- Understanding Pennsylvania’s Car Insurance Requirements

- Factors Influencing Car Insurance Costs in Pennsylvania

- Exploring Affordable Car Insurance Options in Pennsylvania

- Tips for Saving Money on Car Insurance in Pennsylvania

- Resources for Finding Cheap Car Insurance in Pennsylvania: Cheap Car Insurance In Pa

- Last Point

- Quick FAQs

Cheap car insurance in PA is a top priority for many drivers, but navigating the complexities of Pennsylvania’s insurance landscape can be daunting. Understanding the state’s mandatory coverage requirements, the factors influencing premiums, and available options are crucial for finding affordable protection.

Pennsylvania law mandates specific car insurance coverages, including liability, uninsured/underinsured motorist, and accident benefits. These requirements ensure financial protection for drivers and passengers in case of an accident. The cost of car insurance in Pennsylvania can vary significantly depending on factors like driving history, vehicle type, age, location, and credit score. However, several strategies can help drivers find affordable coverage, such as shopping around for quotes, taking advantage of discounts, and maintaining a good driving record.

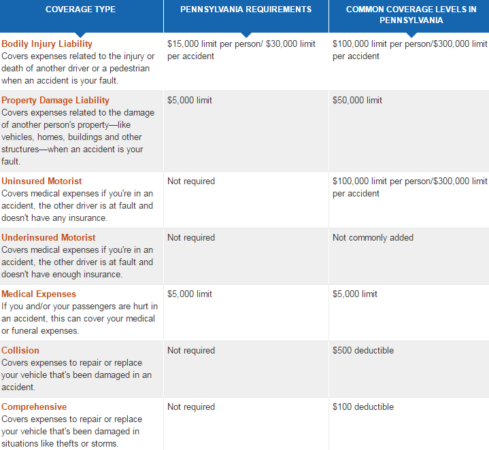

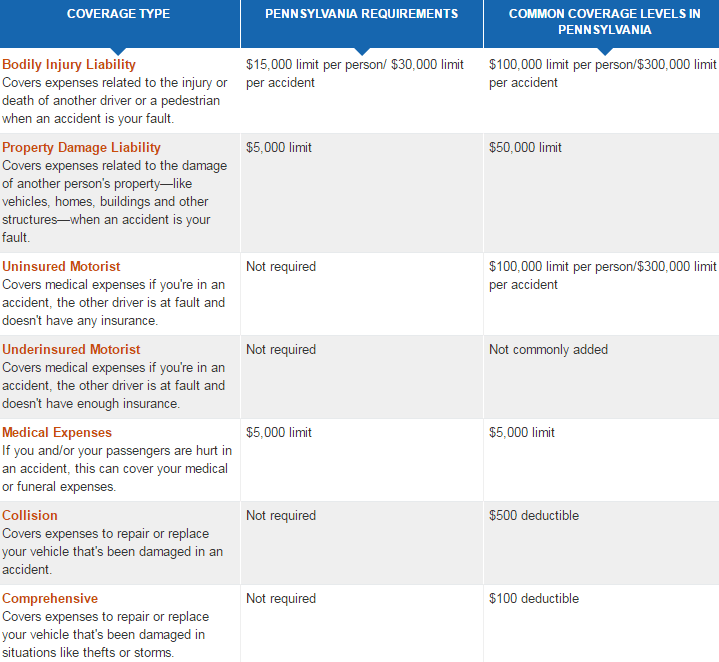

Understanding Pennsylvania’s Car Insurance Requirements

Pennsylvania law requires all drivers to carry a minimum amount of car insurance to protect themselves and others on the road. This insurance coverage is crucial for financial protection in case of an accident.

Liability Coverage

Liability coverage is the most fundamental type of car insurance in Pennsylvania. It protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of:

- Medical expenses for the other driver and passengers

- Property damage to the other driver’s vehicle

- Lost wages for the other driver

- Pain and suffering for the other driver

Pennsylvania law requires a minimum liability coverage of:

- $15,000 for bodily injury per person

- $30,000 for bodily injury per accident

- $5,000 for property damage per accident

It’s essential to understand that these are minimum limits. If you cause an accident with damages exceeding these limits, you’ll be personally responsible for the remaining costs.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage. It covers your medical expenses, lost wages, and other damages if you’re injured by an uninsured or underinsured driver.

Pennsylvania requires a minimum uninsured/underinsured motorist coverage equal to your liability coverage limits. This means you’ll have:

- $15,000 for bodily injury per person

- $30,000 for bodily injury per accident

- $5,000 for property damage per accident

Accident Benefits Coverage

Accident benefits coverage, also known as “no-fault” coverage, covers your medical expenses and lost wages regardless of who caused the accident. This coverage applies to you and your passengers.

