Cheap florida insurance car – Cheap Florida car insurance can be a daunting task, given the state’s high insurance rates. Florida’s unique insurance landscape, influenced by factors like frequent weather events, high accident rates, and a complex legal system, makes finding affordable coverage a priority for many drivers.

This guide will delve into the intricacies of Florida’s insurance market, exploring strategies for finding affordable car insurance while ensuring adequate protection. We’ll cover everything from understanding the factors that influence premiums to identifying the best insurance providers and navigating the process of obtaining coverage.

Understanding Florida’s Insurance Landscape

Florida’s car insurance landscape is distinct and often more expensive than other states. This is due to a combination of factors, including a high number of uninsured drivers, a litigious environment, and frequent natural disasters. Understanding these nuances is crucial for drivers seeking affordable car insurance in the Sunshine State.

Factors Contributing to Higher Car Insurance Costs

Several factors contribute to Florida’s higher car insurance costs.

- High Number of Uninsured Drivers: Florida has a significant number of uninsured drivers, which can increase premiums for insured drivers. When uninsured drivers cause accidents, insured drivers may have to pay for their own damages.

- Litigious Environment: Florida has a reputation for being a “litigious” state, meaning that there are many lawsuits filed, including those related to car accidents. This can lead to higher insurance premiums as insurers need to cover potential legal costs.

- Frequent Natural Disasters: Florida is prone to hurricanes, floods, and other natural disasters, which can damage vehicles and increase insurance claims. Insurers factor in these risks when setting premiums.

- High Cost of Living: Florida’s high cost of living, including healthcare and vehicle repair costs, can also contribute to higher insurance premiums.

Challenges Faced by Florida Drivers

Florida drivers face unique challenges in the car insurance market.

- Finding Affordable Coverage: Due to the factors mentioned above, finding affordable car insurance in Florida can be challenging. Drivers may need to shop around and compare quotes from multiple insurers to find the best rates.

- Understanding Coverage Options: Florida has a complex system of car insurance coverage options, and drivers need to carefully understand their options to ensure they have adequate protection.

- Dealing with Uninsured Drivers: Florida’s high number of uninsured drivers means that insured drivers are at risk of being involved in accidents with drivers who cannot cover their damages.

Florida Insurance Market Overview

The Florida insurance market is characterized by a complex regulatory environment and a diverse range of insurance companies.

- Key Players: The Florida insurance market is dominated by a few large national insurers, as well as numerous smaller regional and local companies. Some of the major players include State Farm, Geico, Allstate, and Progressive.

- Regulations: The Florida Office of Insurance Regulation (OIR) oversees the insurance industry in the state. The OIR sets regulations for insurance rates, coverage options, and consumer protection.

- Financial Stability: The Florida insurance market has experienced periods of instability, particularly in the aftermath of major hurricanes. The state has implemented measures to strengthen the financial stability of insurers and protect consumers.

Exploring Cheap Car Insurance Options

Finding affordable car insurance in Florida can be a challenge, but with careful research and comparison, you can secure a policy that fits your budget and needs. This section delves into the various car insurance options available in Florida, explores factors influencing premium costs, and compares different insurance providers.

Types of Car Insurance in Florida

Florida law mandates that all drivers carry at least the minimum liability insurance coverage, which includes:

- Personal Injury Protection (PIP): Covers medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault. Florida has a $10,000 PIP coverage requirement.

- Property Damage Liability (PDL): Protects the insured driver against financial losses if they cause damage to another person’s property.

In addition to the mandatory coverage, drivers can choose to purchase additional optional coverage, such as:

- Collision Coverage: Covers damage to the insured vehicle in a collision, regardless of fault.

- Comprehensive Coverage: Covers damage to the insured vehicle due to non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Protects the insured driver and passengers if they are involved in an accident with a driver who is uninsured or underinsured.

- Medical Payments Coverage (Med Pay): Provides additional medical coverage for the insured driver and passengers, regardless of fault.

