Car insurance requirements in Florida are crucial for every driver, ensuring financial protection in case of accidents. Florida’s unique legal framework demands specific types of coverage, with penalties for non-compliance. This guide unravels the complexities of Florida’s car insurance landscape, helping you navigate the essential requirements and make informed decisions.

Understanding these requirements is not only a legal obligation but also a vital step towards responsible driving and financial security. This guide will delve into the specifics of Florida’s mandatory insurance, the various types of coverage available, factors influencing insurance rates, and strategies for finding affordable coverage.

Florida’s Mandatory Car Insurance Requirements

Driving in Florida requires adhering to the state’s mandatory car insurance laws, ensuring financial protection in case of accidents. This section Artikels the minimum coverage required, the financial responsibility law, and the consequences of driving without insurance.

Minimum Liability Coverage

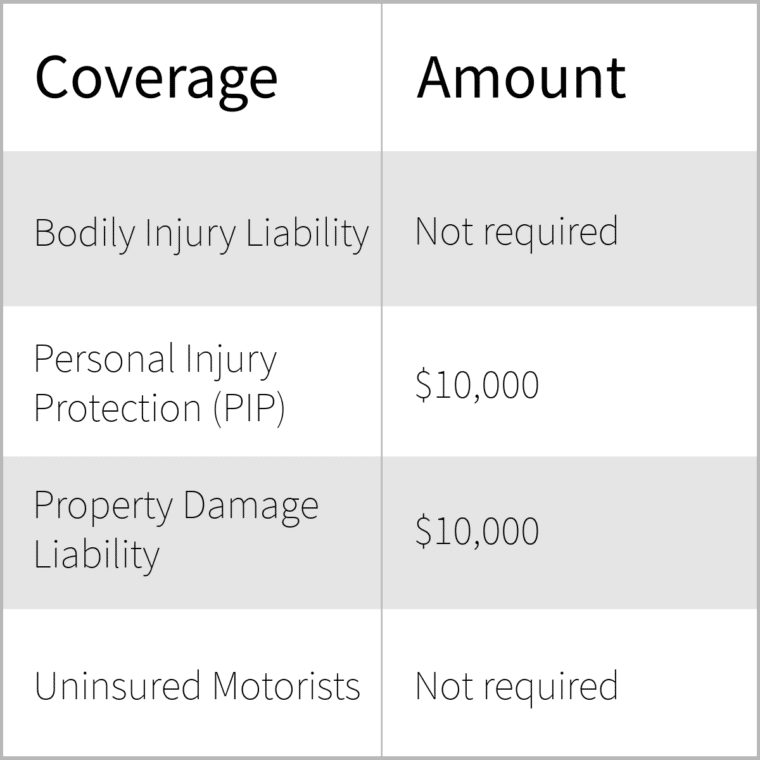

Florida law mandates all drivers to carry a minimum amount of liability insurance. This coverage protects you financially if you cause an accident that injures someone or damages their property. The minimum requirements are:

- Bodily Injury Liability: $10,000 per person and $20,000 per accident. This covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident caused by you.

- Property Damage Liability: $10,000 per accident. This covers damage to another person’s vehicle or property if you are at fault in an accident.

It’s crucial to understand that these are minimum requirements. You may want to consider higher coverage limits to protect yourself from significant financial losses in case of a serious accident.

Financial Responsibility Law

Florida’s Financial Responsibility Law reinforces the importance of having adequate insurance. This law requires drivers to prove their financial responsibility by providing evidence of insurance coverage. If you’re involved in an accident, you must present proof of insurance to the authorities. Failure to do so can result in serious consequences, including:

- Suspension of your driver’s license: Your driving privileges can be suspended until you provide proof of insurance.

- Vehicle registration suspension: Your vehicle registration can be suspended, preventing you from legally driving the vehicle.

- Financial penalties: You may face fines and court costs for violating the Financial Responsibility Law.

