Car insurance prices Florida can vary significantly depending on a number of factors, making it crucial to understand the market before making a decision. From driving history to vehicle type and location, numerous variables influence your premiums. Navigating this complex landscape can feel daunting, but with the right information, you can find affordable and comprehensive coverage that meets your needs.

This guide delves into the intricacies of car insurance in Florida, offering insights into the factors that affect pricing, common coverage options, and strategies for saving money. Whether you’re a new driver, a seasoned motorist, or simply looking for better rates, this comprehensive resource will equip you with the knowledge to make informed choices about your car insurance.

Understanding Car Insurance in Florida

Florida’s car insurance landscape is unique due to a combination of factors, including a high concentration of drivers, a significant number of uninsured motorists, and the state’s no-fault insurance system. Understanding these factors is crucial for Florida residents seeking affordable and comprehensive car insurance.

Factors Influencing Car Insurance Prices in Florida

The cost of car insurance in Florida is influenced by a number of factors, including:

- High Number of Drivers: Florida has a large population and a high concentration of drivers, leading to a higher likelihood of accidents and claims. This increased risk is reflected in higher insurance premiums.

- Significant Uninsured Motorist Population: Florida has a high percentage of uninsured drivers, making it more likely for insured drivers to be involved in accidents with uninsured motorists. To compensate for this risk, insurance companies charge higher premiums.

- Florida’s No-Fault System: Florida’s no-fault insurance system requires drivers to file claims with their own insurance company, regardless of who caused the accident. This system can lead to higher premiums, as insurance companies are responsible for covering the costs of their insured drivers’ injuries, regardless of fault.

- High Property Values: Florida has a high cost of living, including high property values. This means that damage to vehicles in Florida can be more expensive to repair, which can contribute to higher insurance premiums.

- Frequent Natural Disasters: Florida is prone to hurricanes and other natural disasters, which can cause widespread damage to vehicles. Insurance companies factor in this risk when setting premiums.

- Driving Habits: Factors such as age, driving history, and driving record can also significantly impact car insurance prices. Drivers with a history of accidents or traffic violations will typically pay higher premiums.

