- Understanding Car Insurance Rates in Ontario

- Key Factors Affecting Rates

- Driving Record and Safety: Car Insurance Rates In Ontario Canada

- Vehicle Features and Safety

- Insurance Coverage Options

- Tips for Lowering Insurance Rates

- Insurance Shopping and Comparison

- Common Car Insurance Claims

- Wrap-Up

- Common Queries

Car insurance rates in Ontario Canada are a significant expense for many drivers. Understanding the factors that influence these rates is crucial for making informed decisions about your coverage and minimizing your premiums. The Financial Services Commission of Ontario (FSCO) plays a vital role in regulating the car insurance industry, ensuring fair and transparent practices.

Your driving history, vehicle type, age, location, and even the safety features of your car all contribute to your insurance costs. This guide will delve into the intricacies of car insurance rates in Ontario, providing insights into how they are determined and offering practical tips for reducing your premiums.

Understanding Car Insurance Rates in Ontario

Car insurance is a necessity for all vehicle owners in Ontario, and understanding how rates are determined is crucial for making informed decisions about your coverage. Several factors influence the cost of your car insurance, and navigating these complexities can be challenging. This guide aims to demystify the process, providing insights into the factors that shape your insurance premiums and the role of the governing body in ensuring fair practices.

Factors Influencing Car Insurance Rates

The cost of your car insurance is influenced by a variety of factors, which are categorized into driver-related, vehicle-related, and location-related factors.

- Driver-Related Factors: Your driving history, age, and driving experience significantly impact your rates.

- Driving History: A clean driving record with no accidents or violations leads to lower premiums. Conversely, a history of accidents, speeding tickets, or other traffic violations can significantly increase your rates.

- Age and Experience: Younger drivers with less experience are generally considered higher risk and pay higher premiums. As you gain experience and age, your rates tend to decrease.

- Driving Habits: Your driving habits, such as the number of kilometers you drive annually and your driving style, can influence your rates.

- Vehicle-Related Factors: The type of vehicle you drive plays a crucial role in determining your insurance rates.

- Vehicle Make and Model: The make, model, and year of your vehicle influence its safety features and repair costs, which impact your premiums. Vehicles with a history of high repair costs or safety concerns tend to have higher insurance rates.

- Vehicle Value: The value of your vehicle is directly linked to your insurance premiums. More expensive vehicles typically require higher coverage amounts and therefore higher premiums.

- Location-Related Factors: Your location also plays a role in your insurance rates.

- Geographical Location: Areas with higher crime rates or a higher frequency of accidents tend to have higher insurance rates.

- Parking Location: Parking your vehicle in a garage or on a private driveway can lower your rates compared to street parking, as it reduces the risk of theft or damage.

Role of the Financial Services Commission of Ontario (FSCO)

The Financial Services Commission of Ontario (FSCO) is the regulatory body responsible for overseeing the insurance industry in Ontario. FSCO plays a vital role in ensuring fair and competitive pricing practices within the industry. It establishes guidelines for insurance companies to follow, including setting minimum coverage requirements and regulating the pricing of insurance products. FSCO also handles consumer complaints and investigates any unfair or unethical practices by insurance companies.

Components of Car Insurance Premiums

Your car insurance premium is made up of several components, each contributing to the overall cost of your coverage.

- Liability Coverage: This coverage protects you financially if you are found liable for causing damage to another person’s property or injury to another person in an accident.

- Accident Benefits Coverage: This coverage provides financial support for medical expenses, rehabilitation, and lost income in the event of an accident, regardless of fault.

- Direct Compensation Property Damage (DCPD) Coverage: This coverage covers damage to your vehicle in an accident, regardless of fault.

- Optional Coverage: Additional coverage options are available, such as comprehensive coverage, collision coverage, and uninsured motorist coverage, which can provide additional protection for your vehicle and yourself in specific situations.

Key Factors Affecting Rates

Several factors influence car insurance rates in Ontario. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history is a significant factor in determining your car insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, accidents, traffic violations, and DUI convictions can significantly increase your rates.

For example, a single at-fault accident could lead to a 20-30% increase in your insurance premiums, depending on the severity of the accident and your insurance provider.

