Car insurance quotes are essential for securing the right coverage for your vehicle. Understanding how these quotes are calculated, exploring the different types of coverage, and learning how to optimize your quote can save you significant money in the long run.

This comprehensive guide will delve into the intricacies of car insurance quotes, empowering you to make informed decisions and find the best possible rates.

Understanding Car Insurance Quotes

Car insurance quotes are estimates of how much you’ll pay for coverage. They are crucial for comparing different insurance plans and finding the best deal. Understanding the factors that influence quotes and the different types of coverage available is essential for making informed decisions about your car insurance.

Factors Influencing Car Insurance Quotes

Several factors determine your car insurance quote. These factors are used to assess your risk as a driver and help insurance companies determine the cost of covering you.

- Your driving history: Your driving record, including accidents, traffic violations, and DUI convictions, significantly impacts your premium. A clean driving record typically results in lower premiums.

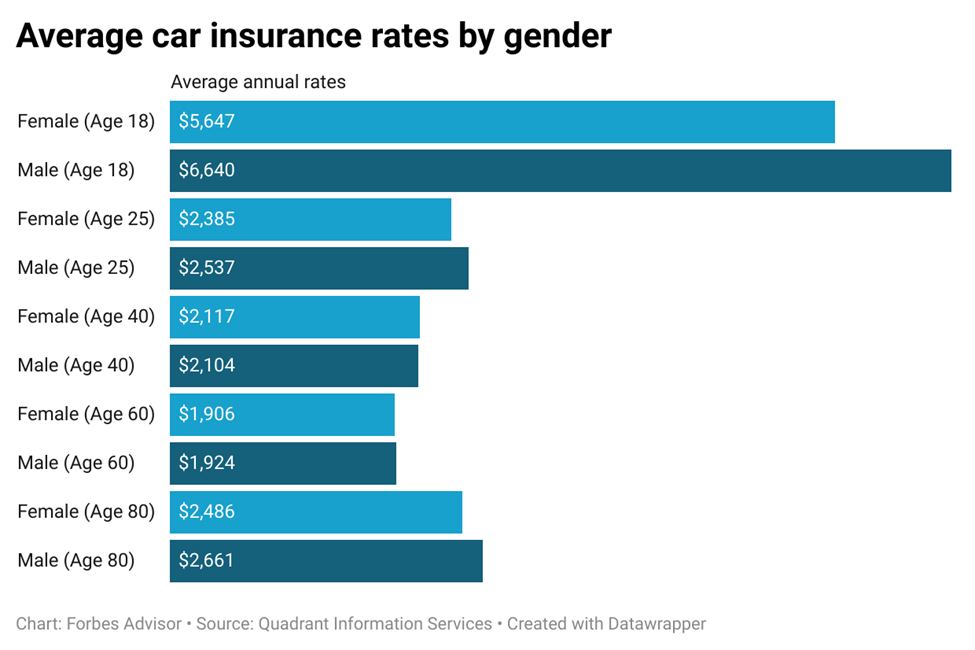

- Your age and gender: Younger drivers, especially males, are statistically more likely to be involved in accidents, leading to higher premiums.

- Your location: The area where you live can affect your quote. Areas with higher crime rates or more traffic congestion often have higher insurance premiums.

- Your car: The make, model, year, and safety features of your car influence your premium. Luxury cars, high-performance vehicles, and newer cars generally have higher premiums due to their higher repair costs.

- Your credit score: In some states, insurance companies use credit scores to assess your financial responsibility. A good credit score can lead to lower premiums.

- Your coverage: The type and amount of coverage you choose significantly impact your quote. More comprehensive coverage typically means higher premiums.

- Your driving habits: Your driving habits, such as mileage, driving frequency, and driving purpose, can affect your quote. For example, drivers who commute long distances or frequently drive at night may pay higher premiums.

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is crucial for choosing the right policy for your needs. Each type of coverage provides protection against specific risks, and the cost of each type varies depending on your individual circumstances.

- Liability Coverage: This is the most basic type of car insurance and is usually required by law. Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other driver’s medical expenses, lost wages, and property damage.

- Collision Coverage: This coverage pays for repairs to your car if it’s damaged in an accident, regardless of who is at fault. Collision coverage is optional but is typically required if you have a car loan or lease.

