- Understanding the Need for Cheap Car Insurance

- Key Factors Influencing Car Insurance Costs

- Strategies for Finding Affordable Car Insurance

- Comparing Quotes from Multiple Insurers

- Negotiating with Insurance Companies: Cheapest Car Insurance

- Understanding Insurance Policies and Coverage

- The Importance of Safe Driving Practices

- Avoiding Common Mistakes

- Last Word

- Helpful Answers

Cheapest car insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the world of car insurance can be a daunting task, especially when you’re on a tight budget. Understanding the factors that influence insurance premiums, exploring effective strategies for finding affordable options, and comparing quotes from multiple insurers are essential steps in securing the best coverage at the most competitive price.

This guide will delve into the intricacies of car insurance, empowering you with the knowledge and tools necessary to make informed decisions and secure the most affordable coverage for your needs. From understanding the key factors that influence insurance costs to exploring effective negotiation techniques, this comprehensive resource will guide you through every step of the process.

Understanding the Need for Cheap Car Insurance

Finding the cheapest car insurance is a common concern for many individuals, particularly in today’s economic climate. The need for affordable car insurance stems from a combination of factors, including financial constraints, individual circumstances, and the desire to maximize savings.

Financial Implications of High Premiums

High insurance premiums can significantly impact an individual’s financial well-being, especially for those on a tight budget. Paying a large sum for car insurance can strain finances and limit the ability to save for other essential expenses, such as housing, food, or healthcare. In some cases, high premiums can even lead to financial hardship, forcing individuals to make difficult choices about their spending priorities.

The average annual cost of car insurance in the United States is around $1,427, according to the Insurance Information Institute. However, premiums can vary significantly based on factors such as location, driving history, and vehicle type.

Situations Where Cheap Car Insurance is Crucial

- New Drivers: Inexperienced drivers often face higher insurance premiums due to their lack of driving history. Finding the cheapest car insurance option can help mitigate the financial burden of insurance costs during the early stages of driving.

- Individuals with Tight Budgets: People with limited financial resources may find it challenging to afford high insurance premiums. Seeking the cheapest car insurance can help ensure they have adequate coverage without compromising their financial stability.

- Students: Students often have limited income and may be on a tight budget. Finding affordable car insurance can help them manage their expenses and avoid financial stress.

- Individuals with Multiple Cars: Families or individuals with multiple vehicles may find that insurance premiums can add up quickly. Finding the cheapest options for each car can help minimize overall insurance costs.

Key Factors Influencing Car Insurance Costs

Car insurance premiums are not set in stone. Several factors influence how much you pay for your policy, and understanding these factors can help you find the best deal. Here are some of the key factors that insurance companies consider when calculating your premium.

Age and Driving Experience

Your age and driving experience play a significant role in determining your car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This increased risk translates to higher premiums. As you gain experience and reach a certain age, your premiums tend to decrease. This is because you’re considered a safer driver with a lower likelihood of accidents.

Driving History

Your driving history is a major factor influencing your car insurance costs. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, if you have a history of accidents, traffic violations, or even DUI convictions, you can expect to pay higher premiums. Insurance companies use your driving history as a predictor of your future driving behavior.

Vehicle Type

The type of vehicle you drive significantly affects your car insurance premiums. Higher-performance cars, luxury vehicles, and expensive SUVs are generally more expensive to insure. This is because these vehicles are more likely to be involved in accidents and more costly to repair.