- Rental Reimbursement Coverage: Covers the cost of a rental car if the insured vehicle is damaged or stolen and cannot be driven.

- Roadside Assistance Coverage: Provides assistance with services such as towing, flat tire changes, and jump starts.

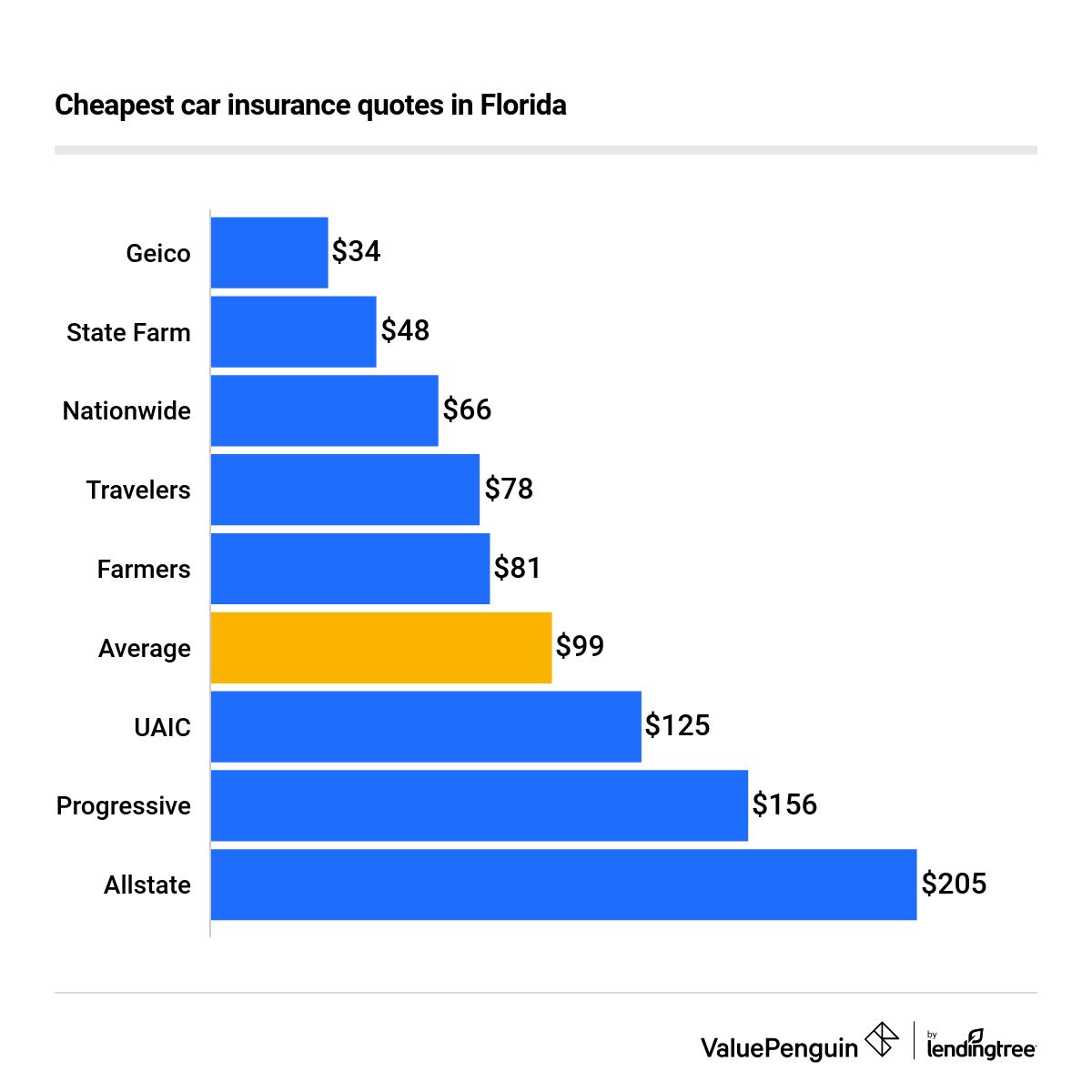

Comparing Insurance Providers in Florida

Florida has a wide range of insurance providers, each offering varying rates and coverage options. Comparing quotes from multiple providers is crucial to finding the most affordable policy.