Vehicle Type

The type of vehicle you drive plays a crucial role in determining your insurance rates.

Vehicle Types and Rates

- Sedans: Typically, sedans are considered less risky to insure than SUVs or trucks, resulting in lower premiums.

- SUVs: SUVs, due to their size and potential for greater damage in accidents, often have higher insurance rates compared to sedans.

- Trucks: Trucks, especially larger models, are generally considered the riskiest to insure, leading to the highest premiums among the three types.

Age

Your age is another factor that can influence your car insurance rates.

Age and Insurance Rates

- Young Drivers: Young drivers, particularly those under 25, are often considered statistically riskier due to their lack of experience. This usually results in higher premiums.

- Mature Drivers: Drivers over 65 generally benefit from lower premiums as they are considered statistically less likely to be involved in accidents.

Location

The location where you live can also impact your car insurance rates.

Location and Insurance Rates

- Urban Areas: Higher population density and traffic congestion in urban areas can lead to a higher risk of accidents, potentially resulting in higher premiums.

- Rural Areas: Lower population density and less traffic in rural areas generally translate to lower accident risks, which can result in lower premiums.

Driving Record and Safety: Car Insurance Rates In Ontario Canada

Your driving record is a key factor in determining your car insurance rates in Ontario. Insurance companies use this information to assess your risk as a driver and set your premiums accordingly.

Impact of Traffic Violations and Accidents

Traffic violations and accidents can significantly increase your insurance premiums. Insurance companies view these incidents as indicators of your driving habits and potential risk to others.

- Traffic Violations: Speeding tickets, driving under the influence (DUI), and other traffic violations can result in higher premiums. The severity of the violation and the number of offenses on your record will influence the impact on your rates.

- Accidents: Being involved in an accident, even if you weren’t at fault, can lead to higher insurance premiums. Insurance companies consider accidents as evidence of potential risk, even if you weren’t the primary cause.

Role of Driver Training Programs

Driver training programs can help you become a safer driver and potentially lower your insurance costs. These programs often cover topics like defensive driving, accident avoidance, and safe driving techniques.

- Discount Programs: Some insurance companies offer discounts for drivers who complete approved driver training courses. These discounts can vary depending on the insurer and the type of training program.

- Enhanced Skills: Driver training programs can equip you with valuable skills and knowledge to help you avoid accidents and navigate challenging driving situations. This improved driving ability can lead to a lower risk profile and potentially lower insurance premiums.

Advantages of a Clean Driving Record

Maintaining a clean driving record is one of the best ways to keep your car insurance rates low. A clean record demonstrates to insurance companies that you are a responsible driver with a low risk profile.

- Lower Premiums: Drivers with clean records often qualify for lower insurance premiums. This can save you money over the long term.

- Peace of Mind: Knowing that you have a clean driving record can give you peace of mind and help you avoid the stress and financial burden of higher insurance premiums.

Vehicle Features and Safety

Your vehicle’s safety features and condition significantly impact your car insurance rates in Ontario. Insurance companies recognize that safer vehicles are less likely to be involved in accidents, resulting in lower claims costs. This leads to lower premiums for drivers.

Impact of Safety Features

Safety features play a crucial role in determining insurance costs. Vehicles equipped with advanced safety technologies, such as anti-lock brakes (ABS), airbags, and electronic stability control (ESC), are generally considered safer and therefore attract lower insurance premiums.

- Anti-lock brakes (ABS) prevent wheels from locking during braking, improving vehicle control and reducing the risk of skidding. This enhanced stability reduces the likelihood of accidents, leading to lower insurance rates.

- Airbags provide a safety cushion for passengers in the event of a collision. Vehicles with multiple airbags, including side airbags and curtain airbags, offer greater protection and consequently lower insurance costs.

- Electronic stability control (ESC) helps maintain vehicle control by automatically applying brakes to individual wheels during a skid or loss of traction. This feature significantly reduces the risk of accidents, resulting in lower insurance premiums.

Vehicle Age and Condition

The age and condition of your vehicle also influence your insurance premiums. Newer vehicles are generally equipped with more advanced safety features and are less likely to experience mechanical failures. This translates into lower insurance costs for newer vehicles. Older vehicles, on the other hand, may not have the same safety features and are more prone to mechanical issues, leading to higher insurance premiums.

