- Understanding Maryland Car Insurance Requirements

- Factors Influencing Car Insurance Rates in Maryland

- Types of Car Insurance Coverage in Maryland

- Choosing the Right Car Insurance Policy in Maryland

- Car Insurance Discounts in Maryland

- Filing a Car Insurance Claim in Maryland

- Resources for Maryland Car Insurance: Car Insurance Maryland

- Wrap-Up

- Popular Questions

Car insurance Maryland is a necessity for all drivers in the state, ensuring financial protection in case of accidents. Understanding your coverage options and how factors like driving history and vehicle type impact your premiums is crucial for finding the right policy. From mandatory coverages to available discounts, this guide provides a comprehensive overview of Maryland’s car insurance landscape.

Navigating the world of car insurance can be daunting, but with a little knowledge, you can make informed decisions that protect your finances and peace of mind. This guide will explore the key aspects of car insurance in Maryland, empowering you to find the best coverage for your individual needs.

Understanding Maryland Car Insurance Requirements

Driving in Maryland requires you to have car insurance. The state has specific requirements to ensure drivers are financially responsible for any accidents they may cause.

Maryland’s Mandatory Car Insurance Coverages

Maryland requires all drivers to have the following car insurance coverages:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or damage to other people or property. Liability coverage is divided into two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages related to injuries caused to other people in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement of damaged property, such as another vehicle or a building, if you are at fault for the accident.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, pays for your medical expenses, lost wages, and other damages related to your injuries, regardless of who is at fault for the accident.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. It helps pay for your medical expenses, lost wages, and other damages.

Minimum Liability Limits in Maryland

Maryland requires drivers to carry the following minimum liability limits:

- Bodily Injury Liability: $30,000 per person/$60,000 per accident. This means that your insurance company will pay up to $30,000 for injuries to one person in an accident and up to $60,000 for injuries to all people involved in the accident.

- Property Damage Liability: $15,000. This means that your insurance company will pay up to $15,000 for damage to property caused by your accident.

Penalties for Driving Without Insurance in Maryland

Driving without the required car insurance in Maryland is illegal and can result in severe penalties. These penalties can include:

- Fines: You could face a fine of up to $1,000 for driving without insurance.

- Suspension of your driver’s license: Your driver’s license may be suspended until you obtain the required insurance.

- Vehicle impoundment: Your vehicle may be impounded until you obtain the required insurance.

- Jail time: In some cases, you could face jail time for driving without insurance, especially if you have been convicted of this offense multiple times.

Factors Influencing Car Insurance Rates in Maryland

Several factors contribute to the cost of car insurance in Maryland. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history plays a significant role in determining your car insurance rates. Insurance companies consider your past driving record, including:

- Accidents: Each accident you’ve been involved in, regardless of fault, increases your premiums. The severity of the accident, the number of accidents, and the time elapsed since the accidents are all factored in.

- Traffic Violations: Speeding tickets, reckless driving citations, and DUI convictions can significantly raise your insurance rates. The more serious the violation, the higher the impact on your premium.

- Driving Record Cleanliness: Maintaining a clean driving record with no accidents or violations can earn you discounts and lower your rates.

Age

Your age is a major factor in car insurance pricing.

- Young Drivers: Insurance companies consider young drivers, especially those under 25, as higher risk due to lack of experience and higher accident rates. Their premiums are generally higher.

- Mature Drivers: Drivers over 65 often benefit from lower rates due to their extensive driving experience and lower accident frequency.

Vehicle Type

The type of vehicle you drive significantly impacts your car insurance costs.

- Vehicle Value: Expensive cars with higher repair costs generally attract higher insurance premiums.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, may qualify for discounts, leading to lower premiums.

- Vehicle Performance: High-performance cars, known for their speed and power, are often considered higher risk and result in higher premiums.