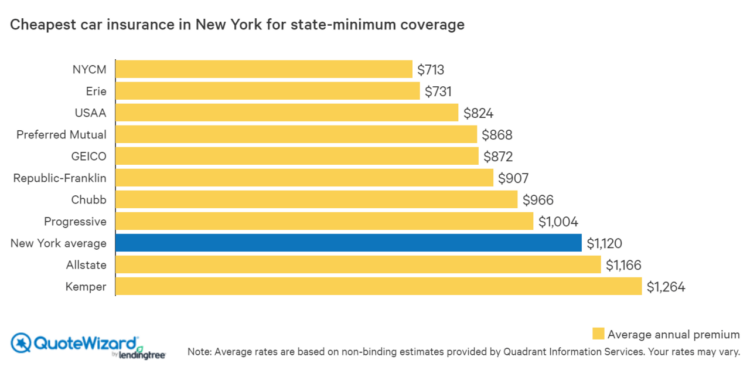

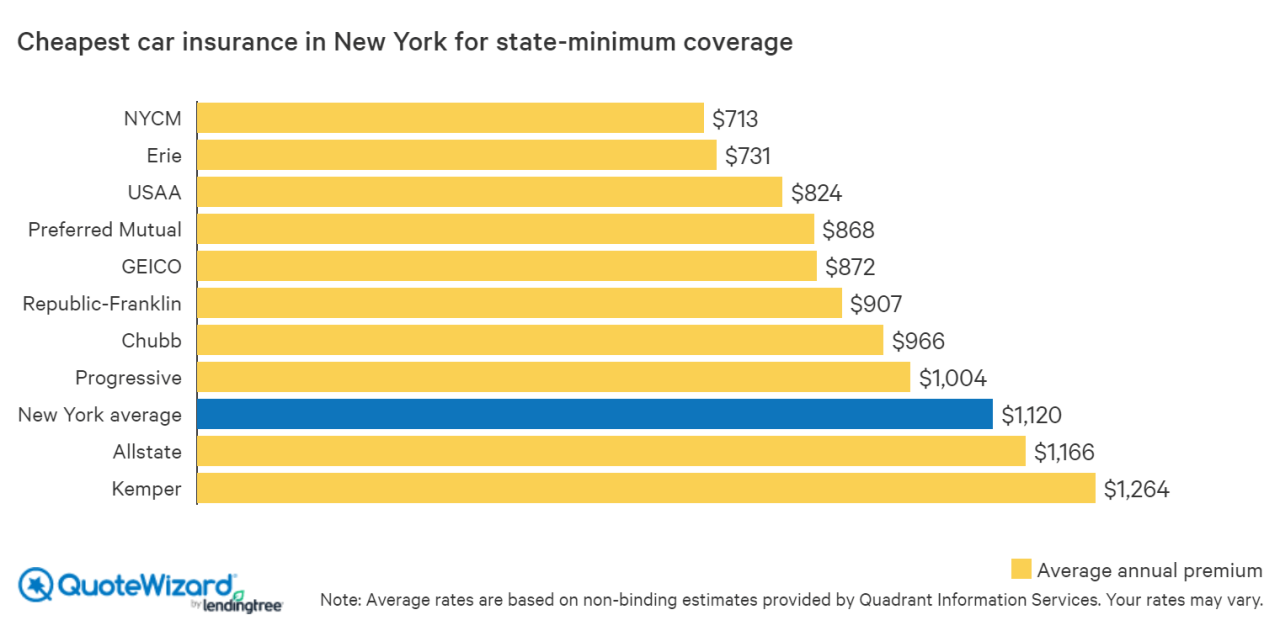

Location

The location where you live also impacts your car insurance rates. Areas with higher crime rates, traffic congestion, and a higher frequency of accidents tend to have higher insurance premiums. Insurance companies assess the risk of theft, accidents, and vandalism in different locations, which affects their pricing.

Credit Score

In many states, your credit score can influence your car insurance premiums. Insurance companies believe that people with good credit are more financially responsible and less likely to file claims. This correlation has led to using credit scores as a factor in determining premiums. However, it’s important to note that this practice is controversial and not universally accepted.

Coverage Levels

The amount of coverage you choose for your car insurance policy also affects your premium. Higher coverage limits, such as comprehensive and collision coverage, provide more protection but come at a higher cost. You need to balance your need for coverage with your budget when choosing your policy.

Insurance Provider

Different insurance providers have different pricing structures and policies. It’s essential to compare quotes from multiple providers to find the best deal. Consider factors such as coverage options, discounts, customer service, and financial stability when choosing an insurer.