- Vehicle age directly impacts insurance rates. Newer vehicles, within the first few years of their lifespan, often come with factory warranties and have a lower risk of breakdowns. This translates to lower insurance costs. As vehicles age, their risk of breakdowns increases, leading to higher premiums. Older vehicles, especially those over 10 years old, may face higher insurance premiums due to their increased risk of mechanical issues and potential for safety concerns.

- Vehicle condition plays a significant role in determining insurance costs. Vehicles that are well-maintained and regularly serviced are less likely to experience breakdowns and are considered safer. This translates to lower insurance premiums. Conversely, vehicles in poor condition, with neglected maintenance or significant wear and tear, are more prone to accidents and breakdowns, resulting in higher insurance costs.

Vehicle Theft Rates

The likelihood of your vehicle being stolen is another factor that insurance companies consider when setting your premiums. Vehicles with high theft rates tend to attract higher insurance premiums.

- Popular models, especially those with high resale value, are more susceptible to theft. Insurance companies consider the theft rate of specific models and adjust premiums accordingly.

- Vehicle features, such as luxury amenities or advanced technology, can increase the risk of theft. Insurance companies may adjust premiums based on the vehicle’s features, as they can make it more appealing to thieves.

Insurance Coverage Options

Ontario’s car insurance offers various coverage options to cater to different needs and risk tolerances. Understanding these options is crucial for making informed decisions and securing the right level of protection.

Coverage Options

The most common types of car insurance coverage in Ontario are:

| Coverage Type | Description | Benefits | Drawbacks |

|---|---|---|---|

| Liability Coverage | Covers damage or injuries you cause to others, including their vehicles, property, and medical expenses. | Protects you from financial ruin if you are at fault in an accident. | Does not cover damage to your own vehicle. |

| Collision Coverage | Covers damage to your vehicle if you are involved in an accident, regardless of fault. | Provides peace of mind knowing your vehicle will be repaired or replaced. | Higher premiums and may not cover all costs. |

| Comprehensive Coverage | Covers damage to your vehicle due to non-collision events, such as theft, vandalism, fire, or natural disasters. | Provides protection against a wide range of risks. | Higher premiums and may not cover all costs. |

| Uninsured Motorist Coverage | Protects you if you are involved in an accident with an uninsured or hit-and-run driver. | Provides financial compensation for injuries or damages caused by an uninsured driver. | Higher premiums and may not cover all costs. |

Choosing the Right Coverage, Car insurance rates in ontario canada

Determining the appropriate coverage level depends on several factors, including:

- Your financial situation: Consider your ability to cover potential costs in case of an accident.

- Your driving record: A clean driving record may qualify you for lower premiums.

- The value of your vehicle: Higher-value vehicles may require more comprehensive coverage.

- Your personal risk tolerance: Evaluate your willingness to accept potential financial risks.

It’s always recommended to consult with an insurance broker to discuss your specific needs and obtain personalized advice on the best coverage options for you.

Tips for Lowering Insurance Rates

Ontario car insurance rates can be expensive, but there are several things you can do to lower your premiums. By implementing some smart strategies, you can potentially save a significant amount of money on your insurance.

Driving Record and Safety

A clean driving record is essential for lower car insurance premiums. Insurance companies consider your driving history, including accidents, tickets, and other violations, to assess your risk. Maintaining a safe driving record can significantly impact your insurance costs.

- Avoid traffic violations: Every traffic ticket, even for minor offenses, can increase your insurance premiums. Driving cautiously and following traffic rules can help you avoid these costly violations.

- Take a defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving practices. Many insurance companies offer discounts for drivers who complete these courses, which can potentially lower your premiums.

- Maintain a good driving record: Consistent safe driving habits are crucial. Avoiding accidents and traffic violations will help you maintain a clean driving record, leading to lower insurance rates.

Vehicle Features and Safety

The type of vehicle you drive plays a significant role in determining your insurance premiums. Insurance companies consider factors like the vehicle’s make, model, safety features, and theft risk when calculating your rates. Choosing a vehicle with safety features can potentially lead to lower premiums.