- Comprehensive Coverage: This coverage protects your car from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Comprehensive coverage is optional, but it’s a good idea to have it if your car is relatively new or has a high value.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP): This coverage covers your medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault. PIP is mandatory in some states.

Key Components of a Car Insurance Quote

A car insurance quote typically includes the following components:

- Premium: This is the amount you pay for your car insurance policy. The premium is typically paid monthly or annually.

- Deductible: This is the amount you pay out of pocket for repairs or medical expenses before your insurance coverage kicks in. A higher deductible usually means a lower premium.

- Coverage Limits: This refers to the maximum amount your insurance company will pay for a specific type of claim. For example, liability coverage limits may specify the maximum amount your insurance company will pay for bodily injury or property damage.

- Discounts: Insurance companies offer various discounts to reduce your premium. Some common discounts include good driver discounts, safe driver discounts, multi-car discounts, and student discounts.

Obtaining Car Insurance Quotes

Getting car insurance quotes is the first step in finding the right coverage for your needs and budget. There are several ways to obtain quotes, each with its own advantages and disadvantages.

Methods for Obtaining Car Insurance Quotes

There are several ways to obtain car insurance quotes, including online quote generators, insurance brokers, and direct insurance companies.

- Online quote generators are websites that allow you to enter your information and receive quotes from multiple insurance companies.

- Insurance brokers act as intermediaries between you and insurance companies. They can shop around for quotes from multiple insurers and help you find the best coverage for your needs.

- Direct insurance companies sell insurance directly to consumers, without using brokers or agents. They often offer lower prices than traditional insurance companies.

Comparing and Contrasting Quote Sources

Each method of obtaining car insurance quotes has its own advantages and disadvantages.

Online Quote Generators

- Advantages: Quick and easy, can compare quotes from multiple insurers at once, often provide instant quotes.

- Disadvantages: May not provide all available options, can be difficult to compare quotes side-by-side, may not be able to provide personalized advice.

Insurance Brokers

- Advantages: Can provide personalized advice, can help you find the best coverage for your needs, can negotiate rates on your behalf.

- Disadvantages: May charge a fee, may not have access to all insurance companies, may not be able to provide instant quotes.

Direct Insurance Companies

- Advantages: Often offer lower prices than traditional insurance companies, may offer more flexible payment options, can be convenient to work with.

- Disadvantages: May have limited customer service options, may not offer as many coverage options, may not be as responsive to customer needs.

Tips for Getting the Best Car Insurance Quotes

- Compare quotes from multiple insurers: Don’t settle for the first quote you receive. Get quotes from several different insurance companies to compare prices and coverage options.

- Be honest and accurate with your information: Providing inaccurate information can lead to higher premiums or even a denied claim.

- Consider your individual needs: Think about your driving history, the type of car you drive, and your coverage needs. This will help you narrow down your choices and find the best insurance policy for you.

- Shop around regularly: Insurance rates can change over time, so it’s a good idea to shop around for new quotes every year or two to make sure you’re getting the best possible price.

- Ask about discounts: Many insurance companies offer discounts for things like good driving records, safety features, and multiple policies. Be sure to ask about any available discounts to save money on your premiums.

- Read the fine print: Before you sign up for a policy, be sure to read the fine print and understand the terms and conditions. This will help you avoid any surprises later on.

Analyzing Car Insurance Quotes

Now that you have a few car insurance quotes in hand, it’s time to carefully compare them and choose the best option for your needs. Analyzing car insurance quotes involves more than just looking at the premium amount. You need to consider the coverage details, discounts, and other factors to determine which quote offers the most value for your money.

Comparing Car Insurance Quotes

A helpful way to compare car insurance quotes is to create a table. The table should include the following columns:

| Insurer Name | Coverage Details | Premium | Discounts |

|---|

For each quote, list the insurer name, the coverage details, the premium amount, and any discounts offered. This will give you a clear picture of the different options available and allow you to easily compare the prices and coverage.

Factors to Consider When Comparing Quotes

Once you have a table comparing the quotes, you can start analyzing them in detail. Here are some factors to consider:

- Coverage: The coverage offered by each insurer should be your primary concern. Make sure the coverage meets your needs and protects you financially in case of an accident or other incident. For example, if you have a newer car, you might want to consider comprehensive and collision coverage, which protects against damage from theft, vandalism, or natural disasters.

