Cheap PIP car insurance Florida is a crucial aspect of responsible driving in the Sunshine State. Understanding PIP coverage, its benefits, and the factors influencing its cost can help you secure affordable protection for yourself and your passengers. Florida law mandates that all drivers carry Personal Injury Protection (PIP) insurance, which covers medical expenses and lost wages in case of an accident. This article will guide you through the intricacies of PIP coverage, explore ways to find affordable options, and provide valuable tips for safe driving.

Navigating the complexities of car insurance can be daunting, but with the right knowledge and strategies, you can find cheap PIP car insurance in Florida that fits your budget and needs. By understanding the key factors that influence premiums, comparing quotes from different providers, and implementing safe driving practices, you can secure comprehensive coverage without breaking the bank.

Understanding PIP Coverage in Florida

Florida is a no-fault insurance state, meaning that drivers are primarily responsible for covering their own medical expenses and lost wages after an accident, regardless of who is at fault. This is where Personal Injury Protection (PIP) coverage comes in. PIP coverage is a crucial component of car insurance in Florida, offering financial protection for medical expenses and lost wages following an accident.

PIP Coverage Requirements in Florida

Florida law mandates that all drivers carry a minimum of $10,000 in PIP coverage. This minimum coverage applies to all vehicles registered in Florida, regardless of whether they are owned by individuals or businesses. The $10,000 minimum is a significant amount, as it represents the amount of coverage available for medical expenses and lost wages.

Benefits Covered by PIP Insurance

PIP insurance provides coverage for a range of benefits, including:

- Medical Expenses: PIP coverage helps pay for medical bills related to injuries sustained in an accident. This includes expenses like doctor’s visits, hospital stays, surgery, and rehabilitation.

- Lost Wages: PIP coverage can also help compensate for lost wages due to an accident-related injury. This benefit helps ensure that individuals can still pay their bills while recovering from their injuries.

- Death Benefits: In the unfortunate event of a fatality, PIP coverage can provide a death benefit to the deceased person’s beneficiaries. This benefit can help cover funeral expenses and other financial needs.

Importance of Choosing Adequate PIP Coverage Levels

While the minimum PIP coverage requirement is $10,000, it is crucial to consider whether this level is sufficient for your needs. It is important to understand that PIP coverage only applies to the individual policyholder and their family members.

It is crucial to note that the $10,000 minimum PIP coverage requirement is only the minimum.

For individuals with higher medical expenses or who rely heavily on their income, it may be advisable to purchase additional PIP coverage. This will provide greater financial protection in the event of an accident.

Factors Influencing Car Insurance Costs in Florida

Car insurance premiums in Florida are influenced by a variety of factors. Understanding these factors can help you find the most affordable coverage for your needs.

Driving History

Your driving history plays a significant role in determining your car insurance premiums. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will likely lead to higher premiums.

Age

Age is another key factor affecting car insurance costs. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Insurance companies often consider younger drivers to be higher risk and charge them higher premiums. As drivers age and gain experience, their premiums typically decrease.

Credit Score

Surprisingly, your credit score can also impact your car insurance premiums in Florida. Insurance companies often use credit scores as a proxy for risk assessment. Individuals with good credit scores are generally considered to be more responsible and reliable, leading to lower premiums. However, it’s important to note that credit scores are not the sole determining factor and other factors are also considered.

Vehicle Type

The type of vehicle you drive can significantly impact your car insurance premiums. Higher-performance vehicles or those with expensive parts are often associated with higher repair costs, leading to higher premiums. Conversely, smaller, less expensive vehicles generally result in lower premiums.

Location

Your location in Florida can also influence your car insurance costs. Areas with higher crime rates or more traffic congestion may have higher accident rates, leading to higher premiums.

