Car insurance Miami Florida is a crucial aspect of responsible driving in the Sunshine State. Miami, known for its bustling streets, diverse demographics, and unpredictable weather, presents unique challenges for drivers. Navigating the complex world of car insurance in this city requires careful consideration of various factors, including coverage options, premium costs, and claim processes. This comprehensive guide aims to equip Miami residents with the knowledge and resources needed to make informed decisions about their car insurance.

Understanding the intricacies of car insurance in Miami, Florida, is essential for drivers seeking peace of mind and financial protection. From the mandatory coverage requirements to the factors influencing premium costs, this guide will provide a clear and concise overview of the car insurance landscape in Miami. Whether you’re a seasoned driver or a new resident, this information will empower you to choose the right policy and navigate the claims process effectively.

Understanding Car Insurance in Miami, Florida: Car Insurance Miami Florida

Miami, Florida, a vibrant city known for its sunny weather and bustling streets, presents a unique set of challenges for drivers. The city’s warm climate, heavy traffic, and diverse demographics all contribute to a distinct car insurance landscape. Understanding the factors that influence car insurance rates in Miami is crucial for finding the best coverage at an affordable price.

Types of Car Insurance Coverage in Miami, Florida

Car insurance in Miami, Florida, like other states, offers various types of coverage to protect drivers and their vehicles. Each coverage type addresses specific risks and can be tailored to meet individual needs.

- Liability Coverage: This coverage is mandatory in Florida and protects drivers from financial responsibility in case of an accident where they are at fault. It covers damages to other vehicles and injuries to other people.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the insured and their passengers, regardless of who is at fault in an accident. It is also mandatory in Florida.

- Collision Coverage: This optional coverage pays for repairs or replacement of the insured vehicle in case of an accident, regardless of fault. It is often recommended for newer vehicles.

- Comprehensive Coverage: This optional coverage protects against damage to the insured vehicle from non-accident events, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This optional coverage provides protection if the insured is involved in an accident with a driver who is uninsured or underinsured. It helps cover damages and injuries caused by the at-fault driver.

- Rental Car Coverage: This optional coverage provides coverage for a rental car if the insured vehicle is damaged or stolen.

Mandatory Car Insurance Requirements in Miami, Florida, Car insurance miami florida

Florida law requires all drivers to carry a minimum amount of liability insurance. These minimum limits are designed to ensure that drivers can cover basic damages and injuries in case of an accident.

The minimum required liability coverage limits in Florida are:

- Bodily Injury Liability: $10,000 per person, $20,000 per accident

- Property Damage Liability: $10,000 per accident

It is important to note that these minimum limits may not be sufficient to cover all damages and injuries in a serious accident. Drivers may want to consider purchasing higher limits of liability coverage to protect themselves financially in case of a significant accident.

Final Wrap-Up

In conclusion, securing adequate car insurance in Miami, Florida, is paramount for every driver. By understanding the unique aspects of car insurance in this city, considering various factors that influence premiums, and carefully selecting the right policy, Miami residents can protect themselves financially and drive with confidence. Remember to prioritize safety on the roads, utilize available resources, and be prepared for any unforeseen events. By taking proactive steps to secure the right car insurance, you can navigate the roads of Miami with peace of mind.

Quick FAQs

What are the mandatory car insurance requirements in Miami, Florida?

Miami, Florida, requires all drivers to have at least the following minimum coverage limits: $10,000 for bodily injury liability per person, $20,000 for bodily injury liability per accident, and $10,000 for property damage liability. It’s important to note that these are minimum requirements, and drivers may need additional coverage depending on their individual needs and risk tolerance.

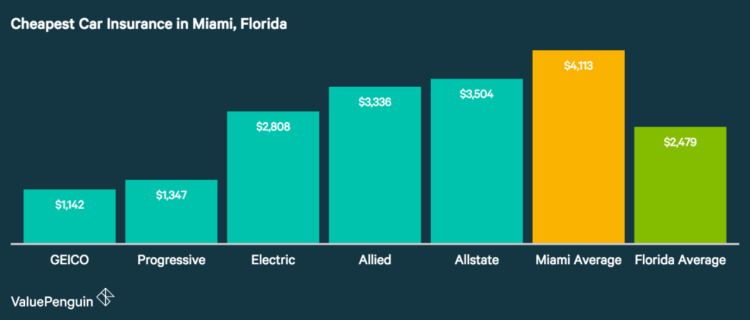

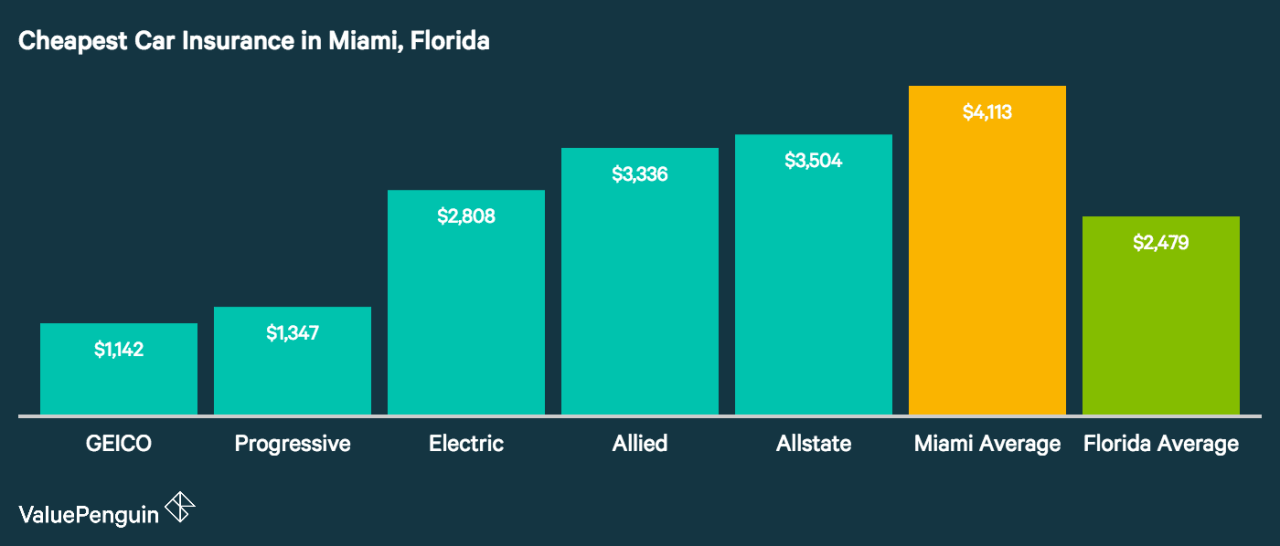

What are some tips for getting affordable car insurance in Miami?

To find affordable car insurance in Miami, consider factors like your driving history, vehicle type, and coverage needs. Shop around for quotes from multiple insurers, consider bundling your car insurance with other policies, and explore discounts offered for safe driving, good grades, or membership in certain organizations. Additionally, maintaining a good driving record and avoiding traffic violations can significantly impact your premium costs.

How do I file a car insurance claim in Miami?

In case of an accident, contact your insurance company immediately to report the incident. Provide them with the necessary details, including the date, time, location, and parties involved. Follow your insurer’s instructions for filing a claim and gather any relevant documentation, such as police reports, photos, and witness statements. Your insurer will guide you through the claims process and assist with any necessary repairs or medical expenses.