Car insurance quotes are the foundation of securing the right coverage for your vehicle. They provide a snapshot of potential costs, allowing you to compare different insurers and policies. Understanding the factors that influence quotes is crucial to finding the best deal that meets your individual needs.

Navigating the world of car insurance quotes can seem daunting, but it doesn’t have to be. By understanding the different types of coverage, the impact of your driving history, and the nuances of policy terms, you can make informed decisions that protect both your finances and your vehicle.

Understanding Car Insurance Quotes

Getting a car insurance quote is the first step in securing financial protection for your vehicle. Understanding the factors that influence these quotes can help you make informed decisions about your coverage and potentially save money.

Factors Influencing Car Insurance Quotes

Car insurance quotes are calculated based on a variety of factors that assess your risk as a driver. Here are some of the most common factors:

- Driving History: Your driving record is a primary factor in determining your premium. A clean record with no accidents or violations will result in lower rates. Conversely, multiple accidents or traffic violations can significantly increase your premiums.

- Vehicle Type: The type of vehicle you drive plays a significant role in your quote. Expensive, high-performance vehicles tend to have higher premiums due to their higher repair costs and potential for theft.

- Location: Your location impacts your insurance rate due to factors like traffic density, crime rates, and weather conditions. Areas with high traffic congestion or frequent severe weather events may have higher premiums.

