Car insurance rate: It’s the price we pay for peace of mind on the road, but how do those numbers get crunched? From your driving history to the type of car you drive, a whole bunch of factors go into determining your premium. Think of it like a puzzle – the more pieces you fit in, the clearer the picture becomes of what you’ll pay.

This guide breaks down the major players influencing your car insurance rate, helping you understand what you can control and how to make smart choices to potentially save some cash. We’ll explore everything from the impact of your driving record to the role of your zip code and the features of your car. Get ready to dive in!

Factors Influencing Car Insurance Rates

Think of car insurance as a game of risk. Insurance companies look at your driving history, age, location, and the car you drive to figure out how likely you are to get into an accident. The more likely you are to cause an accident, the higher your premium.

Driving History

Your driving history is a big deal. It’s like your report card for driving. Insurance companies look at your driving record to see if you’ve been in any accidents, gotten any tickets, or committed any other driving offenses. A clean record means lower premiums, while a history of accidents or violations can make your premiums skyrocket.

For example, a speeding ticket can increase your premium by 20% or more.

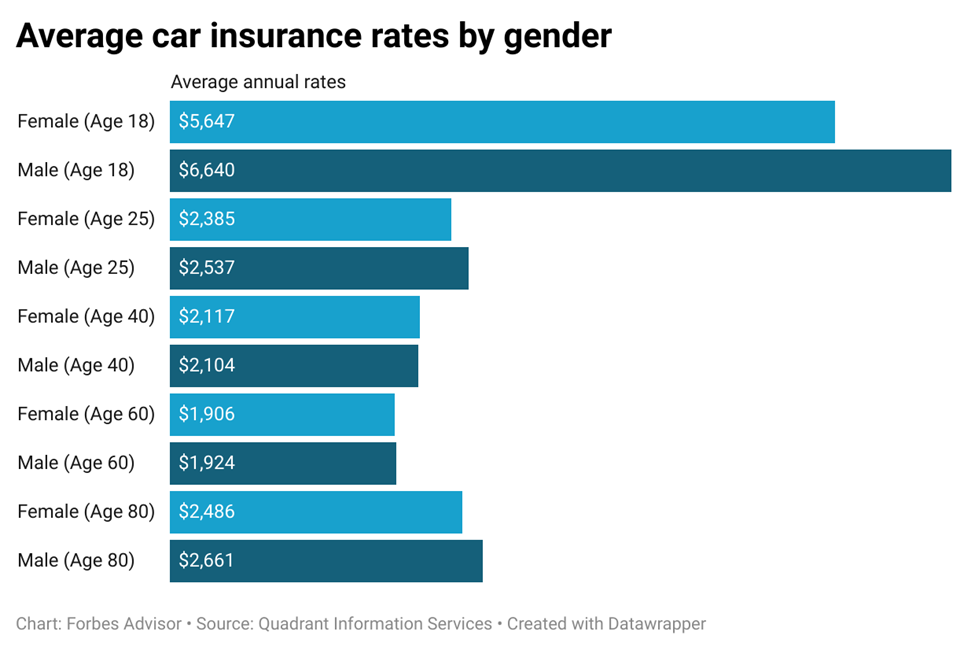

Age and Experience

Younger drivers tend to have higher premiums because they have less experience behind the wheel. Think of it like this: New drivers are like rookies in a sport. They need to learn the ropes and get more experience before they can play like the pros. As you gain experience and reach your mid-20s, your premiums usually start to decrease.

Location

Where you live also plays a role in your car insurance rates. Insurance companies consider factors like population density and crime rates. If you live in a crowded city with a lot of traffic and crime, your premiums might be higher because there’s a greater risk of accidents.

Vehicle Type

The type of car you drive matters, too. Insurance companies look at the make, model, and safety features of your car. A luxury sports car with a high-performance engine is likely to cost more to insure than a basic sedan. This is because these cars are more expensive to repair and are often associated with a higher risk of accidents.

Coverage Options

The amount of coverage you choose also affects your premiums. Basic coverage, like liability, will be cheaper than comprehensive and collision coverage. But, if you want more protection in case of an accident, you’ll need to pay a higher premium.

Understanding Car Insurance Quotes: Car Insurance Rate

Getting car insurance quotes is like trying on different pairs of shoes – you want to find the perfect fit for your needs and budget. Just like a great pair of shoes, the right car insurance policy will keep you comfortable and protected on the road.