Discounts

Many insurance companies offer discounts that can help lower your premiums. Some common discounts include:

- Good student discounts

- Safe driver discounts

- Multi-car discounts

- Bundling discounts

- Anti-theft device discounts

Strategies for Finding Affordable Car Insurance

Finding the cheapest car insurance requires a proactive approach and careful consideration of various factors. By understanding your options and employing effective strategies, you can significantly reduce your insurance premiums. This section will guide you through practical steps and strategies to secure affordable car insurance.

Compare Quotes from Multiple Insurers

Comparing quotes from multiple insurers is the cornerstone of finding cheap car insurance. This allows you to assess the market, identify competitive offers, and ultimately choose the most cost-effective option.

- Use online comparison websites: Websites like Policygenius, Compare.com, and The Zebra allow you to input your details and instantly receive quotes from multiple insurers.

- Contact insurers directly: Reach out to insurers directly to request quotes and discuss specific coverage options. This provides an opportunity to ask questions and negotiate potential discounts.

| Strategy | Description | Benefits | Drawbacks |

|---|---|---|---|

| Compare Quotes from Multiple Insurers | Using online comparison websites or contacting insurers directly to obtain quotes and compare prices. | Provides a comprehensive overview of available options and helps identify the cheapest rates. | May require providing personal information to multiple insurers. |

Shop Around for Discounts

Insurers offer a wide range of discounts to incentivize policyholders and reduce premiums. Taking advantage of these discounts can significantly impact your overall insurance cost.

- Good driving record: Maintaining a clean driving record with no accidents or violations qualifies you for a safe driver discount.

- Multi-car discounts: Insuring multiple vehicles with the same insurer can result in a substantial discount on your premiums.

- Bundling policies: Combining your car insurance with other policies like homeowners or renters insurance can lead to significant savings.

- Anti-theft devices: Installing anti-theft devices like alarms or GPS trackers can reduce your risk of theft and qualify you for a discount.

| Strategy | Description | Benefits | Drawbacks |

|---|---|---|---|

| Shop Around for Discounts | Exploring various discounts offered by insurers, such as safe driver, multi-car, bundling, and anti-theft device discounts. | Reduces premiums by taking advantage of available discounts. | May require fulfilling specific eligibility criteria or installing additional security features. |

Increase Your Deductible

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Increasing your deductible can lower your premium, as you are essentially taking on more financial responsibility in case of an accident.

- Consider your risk tolerance: Evaluate your financial situation and determine how much you can afford to pay in case of an accident.

- Balance cost savings with potential out-of-pocket expenses: While increasing your deductible lowers premiums, it also increases your potential out-of-pocket costs if an accident occurs.

| Strategy | Description | Benefits | Drawbacks |

|---|---|---|---|

| Increase Your Deductible | Raising the amount you pay out-of-pocket before insurance coverage begins. | Reduces premiums by shifting financial responsibility to the policyholder. | Increases potential out-of-pocket expenses in case of an accident. |

Consider a Higher Coverage Limit

Your coverage limits determine the maximum amount your insurance company will pay for covered losses. Choosing a higher coverage limit can potentially lower your premium, as you are essentially accepting a higher level of risk.

- Assess your individual needs: Consider the value of your vehicle and your financial situation to determine the appropriate coverage limit.

- Balance cost savings with potential financial exposure: While a higher coverage limit can reduce premiums, it also limits your financial protection in case of a major accident.

| Strategy | Description | Benefits | Drawbacks |

|---|---|---|---|

| Consider a Higher Coverage Limit | Choosing a higher maximum payout amount for covered losses. | May reduce premiums by accepting a higher level of risk. | Limits financial protection in case of a significant accident. |

Maintain a Good Driving Record

A clean driving record is crucial for securing affordable car insurance. Avoiding accidents, traffic violations, and other driving infractions can significantly lower your premiums.

- Defensive driving courses: Enrolling in defensive driving courses can demonstrate your commitment to safe driving and potentially earn you discounts.