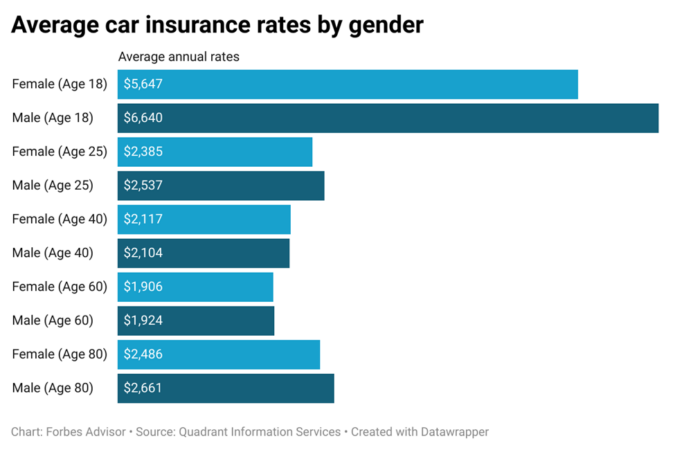

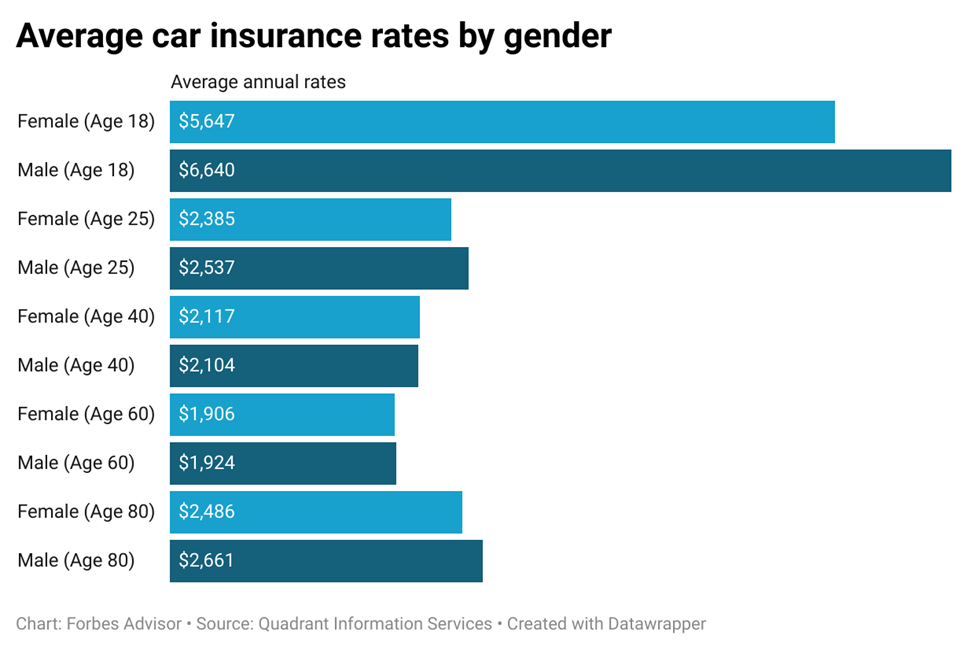

- Age and Gender: Statistically, younger drivers have higher accident rates, which can lead to higher premiums. Gender can also influence rates, as some studies have shown that men tend to have more accidents than women.

- Credit Score: While it may seem unusual, your credit score can affect your car insurance premiums. Insurers often use credit scores as a proxy for risk, as individuals with poor credit history may be more likely to file claims.

- Coverage Options: The type and amount of coverage you choose directly impact your premium. More comprehensive coverage, such as collision and comprehensive coverage, will generally result in higher premiums compared to basic liability coverage.

Types of Car Insurance Coverage, Car insurance quotes

Understanding the different types of car insurance coverage and their impact on your premium is essential for making informed decisions. Here’s a breakdown of common types of coverage:

- Liability Coverage: This is the most basic type of coverage and is required by law in most states. It covers damages to other people’s property or injuries caused by you in an accident.

- Collision Coverage: This coverage pays for repairs to your vehicle if it’s damaged in a collision, regardless of who is at fault. It typically has a deductible, which is the amount you pay out of pocket before the insurance company covers the rest.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, or natural disasters. Like collision coverage, it usually has a deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related costs if you’re injured in an accident, regardless of who is at fault.

Examples of How Factors Affect Quotes

A young driver with a clean driving record living in a rural area with a lower-priced car may receive a lower quote compared to an older driver with a history of accidents living in a major city with a luxury car.

Similarly, choosing a higher deductible for collision and comprehensive coverage can result in lower premiums. This is because you are taking on more financial responsibility for smaller repairs.

Obtaining Car Insurance Quotes

Getting car insurance quotes is a crucial step in finding the best coverage for your needs and budget. By comparing quotes from different insurance companies, you can ensure you’re getting the most competitive rates and comprehensive protection.

Online Platforms and Tools

Various online platforms and tools make obtaining car insurance quotes convenient and efficient. These platforms offer a streamlined process for gathering your information, comparing quotes, and selecting the best option.

- Insurance Company Websites: Most major insurance companies have user-friendly websites where you can request quotes. These websites typically allow you to input your details, including your vehicle information, driving history, and desired coverage levels, to receive personalized quotes.

- Independent Insurance Agents: These agents work with multiple insurance companies, allowing you to compare quotes from various providers in one place. They can provide personalized advice and guidance throughout the process.

- Insurance Comparison Websites: Websites like Policygenius and The Zebra aggregate quotes from multiple insurance companies, making it easy to compare rates and coverage options side-by-side. These platforms often use algorithms to personalize quotes based on your specific needs.

Information Needed for Accurate Quotes

To receive accurate car insurance quotes, you’ll need to provide the following information:

- Personal Information: This includes your name, address, date of birth, and contact details.

- Vehicle Information: You’ll need to provide details about your vehicle, including the year, make, model, VIN (Vehicle Identification Number), and mileage.

- Driving History: Insurance companies use your driving history to assess your risk. You’ll need to provide information about your driving record, including any accidents, tickets, or violations.

- Coverage Preferences: You’ll need to specify your desired coverage levels, including liability limits, collision and comprehensive coverage, and any additional options like uninsured motorist coverage.

- Other Factors: Some insurance companies may consider other factors, such as your credit score, your location, and your driving habits, when calculating your premiums.