- State Farm: Known for its comprehensive coverage options and competitive pricing.

- Geico: Offers a wide range of discounts and online tools for easy policy management.

- Progressive: Offers a variety of insurance products, including car, home, and renters insurance.

- Allstate: Provides personalized insurance plans and a strong customer service reputation.

- USAA: Exclusively for active military personnel, veterans, and their families, offering competitive rates and excellent service.

Factors Influencing Car Insurance Premiums

Several factors can significantly impact your car insurance premium, including:

- Driving History: Drivers with a clean driving record, without accidents or traffic violations, typically receive lower premiums.

- Age: Younger drivers, especially those under 25, are generally considered higher risk and may face higher premiums.

- Vehicle Type: The make, model, and year of the vehicle can influence insurance costs. High-performance vehicles or luxury cars may be more expensive to insure due to their higher repair costs and potential for theft.

- Location: Car insurance rates can vary depending on the location, as factors such as traffic density, crime rates, and weather conditions can influence risk.

- Credit Score: In some states, including Florida, insurance providers may consider your credit score as a factor in determining your premium.

Strategies for Finding Affordable Coverage

In Florida, where car insurance costs are notoriously high, finding affordable coverage is crucial. While many factors influence your premiums, there are several strategies you can employ to reduce your expenses and secure a policy that fits your budget.

Exploring Discounts and Bundling, Cheap florida insurance car

Discounts play a significant role in lowering your insurance premiums. Insurance companies offer a wide array of discounts, and it’s essential to explore these options to find the best deals.

- Good Driver Discounts: Maintaining a clean driving record with no accidents or violations is a major factor in obtaining lower rates. Insurance companies often reward drivers with good driving habits with significant discounts.

- Safe Driver Discounts: Participating in defensive driving courses can demonstrate your commitment to safe driving practices, leading to discounted premiums.

- Bundling Discounts: Combining your car insurance with other policies, such as homeowners or renters insurance, can result in substantial savings. Insurance companies often offer discounts for bundling multiple policies together.

- Other Discounts: Explore other potential discounts, such as discounts for good credit scores, vehicle safety features, and being a member of certain organizations.

Increasing Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Increasing your deductible can lower your premiums significantly.

- Understanding Deductibles: Higher deductibles mean you pay more upfront in the event of a claim, but your monthly premiums will be lower. Consider your financial situation and risk tolerance when deciding on a deductible amount.

- Balancing Risk and Cost: A higher deductible can save you money on premiums but may require you to have more cash on hand in case of an accident.

Comparing Quotes and Providers

Shopping around for insurance quotes from different providers is crucial to finding the best deal.

- Online Quote Tools: Utilize online quote comparison tools that allow you to enter your information and receive quotes from multiple insurers simultaneously.

- Direct Contact: Reach out to insurance companies directly to obtain quotes and discuss your coverage needs.

- Independent Agents: Consider working with an independent insurance agent who can compare quotes from various companies on your behalf.

Understanding Coverage Options

Choosing the right coverage is essential to ensure adequate protection without overspending.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

Factors Influencing Car Insurance Costs

Car insurance premiums are not a one-size-fits-all proposition. Numerous factors contribute to the final cost, and understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history plays a significant role in determining your insurance costs. Insurance companies consider your past driving record, including accidents, traffic violations, and DUI convictions.

- A clean driving record with no accidents or violations will usually result in lower premiums.

- Accidents, even those where you were not at fault, can increase your premiums, as they indicate a higher risk of future accidents.

