Car insurance rate Florida is a topic that sparks interest for many residents, especially with the state’s unique laws and regulations. Navigating the complexities of car insurance can feel overwhelming, but understanding the factors that influence your rates can empower you to make informed decisions. From driving history and vehicle type to coverage options and discounts, a multitude of factors contribute to the cost of your insurance. This guide will delve into the intricacies of car insurance rates in Florida, equipping you with the knowledge to find the best coverage at the most affordable price.

Florida’s no-fault insurance system is a significant factor that sets it apart from other states. This system requires drivers to carry Personal Injury Protection (PIP) coverage, which covers medical expenses and lost wages after an accident, regardless of fault. While this system aims to simplify accident claims, it can also impact your premiums and the way accidents are handled. We’ll explore the nuances of Florida’s no-fault system and how it influences your car insurance rates.

Understanding Car Insurance Rates in Florida

Car insurance rates in Florida are influenced by a complex interplay of factors, including demographics, driving history, vehicle type, and coverage options. Understanding these factors can help Florida residents make informed decisions about their car insurance and potentially save money on their premiums.

Factors Influencing Car Insurance Rates in Florida

Several factors influence car insurance rates in Florida. These factors are used by insurance companies to assess the risk associated with insuring a particular driver and vehicle.

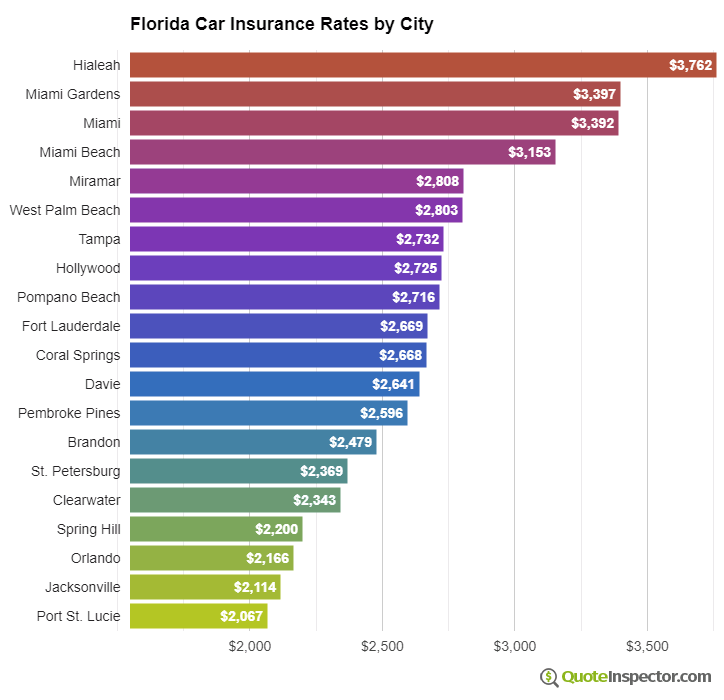