Major Insurance Companies in Florida

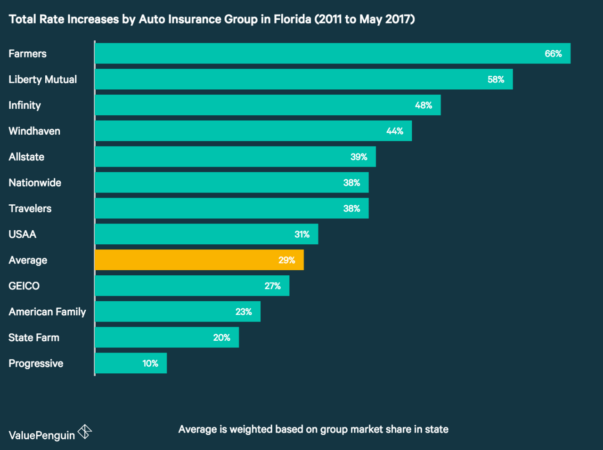

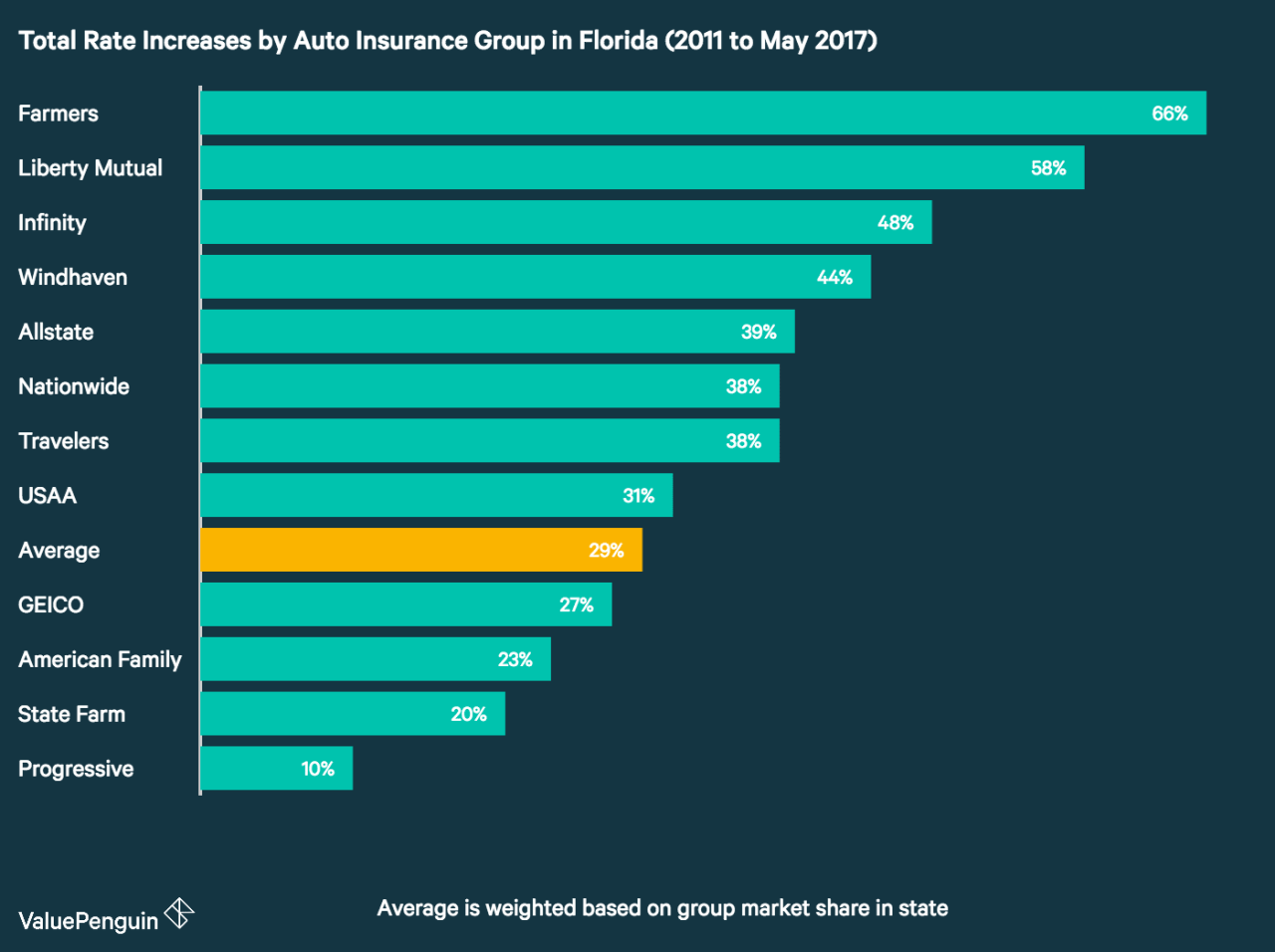

Several major insurance companies operate in Florida, offering a wide range of coverage options. Some of the most prominent companies include:

- State Farm: State Farm is one of the largest insurance companies in the United States, offering a comprehensive range of car insurance products in Florida.

- GEICO: GEICO is known for its competitive rates and convenient online services, making it a popular choice for Florida drivers.

- Progressive: Progressive is a leading provider of car insurance, offering a variety of discounts and coverage options to meet the needs of Florida drivers.

- Allstate: Allstate is another major insurance company with a strong presence in Florida, offering a range of insurance products and services.

- USAA: USAA is a well-respected insurance company that primarily serves military members and their families. USAA offers competitive rates and excellent customer service.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, meaning that drivers are required to file claims with their own insurance company, regardless of who caused the accident. This system is designed to simplify the claims process and reduce litigation.

“Under Florida’s no-fault system, your own insurance company will cover your medical expenses and lost wages, regardless of who caused the accident.”

- Personal Injury Protection (PIP): Florida’s no-fault system requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage. This coverage pays for medical expenses and lost wages, up to the policy limit, for the insured driver and passengers in their vehicle, regardless of fault.

- Limited Tort Option: Drivers can choose to opt out of the no-fault system and pursue a lawsuit for damages if their injuries exceed a certain threshold. However, this option can lead to higher premiums.

Factors Affecting Car Insurance Rates: Car Insurance Prices Florida

Several factors influence car insurance premiums in Florida. These factors are used by insurance companies to assess the risk associated with insuring a particular driver and vehicle. Understanding these factors can help you make informed decisions about your insurance coverage and potentially lower your premiums.

Driving History

Your driving history plays a crucial role in determining your car insurance rates. Insurance companies consider your past driving record, including:

- Accidents: A history of accidents, especially those you were at fault for, will increase your premiums. The severity of the accident, such as property damage or injuries, will also be factored in.

- Traffic Violations: Moving violations, such as speeding tickets, reckless driving, and DUI, can significantly impact your rates. Each violation will typically result in a higher premium for a certain period.

