Cheap car insurance Pennsylvania is a hot topic for drivers in the Keystone State, especially when you consider the state’s unique insurance regulations and the many factors that can influence your rates. From understanding mandatory coverage requirements to comparing quotes from different providers, finding affordable car insurance in Pennsylvania can be a real challenge. But don’t worry, we’re here to break it down and help you navigate the process.

Pennsylvania’s car insurance market is distinct, with its own set of rules and regulations that affect pricing. The state requires drivers to carry specific types of coverage, which can impact the overall cost of insurance. In addition, factors like your age, driving history, vehicle type, and even your credit score can play a role in determining your premium.

Understanding Pennsylvania’s Car Insurance Market

Pennsylvania’s car insurance market is a unique beast, with its own set of rules and regulations that can make finding affordable coverage a real challenge. But don’t worry, we’re here to break it down and help you navigate the wild world of Pennsylvania car insurance.

Factors Influencing Car Insurance Costs

Pennsylvania’s car insurance costs are influenced by a number of factors, including:

- Your Driving Record: This is the big one, folks. If you’ve got a clean record, you’ll likely pay less. But if you’ve got a few too many speeding tickets or accidents, expect to see your premiums climb.

- Your Vehicle: The kind of car you drive matters, too. Fancy sports cars and luxury vehicles are generally more expensive to insure because they cost more to repair. And don’t forget about the age of your car. Older vehicles are typically cheaper to insure.

- Where You Live: Car insurance rates can vary wildly depending on your location in Pennsylvania. Cities tend to have higher rates due to increased risk of accidents and theft.

- Your Age and Gender: Insurance companies often factor in your age and gender when calculating your premiums. Young drivers and males tend to pay higher rates because they are statistically more likely to get into accidents.

- Your Credit Score: This might surprise you, but in some states, including Pennsylvania, insurance companies use your credit score to determine your rates. A good credit score generally translates to lower premiums.

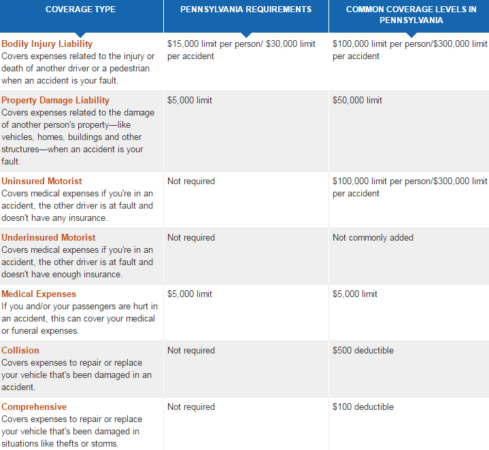

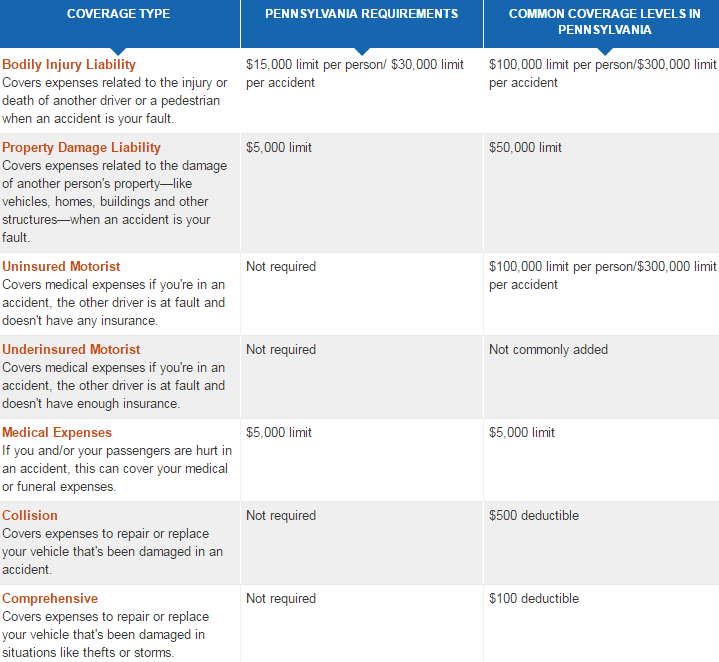

Mandatory Coverage Requirements

Pennsylvania requires all drivers to carry the following minimum insurance coverage:

- Liability Coverage: This protects you financially if you cause an accident that injures someone or damages their property. It’s broken down into two parts:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages resulting from injuries you cause to others.