Comparing Car Insurance Quotes

When you’re comparing car insurance quotes, you’re essentially shopping around for the best deal. Think of it like comparing prices at different grocery stores – you want to get the most value for your money. But it’s not just about price; you need to consider the coverage you’re getting and the level of customer service you can expect.

- Price: This is obviously a big factor, but don’t just go for the cheapest option. Make sure you’re getting adequate coverage for your needs.

- Coverage: Different insurance companies offer different levels of coverage. You’ll need to decide what’s important to you. Do you need comprehensive coverage for damage from theft or vandalism? Do you need collision coverage for accidents?

- Customer Service: You’ll want to choose an insurance company that has a good reputation for customer service. Look for companies that are easy to work with and have a quick claims process.

Obtaining Car Insurance Quotes

Getting car insurance quotes is easier than ever before. You can do it all online, over the phone, or in person. Here’s a step-by-step guide:

- Gather your information: You’ll need your driver’s license, vehicle registration, and any other relevant information about your driving history and vehicle.

- Choose your insurance companies: Do some research online or ask for recommendations from friends and family.

- Get quotes: You can get quotes online, over the phone, or in person. Most insurance companies have online quote tools that make it easy to get a quick estimate.

- Compare quotes: Once you have a few quotes, compare them side-by-side. Look at the price, coverage, and customer service.

- Choose your policy: Once you’ve compared quotes, choose the policy that best meets your needs and budget.

Comparing Car Insurance Policies

Here’s a table comparing the features and costs of different car insurance policies:

| Policy Type | Coverage | Cost |

|---|---|---|

| Liability Only | Covers damage to other people’s property or injuries to others in an accident you cause | Low |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of who is at fault | Medium |

| Comprehensive Coverage | Covers damage to your vehicle from theft, vandalism, or natural disasters | Medium |

| Full Coverage | Includes liability, collision, and comprehensive coverage | High |

Strategies for Lowering Car Insurance Rates

You want to save money on your car insurance, right? Who doesn’t? It’s like trying to get the best deal on a pizza, except instead of pepperoni, you’re talking about your precious vehicle. But don’t worry, you’re not alone in this quest for lower premiums. There are some pretty cool strategies you can use to keep your wallet happy. Let’s dive into these strategies and see how you can get those rates down!

Safe Driving Practices

Driving safely is like being a superhero – it saves lives, protects your car, and even lowers your insurance rates. It’s a win-win situation! Insurance companies love good drivers, and they reward them with lower premiums. So buckle up, put your phone away, and keep your eyes on the road. Here are some tips for driving safely:

- Obey the speed limit: Don’t be a speed demon. Sticking to the speed limit keeps you safe and can help avoid speeding tickets, which can raise your insurance rates.

- Avoid distractions: Texting and driving is like trying to juggle chainsaws – it’s dangerous! Keep your phone out of sight and avoid distractions like eating or putting on makeup while driving.

- Don’t drink and drive: This is a no-brainer. Drinking and driving is a recipe for disaster. Always designate a sober driver or call a taxi or rideshare.

- Maintain your car: Regular car maintenance is like giving your car a spa day. It helps keep it running smoothly and reduces the risk of breakdowns, which could lead to accidents.

Improving Your Driving Record

Your driving record is like your report card – it shows insurance companies how you’ve been driving. A clean driving record is like having straight A’s – it gets you the best rates. Here’s how you can improve your driving record:

- Avoid traffic violations: Every speeding ticket, parking ticket, or other violation is like a strike against you. Try to avoid these as much as possible.

- Complete a defensive driving course: These courses can teach you valuable driving skills and can even lead to discounts on your insurance. It’s like getting a driving lesson from a pro!

- Be patient: If you’ve had a few fender benders in the past, don’t worry. Over time, your driving record will improve, and your insurance rates will go down.

Bundling Insurance Policies

Bundling your car insurance with other policies, like homeowners or renters insurance, is like getting a combo meal at your favorite fast food joint – you save money! Insurance companies often offer discounts for bundling, so it’s definitely worth checking out.

Increasing Deductibles, Car insurance rate

Your deductible is the amount of money you pay out of pocket before your insurance kicks in. It’s like the “co-pay” for your car. Increasing your deductible can lower your premium, but it also means you’ll have to pay more out of pocket if you have an accident. It’s a trade-off, so think about your risk tolerance and how much you’re willing to pay.

Increasing your deductible is like saying, “I’m willing to take on a little more risk in exchange for lower premiums.”