- Driving Record Cleanliness: A clean driving record with no accidents or violations will generally lead to lower premiums. Maintaining a good driving record is crucial for keeping your insurance costs down.

Vehicle Type and Value

The type and value of your vehicle are significant factors influencing your insurance premiums. Insurance companies assess the risk associated with different vehicles based on:

- Make and Model: Some car models are known for their safety features and lower repair costs, leading to lower insurance premiums. Conversely, vehicles with a history of high repair costs or frequent accidents may have higher premiums.

- Vehicle Age: Newer vehicles typically have higher insurance premiums due to their higher replacement value and advanced technology. Older vehicles, while having lower replacement costs, may have higher premiums if they are prone to breakdowns or repairs.

- Vehicle Value: The higher the value of your vehicle, the more it will cost to replace or repair in case of an accident. Consequently, higher-value vehicles typically have higher insurance premiums.

Age, Gender, and Marital Status

While these factors might seem discriminatory, insurance companies use them to assess risk based on historical data. They generally consider:

- Age: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk translates into higher premiums for younger drivers. However, premiums tend to decrease as drivers age and gain more experience.

- Gender: Historically, men have been statistically more likely to be involved in accidents than women. This can result in slightly higher premiums for men. However, this gap is narrowing, and some insurance companies now offer gender-neutral rates.

- Marital Status: Married individuals tend to have lower insurance premiums compared to single individuals. This is attributed to the assumption that married drivers are more responsible and less likely to take risks.

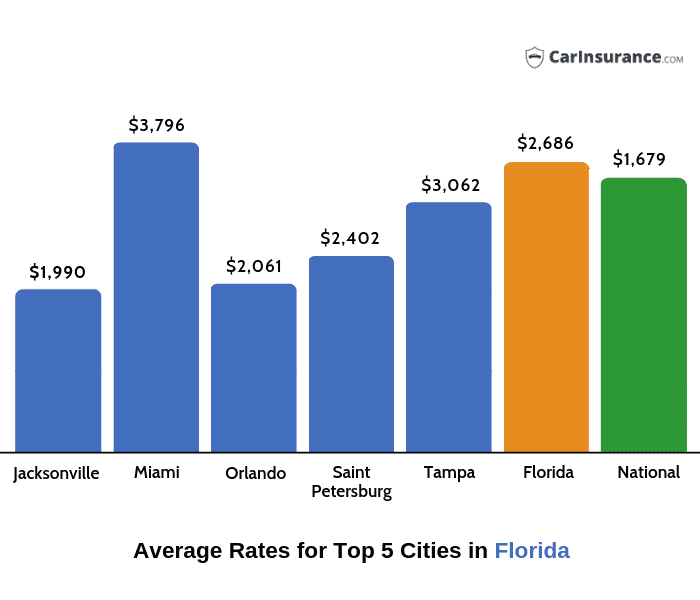

Location and Zip Code

Your location and zip code play a crucial role in determining your car insurance rates. Insurance companies consider the following factors:

- Traffic Density: Areas with high traffic density, such as major cities, tend to have higher accident rates, leading to higher insurance premiums. Conversely, rural areas with lower traffic density may have lower premiums.

- Crime Rates: Areas with higher crime rates, including car theft, vandalism, and accidents, often have higher insurance premiums. Insurance companies assess the risk of vehicle damage or theft in different locations.

- Weather Conditions: Areas prone to severe weather events, such as hurricanes, floods, and tornadoes, may have higher insurance premiums. Insurance companies consider the potential for damage to vehicles during these events.

Common Coverage Options and Their Impact

In Florida, car insurance policies offer a variety of coverage options, each designed to protect you financially in different scenarios. Understanding these options and their impact is crucial for choosing the right coverage for your needs and budget.

Liability Coverage

Liability coverage is the most basic type of car insurance and is required in Florida. It protects you financially if you cause an accident that results in injury or damage to another person or their property.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other driver or passengers in an accident you caused.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle or any other property you damage in an accident.

The minimum liability coverage required in Florida is $10,000 for bodily injury per person, $20,000 for bodily injury per accident, and $10,000 for property damage per accident. However, these minimums may not be enough to cover all potential costs, so it’s advisable to consider higher limits.

Collision Coverage

Collision coverage protects you against financial losses if your vehicle is damaged in an accident, regardless of who is at fault. This coverage pays for repairs or replacement of your vehicle, minus your deductible.

- Deductible: This is the amount you pay out of pocket before your insurance coverage kicks in.

- Benefits: Collision coverage can be crucial for protecting your investment in your vehicle and ensuring you can get it repaired or replaced after an accident.

