Car insurance quotes Florida comparison is essential for finding the best coverage at the most affordable price. Florida’s unique insurance landscape, influenced by factors like driving history, vehicle type, and location, necessitates a thorough comparison to secure the most suitable policy.

Navigating the complexities of car insurance in Florida can be daunting, but understanding the key elements and utilizing available resources can make the process much smoother. From comprehending different coverage options to leveraging comparison tools, this guide equips you with the knowledge and strategies to make informed decisions about your car insurance.

Understanding Car Insurance Quotes in Florida: Car Insurance Quotes Florida Comparison

Getting a car insurance quote in Florida can feel like navigating a maze. There are many factors that come into play, and understanding them is key to finding the best coverage at the right price. This guide will break down the essentials of Florida car insurance quotes, helping you make informed decisions.

Factors Influencing Car Insurance Quotes in Florida

Car insurance companies in Florida use a complex formula to calculate your premium. This formula considers various factors, including your driving history, the type of vehicle you own, your age, and your location.

- Driving History: Your driving record plays a significant role in determining your insurance costs. A clean driving record with no accidents or traffic violations will typically result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher premiums.

- Vehicle Type: The type of vehicle you drive also influences your insurance rates. High-performance cars, luxury vehicles, and newer models tend to have higher premiums due to their higher repair costs and potential for greater damage.

- Age: Your age is a factor in car insurance pricing. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. As you age, your premiums tend to decrease as you gain more driving experience.

- Location: The location where you live and drive also plays a role in determining your insurance rates. Areas with higher crime rates or more traffic congestion typically have higher insurance premiums due to the increased risk of accidents and theft.

Types of Car Insurance Coverage in Florida, Car insurance quotes florida comparison

Florida law requires all drivers to carry certain types of car insurance coverage. Understanding the different types of coverage is essential to ensure you have adequate protection in case of an accident.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. Liability coverage includes bodily injury liability, which covers medical expenses and lost wages, and property damage liability, which covers repairs or replacement of damaged property.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. Collision coverage is optional but highly recommended, especially if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Like collision coverage, comprehensive coverage is optional but recommended for added peace of mind.

- Personal Injury Protection (PIP): Florida law requires all drivers to carry PIP coverage, which covers medical expenses and lost wages for you and your passengers in case of an accident, regardless of who is at fault.

Common Car Insurance Discounts in Florida

Many car insurance companies offer discounts to lower your premiums. By taking advantage of these discounts, you can save money on your car insurance.

- Good Driver Discount: This discount is typically offered to drivers with a clean driving record and no accidents or traffic violations.

- Safe Vehicle Discount: This discount is offered for vehicles equipped with safety features, such as anti-lock brakes, airbags, and stability control.

- Multi-Policy Discount: Many insurance companies offer discounts if you bundle multiple insurance policies, such as car insurance, homeowners insurance, and renters insurance, with the same company.

Importance of Comparing Car Insurance Quotes

In the competitive Florida car insurance market, comparing quotes from multiple providers is crucial for securing the best possible coverage at the most affordable price. Taking the time to compare quotes can lead to significant savings and ensure you have the right protection for your vehicle and financial well-being.

Benefits of Comparing Car Insurance Quotes

Comparing quotes from multiple providers offers numerous advantages that can benefit your overall financial situation and peace of mind.

- Lower Premiums: By comparing quotes, you can identify insurers offering the most competitive rates for your specific needs and risk profile. This can result in substantial savings on your annual insurance premiums.

- Wider Coverage Options: Different insurance companies offer varying coverage options and add-ons. Comparing quotes allows you to explore these options and choose the policy that best aligns with your individual requirements and budget.

- Improved Understanding of Coverage: The process of comparing quotes forces you to carefully review the terms and conditions of each policy. This increased understanding of your coverage options can help you make informed decisions about your insurance needs.

- Enhanced Negotiation Power: Armed with quotes from multiple insurers, you can leverage this information to negotiate better rates with your current provider or explore more favorable terms with a new insurer.

How to Effectively Compare Car Insurance Quotes

Comparing car insurance quotes effectively involves a structured approach that ensures you gather all the necessary information and make informed decisions.

- Gather Your Information: Before starting the comparison process, gather essential information such as your driving history, vehicle details, and desired coverage levels. This will allow you to provide accurate information to each insurer for personalized quotes.