- Traffic violations, such as speeding tickets or running red lights, can also raise your premiums.

- DUI convictions are particularly severe and can lead to significantly higher premiums or even denial of coverage.

Age

Age is a key factor in car insurance pricing, as younger and older drivers tend to have higher accident rates.

- Younger drivers, particularly teenagers, often lack experience and are more prone to risky driving behaviors, leading to higher premiums.

- Older drivers, while generally more experienced, may face challenges with vision, reaction time, and physical abilities, which can also increase their risk of accidents.

- Drivers in their mid-20s to mid-50s typically have lower premiums due to their experience and lower accident risk.

Gender

While the role of gender in insurance pricing is debated, statistics have shown that men tend to have higher accident rates than women.

- In some states, insurance companies may charge higher premiums for men due to their statistically higher accident risk.

- However, this practice is being challenged, and some states have outlawed gender-based pricing.

- It’s important to note that this difference is statistically based and does not reflect individual driving habits.

Credit Score

Credit score is an increasingly common factor considered by insurance companies. The reasoning behind this is that people with good credit history tend to be more responsible and reliable, which can translate to safer driving habits.

- Individuals with higher credit scores may qualify for lower premiums, while those with lower scores may face higher premiums.

- This practice is controversial, as it links driving behavior to financial history, but it is becoming more prevalent in the insurance industry.

Vehicle Type

The type of vehicle you drive significantly influences your insurance costs.

- Luxury vehicles, sports cars, and high-performance cars are generally more expensive to repair or replace, leading to higher insurance premiums.

- Older vehicles, especially those with safety features that are outdated, may also have higher premiums due to their increased risk of accidents and higher repair costs.

Safety Features

Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, electronic stability control, and lane departure warning systems, are generally considered safer and therefore attract lower insurance premiums.

- These features help prevent accidents or mitigate their severity, reducing the risk for insurance companies.

- Insurance companies often offer discounts for vehicles with such safety features.

Location

The location where you live can also affect your car insurance costs.

- Urban areas with high traffic density and congestion tend to have higher accident rates, resulting in higher premiums.

- Rural areas with lower population density and less traffic may have lower premiums.

- The specific location within a city or town can also influence premiums, as some neighborhoods may have higher crime rates or accident history.

Driving Habits

Your driving habits significantly influence your insurance premiums.

- Drivers who commute long distances or frequently drive in hazardous conditions, such as heavy traffic or inclement weather, are considered higher risk and may face higher premiums.

- Drivers who use their vehicle primarily for personal use and drive fewer miles per year may qualify for lower premiums.

- Safe driving habits, such as avoiding speeding, following traffic laws, and maintaining a safe distance from other vehicles, can help lower your premiums.

Risk Factors

Various other factors can impact your insurance premiums.

- Your occupation, if it involves driving frequently or in hazardous conditions, can affect your premiums.

- The number of drivers in your household, particularly young or inexperienced drivers, can increase your premiums.

- The purpose of your vehicle, such as business use or transporting goods, can also affect your premiums.

Avoiding Common Mistakes

The quest for cheap car insurance in Florida can be a minefield of potential pitfalls. Navigating this landscape effectively requires an understanding of common mistakes to avoid and a commitment to making informed decisions.

Identifying and Avoiding Scams

It’s crucial to be wary of scams and misleading offers when searching for affordable car insurance. Here’s how to protect yourself:

- Beware of unsolicited offers: Legitimate insurance companies typically don’t contact you out of the blue with offers. Be cautious of calls or emails promising incredibly low rates without any prior inquiry.

- Verify the legitimacy of companies: Before providing any personal information, verify the insurance company’s legitimacy by checking their license with the Florida Department of Financial Services.

- Avoid high-pressure sales tactics: If a salesperson is pressuring you to make a decision immediately, it’s a red flag. Take your time, research, and compare quotes before committing.

