Car insurance quotes comparison is essential for finding the best deal on your car insurance. By comparing quotes from multiple providers, you can ensure that you are getting the most comprehensive coverage at the most affordable price.

Understanding the factors that influence car insurance quotes, such as your driving history, vehicle type, and location, can help you make informed decisions. Different types of coverage, such as liability, collision, and comprehensive, offer varying levels of protection. You should also understand the components that make up an insurance premium, including your driving history, vehicle type, and location.

Understanding Car Insurance Quotes: Car Insurance Quotes Comparison

Car insurance quotes are estimates of how much you’ll pay for coverage. They are calculated based on several factors, and understanding these factors can help you get the best possible price.

Factors That Influence Car Insurance Quotes

Your car insurance quote is influenced by a number of factors. Some of these factors are within your control, while others are not.

- Your Driving Record: A clean driving record with no accidents or traffic violations will result in a lower premium. On the other hand, a history of accidents or violations will increase your premium.

- Your Age and Gender: Younger drivers and male drivers are statistically more likely to be involved in accidents, which can lead to higher premiums.

- Your Location: Car insurance premiums are often higher in urban areas due to increased traffic congestion and higher risk of accidents.

- Your Vehicle: The make, model, and year of your vehicle can affect your insurance premium. More expensive vehicles or vehicles with higher repair costs tend to have higher premiums.

- Your Credit Score: In some states, insurers can use your credit score to determine your insurance premium. Individuals with good credit scores generally receive lower premiums.

- Your Coverage: The type and amount of coverage you choose will also affect your premium. More comprehensive coverage typically comes with a higher premium.

Types of Car Insurance Coverage

There are several different types of car insurance coverage available. Understanding the different types of coverage can help you choose the right policy for your needs.

- Liability Coverage: This coverage protects you from financial responsibility if you cause an accident that injures someone or damages their property. Liability coverage is usually required by law.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by something other than an accident, such as theft, vandalism, or a natural disaster.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured.

- Medical Payments Coverage: This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

Components of an Insurance Premium

Your car insurance premium is made up of several different components.

- Base Premium: This is the starting point for your premium and is based on factors such as your age, location, and vehicle type.

- Driving Record: Your driving history, including accidents and violations, can significantly impact your premium.

- Coverage Options: The type and amount of coverage you choose will also influence your premium.

- Deductibles: A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically lead to lower premiums.

- Discounts: Many insurers offer discounts for safe driving, good student status, and other factors. These discounts can help lower your premium.

Importance of Comparison

Shopping around for car insurance quotes is crucial for securing the best possible deal. It allows you to compare prices, coverage options, and discounts from various insurers, empowering you to make an informed decision.

Potential Savings

Comparing car insurance quotes can lead to significant savings. By getting quotes from multiple insurers, you can identify the most competitive rates and potentially save hundreds of dollars annually. For instance, a study by the Insurance Information Institute found that drivers who switched insurance companies saved an average of $740 per year.

Methods for Comparing Quotes

There are several ways to compare car insurance quotes, each with its own advantages and disadvantages. Choosing the right method depends on your individual needs and preferences.

By using a combination of methods, you can ensure you are getting the best possible rate on your car insurance.

Car Insurance Comparison Websites

Car insurance comparison websites are a popular and convenient way to compare quotes from multiple insurers in one place. These websites typically allow you to enter your information once and then receive quotes from a variety of insurers.

This can save you a lot of time and effort compared to contacting each insurer individually.

| Website | Pros | Cons |

|---|---|---|

| Compare.com |

|

|

| Policygenius |

|

|

| The Zebra |

|

|

Getting Quotes Through an Insurance Broker

Insurance brokers are independent professionals who can help you find the best car insurance policy for your needs. They work with a variety of insurers and can provide you with quotes from multiple companies.

Brokers can be helpful if you are unsure about which insurer to choose or if you have complex insurance needs.

However, it is important to note that brokers may charge a fee for their services.

Comparing Quotes Directly with Insurance Companies

You can also compare car insurance quotes directly with insurance companies. This can be a good option if you know which insurers you want to consider or if you prefer to deal with companies directly.

