clean driving record generally translates to lower premiums.

- Age and Gender: Younger drivers and males generally have higher insurance premiums due to their higher risk profiles. As drivers age and gain more experience, their premiums tend to decrease.

- Vehicle Type and Value: The type and value of your vehicle play a role in determining your insurance premiums. Sports cars and luxury vehicles typically have higher premiums due to their higher repair costs and risk of theft.

- Location: The area where you live can affect your insurance premiums. Areas with higher crime rates or more frequent accidents generally have higher premiums.

- Credit Score: In some states, insurance companies use credit scores as a factor in determining insurance premiums. A good credit score can potentially lead to lower premiums.

- Deductibles: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can generally lead to lower premiums.

By understanding these factors, you can take steps to potentially lower your car insurance premiums. For example, maintaining a clean driving record, choosing a safe and less expensive vehicle, and considering a higher deductible can all contribute to lower premiums.

Finding the Right Insurance Provider

Finding the right car insurance provider in Indiana can feel like navigating a maze of options. With so many companies vying for your business, it’s essential to compare and contrast their offerings to find the best fit for your needs and budget.

Top Car Insurance Companies in Indiana

To help you make an informed decision, here’s a table showcasing some of the top car insurance companies in Indiana based on customer reviews, ratings, and coverage options:

| Company Name | Rating | Key Features | Coverage Options |

|---|---|---|---|

| Progressive | 4.5/5 |

|

|

| State Farm | 4.3/5 |

|

|

| Geico | 4.2/5 |

|

|

| USAA | 4.8/5 |

|

|

Essential Coverage Options

In Indiana, your car insurance policy should include essential coverage options that protect you financially in case of an accident. These coverages are not optional, but rather mandatory by law. Understanding these coverages is crucial for ensuring you have adequate protection.

Liability Coverage

Liability coverage is the most important type of car insurance in Indiana. It covers the costs of damages and injuries you cause to other people or their property in an accident. Indiana requires all drivers to carry at least $25,000 in bodily injury liability coverage per person, $50,000 per accident, and $10,000 in property damage liability coverage. This means that if you are at fault in an accident, your insurance company will pay up to these limits for the other party’s medical bills, lost wages, and property damage.

Collision and Comprehensive Coverage

Collision and comprehensive coverage protect your own vehicle in case of an accident or other damage. Collision coverage pays for repairs or replacement of your car if you are involved in an accident, regardless of who is at fault. Comprehensive coverage covers damage to your vehicle from events like theft, vandalism, fire, hail, and natural disasters. While not mandatory, these coverages are highly recommended for most drivers as they protect your investment in your car.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your losses. This coverage will pay for your medical bills, lost wages, and other expenses if you are injured in an accident caused by an uninsured or underinsured driver.

Saving on Car Insurance Premiums

In Indiana, you have options to lower your car insurance costs. By understanding these strategies and making informed choices, you can significantly reduce your premium payments.

Strategies to Lower Car Insurance Costs

Several strategies can help you save money on your car insurance premiums. These include:

- Shop around for quotes: Compare quotes from different insurance companies to find the best rates for your needs. Online comparison websites can make this process easier.

- Increase your deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can lead to lower premiums.

- Bundle your policies: Combining your car insurance with other policies, like homeowners or renters insurance, can often result in discounts.

- Maintain a good driving record: A clean driving record with no accidents or violations is a significant factor in determining your insurance premiums.

- Consider a safe car: Certain car models are considered safer and less prone to accidents, which can result in lower insurance rates.

- Take defensive driving courses: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for discounts.

Improving Your Driving Record

A good driving record is essential for lowering your car insurance costs. Here are some tips to maintain a clean record:

- Obey traffic laws: Avoid speeding, running red lights, or driving under the influence.

- Drive defensively: Be aware of your surroundings, anticipate potential hazards, and maintain a safe following distance.

- Avoid distractions: Put away your phone, refrain from texting, and avoid other distractions while driving.

- Maintain your vehicle: Regular maintenance, including tire checks and oil changes, can help prevent accidents.

Common Discounts Offered by Indiana Insurance Companies

Many Indiana insurance companies offer discounts to policyholders. Here are some common discounts:

- Good student discount: This discount is typically available to students with good grades.

- Safe driver discount: This discount is awarded to drivers with a clean driving record and no accidents or violations.

- Multi-car discount: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount.

- Anti-theft device discount: Installing anti-theft devices in your car can lower your premiums.

- Loyalty discount: Some insurance companies offer discounts to customers who have been with them for a certain period.

- Telematics discount: This discount is available to drivers who use a telematics device that tracks their driving habits.

Filing a Claim

In Indiana, filing a car insurance claim is a straightforward process, but understanding the steps involved is essential for a smooth experience. The process typically begins with reporting the accident to your insurance company and providing all the necessary details.

Reporting an Accident and Initiating a Claim

After an accident, it’s crucial to take immediate steps to protect yourself and others involved. Here’s a step-by-step guide for reporting an accident and initiating a claim:

- Check for Injuries: Ensure the safety of everyone involved. If there are injuries, call emergency services immediately.

