Car insurance prices are a significant expense for most car owners, and understanding the factors that influence them is crucial for making informed decisions. From your driving history and location to the type of vehicle you drive and your credit score, numerous elements play a role in determining your premiums. This guide explores the complexities of car insurance pricing, providing insights into how you can navigate this landscape and potentially save money.

This comprehensive guide covers everything from the different types of coverage available to tips for lowering your premiums and understanding the claims process. Whether you’re a new driver or a seasoned motorist, this information will empower you to make smart choices and ensure you have the right car insurance protection at a price that fits your budget.

Factors Influencing Car Insurance Prices

Car insurance premiums are influenced by a variety of factors, including your personal characteristics, driving history, the vehicle you drive, and your location. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Age, Car insurance prices

Age plays a significant role in determining car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to factors such as lack of experience and risk-taking behavior. As a result, insurers often charge higher premiums for younger drivers. Conversely, older drivers, typically over 65, are considered to be more experienced and cautious, which can lead to lower premiums.

Driving History

Your driving history is another crucial factor that insurance companies consider. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, having a history of accidents, speeding tickets, or DUI convictions will likely increase your insurance costs. Insurance companies use this information to assess your risk of future accidents.

Location

The location where you live can also impact your car insurance premiums. Areas with higher population density, more traffic, and higher rates of car theft tend to have higher insurance rates. Insurers consider the frequency of accidents, crime rates, and other factors specific to your location when determining your premium.

Credit Score

Surprisingly, your credit score can influence your car insurance premiums. Insurance companies believe that individuals with good credit scores are more financially responsible and less likely to file claims. Therefore, they may offer lower premiums to those with higher credit scores. This practice is not universal, and some states prohibit insurance companies from using credit scores to determine premiums.

Type of Vehicle

The type of vehicle you drive significantly affects your insurance premiums. Luxury cars, high-performance models, and expensive vehicles are more expensive to repair or replace, leading to higher insurance costs. In addition, sports cars and other high-performance vehicles are often associated with a higher risk of accidents due to their speed and handling capabilities. Conversely, smaller, less expensive cars tend to have lower insurance premiums.

Types of Car Insurance Coverage

Car insurance is a necessity for most drivers, providing financial protection in the event of an accident or other covered event. It’s important to understand the different types of coverage available to make sure you have the right protection for your needs.

Liability Coverage

Liability coverage is the most basic type of car insurance and is typically required by law. It protects you financially if you cause an accident that injures someone or damages their property. Liability coverage is divided into two parts: bodily injury liability and property damage liability.

- Bodily injury liability covers medical expenses, lost wages, and pain and suffering for people injured in an accident you caused.

- Property damage liability covers the cost of repairs or replacement of property damaged in an accident you caused.

The amount of liability coverage you need depends on your individual circumstances, but it’s generally recommended to have enough coverage to protect yourself from significant financial losses.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional, but it can be very beneficial if you have a newer car or if you finance your vehicle.

- For example, if you have a car loan, your lender may require you to carry collision coverage to protect their investment.

- Collision coverage can also help you avoid paying out-of-pocket for repairs if you’re involved in an accident that is your fault.

Comprehensive Coverage

Comprehensive coverage pays for repairs or replacement of your vehicle if it’s damaged by something other than an accident, such as theft, vandalism, fire, or hail. Like collision coverage, comprehensive coverage is optional, but it can be helpful to protect yourself from unexpected expenses.

- For example, if your car is stolen or damaged by a tree falling on it, comprehensive coverage will help you get it repaired or replaced.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re injured in an accident caused by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. This coverage is optional, but it’s highly recommended because it can provide vital financial protection in the event of a serious accident.

- It’s important to note that UM/UIM coverage only applies if the other driver is at fault.

Deductibles

A deductible is the amount of money you pay out-of-pocket before your insurance company starts paying for covered expenses. The higher your deductible, the lower your premium will be. However, you’ll also have to pay more out-of-pocket if you need to file a claim.

- For example, if you have a $500 deductible and your car is damaged in an accident, you’ll have to pay the first $500 of repairs yourself, and your insurance company will pay the rest.

- When choosing a deductible, it’s important to consider your budget and your risk tolerance.

Choosing the Right Car Insurance Policy: Car Insurance Prices

Choosing the right car insurance policy can be a daunting task, as there are numerous factors to consider and a wide range of options available. This section aims to provide a comprehensive guide to help you navigate this process effectively.

Factors to Consider

When selecting a car insurance policy, it’s crucial to consider several factors that directly impact your coverage and premiums. These factors include:

- Your Driving History: Your driving record plays a significant role in determining your insurance premiums. A clean driving history with no accidents or violations will typically result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will lead to higher premiums.

- Your Vehicle: The type of vehicle you drive, its make, model, year, and safety features all influence your insurance costs. High-performance vehicles or luxury cars tend to be more expensive to insure due to their higher repair costs and greater risk of theft.