- Premium: The premium is the amount you pay for your car insurance. It’s important to compare the premiums of different insurers to find the most affordable option. However, don’t just focus on the lowest premium. Consider the coverage offered and the insurer’s financial stability.

- Discounts: Many insurers offer discounts for various factors, such as good driving records, safety features in your car, or bundling your car insurance with other insurance policies. Be sure to inquire about available discounts and factor them into your analysis.

- Customer Service: Consider the insurer’s reputation for customer service. Read online reviews and talk to friends or family members who have used the insurer in the past. You want to choose an insurer that is responsive and helpful when you need them.

- Financial Stability: It’s important to choose an insurer that is financially stable. This means they have enough resources to pay claims in the event of a major accident or natural disaster. You can check an insurer’s financial stability rating through independent organizations such as A.M. Best or Standard & Poor’s.

Choosing the Best Quote

After carefully analyzing the quotes, you can choose the best option for your needs. The best quote is the one that offers the right balance of coverage, affordability, and customer service.

It’s important to remember that the cheapest quote isn’t always the best.

Consider the long-term value of the coverage and the insurer’s reputation for claims handling and customer service.

Understanding Car Insurance Discounts

Car insurance discounts can significantly reduce your premium, making your coverage more affordable. Understanding the types of discounts available and how to qualify for them is crucial in minimizing your insurance costs.

Common Car Insurance Discounts

Discounts are offered by insurance companies to incentivize safe driving practices, responsible vehicle ownership, and other factors that reduce the risk of accidents. Here are some common car insurance discounts:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, typically with no accidents or traffic violations for a specific period. The duration of the clean driving record required for eligibility varies depending on the insurer.

- Safe Driver Discount: Similar to the good driver discount, this discount is offered to drivers who demonstrate safe driving habits. This can be assessed through telematics devices that track driving behavior or by participating in driver safety courses.

- Multi-Car Discount: This discount is offered when you insure multiple vehicles with the same insurance company. The discount typically increases with each additional vehicle insured.

- Multi-Policy Discount: This discount is available when you bundle your car insurance with other insurance policies, such as homeowners or renters insurance, with the same insurer.

- Good Student Discount: This discount is offered to students who maintain a good academic record, usually with a minimum GPA requirement. This discount is generally available to students under a certain age, often up to 25.

- Defensive Driving Course Discount: Completing a defensive driving course, which teaches safe driving practices and accident prevention techniques, can qualify you for this discount. This discount can vary based on the course provider and the insurer.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms, immobilizers, or GPS tracking systems, can make your vehicle less attractive to thieves and qualify you for this discount.

- Low Mileage Discount: If you drive your vehicle less than a certain number of miles annually, you may qualify for this discount. This discount is based on the assumption that drivers with lower mileage have a lower risk of accidents.

- Vehicle Safety Feature Discount: Vehicles equipped with safety features, such as airbags, anti-lock brakes, and electronic stability control, are considered safer and may qualify for this discount.

- Loyalty Discount: This discount is offered to long-term policyholders who have maintained their insurance coverage with the same company for a specific period.

Eligibility Criteria for Discounts

Each insurance company has its own specific eligibility criteria for discounts. It’s essential to contact your insurer to understand the requirements for each discount you’re interested in. Generally, the eligibility criteria may include:

- Driving Record: Your driving history, including accidents, violations, and years of driving experience, plays a significant role in determining your eligibility for various discounts.

- Vehicle Information: The make, model, year, and safety features of your vehicle can affect your eligibility for certain discounts.

- Age and Gender: Your age and gender may influence your eligibility for some discounts, as younger and male drivers are statistically associated with higher risk.

- Location: The location where you reside and the risk of accidents in your area can affect your eligibility for certain discounts.

- Other Factors: Other factors, such as your credit score, occupation, and driving habits, may also be considered for certain discounts.

Maximizing Discounts to Lower Premiums

To maximize your car insurance discounts, consider the following strategies:

- Maintain a Clean Driving Record: This is the most crucial factor in qualifying for many discounts. Avoid accidents and traffic violations by practicing safe driving habits.

- Bundle Your Policies: Combining your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant savings through multi-policy discounts.

- Shop Around for Quotes: Different insurance companies offer different discounts, so comparing quotes from multiple insurers can help you find the best rates.