- Drawbacks: The cost of collision coverage can be significant, especially for newer or more expensive vehicles. If you have an older car with a lower value, it may not be financially beneficial to purchase collision coverage.

Comprehensive Coverage

Comprehensive coverage protects you against damage to your vehicle caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. Like collision coverage, it pays for repairs or replacement, minus your deductible.

- Benefits: Comprehensive coverage can be important for protecting your vehicle against unforeseen events that could result in costly repairs or replacement.

- Drawbacks: The cost of comprehensive coverage can be significant, and it may not be necessary for older vehicles with a lower value.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

UM/UIM coverage protects you if you are injured in an accident caused by an uninsured or underinsured driver.

- Uninsured Motorist Coverage (UM): This coverage protects you if the other driver does not have any insurance.

- Underinsured Motorist Coverage (UIM): This coverage protects you if the other driver’s insurance limits are not enough to cover your damages.

- Benefits: UM/UIM coverage can be crucial in Florida, where a significant number of drivers are uninsured. It can help you cover medical expenses, lost wages, and other damages.

- Drawbacks: UM/UIM coverage is optional in Florida, but it is highly recommended. However, it can add to the cost of your insurance premium.

Personal Injury Protection (PIP), Car insurance prices florida

PIP coverage is mandatory in Florida and covers your medical expenses, lost wages, and other damages, regardless of who is at fault in an accident.

- Benefits: PIP coverage is essential in Florida because it provides immediate financial protection for your medical expenses and lost wages after an accident.

- Drawbacks: PIP coverage has a limit of $10,000 per person, and it may not be enough to cover all potential medical expenses.

Optional Coverages

In addition to the basic coverages discussed above, Florida car insurance policies offer various optional coverages that can provide additional protection.

- Rental Reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance with services like towing, flat tire changes, and jump starts.

These optional coverages can be beneficial, but they can also increase your insurance premium. It’s important to weigh the potential benefits against the added cost before deciding whether to add them to your policy.

Strategies for Saving on Car Insurance

Car insurance in Florida can be expensive, but there are strategies you can employ to reduce your premiums. By understanding the factors that influence your rates and taking proactive steps, you can significantly lower your car insurance costs.

Finding the Best Car Insurance Quotes

Finding the best car insurance quotes requires a strategic approach. It involves comparing rates from multiple insurers, considering various factors, and understanding the nuances of each policy.

- Use online comparison websites: Websites like Insurance.com, The Zebra, and Policygenius allow you to compare quotes from multiple insurers simultaneously, saving you time and effort.

- Contact insurance companies directly: While online comparison websites are helpful, contacting insurance companies directly allows you to discuss your specific needs and obtain personalized quotes.

- Get multiple quotes for the same coverage: Compare quotes for identical coverage levels from different insurers to ensure you’re getting the best value for your money.

- Negotiate your premium: Don’t hesitate to negotiate your premium with insurers, especially if you have a good driving record and have been with the company for a long time.

- Consider bundling insurance policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts.

Impact of Bundling Insurance Policies on Premiums

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts. Insurers offer these discounts because they see you as a more valuable customer, reducing their risk and administrative costs.

Bundling policies can result in savings of up to 25% or more on your premiums.

- Reduced administrative costs: Insurers can streamline their operations by handling multiple policies for the same customer, reducing their administrative costs.

- Increased customer loyalty: Bundling policies often encourages customers to stay with the same insurer, increasing customer loyalty and reducing churn rates.

- Reduced risk: Insurers perceive customers with multiple policies as less risky, as they are more likely to maintain a good driving record and responsible behavior.

Improving Driving History and Reducing Risk Factors

Your driving history and risk factors significantly influence your car insurance premiums. By improving your driving record and minimizing risk, you can significantly reduce your insurance costs.

- Maintain a clean driving record: Avoid traffic violations, accidents, and speeding tickets. A clean driving record is crucial for obtaining lower premiums.

- Drive safely and defensively: Practice safe driving habits, such as obeying traffic laws, avoiding distractions, and being aware of your surroundings. Defensive driving courses can further enhance your driving skills.

- Install safety features: Installing safety features like anti-theft devices, airbags, and anti-lock brakes can demonstrate to insurers your commitment to safety and result in lower premiums.

- Consider a higher deductible: Opting for a higher deductible can lower your premium, as you agree to pay more out of pocket in case of an accident. However, ensure you can afford the deductible if needed.

- Choose a safe car: The type of car you drive plays a significant role in your insurance premiums. Safer vehicles with advanced safety features tend to have lower insurance costs.

