Cheap car insurance Orlando Florida can be a challenge, considering the city’s bustling traffic, higher-than-average accident rates, and unique demographic mix. However, with the right strategies, finding affordable coverage is possible. This guide will delve into the Orlando car insurance market, highlighting key factors influencing premiums, and providing actionable tips to save on your policy.

Understanding the Orlando car insurance market is crucial. Factors like traffic density, accident rates, and demographics all play a role in determining premiums. Additionally, local laws and regulations, as well as the presence of major insurance companies and independent agents, shape the market landscape.

Understanding the Orlando Car Insurance Market

Navigating the car insurance market in Orlando, Florida, requires an understanding of the unique factors that influence premiums. Orlando’s vibrant economy, diverse demographics, and heavy traffic contribute to a dynamic insurance landscape.

Traffic Density and Accident Rates

Orlando’s bustling population and numerous tourist attractions result in high traffic volumes, contributing to a higher frequency of accidents. The Florida Department of Highway Safety and Motor Vehicles reported a significant number of crashes in the Orlando Metropolitan Statistical Area, highlighting the impact of traffic density on accident rates. This increased risk of accidents directly impacts insurance premiums, as insurers factor in the likelihood of claims.

Local Laws and Regulations

Florida’s “no-fault” insurance system requires drivers to carry Personal Injury Protection (PIP) coverage, which covers medical expenses regardless of fault. This mandate influences the structure of car insurance policies in Orlando, affecting premium calculations. Additionally, state-specific regulations on minimum coverage requirements and discounts impact the cost of insurance.

Influence of Major Insurance Companies and Independent Agents

Orlando’s insurance market is shaped by the presence of major national insurance companies and independent insurance agents. The competition among these entities can lead to diverse coverage options and pricing strategies. Independent agents often have access to multiple insurance carriers, allowing them to offer tailored solutions and competitive rates.

Factors Influencing Cheap Car Insurance

The cost of car insurance in Orlando, Florida, can vary significantly depending on several factors. Understanding these factors can help you make informed decisions to secure the most affordable coverage.

Driving History

Your driving history is a major determinant of your insurance premiums. A clean driving record with no accidents or traffic violations will generally lead to lower rates. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely result in higher premiums. Insurance companies use your driving history to assess your risk profile, and a history of accidents suggests a higher likelihood of future claims.

Vehicle Type

The type of vehicle you drive also plays a significant role in your insurance costs. Luxury cars, high-performance vehicles, and newer models often have higher premiums due to their higher repair costs and greater risk of theft. Conversely, older, less expensive vehicles typically have lower premiums. The safety features of your vehicle also influence your rates. Cars with advanced safety features like anti-lock brakes and airbags may qualify for discounts.

Age

Your age is another factor that insurance companies consider. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, which leads to higher premiums. As you age, your premiums generally decrease because you are considered a lower risk.

Credit Score

Surprisingly, your credit score can also impact your car insurance premiums. Insurance companies believe that individuals with good credit are more financially responsible and less likely to file claims. While this practice is controversial, it is a common factor used by many insurers.

Discounts and Special Offers

Several discounts and special offers can help lower your car insurance costs. These include:

- Good Student Discount: This discount is available to students who maintain a good academic record.

- Safe Driver Discount: This discount is offered to drivers with a clean driving record and no accidents or violations.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may qualify for a discount.

- Multi-Policy Discount: You may receive a discount if you bundle your car insurance with other insurance policies, such as home or renters insurance.

- Anti-theft Device Discount: Installing anti-theft devices in your car can make it less attractive to thieves and qualify you for a discount.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount.

Insurance Company Variations, Cheap car insurance orlando florida

Insurance companies have different pricing models and coverage options. Some companies may offer lower premiums for specific types of drivers or vehicles. Others may have more comprehensive coverage options, which can lead to higher premiums. It is crucial to compare quotes from multiple insurers to find the best rates and coverage for your needs. For instance, a company specializing in insuring young drivers might offer competitive rates for those under 25, while another company might have lower premiums for older drivers with a clean driving record.

Finding Affordable Car Insurance Options

Finding the cheapest car insurance in Orlando involves exploring various options and understanding your specific needs. This section will provide insights into reputable insurance companies, price comparisons, and the advantages and disadvantages of online comparison tools.