Analyzing Car Insurance Quotes

You’ve gathered a few car insurance quotes, but now what? The next step is to carefully analyze these quotes to ensure you choose the best policy for your needs and budget.

Key Elements to Consider When Comparing Car Insurance Quotes

To make an informed decision, it’s crucial to examine several key elements within each quote. These elements will help you understand the scope of coverage, potential costs, and overall value of each policy.

- Coverage Levels: Compare the coverage levels offered by each insurer. This includes liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Pay close attention to the limits of coverage for each category, as these limits determine the maximum amount the insurer will pay for a covered claim.

- Deductibles: The deductible is the amount you pay out-of-pocket before your insurance kicks in. Higher deductibles typically lead to lower premiums, while lower deductibles result in higher premiums. Determine the deductible level that balances your risk tolerance with your budget.

- Premiums: The premium is the amount you pay for your car insurance policy. Compare the monthly or annual premiums quoted by each insurer. Remember to consider the coverage levels and deductibles when comparing premiums. A lower premium may not be the best deal if it comes with significantly less coverage or a higher deductible.

- Discounts: Many insurers offer discounts for various factors, such as good driving records, safety features in your vehicle, and bundling multiple insurance policies. Inquire about available discounts and factor them into your premium comparisons.

Interpreting Terms and Conditions

While comparing quotes, it’s essential to carefully review the terms and conditions of each policy. This section Artikels the insurer’s responsibilities and limitations.

- Exclusions: Pay attention to any exclusions, which are situations or events not covered by the policy. For example, some policies may exclude coverage for certain types of damage, such as wear and tear or damage caused by a natural disaster. Understanding exclusions can help you avoid surprises later.

- Limits and Caps: Policies often have limits and caps on coverage. These limits define the maximum amount the insurer will pay for a particular type of claim. For example, a policy may have a $100,000 limit for bodily injury liability coverage. If you are involved in an accident exceeding this limit, you may be personally responsible for the remaining costs.

- Claims Process: Review the claims process Artikeld in the policy. This section details the steps you need to take to file a claim and the information you’ll need to provide. Understanding the claims process can help you navigate it smoothly if you need to file a claim in the future.

Calculating the Total Cost of Insurance Over Time

While comparing premiums, it’s important to consider the total cost of insurance over time. This includes the premium payments, deductibles, and potential out-of-pocket expenses.

The total cost of insurance over time = (Annual Premium x Number of Years) + (Deductible x Number of Claims) + Out-of-Pocket Expenses

For example, let’s say you have a $1,000 annual premium, a $500 deductible, and you expect to file one claim every five years. Over ten years, the total cost of insurance would be:

($1,000 x 10) + ($500 x 2) + Out-of-Pocket Expenses = $11,000 + Out-of-Pocket Expenses

This calculation helps you compare the long-term costs of different insurance policies, even if the initial premiums seem similar.

Choosing the Right Car Insurance

Now that you understand the basics of car insurance quotes, it’s time to choose the policy that best suits your needs. This decision requires careful consideration of various factors, including your individual circumstances, driving habits, and financial situation.

Prioritizing Factors

Choosing the right car insurance involves weighing different factors. It’s not just about finding the cheapest option, but about finding the best value for your needs.

- Coverage Needs: Consider the type and amount of coverage you require. Factors like the age and value of your car, your driving record, and your location will influence your coverage needs. Comprehensive and collision coverage protect against damage to your vehicle, while liability coverage protects you against claims from others if you cause an accident.

- Deductibles: Deductibles are the amounts you pay out-of-pocket before your insurance covers the rest. Higher deductibles generally mean lower premiums, but you’ll have to pay more in case of an accident. Choose a deductible that you can comfortably afford.

- Premium Costs: Premiums are the regular payments you make for your insurance. While cost is important, don’t solely focus on the cheapest option. Consider the coverage and benefits included in the premium.