Benefits of Enrolling in Driver Safety Courses

Enrolling in driver safety courses can not only improve your driving skills but also lead to significant discounts on your car insurance premiums. Insurers often recognize these courses as a demonstration of your commitment to safe driving and reward you with lower rates.

- Reduced risk of accidents: Driver safety courses teach defensive driving techniques, helping you avoid accidents and improve your overall driving skills.

- Lower insurance premiums: Many insurers offer discounts for completing driver safety courses, recognizing the positive impact on your driving behavior.

- Enhanced driving knowledge: These courses provide valuable information on traffic laws, road safety, and defensive driving techniques, improving your overall driving awareness.

- Improved driving skills: By practicing and learning new driving techniques, you can become a safer and more confident driver.

Common Insurance Claims and Processes

Understanding the car insurance claims process in Florida is crucial for policyholders, as it guides them through the steps of reporting an accident and seeking compensation. The process can seem daunting, but with proper knowledge, it becomes more manageable.

Steps Involved in Filing a Car Insurance Claim

The following steps Artikel the process of filing a car insurance claim in Florida:

- Report the Accident: Immediately contact your insurance company and report the accident, providing details like the date, time, location, and parties involved.

- File a Claim: Your insurance company will guide you through the claim filing process, typically requiring you to complete a claim form, providing details about the accident and the damages.

- Provide Documentation: Gather and submit necessary documents like police reports, medical records, and repair estimates to support your claim.

- Insurance Company Investigation: The insurance company will investigate the claim, reviewing the provided documents and potentially conducting an independent investigation.

- Claim Determination: The insurance company will assess the validity of your claim and determine the amount of coverage available based on your policy and the accident details.

- Claim Settlement: If your claim is approved, the insurance company will issue payment for the covered damages, either directly to you or to the repair shop or medical provider.

Typical Claims Process Timeline

The timeline for processing a car insurance claim in Florida varies depending on the complexity of the claim and the cooperation of all parties involved. However, a typical timeline can be estimated as follows:

- Initial Claim Reporting: Within 24-48 hours of reporting the accident.

- Claim Filing and Documentation: Within 3-5 business days after reporting the accident.

- Insurance Company Investigation: Within 7-14 business days after receiving all necessary documentation.

- Claim Determination: Within 14-21 business days after the investigation is complete.

- Claim Settlement: Within 1-2 weeks after the claim is approved.

Common Types of Car Insurance Claims

Car insurance claims in Florida can be categorized into various types, each with its own resolution method:

- Collision Claims: These claims arise from accidents involving a collision with another vehicle or an object, such as a tree or a building. The resolution typically involves repairing or replacing the damaged vehicle.

- Comprehensive Claims: These claims cover damages to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. The resolution may involve repair, replacement, or financial compensation for the loss.

- Liability Claims: These claims arise when you are at fault for an accident that causes damage to another person’s property or injuries to another person. The resolution typically involves payment for the damages or injuries caused.

- Personal Injury Protection (PIP) Claims: In Florida, PIP coverage is mandatory and covers medical expenses and lost wages for injuries sustained in an accident, regardless of fault. The resolution involves payment for medical bills and lost wages, subject to the policy limits.

Navigating Insurance Claim Disputes

Disputes can arise during the claims process, often related to the coverage amount, liability determination, or the interpretation of policy terms. Here are some tips for navigating such disputes:

- Review Your Policy: Thoroughly understand the terms and conditions of your insurance policy, especially the coverage limits and exclusions.

- Document Everything: Keep detailed records of all communications with the insurance company, including dates, times, and summaries of conversations.

- Seek Legal Advice: If you cannot resolve the dispute through direct communication with the insurance company, consider seeking legal advice from an experienced attorney specializing in insurance claims.

Ultimate Conclusion

Ultimately, understanding the intricacies of car insurance prices Florida empowers you to make informed decisions about your coverage. By considering factors like driving history, vehicle type, and location, you can identify opportunities to save money and secure the best possible rates. Remember, taking the time to compare quotes and explore different options can lead to significant savings and peace of mind.

FAQ Explained

How do I get the best car insurance rates in Florida?

Shop around and compare quotes from multiple insurance companies. Consider bundling your car insurance with other policies, such as homeowners or renters insurance. Also, improve your driving record and consider taking a defensive driving course.

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to have at least $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL) coverage. However, it’s recommended to have higher limits for greater protection.

What are some common car insurance claims in Florida?

Common claims include accidents, theft, vandalism, and natural disasters like hurricanes and floods. Florida’s unique weather patterns can lead to more frequent claims compared to other states.