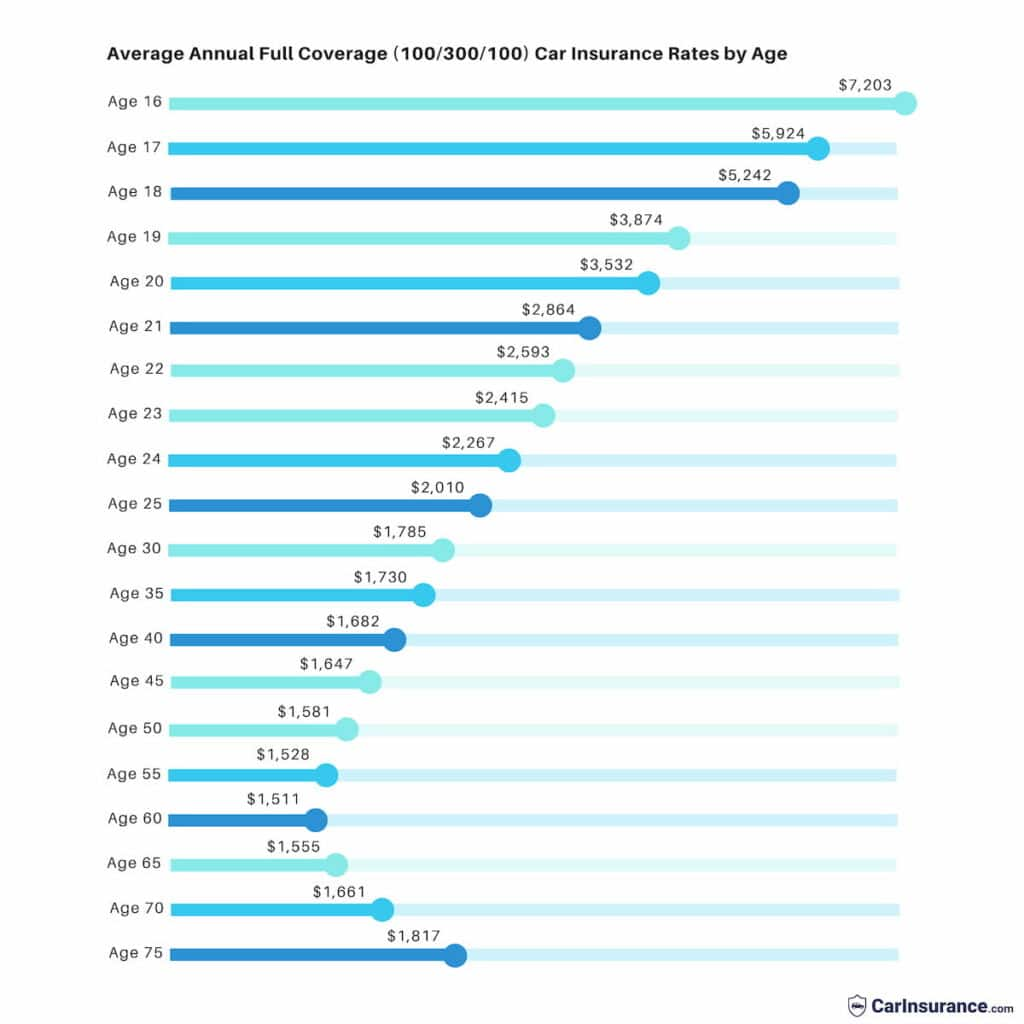

- Demographics: Factors like age, gender, and marital status can influence car insurance rates. Younger drivers, for instance, are statistically more likely to be involved in accidents, leading to higher premiums. Similarly, drivers living in urban areas with higher traffic density may face higher rates due to increased accident risks.

- Driving History: A clean driving record is crucial for obtaining lower car insurance rates. Drivers with past accidents, traffic violations, or DUI convictions will generally pay higher premiums. Insurance companies view these events as indicators of higher risk and adjust rates accordingly.

- Vehicle Type: The type of vehicle you drive significantly impacts your car insurance rates. Sports cars and luxury vehicles are often more expensive to repair, leading to higher premiums. Additionally, the safety features of your car, such as anti-theft devices and airbags, can influence rates. Vehicles with advanced safety features often qualify for discounts.

- Coverage Options: The amount and type of coverage you choose directly affect your car insurance premiums. Higher coverage limits for liability, collision, and comprehensive coverage generally lead to higher premiums. Conversely, opting for lower coverage limits or choosing a higher deductible can result in lower premiums.

Average Car Insurance Rates in Florida

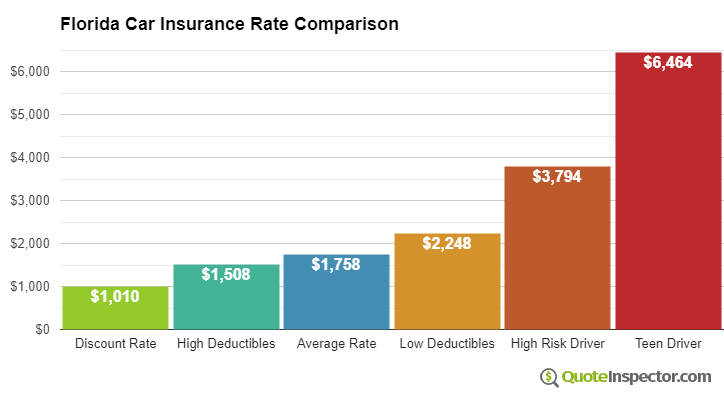

The average car insurance rate in Florida can vary depending on the factors mentioned above. According to recent data from the Insurance Information Institute (III), the average annual car insurance premium in Florida is around $2,200. This is slightly higher than the national average of $1,771.