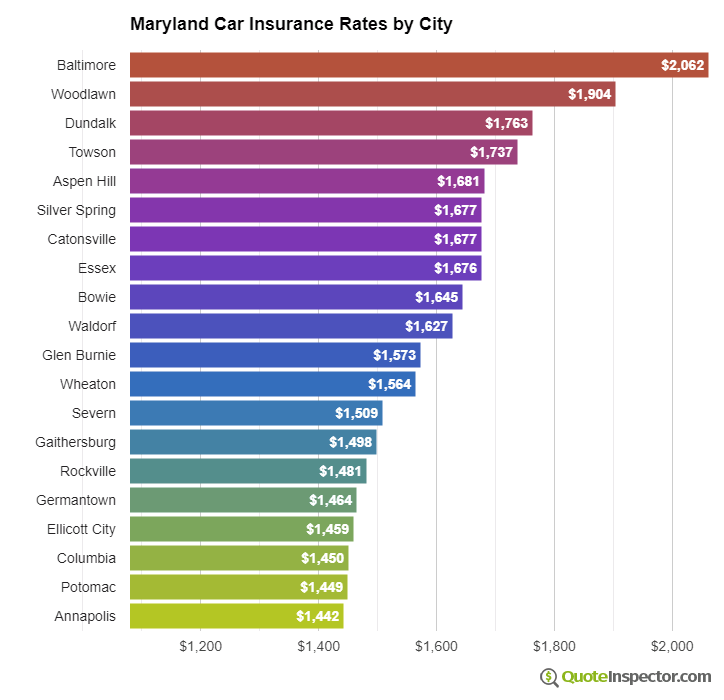

Location

Your location in Maryland influences your car insurance rates.

- Urban Areas: Insurance premiums are typically higher in densely populated urban areas with higher traffic volume and risk of accidents.

- Rural Areas: Rates are generally lower in rural areas with less traffic congestion and lower accident rates.

- Crime Rates: Areas with higher crime rates may have higher car insurance premiums due to the increased risk of theft or vandalism.

Types of Car Insurance Coverage in Maryland

Maryland law mandates several types of car insurance coverage to ensure financial protection for drivers and passengers in the event of an accident. Understanding these coverage types is crucial for making informed decisions about your car insurance policy.

Liability Coverage

Liability coverage is the most essential type of car insurance. It protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. This coverage covers:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and pain and suffering for the other driver and passengers if you are at fault in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle or property if you are at fault in an accident.

In Maryland, minimum liability limits are required:

$30,000 per person for bodily injury

$60,000 per accident for bodily injury

$15,000 per accident for property damage

If you are involved in an accident where your liability exceeds these limits, you are personally responsible for the difference.

Collision Coverage

Collision coverage protects you against financial loss if your car is damaged in an accident, regardless of who is at fault. It covers the cost of repairs or replacement of your vehicle after a collision with another vehicle or object, such as a tree or a pole.

- This coverage is optional but highly recommended. If you have a car loan or lease, your lender may require collision coverage.

- The amount of coverage you choose will determine the amount you receive for repairs or replacement, minus your deductible.

Comprehensive Coverage

Comprehensive coverage protects you against financial loss if your car is damaged due to events other than a collision, such as:

- Theft

- Vandalism

- Fire

- Hail

- Flood

Like collision coverage, comprehensive coverage is optional but can be valuable for protecting your investment in your vehicle. It covers the cost of repairs or replacement of your vehicle, minus your deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you in the event of an accident with a driver who has no insurance or insufficient insurance to cover your damages.

- This coverage is optional but highly recommended. It provides financial protection for your medical expenses, lost wages, and pain and suffering.

- UM/UIM coverage is typically available in amounts equal to your liability limits.

Personal Injury Protection (PIP)

PIP coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages, regardless of who is at fault in an accident.

- In Maryland, PIP coverage is mandatory.

- The minimum coverage required is $2,500.