- Avoid risky driving behaviors: Abstain from speeding, distracted driving, and other risky behaviors that could lead to accidents or violations.

| Strategy | Description | Benefits | Drawbacks |

|---|---|---|---|

| Maintain a Good Driving Record | Avoiding accidents, traffic violations, and other driving infractions. | Qualifies you for discounts and lower premiums. | Requires consistent safe driving practices and adherence to traffic laws. |

Consider a Usage-Based Insurance Program

Usage-based insurance programs track your driving habits and offer discounts based on your driving behavior. These programs utilize telematics devices or smartphone apps to monitor your driving patterns.

- Safe driving incentives: Programs often reward safe driving practices like avoiding speeding, hard braking, and late-night driving.

- Data privacy concerns: Consider the potential privacy implications of sharing your driving data with your insurer.

| Strategy | Description | Benefits | Drawbacks |

|---|---|---|---|

| Consider a Usage-Based Insurance Program | Participating in programs that track your driving habits and offer discounts based on your driving behavior. | Provides personalized discounts based on safe driving practices. | May raise privacy concerns due to data collection and monitoring. |

Negotiate with Your Insurer, Cheapest car insurance

Don’t hesitate to negotiate with your insurer to secure the best possible rate. You can leverage your good driving record, loyalty to the insurer, or other factors to request a lower premium.

- Shop around for better offers: Use quotes from other insurers as leverage to negotiate a lower rate with your current insurer.

- Highlight your positive attributes: Emphasize your clean driving record, multiple policies, or other factors that make you a valuable customer.

| Strategy | Description | Benefits | Drawbacks |

|---|---|---|---|

| Negotiate with Your Insurer | Discussing your insurance rate with your insurer and exploring potential discounts or adjustments. | May result in a lower premium based on your individual circumstances. | May require strong negotiation skills and a willingness to switch insurers. |

Consider State-Specific Discounts

Some states offer specific discounts for car insurance, such as discounts for good students, military personnel, or homeowners. Research your state’s available discounts to see if you qualify.

- Contact your state’s insurance department: Reach out to your state’s insurance department for information on available discounts.

- Check with your insurer: Inquire with your current insurer about any state-specific discounts you may be eligible for.

| Strategy | Description | Benefits | Drawbacks |

|---|---|---|---|

| Consider State-Specific Discounts | Exploring discounts offered by your state, such as good student, military, or homeowner discounts. | May provide additional savings beyond standard discounts. | May require meeting specific eligibility criteria. |

Comparing Quotes from Multiple Insurers

Obtaining quotes from various insurance providers is crucial for finding the cheapest car insurance. By comparing different offers, you can identify the best deal that aligns with your specific needs and budget.

Comparing Quotes from Multiple Insurers

To effectively compare quotes, consider the following key aspects:

* Coverage Options: Ensure the quotes you compare offer similar coverage levels.

* Deductibles: Higher deductibles generally result in lower premiums.

* Discounts: Check for available discounts based on factors such as good driving history, safety features, and bundling policies.

* Customer Service: Read reviews and ratings to gauge the insurer’s reputation for customer service.

Reputable Insurance Comparison Websites and Apps

Here are some well-known insurance comparison websites and apps:

* Policygenius: A platform that allows you to compare quotes from multiple insurers for various types of insurance, including car insurance.

* The Zebra: A website that offers a comprehensive comparison of car insurance quotes from top providers.

* NerdWallet: A website that provides financial advice and tools, including car insurance comparison.

* Insurify: An app that allows you to compare quotes from various insurers and get personalized recommendations.

* Compare.com: A website that offers a wide range of insurance comparison services, including car insurance.

These websites and apps make it easy to obtain multiple quotes and compare them side-by-side, allowing you to find the best value for your car insurance needs.

Negotiating with Insurance Companies: Cheapest Car Insurance

While many people believe that car insurance premiums are fixed and non-negotiable, there is often room for negotiation, especially if you’re a good driver with a clean record. Insurance companies are motivated to retain loyal customers and may be willing to offer discounts or adjust your policy terms to keep you as a policyholder.