Pennsylvania requires a minimum accident benefits coverage of:

- $5,000 for medical expenses

- $1,500 for lost wages

Financial Responsibility Law

Pennsylvania’s financial responsibility law requires drivers to prove they have the necessary insurance coverage to drive legally. This can be done by:

- Providing proof of insurance to law enforcement officers upon request

- Carrying a copy of your insurance card in your vehicle

- Maintaining a valid insurance policy with a licensed insurance company

If you’re caught driving without insurance, you can face:

- Fines

- Suspension of your driver’s license

- Possible jail time

Factors Influencing Car Insurance Costs in Pennsylvania

Car insurance premiums in Pennsylvania are determined by a variety of factors. Understanding these factors can help you find the best rates and save money on your insurance.

Driving History

Your driving history is one of the most important factors that insurers consider when setting your premiums. A clean driving record with no accidents or violations will result in lower premiums. On the other hand, if you have a history of accidents, speeding tickets, or other violations, you can expect to pay higher premiums.

Vehicle Type

The type of vehicle you drive also plays a significant role in determining your car insurance costs. Certain vehicle types are considered more expensive to repair or replace, and therefore, insurance premiums are higher. For instance, luxury cars, sports cars, and high-performance vehicles are typically more expensive to insure than standard sedans or hatchbacks.

Age

Your age is another factor that insurers consider. Younger drivers, particularly those under the age of 25, are statistically more likely to be involved in accidents. Therefore, they often face higher premiums. As you age and gain more driving experience, your premiums may decrease.

Location

The location where you live can also influence your car insurance costs. Areas with high rates of car theft, accidents, or vandalism tend to have higher insurance premiums. Insurers assess the risk associated with different locations and adjust premiums accordingly.

Credit Score

Surprisingly, your credit score can also affect your car insurance premiums in Pennsylvania. Insurers use credit scores as a proxy for financial responsibility, and individuals with good credit scores are often seen as less risky. As a result, they may qualify for lower premiums.

Insurance Discounts, Cheap car insurance in pa

Insurers offer a variety of discounts to help policyholders save money on their premiums. These discounts can be based on various factors, such as:

- Good Student Discount: This discount is available to students who maintain a good academic record.

- Safe Driver Discount: Drivers with a clean driving record and no accidents or violations may qualify for this discount.

- Multi-Car Discount: If you insure multiple vehicles with the same insurer, you may be eligible for a multi-car discount.

- Multi-Policy Discount: Insurers often offer discounts if you bundle your car insurance with other types of insurance, such as homeowners or renters insurance.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can reduce your premiums.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and may result in a discount.

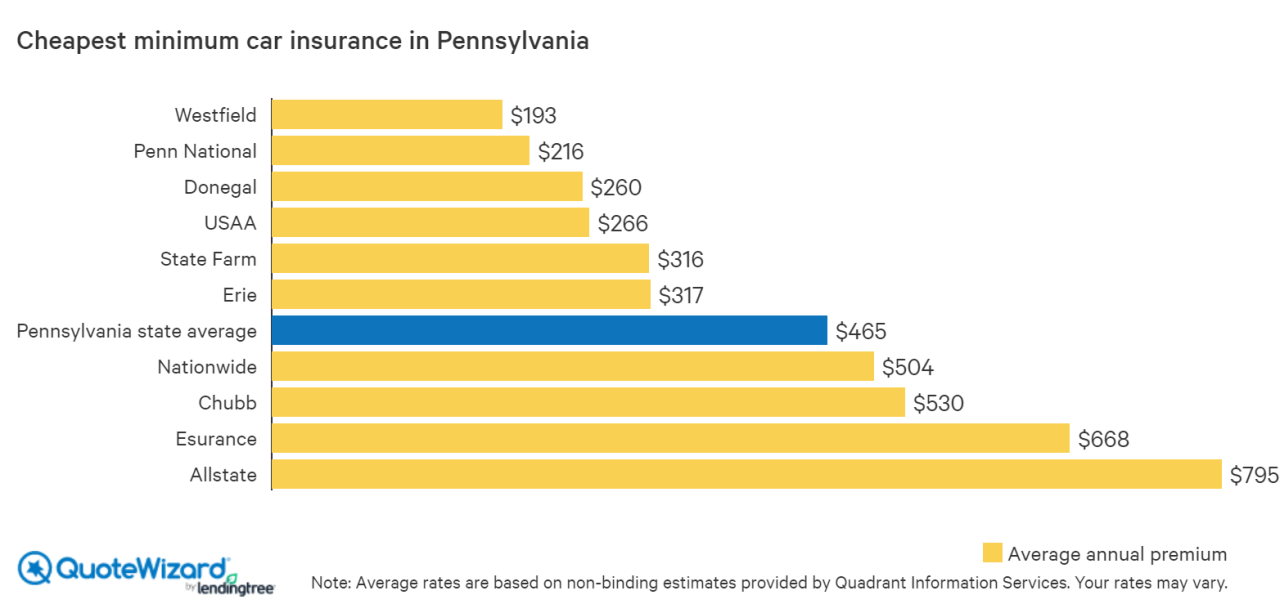

Average Car Insurance Costs in Pennsylvania

The following table provides an estimated comparison of average car insurance costs for different vehicle types and driver profiles in Pennsylvania:

| Vehicle Type | Driver Profile | Average Annual Premium |

|---|---|---|

| Standard Sedan | 30-year-old driver with clean driving record | $1,200 |

| SUV | 30-year-old driver with clean driving record | $1,400 |

| Luxury Sedan | 30-year-old driver with clean driving record | $1,800 |

| Sports Car | 30-year-old driver with clean driving record | $2,200 |

| Standard Sedan | 20-year-old driver with clean driving record | $1,600 |

| SUV | 20-year-old driver with clean driving record | $1,800 |

| Luxury Sedan | 20-year-old driver with clean driving record | $2,400 |

| Sports Car | 20-year-old driver with clean driving record | $2,800 |

Note: These are just estimates and actual premiums may vary based on individual factors and insurance company policies.

Exploring Affordable Car Insurance Options in Pennsylvania

Pennsylvania residents have numerous options when it comes to car insurance, making it crucial to compare different companies and policies to find the most affordable coverage. This section explores various car insurance options available in Pennsylvania, providing insights into different companies, policy types, and online insurance marketplaces.

Major Car Insurance Companies in Pennsylvania

Several major car insurance companies operate in Pennsylvania, each with its strengths and weaknesses.

- State Farm: Known for its extensive network of agents, competitive rates, and strong customer service.

- Geico: Offers a user-friendly online experience, competitive rates, and a wide range of discounts.

- Progressive: Provides personalized coverage options, a strong focus on customer satisfaction, and a variety of discounts.

- Liberty Mutual: Offers a comprehensive suite of insurance products, including car insurance, with a focus on personalized coverage and customer service.

- Erie Insurance: A regional insurer known for its strong customer service, competitive rates, and commitment to community involvement.

Types of Car Insurance Policies in Pennsylvania

Pennsylvania requires all drivers to carry liability insurance. However, different types of car insurance policies offer varying levels of coverage.

- Liability-only: The most basic type of coverage, it only covers damages caused to other people or their property in an accident. This policy does not cover damage to your own vehicle.

- Full coverage: This comprehensive policy includes liability coverage, collision coverage, which protects against damage to your own vehicle in an accident, and comprehensive coverage, which protects against damage from non-accident events like theft, vandalism, or natural disasters.

- Comprehensive: This policy includes liability coverage and comprehensive coverage but does not cover collision damage.

Online Insurance Marketplaces

Online insurance marketplaces provide a convenient way to compare quotes from multiple insurance companies.

- Benefits:

- Convenience: Allows you to compare quotes from multiple companies without leaving your home.

- Transparency: Provides detailed information about each policy, including coverage options and discounts.

- Potential for Savings: By comparing quotes from multiple companies, you can potentially find cheaper car insurance.

Tips for Saving Money on Car Insurance in Pennsylvania

Pennsylvania car insurance rates can be high, but there are several ways to save money on your premiums. By implementing these tips, you can significantly reduce your insurance costs and keep more money in your pocket.

Safe Driving Practices

Maintaining a clean driving record is crucial for obtaining affordable car insurance. A history of traffic violations, accidents, or driving under the influence can significantly increase your premiums.

- Avoid Traffic Violations: Every traffic violation, such as speeding tickets or running red lights, will be recorded on your driving record and can increase your insurance rates. Driving safely and following traffic laws is essential for maintaining low insurance premiums.

- Defensive Driving Courses: Completing a defensive driving course can help you learn safe driving techniques and may even qualify you for discounts on your insurance. These courses teach you how to anticipate potential hazards and react appropriately, reducing the risk of accidents.

- Avoid Accidents: Accidents are a major factor in determining insurance rates. Every accident, regardless of fault, will be reflected in your insurance history and can lead to higher premiums. Drive cautiously and defensively to minimize the risk of accidents.

Bundling Policies

Combining your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in significant discounts.

- Bundling with Homeowners/Renters Insurance: Many insurance companies offer discounts for bundling your car insurance with your homeowners or renters insurance. This allows you to save money on both policies by taking advantage of the combined coverage.

- Other Bundling Options: Some insurers also offer discounts for bundling your car insurance with other types of insurance, such as life insurance or health insurance.