- Choose a vehicle with safety features: Cars equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are generally considered safer and may result in lower insurance premiums. These features can mitigate the risk of accidents and injuries, leading to lower insurance costs for the insurer.

- Consider theft risk: Vehicles with a higher theft risk are often associated with higher insurance premiums. Choosing a vehicle with a lower theft risk can potentially save you money on your insurance.

Insurance Coverage Options

Understanding the different insurance coverage options available to you can help you choose the right coverage at the most affordable price. Consider your individual needs and risk tolerance when making your decisions.

- Compare quotes from multiple insurers: Don’t settle for the first quote you receive. Get quotes from several insurance companies to compare rates and coverage options. This can help you find the best value for your money.

- Review your coverage needs: Assess your current coverage and determine if you need all of the coverage you have. Consider your financial situation and risk tolerance when making these decisions. You might be able to reduce your premiums by reducing unnecessary coverage.

- Increase your deductible: A higher deductible means you’ll pay more out of pocket in case of an accident, but it can also lead to lower premiums. Consider your financial situation and your willingness to pay a higher deductible in case of an accident.

Negotiating Lower Rates

Negotiating with your insurance provider can be a valuable strategy for securing lower premiums. Be prepared to discuss your options and be assertive in advocating for yourself.

- Shop around for better rates: Contact other insurance providers and get quotes for comparable coverage. This can give you leverage when negotiating with your current insurer.

- Bundle your insurance: Combining your car insurance with other insurance products, such as home or renters insurance, can often lead to discounts. This is a common strategy used by insurance companies to incentivize customers to bundle their policies.

- Ask for discounts: Many insurance companies offer discounts for safe driving, good student status, or other factors. Be sure to ask your insurer about all the discounts you may qualify for.

- Be prepared to switch insurers: If you’re not satisfied with your current insurer’s rates or service, be prepared to switch to another provider. This can create competition and motivate your current insurer to offer you a better deal.

Insurance Shopping and Comparison

Finding the best car insurance rates in Ontario involves comparing different insurance companies and their offerings. This process, known as insurance shopping, is crucial for securing a policy that aligns with your needs and budget.

Using Online Insurance Comparison Tools

Online insurance comparison tools simplify the process of comparing rates from various insurance companies. These platforms gather your information and present quotes from multiple providers, allowing you to quickly assess different options.

- User-friendly interface: Most comparison websites are designed with a user-friendly interface, making it easy to input your information and receive quotes.

- Multiple quotes: These tools typically provide quotes from several insurance companies, giving you a comprehensive overview of the market.

- Time-saving: Instead of contacting each insurance company individually, comparison tools save you time and effort.

Reading Insurance Policy Documents

While online comparison tools provide a convenient way to compare rates, it’s essential to read the policy documents carefully before making a decision. This ensures you understand the coverage details, exclusions, and terms and conditions of each policy.

“Don’t just focus on the price; understand what you’re paying for.”

- Coverage details: Carefully review the coverage details, including liability limits, collision and comprehensive coverage, and other optional benefits.

- Exclusions: Pay close attention to any exclusions or limitations in the policy, such as specific types of accidents or circumstances not covered.

- Terms and conditions: Understand the terms and conditions, including payment options, cancellation policies, and dispute resolution procedures.

Common Car Insurance Claims

Car insurance claims are a reality for many Ontario drivers. Understanding the most frequent types of claims and the process involved can help you navigate this process effectively.

In Ontario, the most common types of car insurance claims fall into several categories, each with its own set of circumstances and procedures:

Collision Claims

Collision claims are filed when your vehicle is involved in an accident with another vehicle or object. These claims typically cover damages to your vehicle, as well as any injuries sustained by you or your passengers. This type of claim is the most frequent, reflecting the high volume of traffic and potential for accidents on Ontario roads.

Comprehensive Claims

Comprehensive claims cover damages to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. These claims are less frequent than collision claims but can still be significant. For example, a claim for a vehicle stolen from a parking lot or damaged by a hailstorm would fall under comprehensive coverage.

Third-Party Liability Claims

Third-party liability claims arise when you are responsible for causing damage to another person’s property or injury to another person. This could involve an accident where you are at fault, or a situation where your vehicle causes damage to someone else’s property, such as a parked car or a fence. This type of claim covers the damages or injuries caused to the other party.