- Your Location: Where you live can also impact your car insurance rates. Areas with higher crime rates or a higher frequency of accidents often have higher insurance premiums.

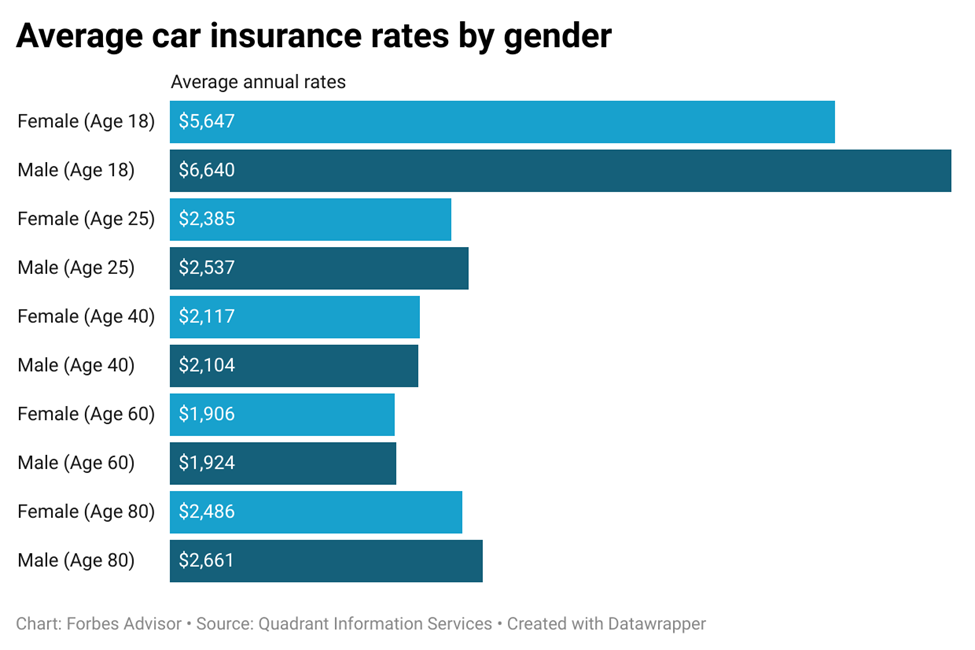

- Your Age and Gender: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. As a result, they often face higher insurance premiums. Gender can also play a role, with some insurance companies offering different rates based on gender.

- Your Coverage Needs: Consider the level of coverage you require based on your individual circumstances. If you have a newer car or a high loan balance, comprehensive and collision coverage might be essential. If you have an older car with a lower loan balance, you might choose to reduce your coverage to save on premiums.

Questions to Ask Insurance Providers

To ensure you choose the best policy for your needs, it’s essential to ask potential insurance providers a series of questions:

- What types of coverage do you offer? This question helps you understand the range of options available and whether the provider offers the specific coverage you need.

- What are your premiums for different coverage levels? This allows you to compare prices and determine the best value for your money.

- What are your deductibles and how do they affect my premiums? Deductibles are the amounts you pay out of pocket before your insurance coverage kicks in. Understanding the relationship between deductibles and premiums is essential to finding the right balance for your budget.

- What are your discounts and how can I qualify for them? Insurance companies offer various discounts for safe driving, good student status, anti-theft devices, and other factors. Understanding these discounts can help you reduce your premiums.

- What is your claims process like? This question helps you understand how easy it is to file a claim and how efficiently the provider handles claims.

- What is your customer service like? This question is crucial to gauge the provider’s responsiveness and willingness to assist you in case of an accident or other issue.

Comparing Car Insurance Providers

Once you have gathered information from multiple insurance providers, it’s helpful to compare their offerings side-by-side. The following table highlights key features and pricing for three popular car insurance providers:

| Provider | Coverage Options | Average Annual Premium | Discounts | Customer Service Rating |

|---|---|---|---|---|

| Provider A | Comprehensive, Collision, Liability, Uninsured Motorist, Personal Injury Protection | $1,200 | Safe Driver, Good Student, Multi-Car, Anti-theft Device | 4.5 stars |

| Provider B | Comprehensive, Collision, Liability, Uninsured Motorist, Personal Injury Protection | $1,000 | Safe Driver, Good Student, Multi-Car, Anti-theft Device, Loyalty | 4 stars |

| Provider C | Comprehensive, Collision, Liability, Uninsured Motorist, Personal Injury Protection | $1,100 | Safe Driver, Good Student, Multi-Car, Anti-theft Device, Bundling | 4.2 stars |

Remember that these are just examples, and actual premiums will vary based on your individual circumstances.

Saving Money on Car Insurance

Car insurance is a necessary expense, but it can also be a significant drain on your budget. Fortunately, there are several strategies you can employ to reduce your premiums and save money.

Tips for Lowering Car Insurance Premiums

Here are some practical tips and strategies for lowering your car insurance premiums:

- Maintain a Good Driving Record: A clean driving record is one of the most important factors influencing your insurance rates. Avoid traffic violations, accidents, and DUI convictions.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can significantly lower your premium. Carefully consider your financial situation and risk tolerance when choosing a deductible.