- Property Damage Liability: Covers damage you cause to another person’s property, like their car or a fence.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

These mandatory coverage requirements are designed to ensure that all drivers have some financial protection in case of an accident. However, they can also make car insurance in Pennsylvania more expensive than in some other states.

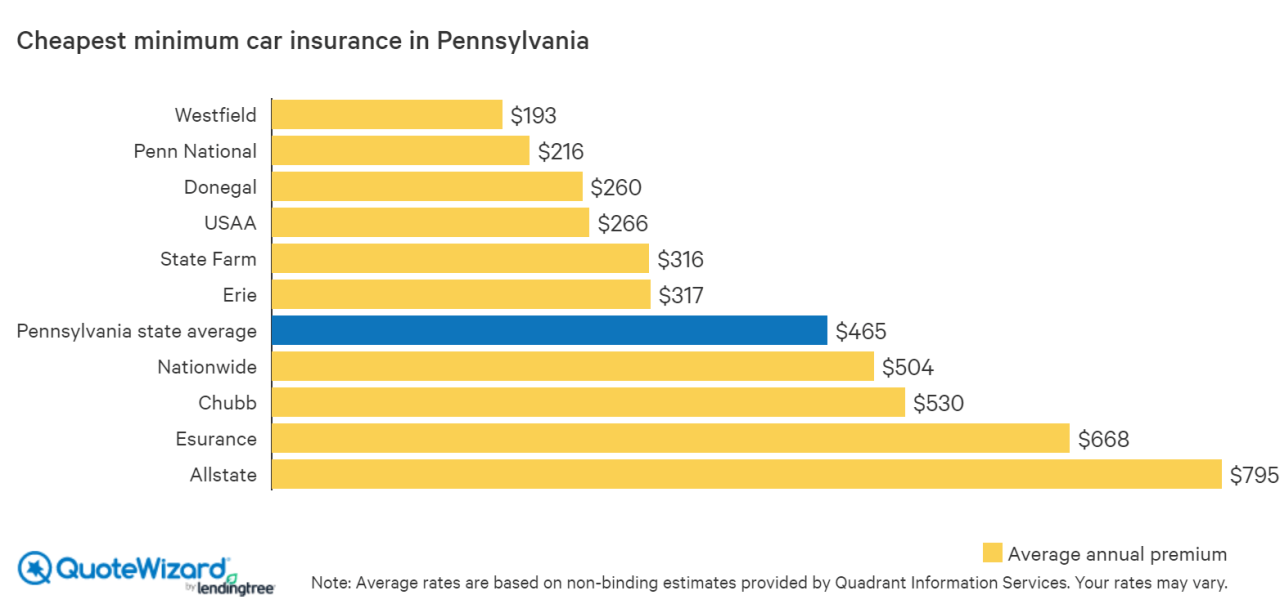

Average Car Insurance Premiums, Cheap car insurance pennsylvania

Pennsylvania is notorious for having some of the highest car insurance premiums in the country. According to the Insurance Information Institute, the average annual premium for car insurance in Pennsylvania is around $1,500, which is significantly higher than the national average of about $1,000.

This high cost is largely due to the state’s mandatory coverage requirements and the fact that Pennsylvania has a relatively high number of uninsured drivers.

Choosing the Right Insurance Provider

Picking the right car insurance provider in Pennsylvania is like choosing the perfect pizza topping – it’s all about finding the right combination of features, price, and service to satisfy your needs.

Understanding Provider Services and Features

To make the best decision, you need to understand the different services and features offered by major car insurance providers in Pennsylvania.

- Coverage Options: Providers offer a variety of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Make sure you understand the different types of coverage and choose the ones that best protect you and your car.

- Discounts: Many providers offer discounts for good driving records, safety features, multiple policies, and other factors. These discounts can significantly reduce your premium, so be sure to ask about them.

- Customer Service: A provider’s customer service can make all the difference when you need to file a claim or have a question about your policy. Look for providers with a reputation for responsiveness and helpfulness.

- Digital Tools: Many providers offer online portals and mobile apps that allow you to manage your policy, pay your premiums, and file claims easily. These digital tools can save you time and hassle.

- Claims Handling: A provider’s claims handling process is crucial when you need to file a claim. Look for providers with a reputation for prompt and fair claims handling.

The Importance of a Strong Reputation

Choosing a provider with a strong reputation for customer service and claims handling is essential. Imagine this: You’re stuck in a fender bender, your car’s totaled, and you’re dealing with the stress of getting it fixed. A provider with a stellar reputation will make this process smoother by being responsive, transparent, and fair in their dealings.