Discounts Offered by Insurance Companies

Insurance companies are like treasure chests – they’re full of discounts waiting to be discovered. Here are some common discounts you can look for:

- Good Driver Discounts: This is like getting a gold star for being a safe driver. Insurance companies reward good drivers with lower premiums.

- Safety Feature Discounts: If your car has safety features like anti-theft devices, airbags, or anti-lock brakes, you can get a discount. It’s like getting a discount for having a super-safe car!

- Student Discounts: If you’re a good student, you can get a discount. Insurance companies believe good students are more responsible drivers.

- Multi-Car Discounts: If you have multiple cars insured with the same company, you can get a discount. It’s like a family discount for your car insurance.

Car Insurance Claims and Processes

Filing a car insurance claim can be a stressful experience, but understanding the process can make it smoother. This section Artikels the steps involved in filing a claim, explains different claim types, and highlights the role of insurance adjusters.

Filing a Car Insurance Claim

The process of filing a car insurance claim typically involves the following steps:

- Contact your insurance company: After an accident, immediately report the incident to your insurance company. You can usually do this by phone, online, or through their mobile app.

- Provide necessary details: Be prepared to provide information about the accident, including the date, time, location, and the other parties involved. You should also provide your policy details and contact information.

- File a claim: Your insurance company will guide you through the claim filing process. This may involve completing a claim form, providing documentation, and taking photos of the damage.

- Insurance adjuster evaluation: An insurance adjuster will be assigned to your claim. They will investigate the accident, assess the damage, and determine the amount of coverage available.

- Negotiate settlement: The insurance adjuster will work with you to determine a fair settlement for your claim. You may need to provide additional documentation or negotiate the amount offered.

- Receive payment: Once the settlement is agreed upon, your insurance company will process the payment. The payment may be sent directly to you or to a repair shop.

Types of Car Insurance Claims

There are different types of car insurance claims, depending on the circumstances of the accident:

- Collision Claims: These claims are filed when your car is damaged in an accident with another vehicle or object. They are covered by collision coverage, which is optional and typically has a deductible.

- Comprehensive Claims: These claims cover damage to your car caused by events other than collisions, such as theft, vandalism, natural disasters, or animal collisions. They are also covered by comprehensive coverage, which is optional and typically has a deductible.

- Liability Claims: These claims are filed when you are at fault for an accident and cause damage to another person’s vehicle or property, or injuries to another person. They are covered by liability coverage, which is required in most states.

Role of Insurance Adjusters

Insurance adjusters play a crucial role in the claims process. They are responsible for:

- Investigating the accident: They gather information about the accident, including witness statements, police reports, and photos of the damage.

- Assessing the damage: They determine the extent of the damage to your vehicle and any other property involved in the accident.

- Determining coverage: They review your insurance policy to determine the amount of coverage available for your claim.

- Negotiating settlement: They work with you to determine a fair settlement for your claim.

Handling a Car Insurance Claim Effectively

Here are some tips for handling a car insurance claim effectively:

- Document everything: Take photos and videos of the damage to your car, the accident scene, and any injuries. Record the names and contact information of all parties involved.

- Report the claim promptly: Contact your insurance company as soon as possible after the accident.

- Be honest and cooperative: Provide accurate information to your insurance adjuster and cooperate with their investigation.

- Understand your policy: Review your insurance policy carefully to understand your coverage and deductibles.

- Keep track of all communication: Keep a record of all communication with your insurance company, including dates, times, and details of conversations.

- Seek professional advice: If you have questions or concerns about your claim, don’t hesitate to seek advice from a lawyer or insurance professional.

Closure

Navigating the world of car insurance can feel like driving through a maze, but understanding the factors that shape your rate can empower you to make informed decisions. Remember, being a safe driver, comparing quotes, and knowing your options can lead to a more affordable ride. So buckle up, and let’s hit the road to saving money on your car insurance!

FAQ Overview

What are some common discounts I can get on car insurance?

Insurance companies offer a range of discounts for things like good driving records, safety features in your car, bundling insurance policies, and even taking a defensive driving course.

How often should I review my car insurance policy?

It’s a good idea to review your policy at least once a year, especially if you’ve had any major life changes like getting married, buying a new car, or moving to a different location. You might find that you’re paying for coverage you don’t need or that there are better rates available.

Can I lower my insurance rate by paying my premium in full?

Some insurance companies offer discounts for paying your premium in full, so it’s worth asking about this option.

What should I do if I get into an accident?

Stay calm and safe. If anyone is injured, call 911 immediately. Then, exchange information with the other driver(s) involved, take photos of the damage, and contact your insurance company as soon as possible to report the accident.