To get a quote, you will need to provide the insurer with your personal information, including your driving history, vehicle information, and desired coverage.

- Gather your information: Before you start comparing quotes, make sure you have all the necessary information on hand. This includes your driver’s license number, vehicle identification number (VIN), and any relevant information about your driving history, such as accidents or traffic violations.

- Visit the insurer’s website: Most insurers have online quote tools that allow you to get a quote quickly and easily. Simply enter your information and click on “Get a Quote.”

- Contact the insurer directly: You can also get a quote by calling or emailing the insurer directly. Be prepared to answer questions about your driving history, vehicle information, and desired coverage.

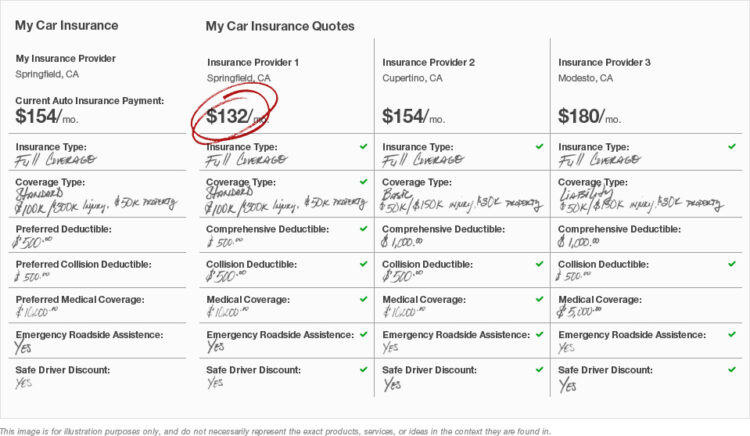

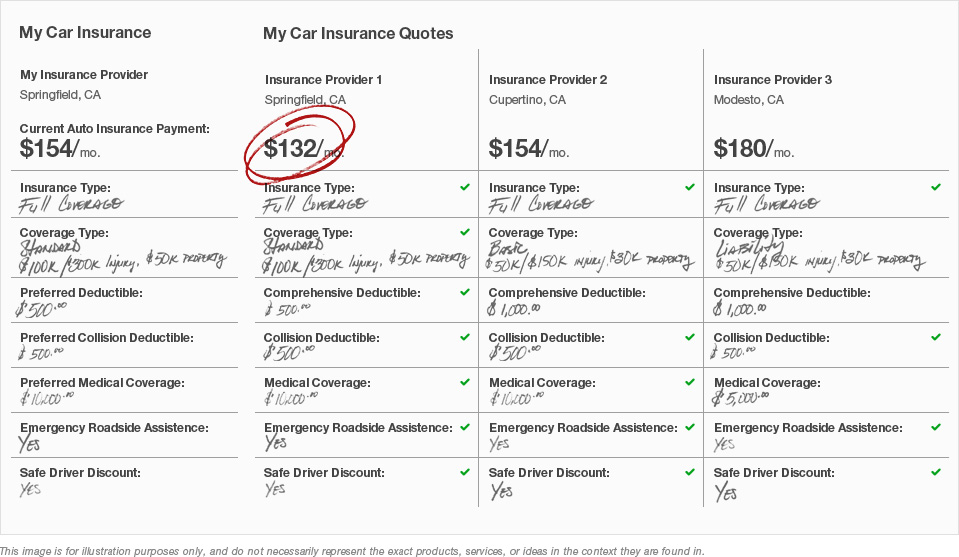

- Compare the quotes: Once you have received quotes from multiple insurers, compare the rates, coverage options, and discounts offered. Make sure to consider all factors, including the insurer’s financial stability and customer service reputation.

Factors to Consider When Comparing

Comparing quotes from multiple car insurance providers is crucial for finding the best deal. It allows you to weigh different options and choose the policy that best suits your needs and budget. When comparing quotes, several key factors should be considered, such as coverage, price, and customer service.