Financial Stability and Claims History

Understanding a provider’s financial stability and claims history is like knowing your favorite restaurant’s ingredients – it gives you peace of mind.

- Financial Stability: A financially stable provider is more likely to be able to pay your claims, even in the event of a major disaster. You can check a provider’s financial rating with organizations like AM Best and Standard & Poor’s.

- Claims History: A provider’s claims history can give you an idea of how they handle claims. Look for providers with a low number of complaints and a history of resolving claims fairly.

Navigating the Insurance Process

Getting car insurance in Pennsylvania might seem like a chore, but it doesn’t have to be a total drag. You can get the best deal if you know how to navigate the process. Think of it like a game of “car insurance bingo” – you gotta play your cards right to win!

Obtaining Car Insurance Quotes

Before you commit to a policy, you’ll want to get quotes from different insurance companies to compare prices and coverage options. It’s like shopping for a new pair of kicks – you wouldn’t buy the first pair you see, right?

Here’s how to get those quotes:

- Online Comparison Websites: Websites like Insurance.com, The Zebra, and Policygenius let you compare quotes from multiple insurers in one place. It’s like a car insurance buffet – you can pick and choose what you want!

- Directly Contact Insurers: You can also get quotes directly from individual insurance companies. You can visit their websites, call them, or visit their offices. This is like going straight to the source – you get the real deal, no middleman!

- Local Insurance Agents: Working with a local agent can be a great way to get personalized advice and help navigating the process. Think of them as your car insurance guru – they know the ins and outs of the market.

Reviewing Policy Documents

Once you’ve got a few quotes, it’s time to put on your detective hat and review those policy documents. You want to make sure you understand what you’re getting – no surprises later!

- Coverage Types: Pay close attention to the types of coverage included in the policy, such as liability, collision, comprehensive, and uninsured motorist coverage. You want to make sure you have the right protection for your car and yourself. Think of it like having a safety net – you don’t want to be caught without one!

- Deductibles: The deductible is the amount you’ll have to pay out of pocket before your insurance kicks in. A higher deductible means lower premiums, but you’ll have to pay more in case of an accident. It’s like choosing between a big, comfy couch and a smaller, more affordable one – you gotta weigh the pros and cons.

- Limits: The limits on your policy determine the maximum amount your insurance will pay for a covered event. Make sure these limits are high enough to cover your needs. Think of it like setting a budget – you want to make sure you have enough to cover your expenses.

- Exclusions: Exclusions are things that aren’t covered by your policy. Be sure to read through the fine print and understand what’s not covered. Think of it like reading the “fine print” on a menu – you don’t want to be surprised when the bill comes!

Navigating the Claims Process

If you’re ever in a car accident, you’ll need to file a claim with your insurance company. It’s like calling for backup – your insurance is there to help you get back on track.

- Report the Accident: Report the accident to your insurance company as soon as possible. This is like calling 911 for your car – it’s important to get help right away!

- Gather Information: Collect information from the other driver, witnesses, and the police. This is like taking notes – you want to have all the details in case you need them later.

- Follow Instructions: Your insurance company will guide you through the claims process. Follow their instructions carefully to ensure a smooth experience. Think of it like following a recipe – you want to make sure you’re doing everything right!

Last Recap

Getting the best deal on car insurance in Pennsylvania doesn’t have to be a headache. By understanding the key factors that influence rates, comparing quotes from different providers, and taking advantage of available discounts, you can find affordable coverage that fits your needs and budget. Remember, a little research and effort can go a long way in securing the best possible car insurance rates in Pennsylvania.

Question Bank: Cheap Car Insurance Pennsylvania

What are the mandatory car insurance coverages in Pennsylvania?

Pennsylvania requires drivers to carry liability insurance, which covers damage to other people’s property and injuries caused by an accident. This includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How can I compare car insurance quotes from different providers?

You can use online comparison websites, contact insurance agents directly, or work with an independent insurance broker to compare quotes. Be sure to provide accurate information to ensure you receive accurate quotes.

What is the impact of my credit score on car insurance rates in Pennsylvania?

Pennsylvania insurers are allowed to use credit information to determine your rates. A good credit score can help you qualify for lower premiums, while a poor credit score could lead to higher rates.

What are some common car insurance discounts available in Pennsylvania?

Many insurers offer discounts for safe driving, good student records, multiple vehicles, and bundling car insurance with other types of insurance, such as homeowners or renters insurance.