Impact of Florida’s Unique Laws and Regulations

Florida’s unique laws and regulations, particularly its no-fault insurance system and Personal Injury Protection (PIP) coverage, significantly influence car insurance rates.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system. This system requires drivers to file claims with their own insurance companies for injuries sustained in an accident, regardless of fault. While this system aims to simplify the claims process and reduce litigation, it can lead to higher premiums due to the increased claims volume.

Personal Injury Protection (PIP) Coverage

Florida mandates PIP coverage for all drivers, which covers medical expenses and lost wages for injuries sustained in an accident. This coverage is typically limited to $10,000 per person, and drivers have the option to choose a higher limit. The availability and cost of PIP coverage directly impact car insurance rates.

Key Factors Affecting Florida Car Insurance Rates

Your car insurance premiums in Florida are determined by a variety of factors, and understanding these factors can help you make informed decisions to potentially lower your costs. While your driving history, vehicle type, and coverage options are significant, other factors like your age, location, and credit score also play a role.

Driving History

Your driving history is one of the most crucial factors influencing your car insurance rates. Insurance companies assess your risk based on your past driving behavior, including accidents, violations, and DUI convictions. A clean driving record can lead to lower premiums, while a history of incidents can result in higher rates.

- Accidents: Each accident you’ve been involved in, regardless of fault, is recorded on your driving record. The severity of the accident and the number of claims filed can significantly impact your premiums. For example, a minor fender bender might have a lesser impact than a serious accident with injuries.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations can increase your premiums. The severity of the violation and the frequency of offenses contribute to higher rates.

- DUI Convictions: A DUI conviction is a serious offense that carries significant financial penalties, including significantly higher car insurance premiums. Insurance companies view DUI convictions as a high-risk factor, leading to substantially increased rates.

Vehicle Type

The type of vehicle you drive also significantly impacts your car insurance rates. Insurance companies consider factors such as the make, model, year, and safety features of your vehicle when determining your premiums.

- Make and Model: Certain car makes and models are statistically more likely to be involved in accidents or thefts. These vehicles may have higher insurance rates due to their higher repair costs or greater risk of claims. For example, sports cars often have higher premiums than sedans due to their performance capabilities and higher risk of accidents.

- Year: Newer vehicles generally have more advanced safety features and are often equipped with anti-theft systems, leading to lower insurance rates. Older vehicles, on the other hand, may have higher premiums due to their increased risk of breakdowns and repairs.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer and may result in lower insurance premiums.

Coverage Options

The type and amount of coverage you choose significantly influence your car insurance premiums. Understanding the different coverage options and their impact on your rates is essential.

- Liability Coverage: Liability coverage is mandatory in Florida and protects you financially if you are responsible for an accident causing damage to another person’s property or injuries. Higher liability limits offer greater protection but also result in higher premiums.

- Collision Coverage: Collision coverage pays for repairs to your vehicle if you are involved in an accident, regardless of fault. While not mandatory, it’s often recommended, especially for newer vehicles. This coverage can increase your premiums.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damages from events other than collisions, such as theft, vandalism, or natural disasters. This coverage is optional but can be valuable depending on your vehicle’s value and your risk tolerance.

- Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist coverage (UM/UIM) provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured. This coverage is crucial in Florida, where a significant percentage of drivers are uninsured.

Car Insurance Discounts

Florida offers a variety of discounts that can help you lower your car insurance premiums. Understanding and taking advantage of these discounts can significantly impact your overall insurance costs.

- Safe Driver Discount: Drivers with a clean driving record, free of accidents and violations, are eligible for a safe driver discount. This discount rewards responsible drivers and can lead to substantial savings.

- Good Student Discount: Students with good grades and a high GPA may be eligible for a good student discount. This discount encourages academic achievement and recognizes students’ responsible behavior.

- Multi-Car Discount: Insuring multiple vehicles with the same insurance company can qualify you for a multi-car discount. This discount is a reward for bundling your policies and can significantly reduce your premiums.

- Other Discounts: Other discounts may be available depending on your specific circumstances and insurance company. These discounts can include:

- Anti-theft Device Discount: Vehicles equipped with anti-theft devices, such as alarms or immobilizers, may be eligible for a discount.

- Loyalty Discount: Long-term customers may receive a loyalty discount for their continued business.

- Payment Discount: Paying your premium in full or opting for automatic payments may qualify you for a discount.