- Shop Around for Quotes: Compare rates from multiple insurance companies to find the best deals. Use online comparison tools or contact insurers directly to get quotes.

- Bundle Your Policies: Many insurance companies offer discounts for bundling your car insurance with other policies like homeowners or renters insurance.

- Consider a Usage-Based Insurance Program: Some insurers offer programs that track your driving habits, such as mileage and driving style, and reward you with lower rates for safe driving.

- Pay Your Premiums in Full: Paying your premium in full may qualify you for a discount compared to paying monthly installments.

- Ask About Discounts: Insurance companies offer various discounts, including good student discounts, safe driver discounts, and discounts for anti-theft devices.

- Improve Your Credit Score: In some states, your credit score can affect your insurance rates. Work on improving your credit score to potentially lower your premiums.

- Consider a Less Expensive Car: The make, model, and year of your car significantly impact your insurance premiums. Choosing a less expensive car can save you money on insurance.

Discounts Offered by Insurance Companies

Insurance companies offer a wide range of discounts to incentivize safe driving and responsible behavior. Here are some common discounts:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, demonstrating their responsible driving habits.

- Safe Driver Discount: Similar to the good driver discount, this discount rewards drivers who have not been involved in accidents or received traffic violations.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount.

- Bundling Discount: This discount applies when you bundle your car insurance with other types of insurance, such as homeowners, renters, or life insurance.

- Good Student Discount: Students with good academic performance may qualify for a good student discount, reflecting their responsible nature.

- Anti-Theft Device Discount: Installing anti-theft devices in your car, such as alarms or tracking systems, can lower your premium.

- Loyalty Discount: Some insurance companies offer loyalty discounts to long-term customers who have maintained their policies for an extended period.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and qualify you for a discount.

- Paid-in-Full Discount: Paying your premium in full may earn you a discount compared to paying monthly installments.

Negotiating with Insurance Providers

Negotiating with insurance providers can be a worthwhile effort to secure the best possible rates. Here are some tips:

- Be Prepared: Before negotiating, gather information about your driving record, car details, and available discounts.

- Shop Around: Obtain quotes from multiple insurers to have a benchmark for comparison.

- Be Polite and Professional: Maintain a respectful and professional demeanor throughout the negotiation process.

- Highlight Your Positive Attributes: Emphasize your clean driving record, safe driving habits, and any relevant discounts you qualify for.

- Be Willing to Compromise: Negotiation involves finding a mutually agreeable solution. Be prepared to make concessions if necessary.

- Don’t Be Afraid to Walk Away: If you are not satisfied with the offered rate, be willing to walk away and consider other insurance options.

Understanding Car Insurance Claims

Filing a car insurance claim can be a stressful experience, but understanding the process can make it easier. Knowing what to expect and how to navigate the steps involved can help you get the compensation you deserve.

Filing a Car Insurance Claim

You should file a claim as soon as possible after an accident. Contact your insurance company immediately, and provide them with the necessary information. This typically includes the date, time, and location of the accident, as well as the names and contact information of all parties involved.

Resolving a Car Insurance Claim

Once you have filed a claim, your insurance company will assign an adjuster to investigate the incident. The adjuster will review the details of the accident, assess the damage to your vehicle, and determine the extent of your injuries.

Documentation Requirements

To support your claim, you will need to provide your insurance company with relevant documentation. This might include:

- A copy of the police report

- Photos and videos of the accident scene and vehicle damage

- Medical bills and records

- Repair estimates from a qualified mechanic

- Proof of ownership of the vehicle

Communication with Insurance Adjusters

Communicating effectively with your insurance adjuster is crucial. Be honest and accurate in your statements, and provide all requested documentation promptly.

- Maintain a record of all communication with the adjuster, including dates, times, and content of conversations.

- Be polite and respectful, even if you are frustrated with the process.

- If you have any questions or concerns, do not hesitate to ask for clarification.

Outcome Summary

Navigating the world of car insurance can feel overwhelming, but with a clear understanding of the factors at play, you can make informed decisions to secure the best coverage at a reasonable price. By understanding how your driving habits, vehicle choice, and financial standing influence your premiums, you can take proactive steps to optimize your policy and potentially save money. Remember, the right car insurance is an investment in your financial well-being and peace of mind.

FAQ Section

How often should I review my car insurance policy?

It’s generally recommended to review your car insurance policy annually, or even more frequently if there are significant life changes, such as a new car purchase, a change in your driving record, or a move to a new location.

What are the benefits of bundling my car and home insurance?

Bundling your car and home insurance with the same provider often leads to significant discounts, as insurance companies reward customers for loyalty and multiple policy coverage.

Can I get a discount for being a good driver?

Yes, many insurance companies offer discounts for drivers with clean driving records, such as those who have not been involved in accidents or received traffic violations.