Negotiating Strategies

Negotiating with insurance companies can be a successful way to lower your premiums. Here are some strategies you can use:

- Bundle your policies: Combining your car insurance with other policies, like homeowners or renters insurance, can often result in significant discounts. Insurance companies reward customers who bundle their policies, as it reduces their administrative costs and creates a more loyal customer base.

- Shop around and compare quotes: Before negotiating, get quotes from several different insurance companies. This gives you a clear understanding of the market rate for your coverage and strengthens your position when negotiating with your current insurer.

- Improve your driving record: A clean driving record is a significant factor in determining your insurance premiums. If you have any minor violations on your record, consider taking a defensive driving course to improve your driving skills and potentially lower your premiums. A good driving record can be a strong bargaining chip when negotiating with your insurer.

- Increase your deductible: Raising your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can lead to lower premiums. Be sure to consider your financial situation and risk tolerance when deciding on a deductible amount.

- Ask about discounts: Insurance companies often offer discounts for various factors, such as good grades, safe driving courses, vehicle safety features, and even loyalty. Don’t be afraid to ask your insurer about all available discounts you may qualify for.

- Be polite and respectful: Maintaining a professional and respectful demeanor throughout the negotiation process can increase your chances of success. Be clear about your needs and expectations, but avoid being aggressive or demanding.

- Be prepared to walk away: If you’re not satisfied with the insurer’s offer, be prepared to walk away and shop around for a better deal. Having other quotes in hand can give you leverage in negotiations.

Understanding Insurance Policies and Coverage

Choosing the right car insurance policy is crucial, as it safeguards you financially in the event of an accident or other covered incidents. It’s essential to understand the various types of coverage available and how they can protect you.

Types of Car Insurance Policies

Different car insurance policies offer varying levels of coverage, catering to diverse needs and budgets.

- Liability Coverage: This is the most basic type of car insurance, providing financial protection to others if you cause an accident. It covers bodily injury and property damage to third parties.

- Collision Coverage: This covers damage to your own vehicle in an accident, regardless of fault.

- Comprehensive Coverage: This protects your vehicle against non-collision damages, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This provides coverage if you are involved in an accident with a driver who has no insurance or insufficient coverage.

- Personal Injury Protection (PIP): This covers your medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of fault.

- Medical Payments Coverage (Med Pay): This provides coverage for medical expenses for you and your passengers, regardless of fault.

Key Terms and Definitions

Understanding the terminology used in car insurance policies is essential for making informed decisions.

- Premium: The amount you pay for your car insurance policy.

- Deductible: The amount you pay out of pocket for repairs or replacement before your insurance coverage kicks in.

- Coverage Limits: The maximum amount your insurance company will pay for a covered claim.

- Exclusions: Specific events or circumstances that are not covered by your insurance policy.

- Endorsements: Additional coverage options that can be added to your policy.

Importance of Reviewing Insurance Policies

It’s crucial to carefully review your car insurance policy to ensure you understand the coverage you have and any limitations.

- Coverage Limits: Check your policy to ensure the coverage limits are sufficient to cover your potential financial liabilities.

- Deductibles: Consider your budget and risk tolerance when choosing your deductibles. Higher deductibles generally result in lower premiums, but you’ll pay more out of pocket in case of a claim.

- Exclusions: Understand what events or circumstances are not covered by your policy.

- Endorsements: Explore additional coverage options that may be beneficial, such as roadside assistance or rental car reimbursement.

The Importance of Safe Driving Practices

Your driving record plays a crucial role in determining your car insurance premiums. Safe driving habits not only protect you and others on the road but also contribute to lower insurance costs. By prioritizing safety, you can significantly reduce your risk of accidents, leading to more affordable insurance premiums.

The Correlation Between Safe Driving and Lower Insurance Costs

Insurance companies use a complex system to calculate premiums, taking into account factors such as your driving history, age, location, and the type of vehicle you drive. A clean driving record, free of accidents, violations, or other incidents, is highly valued by insurance companies. This is because statistically, drivers with a history of safe driving are less likely to file claims, resulting in lower overall costs for the insurance company. This translates into lower premiums for you.