- Read the fine print: Carefully review the insurance policy before signing. Pay attention to deductibles, coverage limits, and exclusions.

Choosing a Reputable and Reliable Insurance Provider

Selecting a reputable and reliable insurance provider is crucial for ensuring you have adequate coverage and a positive experience. Here’s how to make an informed choice:

- Check financial stability: Look for companies with strong financial ratings from agencies like A.M. Best. A financially stable insurer is more likely to be able to pay claims when you need them.

- Read customer reviews: Review websites like the Better Business Bureau (BBB) and J.D. Power can provide insights into customer satisfaction and claims handling.

- Consider company reputation: Look for companies known for their fair claims handling practices and responsiveness to customer needs.

- Compare quotes from multiple providers: Don’t settle for the first quote you receive. Compare prices and coverage options from different insurers to find the best fit for your needs and budget.

Additional Considerations

Beyond the core aspects of finding cheap car insurance in Florida, several additional factors can influence your choices and overall experience. These considerations extend beyond just the price tag and encompass aspects like customer service, provider reputation, and additional coverage options.

Comparing Insurance Providers

Understanding the differences between various insurance providers in Florida is crucial for making an informed decision. Here’s a table comparing some of the major players based on price, coverage, and customer service:

| Provider | Price (Average Annual Premium) | Coverage Options | Customer Service |

|—|—|—|—|

| State Farm | $1,500 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection | 4.5/5 stars |

| Geico | $1,400 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection | 4/5 stars |

| Progressive | $1,300 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection, Rental Car Reimbursement | 3.5/5 stars |

| USAA | $1,200 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection, Roadside Assistance | 4.8/5 stars |

| Allstate | $1,600 | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection, Accident Forgiveness | 3.8/5 stars |

Note: The average annual premiums are estimates and can vary based on individual factors such as driving history, vehicle type, and location.

Obtaining Car Insurance in Florida

The process of obtaining car insurance in Florida involves several steps, as illustrated in the flowchart below:

Flowchart:

1. Gather Information: Collect your driving history, vehicle information, and personal details.

2. Compare Quotes: Contact multiple insurance providers to obtain quotes.

3. Choose a Provider: Select the provider offering the best combination of price and coverage.

4. Complete Application: Fill out the application form and provide the required documentation.

5. Make Payment: Pay the initial premium to activate your insurance policy.

6. Receive Policy Documents: Receive your insurance policy documents, including the policy details and coverage information.

Important Note: Ensure that you understand the terms and conditions of your policy before signing any documents.

Resources for Further Information

For drivers seeking additional information on car insurance in Florida, several resources can be helpful:

- Florida Office of Insurance Regulation (OIR): The OIR is the state agency responsible for regulating the insurance industry in Florida. They offer information on consumer rights, insurance company ratings, and complaint procedures.

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that provides information and resources on insurance issues. They offer a consumer information website with resources on car insurance, including tips for finding affordable coverage.

- Insurance Information Institute (III): The III is a non-profit organization that provides information on insurance issues. They offer resources on car insurance, including information on coverage options, claims procedures, and consumer rights.

Final Summary

Finding cheap Florida car insurance doesn’t have to be a stressful endeavor. By understanding the market, exploring different options, and implementing smart strategies, you can secure affordable coverage that meets your needs. Remember, a little research and comparison shopping can go a long way in saving you money on your car insurance premiums.

FAQs: Cheap Florida Insurance Car

What are the main reasons for high car insurance costs in Florida?

Florida has high insurance costs due to factors like frequent accidents, high litigation rates, and a large number of uninsured drivers.

How can I lower my car insurance premiums in Florida?

You can lower your premiums by bundling policies, increasing deductibles, improving your driving record, and exploring discounts.

What are some common mistakes to avoid when searching for cheap car insurance?

Avoid choosing the cheapest option without considering coverage, falling for scams or misleading offers, and neglecting to compare quotes from multiple providers.