Reputable Car Insurance Companies in Orlando

Choosing a car insurance company in Orlando can be overwhelming due to the numerous options available. Understanding the strengths and weaknesses of different companies can help you make an informed decision.

- State Farm: Known for its strong customer service and extensive network of agents, State Farm offers a wide range of coverage options. However, premiums can be higher compared to some competitors.

- Geico: Geico is popular for its competitive pricing and convenient online and mobile services. However, their customer service may not be as personalized as other companies.

- Progressive: Progressive is recognized for its innovative features, including its Name Your Price tool, which allows you to set a budget and find insurance options that fit. However, their coverage options might be limited in some cases.

- Allstate: Allstate offers a wide range of insurance products, including auto, home, and life insurance. Their Drive Safe & Save program can reward safe drivers with discounts. However, their premiums can be higher than average.

- USAA: USAA is known for its exceptional customer service and competitive rates, but membership is restricted to active military personnel, veterans, and their families.

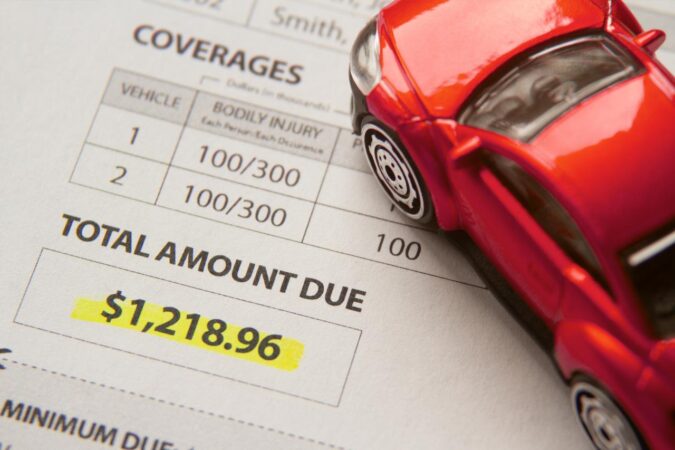

Comparing Car Insurance Premiums

The cost of car insurance varies significantly based on factors such as vehicle type, driver profile, and coverage level. Here’s a table comparing average premiums for common vehicle types and driver profiles:

| Vehicle Type | Driver Profile | State Farm | Geico | Progressive | Allstate |

|---|---|---|---|---|---|

| Sedan | Single, 30-year-old, good driving record | $1,200 | $1,000 | $1,100 | $1,300 |

| SUV | Married, 40-year-old, minor traffic violation | $1,500 | $1,300 | $1,400 | $1,600 |

| Truck | Single, 25-year-old, multiple traffic violations | $2,000 | $1,800 | $1,900 | $2,200 |

Note: These premiums are estimates and can vary based on individual circumstances.

Advantages and Disadvantages of Online Comparison Tools

Online comparison tools are valuable resources for finding cheap car insurance. They allow you to compare quotes from multiple companies simultaneously, saving you time and effort.

- Advantages:

- Convenience: Access quotes from multiple companies in one place.

- Time-Saving: Eliminate the need for contacting each company individually.

- Transparency: Provides a clear comparison of coverage options and prices.

- Disadvantages:

- Limited Information: May not provide comprehensive details about each company.

- Potential for Inaccurate Quotes: Quotes can be inaccurate if your information is not entered correctly.

- Lack of Personalized Advice: Online tools cannot provide tailored recommendations.

Tips for Saving on Car Insurance

Finding cheap car insurance in Orlando, Florida, is possible, but it requires proactive steps and a thorough understanding of the market. To save money on your car insurance premiums, consider these strategies.

Improving Driving Habits

Safe driving practices are crucial for lowering your car insurance premiums. Insurance companies assess your driving record to determine your risk level. A clean driving record with no accidents or violations can significantly reduce your premiums. Here are some tips for improving your driving habits:

- Avoid Distracted Driving: Distracted driving, such as texting or talking on the phone while driving, increases your risk of accidents. Focus on the road and avoid any distractions.

- Maintain a Safe Speed: Speeding is a major factor in accidents. Obey speed limits and drive defensively to reduce your risk of accidents.

- Avoid Aggressive Driving: Aggressive driving, such as tailgating, weaving in and out of traffic, and running red lights, increases your risk of accidents and can result in higher insurance premiums.