Finding Affordable Car Insurance in Florida

Finding affordable car insurance in Florida can be a challenge, given the state’s high rates. However, by understanding your options and implementing smart strategies, you can secure competitive coverage without breaking the bank.

Comparing Car Insurance Providers in Florida

To find the best car insurance rates in Florida, it’s crucial to compare quotes from multiple providers. Here’s a table comparing some of the top car insurance companies in Florida, based on average rates, coverage options, and customer service ratings:

| Provider | Average Annual Rate | Coverage Options | J.D. Power Customer Satisfaction Rating |

|---|---|---|---|

| State Farm | $1,800 | Comprehensive, collision, liability, personal injury protection (PIP), uninsured/underinsured motorist (UM/UIM) | 4 out of 5 |

| Geico | $1,700 | Comprehensive, collision, liability, PIP, UM/UIM | 4 out of 5 |

| Progressive | $1,650 | Comprehensive, collision, liability, PIP, UM/UIM | 3 out of 5 |

| Allstate | $1,900 | Comprehensive, collision, liability, PIP, UM/UIM | 3 out of 5 |

| USAA | $1,500 (for military members and their families) | Comprehensive, collision, liability, PIP, UM/UIM | 5 out of 5 |

Note: These are average rates and may vary depending on individual factors like driving history, vehicle type, and location.

Tips for Getting the Best Car Insurance Rates in Florida

Here are some strategies to help you secure the most affordable car insurance in Florida:

- Shop around and compare quotes: Get quotes from multiple insurers to compare rates and coverage options. Online comparison websites can make this process easier.

- Bundle your insurance policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in discounts.

- Maintain a good driving record: Avoiding accidents, traffic violations, and DUI convictions can significantly reduce your insurance premiums.

- Increase your deductible: A higher deductible means lower premiums, but you’ll pay more out of pocket if you need to file a claim.

- Ask about discounts: Many insurers offer discounts for factors like good student status, safe driving courses, and anti-theft devices.

- Negotiate with your insurer: Don’t be afraid to negotiate with your insurer for a better rate, especially if you’ve been a loyal customer.

- Consider a usage-based insurance program: These programs track your driving habits and offer discounts for safe driving behavior.

Resources for Comparing Car Insurance Quotes

Several resources can help Florida residents compare car insurance quotes and find the best deals:

- Online comparison websites: Websites like Insurance.com, The Zebra, and Policygenius allow you to compare quotes from multiple insurers simultaneously.

- Insurance brokers: Brokers can help you compare quotes from different insurers and find the best policy for your needs.

- Your state’s Department of Insurance: The Florida Office of Insurance Regulation (OIR) provides information on car insurance rates, consumer rights, and complaints.

Understanding Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, which means that after a car accident, each driver involved is primarily responsible for their own medical expenses and lost wages, regardless of who caused the accident. This system is designed to simplify the claims process and reduce litigation.

How Florida’s No-Fault System Works

In Florida, drivers are required to carry Personal Injury Protection (PIP) coverage, which is a type of no-fault insurance. When an accident occurs, PIP coverage kicks in to cover the insured driver’s medical expenses and lost wages, up to a certain limit. The PIP coverage limit is typically $10,000, but can be higher depending on the driver’s policy.

Benefits and Drawbacks of Florida’s No-Fault System

Benefits

- Faster Claims Processing: Since drivers are primarily responsible for their own expenses, the claims process is often faster than in fault-based systems. This is because drivers can file claims with their own insurance company, without having to wait for a determination of fault.

- Reduced Litigation: No-fault systems aim to reduce the number of lawsuits related to car accidents. Since drivers are responsible for their own expenses, there is less incentive to sue the other driver.

Drawbacks

- Limited Coverage: PIP coverage only covers a limited amount of medical expenses and lost wages. If the expenses exceed the coverage limit, the injured driver may have to pay out-of-pocket or pursue a claim against the other driver.

- Potential for Abuse: Some drivers may take advantage of the no-fault system by exaggerating their injuries or seeking unnecessary medical treatment.

- Higher Premiums: Florida’s no-fault system can lead to higher insurance premiums, as insurers have to cover the costs of PIP coverage.

Personal Injury Protection (PIP) Coverage

PIP coverage is a crucial part of Florida’s no-fault insurance system. It provides coverage for the insured driver’s medical expenses and lost wages, regardless of who caused the accident.

Key Features of PIP Coverage

- Medical Expenses: PIP coverage typically covers 80% of the insured driver’s medical expenses, up to the policy limit. This includes expenses for emergency care, hospitalization, surgery, rehabilitation, and other medical treatments.