Coverage

Coverage refers to the protection offered by your car insurance policy. Different insurance companies offer various coverage options, and it’s essential to understand what each covers and how it might affect your premium.

- Liability coverage: This covers damages to other people’s property or injuries caused by an accident you are responsible for. It’s usually a legal requirement to have a minimum amount of liability coverage.

- Collision coverage: This covers damages to your car if you are involved in an accident, regardless of who is at fault. You can choose a deductible, which is the amount you pay out of pocket before the insurance company covers the rest.

- Comprehensive coverage: This covers damages to your car from events other than accidents, such as theft, vandalism, or natural disasters. You can also choose a deductible for this coverage.

- Uninsured/underinsured motorist coverage: This covers damages to your car and injuries if you are hit by a driver without insurance or with insufficient coverage.

Price

Price is a major factor in choosing car insurance. However, it’s important to consider the overall value of the policy, not just the lowest price.

- Compare quotes from multiple providers: Get quotes from at least three to five different insurance companies to compare prices and coverage options.

- Consider discounts: Many insurance companies offer discounts for good driving records, safety features in your car, or bundling multiple insurance policies.

- Evaluate deductibles: A higher deductible means you pay more out of pocket in case of an accident but can lower your premium.

Customer Service

Customer service is an important factor to consider when choosing an insurance provider.

- Read online reviews: Check customer reviews on websites like Trustpilot or Google Reviews to get an idea of the company’s reputation for customer service.

- Ask about claims processes: Find out how easy it is to file a claim and how quickly the company responds to claims.

- Contact the company: Call or email the insurance company to ask questions and get a feel for their customer service.

Driving History

Your driving history plays a significant role in determining your car insurance premium. A clean driving record with no accidents or traffic violations will typically result in lower premiums.

“If you have a history of accidents or traffic violations, you may have to pay a higher premium. However, some insurance companies offer programs that help drivers with a poor driving history improve their rates over time.”

Vehicle Type

The type of vehicle you drive also impacts your insurance premium.

- Make and model: Some car models are more expensive to repair or replace, leading to higher insurance premiums.

- Safety features: Cars with advanced safety features, such as anti-lock brakes or airbags, may qualify for discounts.

- Value: The value of your car also influences your premium. A more expensive car will typically have a higher premium.

Location, Car insurance quotes comparison

Your location can significantly impact your car insurance premium.

- Population density: Areas with higher population density tend to have more traffic and accidents, leading to higher insurance rates.

- Crime rates: Areas with high crime rates, especially vehicle theft, may have higher insurance premiums.

- Weather conditions: Areas prone to severe weather events, such as hurricanes or tornadoes, may have higher insurance rates due to the risk of damage to vehicles.

Tips for Getting the Best Quote

Finding the best car insurance quote involves more than just clicking through a few websites. It requires a strategic approach to ensure you get the most competitive rates and the coverage you need.

Being Honest and Accurate

Providing accurate information is crucial when getting car insurance quotes. Insurance companies use this information to assess your risk and determine your premium. Any inaccuracies or omissions can lead to higher premiums or even policy cancellation later on.

- Driving history: Be truthful about any accidents, tickets, or violations, even if they seem minor.

- Vehicle information: Provide accurate details about your car, including make, model, year, and mileage.

- Personal information: Ensure your address, contact information, and employment details are correct.

Negotiating with Insurance Providers

Once you have a few quotes, don’t be afraid to negotiate. Insurance companies are often willing to work with you to find a price that fits your budget.

- Ask about discounts: Many insurers offer discounts for good driving records, safety features, multiple policies, and more.

- Shop around: Get quotes from multiple insurers and compare them side-by-side.

- Consider bundling: Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to significant savings.

- Be prepared to walk away: If you’re not satisfied with the price or coverage offered, don’t be afraid to look for another provider.

Understanding Policy Details

Once you’ve compared quotes and chosen a policy, it’s crucial to understand the details of your car insurance policy. This ensures you’re fully aware of the coverage you’re getting and the terms and conditions that apply.