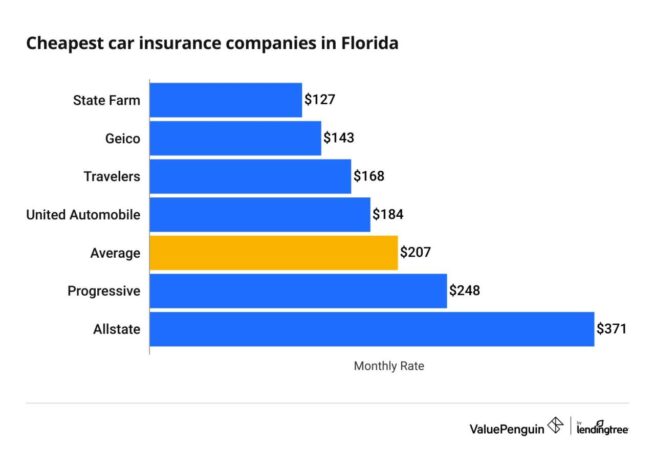

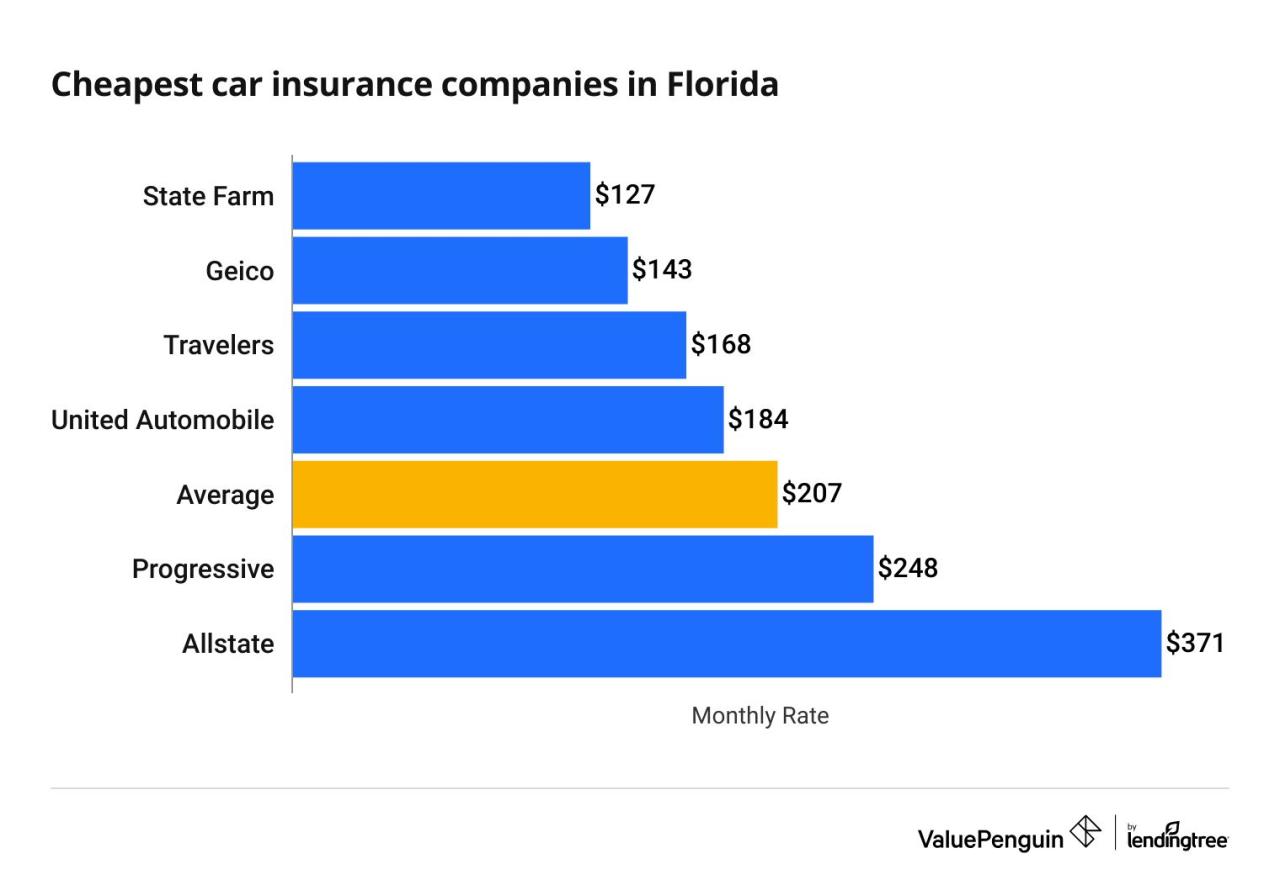

Insurance Provider

Different insurance providers offer varying rates for similar coverage. It’s essential to compare quotes from multiple providers to find the most competitive rates. Factors like the provider’s financial stability, customer service, and claim handling practices can also impact your decision.

Finding Affordable PIP Car Insurance in Florida

Finding the right car insurance policy can be a daunting task, especially in a state like Florida with its unique requirements. To help you navigate this process, we’ll delve into strategies for finding affordable PIP car insurance in Florida.