Choosing the Right Car Insurance Policy in Maryland

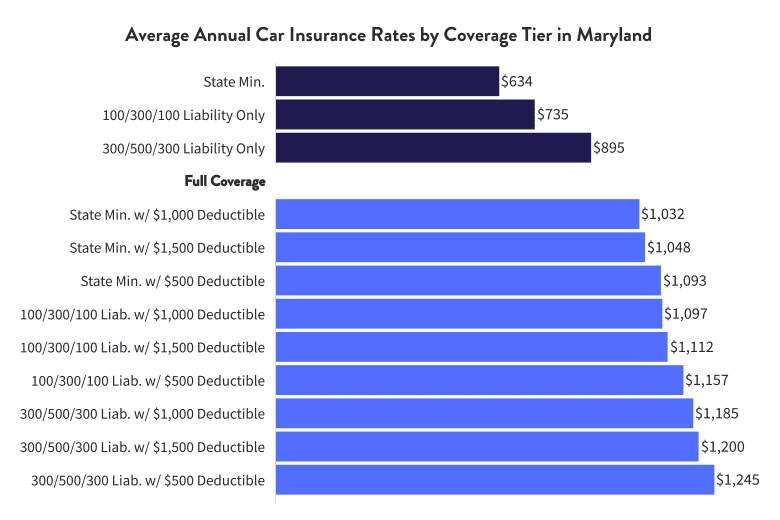

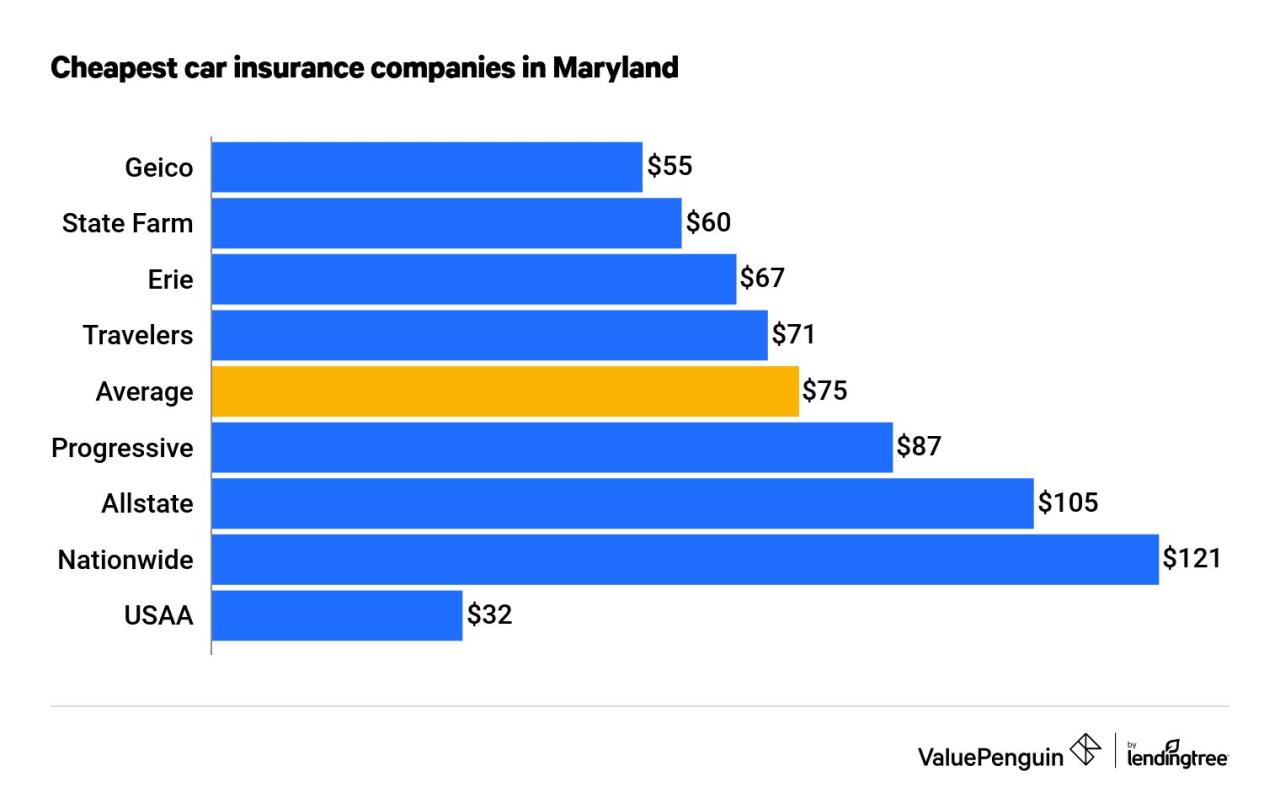

Finding the best car insurance policy in Maryland involves a careful process of comparing quotes, understanding your coverage needs, and carefully reviewing policy terms. This process ensures you get the right level of protection at a price that fits your budget.

Comparing Car Insurance Quotes

Comparing quotes from different insurance companies is essential for finding the best deal. By getting multiple quotes, you can see how prices vary based on factors like your driving history, vehicle type, and coverage options.

- Use online comparison tools: Many websites allow you to enter your information once and receive quotes from multiple insurers. This saves you time and effort.

- Contact insurance companies directly: Reach out to insurance companies you are interested in to get personalized quotes. This allows you to ask questions and discuss your specific needs.

- Consider discounts: Ask about available discounts, such as good driver discounts, multi-policy discounts, or safety feature discounts.

Understanding Your Coverage and Policy Terms

It is crucial to understand the coverage you are purchasing and the terms of your policy. This ensures you are adequately protected in case of an accident or other covered event.

- Review your policy carefully: Read through your policy document to understand the specifics of your coverage, including limits, deductibles, and exclusions.

- Ask questions: If you have any questions about your policy, don’t hesitate to contact your insurance agent or company representative for clarification.

- Consider your needs: Evaluate your individual needs and driving habits to determine the appropriate level of coverage for you.

Car Insurance Discounts in Maryland

Maryland car insurance companies offer various discounts to help policyholders save money on their premiums. These discounts are designed to reward safe driving habits, responsible vehicle ownership, and other factors that reduce the risk of accidents.

Discounts Based on Driving Habits, Car insurance maryland

Many insurers offer discounts for safe driving. Here are some common examples:

- Good Driver Discount: This discount is usually awarded to drivers with a clean driving record, typically with no accidents or traffic violations for a specific period, usually 3-5 years. The discount percentage can vary depending on the insurer and the driver’s specific record.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can qualify you for this discount. The course teaches safe driving practices and can help reduce your risk of accidents. The discount amount can vary depending on the insurer and the course taken.

- Telematics Discount: Some insurers offer discounts to drivers who use a telematics device, such as a smartphone app or a plug-in device, that monitors their driving habits. These devices track factors like speed, braking, and mileage. Drivers who exhibit safe driving behaviors can earn discounts.

Discounts Based on Vehicle Features

The safety features of your vehicle can also influence your insurance premium.

- Anti-theft Device Discount: Having anti-theft devices installed in your vehicle, such as an alarm system or a GPS tracking device, can reduce the risk of theft and qualify you for this discount.

- Airbag/Safety Belt Discount: Vehicles equipped with airbags and safety belts are generally considered safer, leading to lower insurance premiums.

Discounts Based on Other Factors

- Multi-Policy Discount: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in a significant discount.

- Good Student Discount: This discount is typically available to students who maintain a certain GPA, usually a 3.0 or higher. It reflects the lower risk associated with good students.

- Military Discount: Some insurance companies offer discounts to active military personnel, veterans, or their families. The discount is often a recognition of their service and commitment.

How to Get the Discounts

To qualify for these discounts, you will typically need to provide your insurance company with the necessary documentation, such as proof of a clean driving record, completion certificate for a defensive driving course, or details about your vehicle’s safety features.

Filing a Car Insurance Claim in Maryland

If you’re involved in a car accident in Maryland, filing a claim with your insurance company is crucial to getting the necessary compensation for damages and injuries. This process can seem daunting, but understanding the steps involved can make it smoother.

Reporting a Car Accident

After a car accident, your priority should be ensuring everyone’s safety and calling the authorities if necessary. Once the immediate situation is addressed, you need to report the accident to your insurance company.