Types of Car Insurance Policies

Car insurance policies are designed to protect you financially in case of an accident or other incidents involving your vehicle. Here are the common types of car insurance policies:

- Liability Insurance: This is the most basic type of car insurance and covers damages to other people’s property or injuries to others in an accident where you are at fault. It does not cover your own vehicle.

- Collision Coverage: This covers damages to your own vehicle in an accident, regardless of who is at fault. This is typically required if you have a loan on your car.

- Comprehensive Coverage: This covers damages to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. It’s usually optional, but recommended for newer vehicles.

- Uninsured/Underinsured Motorist Coverage: This protects you in case you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. This can help cover your medical expenses and property damage.

- Personal Injury Protection (PIP): This covers your medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of who is at fault. It’s often required in some states.

Key Terms and Conditions

Understanding the key terms and conditions in your car insurance policy is crucial. This helps you avoid any surprises or misunderstandings. Here are some common terms to be aware of:

- Deductible: This is the amount you pay out-of-pocket for repairs or replacements before your insurance coverage kicks in.

- Premium: This is the amount you pay regularly to your insurance company for coverage.

- Coverage Limits: These are the maximum amounts your insurance company will pay for specific types of claims, such as bodily injury or property damage.

- Exclusions: These are specific situations or events that are not covered by your insurance policy. For example, your policy might exclude coverage for damages caused by driving under the influence of alcohol or drugs.

- Cancellation Policy: This Artikels the process for canceling your policy and any potential penalties or fees.

Reading and Understanding Your Policy

Car insurance policies can be complex and lengthy documents. It’s important to take the time to read and understand the details of your policy:

- Start with the Summary of Coverage: This section provides a concise overview of your policy’s key features, including coverage types, limits, deductibles, and exclusions.

- Review the Declarations Page: This page lists your personal information, the insured vehicle details, and the effective dates of your coverage.

- Read the Coverage Sections: Each coverage type, such as liability, collision, or comprehensive, has a dedicated section explaining its terms and conditions in detail.

- Pay Attention to Exclusions and Limitations: These sections Artikel specific situations or events that are not covered by your policy.

- Don’t Hesitate to Ask Questions: If you have any questions or uncertainties about your policy, contact your insurance agent or company representative for clarification.

Maintaining Your Insurance Coverage

It’s crucial to regularly review your car insurance policy to ensure it aligns with your current needs and financial situation. Your circumstances can change over time, requiring adjustments to your coverage.

Adjusting Coverage as Your Needs Change

Regularly reviewing your policy can help you identify areas where you can save money or potentially increase coverage.

- Changes in Vehicle Usage: If you’ve reduced your daily commute or started working from home, you may be able to switch to a lower mileage or less frequent usage plan, potentially leading to lower premiums.

- Vehicle Modifications: Upgrading your car with safety features like anti-theft systems or advanced driver-assistance systems can qualify you for discounts. Inform your insurer about any modifications to ensure your policy reflects these changes.

- Life Changes: Major life events like marriage, having children, or purchasing a new home can influence your insurance needs. These changes might require you to adjust your liability coverage or add additional drivers to your policy.

- Financial Situation: If your financial situation has improved, you may be able to afford higher deductibles, which can often lead to lower premiums. Conversely, if your financial situation has become more precarious, you may need to consider increasing your coverage limits.

Conclusion

Comparing car insurance quotes is a crucial step in securing the best possible coverage for your vehicle. By taking the time to understand your options and compare quotes from different providers, you can find a policy that meets your needs and fits your budget. Remember to consider factors such as coverage, price, and customer service, and don’t hesitate to negotiate with insurance providers to get the best deal.

Detailed FAQs

What is the best way to compare car insurance quotes?

The best way to compare car insurance quotes is to use a comparison website or contact an insurance broker. You can also get quotes directly from insurance companies.

How often should I compare car insurance quotes?

It is a good idea to compare car insurance quotes at least once a year, or whenever your current policy is up for renewal. You may also want to compare quotes if your driving record changes or if you make any significant changes to your vehicle.

What factors should I consider when comparing car insurance quotes?

When comparing car insurance quotes, you should consider the following factors: coverage, price, customer service, and financial stability of the insurance company.