- Lost Wages: PIP coverage can also provide benefits for lost wages, up to a certain limit. This helps compensate for income lost due to the accident.

- Death Benefits: In the event of a fatal accident, PIP coverage may provide death benefits to the deceased driver’s beneficiaries.

Implications for Drivers

- Mandatory Coverage: Florida law requires all drivers to carry PIP coverage, with a minimum coverage limit of $10,000. This ensures that drivers have some financial protection in the event of an accident.

- Limited Coverage: It is important to understand that PIP coverage is not unlimited. Drivers should carefully consider their coverage needs and ensure that they have sufficient PIP coverage to meet their potential expenses.

- Impact on Accident Claims: PIP coverage is the primary source of compensation for medical expenses and lost wages in Florida. However, drivers may be able to pursue additional compensation from the other driver, depending on the circumstances of the accident.

Car Insurance Requirements in Florida

Florida mandates that all drivers carry a minimum amount of car insurance to protect themselves and others on the road. Understanding these requirements is crucial for drivers in Florida to avoid penalties and ensure they have adequate coverage in case of an accident.

Minimum Car Insurance Coverage Requirements in Florida

Florida’s law requires drivers to have a minimum amount of insurance coverage, known as the “Financial Responsibility Law.” This law Artikels the specific types and amounts of coverage that drivers must maintain.

- Personal Injury Protection (PIP): PIP coverage is a no-fault insurance benefit that covers medical expenses, lost wages, and other related costs for the insured driver and passengers in their vehicle, regardless of who caused the accident. In Florida, the minimum PIP coverage requirement is $10,000 per person. This means that if you are injured in an accident, your PIP coverage will pay up to $10,000 for your medical expenses, lost wages, and other related costs.

- Property Damage Liability (PDL): PDL coverage protects you from financial responsibility if you cause damage to another person’s property in an accident. The minimum PDL coverage requirement in Florida is $10,000. This means that if you cause an accident that damages another person’s vehicle or property, your PDL coverage will pay up to $10,000 to cover the costs of repairs or replacement.

Consequences of Driving Without Adequate Insurance in Florida, Car insurance rate florida

Driving without the minimum required insurance coverage in Florida can lead to significant consequences, including:

- Fines and Penalties: Driving without insurance in Florida is a serious offense. You could face fines of up to $1,000 and a suspension of your driver’s license.

- Vehicle Impoundment: If you are caught driving without insurance, your vehicle may be impounded until you provide proof of insurance.

- Financial Responsibility: If you cause an accident without insurance, you could be held personally responsible for all damages, including medical expenses, property damage, and lost wages. This could result in significant financial hardship.

Ensuring Compliance with Florida’s Car Insurance Laws

To avoid the consequences of driving without adequate insurance, it is essential to ensure compliance with Florida’s car insurance laws. Here are some tips:

- Purchase the Minimum Required Coverage: Ensure that your car insurance policy includes the minimum required coverage in Florida, which includes $10,000 PIP and $10,000 PDL.

- Maintain Proof of Insurance: Keep your insurance card or electronic proof of insurance readily available in your vehicle.

- Review Your Policy Regularly: Regularly review your insurance policy to ensure that you have adequate coverage and that your information is up-to-date.

- Consult with an Insurance Agent: If you have any questions or concerns about your car insurance coverage, consult with a licensed insurance agent who can provide guidance and recommendations.

Ultimate Conclusion: Car Insurance Rate Florida

Understanding car insurance rates in Florida is crucial for every driver. By understanding the factors that influence your premiums, you can make informed choices about your coverage and take advantage of available discounts. Remember, shopping around and comparing quotes from different insurers is essential to finding the best value for your needs. With the knowledge and strategies Artikeld in this guide, you can navigate the world of Florida car insurance with confidence, ensuring you have the right coverage at a price that fits your budget.

Popular Questions

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage, $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person and $20,000 per accident.

How can I lower my car insurance rates in Florida?

You can lower your car insurance rates by maintaining a good driving record, taking defensive driving courses, bundling your car and home insurance, and comparing quotes from multiple insurers.

What is the difference between collision and comprehensive coverage?

Collision coverage covers damage to your car caused by an accident, while comprehensive coverage covers damage caused by events other than accidents, such as theft, vandalism, or natural disasters.