Increasing Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Increasing your deductible can lower your monthly premiums, as you are taking on more financial responsibility for smaller claims.

- Higher Deductible, Lower Premium: By choosing a higher deductible, you agree to pay more out-of-pocket for smaller claims, but your insurance premiums will be lower. This strategy can be beneficial if you are confident in your ability to cover smaller expenses.

- Consider Your Risk Tolerance: Before increasing your deductible, consider your risk tolerance and financial situation. Ensure you can afford to pay the higher deductible in case of an accident.

Shopping Around for Quotes

Obtaining quotes from multiple insurance companies is essential for finding the most affordable coverage. Different insurance providers have varying rates and coverage options, so it’s crucial to compare quotes before making a decision.

- Use Online Comparison Tools: Online comparison websites make it easy to compare quotes from multiple insurers simultaneously. This allows you to quickly identify the best deals available for your specific needs.

- Contact Insurance Agents Directly: You can also contact insurance agents directly to get quotes and discuss your insurance needs. This allows you to receive personalized recommendations and ask questions about specific coverage options.

Car Safety Features and Anti-theft Devices

Cars equipped with advanced safety features and anti-theft devices are often considered lower risk by insurance companies, which can result in lower premiums.

- Safety Features: Features like anti-lock brakes, airbags, and electronic stability control can reduce the severity of accidents and may qualify you for discounts.

- Anti-theft Devices: Installing anti-theft devices, such as alarms, immobilizers, or GPS tracking systems, can deter theft and may lead to lower insurance rates.

Resources for Finding Cheap Car Insurance in Pennsylvania: Cheap Car Insurance In Pa

Finding the best car insurance rates in Pennsylvania can be a challenging task, especially with so many options available. Fortunately, several resources can help you navigate the process and locate affordable coverage.

Online Comparison Websites

These websites allow you to compare quotes from multiple insurance companies simultaneously. By providing your information once, you can receive customized quotes from various insurers, making it easier to identify the most competitive rates.

- Insurify: A popular online platform that compares quotes from over 20 insurance companies. It also provides insights into coverage options and factors affecting your premium.

- Policygenius: Another comprehensive website that allows you to compare quotes from top insurers. It offers a user-friendly interface and provides guidance on choosing the right coverage.

- The Zebra: This website stands out for its transparent and detailed comparison tools. It provides a breakdown of coverage options and highlights potential savings based on your individual profile.

- QuoteWizard: Known for its extensive network of insurance providers, QuoteWizard allows you to compare quotes from various insurers in your area. It also offers additional features like discount calculators and insurance guides.

Consumer Protection Agencies

These agencies play a crucial role in ensuring fair insurance practices and protecting consumers’ rights. They provide information about insurance policies, assist with resolving disputes, and offer guidance on navigating the insurance process.

- Pennsylvania Insurance Department (PID): The primary regulatory body for insurance in Pennsylvania. The PID investigates consumer complaints, enforces insurance laws, and provides educational resources.

- Pennsylvania Office of the Attorney General: This office handles consumer protection matters, including insurance disputes. They can provide legal advice and assistance in resolving insurance-related issues.

- Better Business Bureau (BBB): A non-profit organization that accredits businesses and helps consumers make informed decisions. The BBB provides ratings for insurance companies, allowing you to assess their reliability and customer service.

Major Insurance Companies in Pennsylvania

The table below lists some of the major insurance companies operating in Pennsylvania, along with their contact information.

| Insurance Company | Phone Number | Website |

|---|---|---|

| State Farm | 1-800-424-4211 | www.statefarm.com |

| Geico | 1-800-434-5300 | www.geico.com |

| Progressive | 1-800-776-4737 | www.progressive.com |

| Allstate | 1-800-ALLSTATE | www.allstate.com |

| Liberty Mutual | 1-800-225-2440 | www.libertymutual.com |

Last Point

Finding cheap car insurance in PA requires careful planning and research. By understanding Pennsylvania’s insurance requirements, exploring affordable options, and implementing cost-saving strategies, drivers can secure the necessary coverage at a price that fits their budget. Remember, prioritizing safety and responsible driving practices can significantly impact your insurance premiums and ultimately contribute to a safer driving experience for everyone on the road.

Quick FAQs

What are the minimum car insurance coverage requirements in PA?

Pennsylvania requires drivers to have liability insurance, uninsured/underinsured motorist coverage, and accident benefits. These coverages protect you and others in case of an accident.

How can I get a discount on my car insurance in PA?

Many insurance companies offer discounts for safe driving, bundling policies, and having safety features in your vehicle.

What are some tips for finding cheap car insurance in PA?

Shop around for quotes from multiple insurance companies, consider increasing your deductible, and maintain a good driving record.