- Discounts: Many insurers offer discounts for good driving records, safety features in your car, or bundling multiple insurance policies. Take advantage of these discounts to lower your premiums.

Evaluating Coverage and Benefits

Once you have a general idea of the factors you want to prioritize, it’s time to compare different insurance policies.

- Coverage Options: Compare the coverage offered by different insurers. Look for policies that provide adequate protection for your specific needs, such as collision, comprehensive, liability, and uninsured/underinsured motorist coverage.

- Benefits: Evaluate the additional benefits offered by each insurer, such as roadside assistance, rental car reimbursement, or accident forgiveness. These benefits can add value to your policy and provide peace of mind.

- Customer Service: Consider the insurer’s reputation for customer service. Read reviews and check with the Better Business Bureau to get an idea of their responsiveness and helpfulness.

- Claims Process: Research the insurer’s claims process. Look for companies with a reputation for prompt and fair claims handling. Ask about their claim handling procedures and how they handle disputes.

Understanding Insurer Reputation and Financial Stability

Choosing a reputable and financially stable insurer is crucial for ensuring that your claims will be paid when you need them.

- Financial Ratings: Check the insurer’s financial ratings from agencies like A.M. Best, Moody’s, and Standard & Poor’s. These ratings assess the insurer’s financial strength and ability to meet its obligations. Look for companies with strong financial ratings, indicating a lower risk of insolvency.

- Reputation: Research the insurer’s reputation by reading online reviews, checking with consumer advocacy groups, and speaking to friends or family members who have experience with the company. A good reputation suggests that the insurer is reliable and trustworthy.

- Customer Satisfaction: Look for insurers with high customer satisfaction ratings. This indicates that customers are generally happy with the company’s services and claims handling.

Managing Car Insurance

Managing your car insurance policy is crucial to ensure you have the right coverage and avoid any gaps in protection. This involves making timely payments, updating your policy information, understanding the terms and conditions, and knowing how to file a claim.

Making Payments and Updating Policy Information

Making timely payments is essential to keep your car insurance policy active. Most insurers offer various payment options, including online payments, mail-in checks, and automatic deductions from your bank account. You should also update your policy information whenever there are changes, such as a change in address, vehicle ownership, or driver’s license status. This ensures your policy remains accurate and reflects your current situation.

Filing Claims and Resolving Disputes

If you need to file a claim, it’s important to do so promptly and accurately. Most insurers have a dedicated claims department you can contact. You’ll typically need to provide information about the incident, such as the date, time, location, and involved parties. It’s essential to follow the insurer’s claim process and provide all necessary documentation. If you disagree with the insurer’s decision on your claim, you have the right to appeal their decision.

Understanding Policy Terms and Conditions

Your car insurance policy Artikels the coverage you have, the limits of that coverage, and the conditions under which you can file a claim. It’s crucial to read and understand your policy thoroughly to ensure you’re aware of your rights and responsibilities. Some key terms to understand include:

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Premium: The amount you pay for your car insurance policy.

- Coverage Limits: The maximum amount your insurer will pay for a covered claim.

- Exclusions: Situations or events that are not covered by your policy.

You can also contact your insurer directly to clarify any questions you have about your policy.

Ultimate Conclusion

Finding the right car insurance policy involves more than just comparing quotes. It requires careful consideration of your individual needs, a thorough understanding of the coverage offered, and an evaluation of the insurer’s reputation. By taking the time to research and compare, you can secure a policy that provides peace of mind and financial protection.

Questions and Answers: Car Insurance Quotes

What factors affect car insurance quotes?

Several factors influence car insurance quotes, including your driving history, age, location, vehicle type, and credit score.

How often should I compare car insurance quotes?

It’s generally recommended to compare car insurance quotes annually or whenever you experience a significant life change, such as moving, getting married, or adding a new driver to your policy.

What is the difference between liability and collision coverage?

Liability coverage protects you financially if you cause an accident, while collision coverage pays for damage to your own vehicle in an accident, regardless of fault.