Reputable Car Insurance Providers in Florida

Choosing a reputable car insurance provider is crucial. Here’s a list of some well-known and reliable providers in Florida:

- State Farm

- Geico

- Progressive

- Allstate

- USAA (for military members and their families)

- Florida Peninsula Insurance

- Auto-Owners Insurance

Comparing Car Insurance Quotes

Comparing quotes from different insurance providers is essential for securing the best deal. This process can be streamlined using online comparison tools or by contacting providers directly.

- Online Comparison Tools: Websites like Policygenius, The Zebra, and Insurance.com allow you to compare quotes from multiple providers simultaneously, saving you time and effort.

- Direct Contact: You can also obtain quotes by contacting insurance providers directly through their websites or phone lines. Be prepared to provide your personal and vehicle information for an accurate quote.

Tips for Negotiating Lower Insurance Premiums

Once you’ve gathered quotes, you can negotiate lower premiums by implementing these strategies:

- Bundle Your Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

- Improve Your Driving Record: Maintaining a clean driving record is paramount. Avoid traffic violations and accidents to benefit from lower premiums.

- Consider a Higher Deductible: Opting for a higher deductible can reduce your monthly premiums, but you’ll be responsible for paying a larger amount out-of-pocket in the event of an accident.

- Ask About Discounts: Many insurance providers offer discounts for safe driving, good student status, and other factors. Don’t hesitate to inquire about these discounts and see if you qualify.

- Shop Around Regularly: Insurance rates can fluctuate, so it’s advisable to shop around for new quotes every year or two to ensure you’re getting the best deal.

Understanding PIP Claims and Processes

In Florida, the PIP coverage is designed to help you pay for medical expenses and lost wages after an accident, regardless of who was at fault. Understanding the process for filing a PIP claim is crucial to ensuring you receive the benefits you’re entitled to.

Filing a PIP Claim

After an accident, it’s important to notify your insurance company as soon as possible. Your insurer will provide you with instructions on how to file a claim. The following steps Artikel the general process:

- Report the Accident: Contact your insurance company immediately to report the accident. Provide all relevant details, including the date, time, location, and parties involved.

- Seek Medical Attention: If you’ve been injured, seek medical attention right away. This is essential for documenting your injuries and establishing a link between the accident and your treatment.

- Submit a Claim: Your insurance company will provide you with a claim form to complete. This form will require information about the accident, your injuries, and the medical treatment you’ve received. You’ll need to submit this form along with supporting documentation.

- Provide Documentation: Gather and submit all necessary documentation, including medical bills, pay stubs, and police reports. The more comprehensive your documentation, the stronger your claim.

Documentation Required for a Successful PIP Claim

To ensure a successful PIP claim, you’ll need to provide your insurance company with the following documentation:

- Accident Report: This document, usually provided by the police, details the circumstances of the accident and any injuries sustained.

- Medical Records: This includes all medical bills, treatment records, and doctor’s notes related to the accident.

- Lost Wage Statements: If you’ve missed work due to your injuries, provide documentation from your employer verifying your lost wages.

- Photographs of the Accident Scene: These can help support your claim and provide visual evidence of the accident.

- Personal Injury Protection (PIP) Coverage Information: This information Artikels your policy’s coverage limits and benefits.

Timeframes for Processing and Settling PIP Claims

The time it takes to process and settle a PIP claim can vary depending on the complexity of the claim and the insurance company’s procedures. However, you can expect the following general timelines:

- Initial Claim Review: Your insurance company will review your claim within a few days of receiving it.

- Medical Treatment and Documentation: Once your claim is accepted, you’ll need to continue your medical treatment and provide ongoing documentation to your insurer.

- Claim Settlement: Your insurance company will typically make a decision on your claim within 30 days of receiving all required documentation.

Seeking Legal Advice

While the PIP claims process is generally straightforward, there are instances where you may face difficulties. If you encounter any challenges, it’s advisable to seek legal advice from a qualified attorney. An attorney can:

- Help You Understand Your Rights: A lawyer can explain your rights and responsibilities under Florida’s PIP law.

- Negotiate with Your Insurance Company: An attorney can advocate on your behalf with your insurance company to ensure you receive the benefits you’re entitled to.

- File a Lawsuit: If your claim is denied or you’re dissatisfied with the settlement, an attorney can file a lawsuit to pursue your claim in court.

Tips for Safe Driving and Reducing Insurance Costs: Cheap Pip Car Insurance Florida

In Florida, safe driving practices are not just a matter of personal responsibility; they can significantly impact your car insurance premiums. By adopting safe driving habits and making informed choices, you can potentially reduce your insurance costs and enjoy greater peace of mind on the road.