- Exchange Information: Obtain the other driver’s name, address, phone number, insurance company, and policy number.

- Document the Scene: Take photos of the damage to your vehicle, the other vehicle, and the accident scene.

- Contact Your Insurance Company: Report the accident to your insurance company as soon as possible. Provide them with all the details you gathered.

- File a Claim: Your insurance company will guide you through the claims process and provide you with the necessary forms.

Tips for Navigating the Claims Process, Car insurance indiana

Following these tips can help you navigate the claims process efficiently and ensure a smooth resolution:

- Be Prompt: Report the accident and file a claim promptly to avoid delays.

- Be Accurate: Provide your insurance company with accurate and complete information.

- Be Cooperative: Work with your insurance company and follow their instructions.

- Keep Records: Maintain copies of all correspondence, documents, and photos related to the claim.

- Be Patient: The claims process can take time, so be patient and persistent.

Additional Resources: Car Insurance Indiana

In addition to the information presented in this guide, several resources can provide further assistance and insights into Indiana car insurance. These resources can help you navigate the insurance landscape, understand your rights, and make informed decisions about your coverage.

Government Agencies and Consumer Protection Organizations

These agencies and organizations play a vital role in protecting consumers’ rights and ensuring fair insurance practices.

- Indiana Department of Insurance (IDOI): The IDOI regulates the insurance industry in Indiana, including car insurance. They offer resources for consumers, including information on insurance rates, consumer complaints, and licensing requirements for insurance companies. You can find their website at [link to IDOI website].

- Indiana Attorney General’s Office: The Attorney General’s Office can help consumers resolve disputes with insurance companies, investigate fraudulent insurance practices, and provide information on consumer protection laws. You can find their website at [link to Attorney General’s website].

- Better Business Bureau (BBB): The BBB provides ratings and reviews of businesses, including insurance companies. You can use this information to research different insurance providers and find companies with a good reputation. You can find their website at [link to BBB website].

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that helps regulate the insurance industry. They provide information on insurance issues, including consumer protection, insurance rates, and insurance fraud. You can find their website at [link to NAIC website].

Online Resources for Car Insurance Information

These websites offer valuable information, tools, and resources for understanding car insurance in Indiana.

- Insurance Information Institute (III): The III is a non-profit organization that provides information on insurance issues, including car insurance. They offer resources for consumers, such as articles, reports, and statistics on insurance rates, claims, and safety. You can find their website at [link to III website].

- Consumer Reports: Consumer Reports provides independent ratings and reviews of products and services, including car insurance. They offer information on insurance companies, coverage options, and pricing. You can find their website at [link to Consumer Reports website].

- NerdWallet: NerdWallet is a personal finance website that offers tools and resources for comparing car insurance rates and finding the best deals. You can find their website at [link to NerdWallet website].

- Bankrate: Bankrate is a financial website that provides information on various financial products, including car insurance. They offer tools for comparing insurance rates and finding the best deals. You can find their website at [link to Bankrate website].

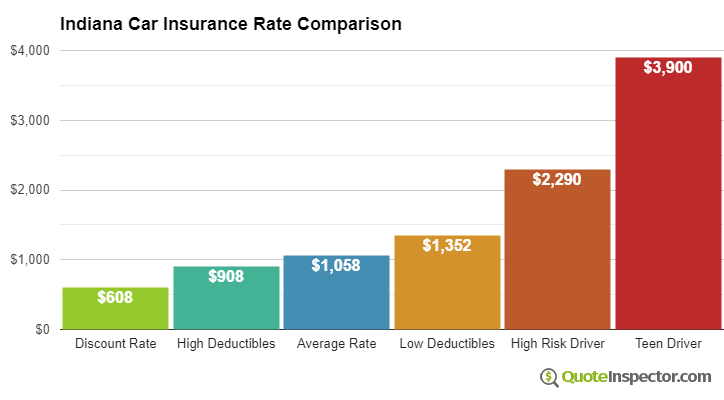

Visual Representation of the Car Insurance Landscape in Indiana

[Description of the image. It could be a flowchart depicting the different types of coverage, key players in the insurance market, and the claims process. The image should illustrate the interactions between consumers, insurance companies, and government agencies involved in the car insurance landscape in Indiana. The image should also highlight the different stages of the claims process, from reporting an accident to receiving compensation.]

Final Conclusion

Understanding car insurance in Indiana is crucial for all drivers. By carefully considering your needs, exploring available coverage options, and comparing different insurance providers, you can find the best policy for your specific circumstances. Remember, choosing the right car insurance can provide peace of mind and financial security on the road.

FAQ Explained

How much car insurance do I need in Indiana?

Indiana law requires minimum liability coverage, but the amount you need will depend on your individual circumstances. Consider your assets, driving history, and the potential risks you face.

What factors affect car insurance premiums in Indiana?

Premiums are influenced by factors like your age, driving record, vehicle type, location, and coverage choices. Comparing quotes from different insurers can help you find the best rates.

How can I get discounts on car insurance in Indiana?

Many insurance companies offer discounts for safe driving, good student status, multiple vehicle coverage, and other factors. Ask about available discounts when getting quotes.