- Upgrade Your Vehicle’s Safety Features: Installing anti-theft devices or opting for a vehicle with advanced safety features can make you eligible for additional discounts.

- Take Defensive Driving Courses: Completing a defensive driving course can improve your driving skills and qualify you for discounts.

- Consider Telematics Programs: Participate in telematics programs that track your driving behavior and offer discounts based on your safe driving habits.

Car Insurance Quote FAQs

Getting a car insurance quote is an important step in finding the right coverage for your needs. However, the process can be confusing, and you might have several questions. This section addresses some frequently asked questions about car insurance quotes.

Understanding Car Insurance Quotes

The following section provides information on the various aspects of car insurance quotes.

- What is a car insurance quote?

- Why are car insurance quotes different?

- What factors affect car insurance quotes?

- How accurate are car insurance quotes?

- How long are car insurance quotes valid for?

A car insurance quote is an estimate of how much you will pay for car insurance. It is based on your individual circumstances, including your driving history, the type of car you drive, and your location.

Car insurance quotes can vary significantly from one insurer to another. This is because insurers use different factors to calculate their rates, and they may have different risk appetites.

Several factors affect car insurance quotes, including your driving history, age, location, the type of car you drive, and your credit score.

Car insurance quotes are estimates, and the actual price you pay may vary. This is because your circumstances may change between the time you get the quote and when you buy the policy.

Car insurance quotes typically have a limited validity period, usually 30 days. After that, they may become outdated and no longer reflect current rates.

Obtaining Car Insurance Quotes

This section provides information on how to obtain car insurance quotes.

- How can I get a car insurance quote?

- What information do I need to get a car insurance quote?

- Can I get a car insurance quote without providing my personal information?

- What happens after I get a car insurance quote?

You can get a car insurance quote online, over the phone, or in person. Online quotes are often the most convenient option, as you can get quotes from multiple insurers quickly and easily.

To get a car insurance quote, you will need to provide information about yourself, your car, and your driving history. This information will be used to calculate your insurance premium.

You can get a general idea of car insurance rates without providing personal information by using an online car insurance quote calculator. However, you will not be able to get an accurate quote without providing your details.

Once you get a car insurance quote, you can compare it to other quotes from different insurers. You can then choose the policy that best meets your needs and budget.

Analyzing Car Insurance Quotes

This section provides information on how to analyze car insurance quotes.

- What should I look for when comparing car insurance quotes?

- How do I compare car insurance quotes?

- What is the best way to choose a car insurance policy?

When comparing car insurance quotes, you should look at the premium, coverage, and deductibles. You should also consider the insurer’s financial stability and customer service ratings.

You can compare car insurance quotes by using a car insurance comparison website. These websites allow you to enter your information once and get quotes from multiple insurers.

The best way to choose a car insurance policy is to compare quotes from multiple insurers and choose the policy that best meets your needs and budget.

Understanding Car Insurance Discounts

This section provides information on car insurance discounts.

- What are car insurance discounts?

- What are some common car insurance discounts?

- How can I find out what discounts I qualify for?

Car insurance discounts are reductions in your premium that you may qualify for based on certain factors, such as your driving history, age, and the type of car you drive.

Some common car insurance discounts include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts.

You can find out what discounts you qualify for by contacting your insurance company or by using an online car insurance quote calculator.

Summary

By understanding the factors that influence car insurance quotes, exploring the various methods for obtaining them, and analyzing the quotes you receive, you can secure the most favorable coverage at a price that fits your budget. Remember, a little effort in researching and comparing quotes can go a long way in saving you money and providing you with the peace of mind that comes with knowing you’re adequately insured.

Popular Questions

How often should I get car insurance quotes?

It’s recommended to get car insurance quotes at least once a year, or even more frequently if you experience any major life changes, such as a new job, a move, or a change in driving habits.

What happens if I don’t have car insurance?

Driving without car insurance is illegal in most jurisdictions. If you’re caught driving without insurance, you could face fines, license suspension, or even jail time. Additionally, you’ll be responsible for all costs associated with any accidents you cause.

What is the difference between liability and collision coverage?

Liability coverage protects you financially if you cause an accident that results in injuries or damage to another person’s property. Collision coverage covers damage to your own vehicle in the event of an accident, regardless of who is at fault.