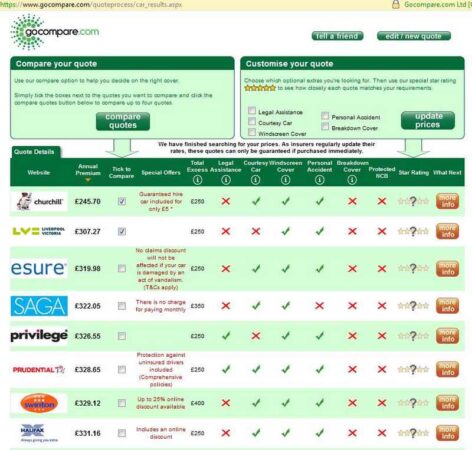

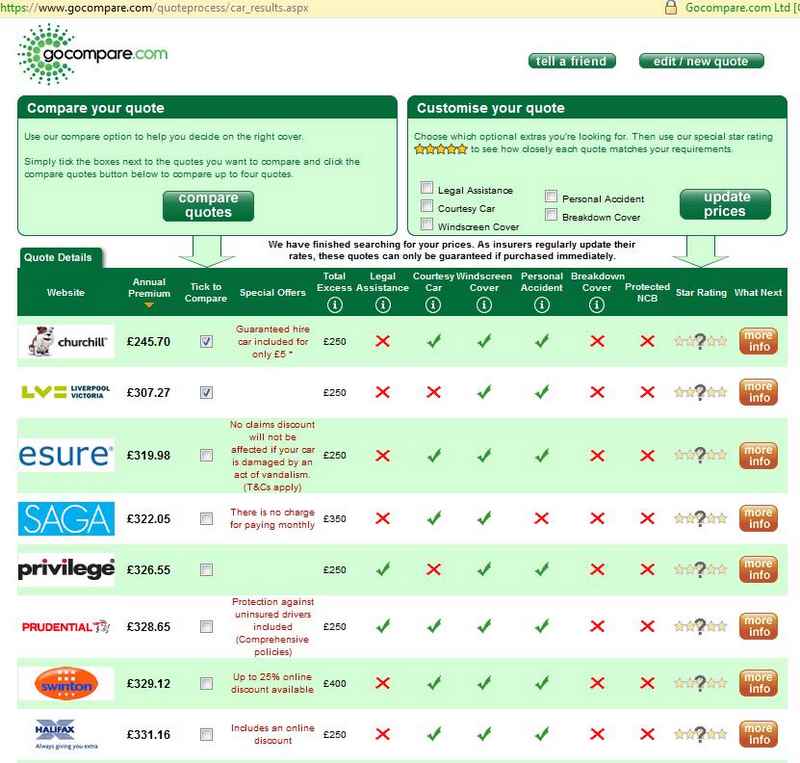

- Use Online Comparison Tools: Utilize online comparison websites or apps that allow you to enter your details and receive quotes from multiple insurers simultaneously. These tools save time and effort by streamlining the comparison process.

- Contact Insurers Directly: While online tools are convenient, contacting insurers directly can provide more detailed information and personalized quotes. This allows you to discuss your specific needs and ask questions about their policies.

- Review Coverage Options: Carefully compare the coverage options offered by each insurer. Ensure the policy meets your specific requirements, including liability limits, comprehensive and collision coverage, and any additional add-ons.

- Compare Prices and Deductibles: Analyze the quoted premiums and deductibles offered by each insurer. Consider the trade-off between lower premiums and higher deductibles, as this can impact your out-of-pocket expenses in the event of an accident.

- Read Policy Documents: Before making a final decision, thoroughly review the policy documents provided by the chosen insurer. Pay close attention to the terms and conditions, exclusions, and any limitations on coverage.

Risks of Choosing the Cheapest Car Insurance Quote

While it’s tempting to go for the cheapest quote, choosing car insurance solely based on price without careful consideration can lead to potential risks.

- Inadequate Coverage: The cheapest quote may offer limited coverage that may not adequately protect you in the event of an accident. This can result in significant out-of-pocket expenses for repairs, medical bills, or legal fees.

- Hidden Fees and Charges: Some insurers may offer low initial premiums but include hidden fees or charges that can increase the overall cost of the policy. Carefully review the policy documents to avoid unexpected expenses.

- Poor Customer Service: Cheap insurers may have poor customer service, making it difficult to file claims or resolve issues. This can lead to frustration and delays in receiving compensation.

- Financial Instability: Some insurers may have a poor financial rating, making it difficult to pay claims in the event of a significant loss. Choosing a financially stable insurer is crucial to ensure your claims are honored.

Final Conclusion

In conclusion, comparing car insurance quotes in Florida is crucial for obtaining the best value for your coverage needs. By understanding the factors influencing quotes, utilizing comparison tools effectively, and considering your individual circumstances, you can secure a policy that provides adequate protection while minimizing your financial burden. Remember to prioritize financial stability, customer service, and a smooth claims handling process when choosing a provider. With careful planning and research, you can find the ideal car insurance solution that meets your specific requirements and offers peace of mind on the road.

Quick FAQs

How often should I compare car insurance quotes?

It’s recommended to compare quotes at least annually, or even more frequently if you experience major life changes like a new car purchase, a change in your driving record, or a move to a different location.

What are the consequences of driving without car insurance in Florida?

Driving without car insurance in Florida is illegal and carries serious consequences, including fines, license suspension, and even vehicle impoundment.

Can I get car insurance quotes without providing my personal information?

While some comparison tools may allow you to get preliminary estimates without providing personal details, you’ll generally need to share your information for a more accurate and personalized quote.