Uninsured/Underinsured Motorist Claims

Uninsured/underinsured motorist claims occur when you are involved in an accident with a driver who is uninsured or underinsured. These claims can be challenging, as the driver at fault may not have the financial resources to cover your damages or injuries. In such cases, your own insurance policy will cover your losses, up to the limits of your coverage.

The Process of Filing a Car Insurance Claim

Filing a car insurance claim involves several steps, and it’s essential to understand the process to ensure a smooth and efficient experience.

- Report the Incident to Your Insurance Company: Immediately contact your insurance company to report the accident or incident that led to the claim. This is crucial to initiate the claim process and provide them with the necessary information.

- Provide Details of the Incident: Your insurance company will ask for detailed information about the incident, including the date, time, location, and parties involved. Be prepared to provide accurate and complete information. This includes details of the damage to your vehicle or other property, as well as any injuries sustained.

- Complete the Claim Form: Your insurance company will provide you with a claim form to complete. This form will require you to provide further details about the incident, including the cause of the accident, the extent of the damage, and any witnesses present. It’s essential to complete the form accurately and thoroughly.

- Submit Supporting Documents: Depending on the type of claim, you may need to submit supporting documents to your insurance company. These documents could include police reports, medical records, repair estimates, or photographs of the damage.

- Meet with an Insurance Adjuster: Once your claim is filed, an insurance adjuster will be assigned to your case. The adjuster will investigate the incident, assess the damage, and determine the amount of coverage you are entitled to. They will contact you to schedule an inspection of your vehicle or property and discuss the next steps in the process.

The Role of the Insurance Adjuster

The insurance adjuster plays a crucial role in the claim process. They are responsible for investigating the incident, assessing the damage, and determining the amount of coverage you are entitled to. Their primary objective is to ensure that your claim is processed fairly and efficiently. The adjuster will also handle any communication with you and other parties involved in the claim.

Insurance adjusters are trained professionals who have a thorough understanding of insurance policies and procedures. They are responsible for ensuring that all claims are handled fairly and in accordance with the terms of your insurance policy.

When working with an insurance adjuster, it’s essential to be cooperative and provide all the necessary information promptly. This will help to expedite the claim process and ensure a fair settlement. It’s also important to understand your rights and responsibilities as a policyholder. If you have any questions or concerns about the claim process, don’t hesitate to ask your adjuster for clarification.

Wrap-Up

Navigating the complexities of car insurance rates in Ontario can be challenging, but with a thorough understanding of the factors involved, you can make informed decisions about your coverage and potentially save money. By considering your driving record, vehicle choice, and insurance options, you can find the best balance between affordability and comprehensive protection.

Common Queries

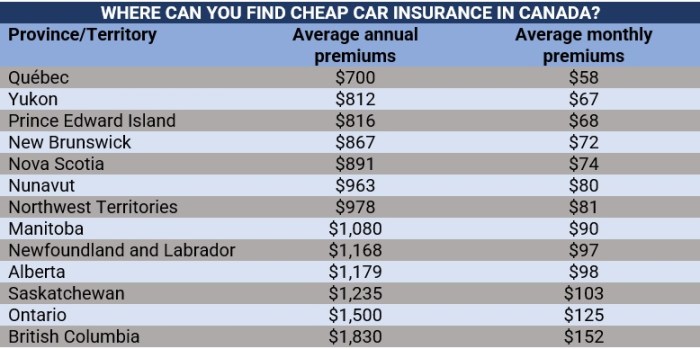

What is the average car insurance rate in Ontario?

The average car insurance rate in Ontario varies widely depending on factors like age, driving history, vehicle type, and location. It’s impossible to provide an exact average, but you can use online comparison tools to get personalized quotes from different insurance companies.

How can I get a discount on my car insurance?

There are various ways to get discounts on your car insurance, such as maintaining a clean driving record, taking defensive driving courses, bundling your insurance policies, and installing safety features in your car.

What are the penalties for driving without car insurance in Ontario?

Driving without car insurance in Ontario is illegal and can result in hefty fines, suspension of your driver’s license, and even vehicle impoundment.