Penalties for Driving Without Insurance

Driving without the required insurance in Florida is a serious offense. If caught, you can face:

- Fines: You could be fined up to $500 for the first offense and even higher for subsequent offenses.

- Jail time: In some cases, you may be sentenced to jail time, especially if you’re involved in an accident without insurance.

- Suspension of driver’s license and vehicle registration: Your driving privileges and vehicle registration can be suspended until you provide proof of insurance.

It’s essential to note that even if you have a valid insurance policy, you could still face penalties if you’re involved in an accident and fail to provide proof of insurance to the authorities.

Types of Car Insurance Coverage in Florida

Florida law mandates that all drivers carry certain types of car insurance. These coverages are designed to protect you and others in the event of an accident. Understanding the different types of coverage available can help you make informed decisions about your insurance policy.

Liability Coverage

Liability coverage is the most basic type of car insurance. It helps pay for damages and injuries you cause to other people or their property in an accident. This coverage is divided into two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages caused by your negligence to the other driver and their passengers.

- Property Damage Liability: This coverage pays for damages to the other driver’s vehicle or property, including repairs or replacement costs.

The minimum liability limits required in Florida are:

$10,000 per person for bodily injury

$20,000 per accident for bodily injury

$10,000 per accident for property damage

It’s important to note that these are minimum limits, and you may want to consider higher limits to protect yourself financially.

Personal Injury Protection (PIP), Car insurance requirements in florida

PIP coverage pays for your medical expenses, lost wages, and other damages resulting from an accident, regardless of who is at fault. This coverage applies to you and your passengers.

- Medical Expenses: PIP covers reasonable and necessary medical expenses, such as doctor visits, hospital stays, and rehabilitation.

- Lost Wages: PIP can help replace income lost due to injuries sustained in an accident.

- Other Damages: PIP may also cover other expenses, such as funeral costs and death benefits.

The minimum PIP coverage required in Florida is $10,000. However, you can choose to purchase higher limits.

Collision Coverage

Collision coverage pays for damages to your vehicle in an accident, regardless of who is at fault. This coverage is optional and helps cover the cost of repairs or replacement of your vehicle.

- Deductible: You’ll typically have to pay a deductible before your collision coverage kicks in.

- Repair or Replacement: Collision coverage can pay for repairs to your vehicle or cover the cost of a replacement if the damage is too extensive.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damages caused by events other than accidents. This coverage is also optional.

- Covered Events: Comprehensive coverage can pay for damages caused by theft, vandalism, fire, hail, floods, and other natural disasters.

- Deductible: You’ll typically have to pay a deductible before your comprehensive coverage kicks in.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you and your passengers if you are involved in an accident with a driver who is uninsured or underinsured.

- Uninsured Motorist Coverage: This coverage pays for damages if you are injured by an uninsured driver.

- Underinsured Motorist Coverage: This coverage helps cover the difference between your damages and the other driver’s liability coverage limits if they are insufficient to cover your losses.

This coverage is optional in Florida, but it’s highly recommended.

Final Review

Navigating Florida’s car insurance system can be challenging, but understanding the requirements and available options is essential for every driver. By following the tips Artikeld in this guide, you can ensure you have the right coverage, protect yourself financially, and drive with confidence knowing you’re compliant with Florida’s laws.

Frequently Asked Questions: Car Insurance Requirements In Florida

What happens if I get into an accident without car insurance in Florida?

Driving without the required insurance in Florida can lead to severe consequences, including fines, license suspension, and even jail time. You may also face significant financial liabilities if you cause an accident without insurance.

How can I lower my car insurance premiums in Florida?

There are several ways to lower your car insurance premiums in Florida. These include maintaining a good driving record, exploring discounts for bundling policies, choosing a higher deductible, and comparing quotes from multiple insurance companies.

What is the difference between collision and comprehensive coverage?

Collision coverage protects your vehicle from damage caused by an accident, while comprehensive coverage covers damage from events like theft, vandalism, and natural disasters.