- Contact your insurance company: You can usually report an accident online, over the phone, or through a mobile app. Be prepared to provide details about the accident, including the date, time, location, and the other parties involved.

- Gather information: Collect as much information as possible about the accident, including:

- The other driver’s name, address, and insurance information

- Contact information for any witnesses

- Photos or videos of the accident scene and any damage to your vehicle

- A police report number if applicable

- File a police report: If the accident involves injuries or significant property damage, you should file a police report. This report will be important documentation for your insurance claim.

Role of the Insurance Adjuster

Once you’ve reported the accident, your insurance company will assign an insurance adjuster to your claim. The adjuster is responsible for investigating the accident, assessing the damages, and determining the amount of compensation you’re entitled to.

- Investigate the accident: The adjuster will review the police report, your statement, and any other available information to determine the cause of the accident and who was at fault.

- Assess the damages: The adjuster will inspect your vehicle and assess the extent of the damage. They may also request an appraisal from a qualified mechanic.

- Determine the compensation: Based on the investigation and assessment, the adjuster will determine the amount of compensation you’re entitled to, which may include:

- Repairs or replacement of your vehicle

- Medical expenses

- Lost wages

- Pain and suffering

Resources for Maryland Car Insurance: Car Insurance Maryland

Finding the right car insurance policy in Maryland can be overwhelming, but there are numerous resources available to help you navigate the process. This section provides information on various resources, including official websites, consumer protection organizations, and other valuable tools.

Maryland Insurance Administration

The Maryland Insurance Administration (MIA) is the state agency responsible for regulating the insurance industry in Maryland. The MIA provides a wealth of information for consumers, including:

- Consumer guides and publications: The MIA offers various publications on car insurance, including guides on understanding your policy, choosing the right coverage, and filing a claim. You can access these resources on the MIA website.

- Complaints and dispute resolution: If you have a dispute with your insurance company, the MIA can assist in resolving the issue. You can file a complaint online or by phone.

- Market conduct investigations: The MIA conducts investigations into insurance companies to ensure they are complying with state laws and regulations.

The MIA website is a valuable resource for consumers seeking information on car insurance in Maryland. You can find a wide range of publications, consumer guides, and information on filing complaints.

Consumer Protection Organizations

Several consumer protection organizations can help you with car insurance-related issues in Maryland. These organizations can provide information, advice, and support if you are facing problems with your insurance company.

- Maryland Office of the Attorney General: The Office of the Attorney General can assist consumers with a wide range of issues, including insurance complaints. You can file a complaint online or by phone.

- Consumer Reports: Consumer Reports is a non-profit organization that provides independent reviews and ratings of products and services, including car insurance. You can access their car insurance ratings and information on their website.

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that regulates the insurance industry. The NAIC website provides information on consumer protection, insurance regulations, and other resources.

Other Resources

Besides official websites and consumer protection organizations, other resources can help you find car insurance information in Maryland.

- Independent Insurance Agents: Independent insurance agents work with multiple insurance companies, allowing them to shop around and find the best policy for your needs.

- Online Insurance Comparison Websites: Websites like Policygenius and The Zebra allow you to compare quotes from multiple insurance companies in one place. These websites can help you save time and money.

- Your Local Library: Your local library may have resources available on car insurance, including consumer guides and publications from the MIA.

Wrap-Up

By understanding the intricacies of Maryland car insurance, you can confidently choose the policy that best suits your circumstances. Remember to compare quotes, explore available discounts, and stay informed about your coverage. Driving safely and responsibly will also contribute to lower premiums and a more secure driving experience.

Popular Questions

What is the minimum car insurance coverage required in Maryland?

Maryland requires all drivers to carry minimum liability insurance coverage, including bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever there’s a significant change in your driving situation, such as a new vehicle, change in address, or improved driving record.

Can I get a discount on my car insurance for having a good driving record?

Yes, many insurance companies offer discounts for drivers with clean driving records. This can include discounts for accident-free driving, safe driving courses, and good student discounts.