- Practice Defensive Driving: Defensive driving techniques can help you avoid accidents and stay safe on the road. Consider taking a defensive driving course to learn how to anticipate potential hazards and react safely.

Increasing Deductibles

Your deductible is the amount you pay out of pocket for repairs or replacement after an accident. Increasing your deductible can lower your premiums. However, consider your financial situation and the potential cost of repairs before increasing your deductible.

“If you can afford a higher deductible, you can save a significant amount on your premiums.”

Bundling Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts. Insurance companies often offer discounts for bundling multiple policies, as it simplifies their risk assessment and reduces administrative costs.

- Homeowners Insurance: If you own a home, bundling your car insurance with homeowners insurance can lead to substantial savings.

- Renters Insurance: If you rent an apartment, bundling your car insurance with renters insurance can also provide discounts.

Maintaining a Good Credit Score

While it may seem surprising, your credit score can affect your car insurance premiums. Insurance companies use credit scores as a proxy for risk assessment, as individuals with good credit scores tend to be more financially responsible.

- Pay Bills on Time: Timely payments demonstrate financial responsibility and can improve your credit score.

- Reduce Debt: High debt levels can negatively impact your credit score. Work towards reducing your debt to improve your credit rating.

- Check Your Credit Report: Review your credit report regularly for errors or inaccuracies that may be affecting your score.

Shopping Around for the Best Rates

It’s crucial to compare quotes from multiple insurance companies to find the best rates. Use online comparison tools or contact insurance companies directly to obtain quotes. Don’t hesitate to negotiate with insurers to try and get the best possible price.

Considerations Beyond Price: Cheap Car Insurance Orlando Florida

While finding cheap car insurance in Orlando is essential, it’s crucial to remember that price shouldn’t be the sole deciding factor. Comprehensive coverage that protects you and your finances in the event of an accident is equally important.

Understanding the coverage options beyond the base requirements can significantly impact your financial security and peace of mind.

Understanding Coverage Options

Choosing the right car insurance coverage is crucial, and understanding the different types available is essential. Beyond the minimum requirements, consider additional coverage options like collision, comprehensive, and uninsured/underinsured motorist coverage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. It’s particularly valuable if you have a newer or financed vehicle.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. It’s recommended for vehicles with a higher value.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It can help cover medical expenses, lost wages, and property damage.

Liability Coverage

Adequate liability coverage is critical for protecting yourself financially in case of an accident. This coverage protects you from financial losses if you’re at fault for an accident that causes injury or damage to others.

Liability coverage typically covers bodily injury and property damage. The amount of coverage you need depends on factors such as the value of your assets, the potential for lawsuits, and the state’s minimum liability requirements.

Customer Service and Claims Handling

While price and coverage are important, customer service and claims handling are equally crucial. Choosing an insurance company with a reputation for excellent customer service and efficient claims processing can make a significant difference in your overall experience.

- Customer Service: Look for an insurance company with a responsive customer service team available by phone, email, or online chat. Consider reading reviews and ratings to gauge customer satisfaction with their service.

- Claims Handling: Evaluate the insurance company’s claims process. Consider factors such as the ease of filing a claim, the time it takes to process a claim, and the overall level of communication during the claims process.

End of Discussion

Navigating the Orlando car insurance market requires careful consideration of multiple factors, including driving history, vehicle type, age, and credit score. Remember, shopping around, comparing quotes from multiple companies, and taking advantage of discounts are essential steps in securing cheap car insurance. By understanding the intricacies of the market and implementing smart strategies, drivers in Orlando can find affordable coverage that meets their needs and budget.

FAQ Compilation

What is the average car insurance cost in Orlando?

The average car insurance cost in Orlando can vary significantly depending on factors like your driving record, vehicle type, and coverage levels. However, you can expect to pay more than the national average due to the city’s higher accident rates and traffic density.

What are the best car insurance companies in Orlando?

Several reputable car insurance companies operate in Orlando, each with its strengths and weaknesses. It’s crucial to compare quotes and coverage options from multiple companies to find the best fit for your needs and budget.

How can I get a discount on my car insurance in Orlando?

Many discounts are available to help lower your car insurance premiums in Orlando. These include discounts for good driving records, safe driving courses, bundling policies, and having safety features in your vehicle. Ask your insurance company about the discounts they offer.