Safe Driving Practices

Adopting safe driving practices is crucial for your safety and can also lead to lower insurance premiums. Here are some tips to consider:

- Maintain a Safe Speed: Exceeding the speed limit significantly increases the risk of accidents. Adhering to posted speed limits not only keeps you and others safe but also reduces the likelihood of speeding tickets, which can negatively impact your insurance rates.

- Avoid Distracted Driving: Distracted driving, including texting, talking on the phone, or using GPS, is a major cause of accidents. Always prioritize safe driving by keeping your full attention on the road and avoiding distractions.

- Buckle Up: Wearing a seatbelt is the most effective way to protect yourself in case of an accident. Make sure all passengers in your vehicle are properly buckled up as well.

- Drive Defensively: Anticipate potential hazards and be prepared to react accordingly. This involves maintaining a safe following distance, scanning the road ahead, and being aware of your surroundings.

- Avoid Alcohol and Drugs: Driving under the influence of alcohol or drugs is illegal and extremely dangerous. Always choose a designated driver or utilize ride-sharing services if you plan to consume alcohol.

- Get Enough Rest: Drowsy driving is as dangerous as driving under the influence. Ensure you are well-rested before getting behind the wheel, and take breaks if you feel tired.

Driver Safety Courses

Driver safety courses can provide valuable insights into safe driving practices and potentially lead to insurance discounts. These courses often cover topics such as defensive driving techniques, accident avoidance strategies, and traffic laws.

- Florida Department of Highway Safety and Motor Vehicles (FLHSMV): The FLHSMV offers a variety of driver safety courses, including defensive driving courses and traffic school for traffic violations. Completing these courses can help you improve your driving skills and potentially qualify for insurance discounts.

- Insurance Companies: Many insurance companies offer discounts for completing driver safety courses. Check with your insurance provider to see if they offer such discounts and what courses are eligible.

- AAA: The American Automobile Association (AAA) offers driver safety courses for various age groups and skill levels. These courses can help you refresh your driving skills and potentially reduce your insurance premiums.

Impact of Driving Violations and Accidents, Cheap pip car insurance florida

Driving violations and accidents can significantly impact your insurance premiums. Insurance companies consider your driving record a key factor in determining your risk profile.

- Traffic Tickets: Receiving traffic tickets, such as speeding tickets or running red lights, can lead to increased insurance premiums. The severity of the violation and the frequency of tickets will affect the impact on your rates.

- Accidents: Accidents, even if you were not at fault, can also lead to higher insurance premiums. Insurance companies consider accidents as evidence of higher risk and may increase your rates to reflect this.

Maintaining a Good Driving Record

Maintaining a clean driving record is essential for keeping your insurance premiums low. Here are some tips to help you achieve this:

- Obey Traffic Laws: Always follow traffic laws, including speed limits, stop signs, and traffic signals. This will help you avoid traffic tickets and maintain a good driving record.

- Be Defensive: Anticipate potential hazards and be prepared to react accordingly. This involves maintaining a safe following distance, scanning the road ahead, and being aware of your surroundings.

- Avoid Distractions: Put away your phone and avoid other distractions while driving. Focus on the road and stay alert to ensure your safety and prevent accidents.

- Regularly Review Your Driving Record: Request a copy of your driving record from the FLHSMV to ensure it is accurate and up-to-date. This will help you identify any errors or violations that may be impacting your insurance rates.

Epilogue

In conclusion, obtaining cheap PIP car insurance in Florida requires a proactive approach and a thorough understanding of your coverage options. By carefully evaluating your needs, comparing quotes, and implementing safe driving practices, you can find affordable protection that safeguards your well-being and financial security. Remember, choosing the right PIP coverage is not just about saving money; it’s about ensuring you have adequate protection in the event of an accident.

Popular Questions

What are the minimum PIP coverage requirements in Florida?

Florida law mandates a minimum PIP coverage of $10,000 per person. However, it is highly recommended to consider higher coverage limits to ensure adequate protection for your medical expenses and lost wages.

How can I compare car insurance quotes from different providers?

Many online platforms and insurance comparison websites allow you to compare quotes from multiple providers simultaneously. You can also contact individual insurance companies directly to request quotes.

What are some tips for negotiating lower insurance premiums?

Consider bundling your car insurance with other policies, such as homeowners or renters insurance. Explore discounts offered for good driving records, safety courses, and security features on your vehicle.

What should I do if I am having difficulties with a PIP claim?

If you encounter issues with your PIP claim, it is advisable to consult with an experienced insurance attorney. They can help you navigate the complexities of the claims process and advocate for your rights.