“Drivers with a history of safe driving are less likely to file claims, resulting in lower overall costs for the insurance company.”

Tips for Maintaining a Safe Driving Record

- Defensive Driving Techniques: Mastering defensive driving techniques, such as anticipating potential hazards, maintaining a safe following distance, and being aware of your surroundings, can significantly reduce the risk of accidents. These techniques involve being proactive and prepared for unexpected situations on the road, minimizing the chances of collisions or other incidents that could affect your insurance premiums.

- Avoiding Distractions: Distracted driving is a major contributor to accidents. Avoid using your phone, eating, or engaging in other activities that take your attention away from the road. Focus solely on driving and ensure you’re fully attentive to your surroundings. This can help you avoid accidents and maintain a clean driving record, leading to lower insurance premiums.

- Maintaining Your Vehicle: Regular maintenance checks and repairs are essential for ensuring your vehicle is in optimal condition. This includes checking tire pressure, fluid levels, and overall mechanical health. A well-maintained vehicle is safer to drive, reducing the risk of breakdowns or accidents that could affect your insurance premiums.

- Following Traffic Laws: Adhering to traffic laws, such as speed limits, stop signs, and traffic signals, is crucial for safe driving. These laws are designed to ensure order and safety on the road. By strictly following traffic laws, you reduce the risk of accidents and violations, contributing to a clean driving record and potentially lower insurance premiums.

- Avoiding Alcohol and Drugs: Driving under the influence of alcohol or drugs is illegal and extremely dangerous. It significantly increases the risk of accidents and can lead to severe penalties, including license suspension and hefty fines. Avoid driving after consuming alcohol or drugs to protect yourself and others on the road. This practice is essential for maintaining a safe driving record and potentially securing lower insurance premiums.

Avoiding Common Mistakes

Navigating the world of car insurance can be tricky, and making common mistakes can significantly impact your insurance costs. Understanding these pitfalls and learning how to avoid them is crucial to securing the best possible rates and ensuring a smooth insurance process.

Providing Inaccurate Information

Providing incorrect or incomplete information during the application process can lead to higher premiums or even policy cancellation.

- Incorrect Personal Information: Providing wrong details about your age, driving history, or address can result in a miscalculation of your risk profile, leading to higher premiums.

- Omitting Relevant Details: Failing to disclose any previous accidents, violations, or claims can lead to policy cancellation if discovered later.

It’s essential to be truthful and accurate when providing information to your insurer.

Choosing the Wrong Coverage

Selecting inadequate coverage can leave you financially vulnerable in case of an accident or other unforeseen events.

- Underinsured/Uninsured Motorist Coverage: This coverage is crucial in case you’re involved in an accident with a driver who has insufficient or no insurance.

- Liability Coverage: Insufficient liability coverage can leave you financially responsible for damages exceeding your policy limits, potentially leading to significant out-of-pocket expenses.

Thoroughly understand your coverage options and choose a policy that aligns with your individual needs and risk tolerance.

Last Word

By understanding the complexities of car insurance, employing strategic approaches to finding affordable options, and navigating the negotiation process effectively, you can secure the most competitive coverage while safeguarding your financial well-being. Remember, the journey to finding the cheapest car insurance is a process that requires careful planning, research, and a commitment to finding the best deal. Armed with the knowledge and strategies Artikeld in this guide, you’ll be well-equipped to navigate the insurance landscape and secure the most affordable coverage for your needs.

Helpful Answers

What are some common mistakes people make when buying car insurance?

Some common mistakes include not comparing quotes from multiple insurers, settling for the first offer, not understanding the coverage options, and failing to review your policy regularly.

How often should I review my car insurance policy?

It’s a good idea to review your policy at least once a year, or whenever there are significant changes in your driving habits, vehicle, or financial situation.

What are some tips for negotiating lower insurance premiums?

Be prepared to negotiate, research your options, be polite and respectful, and be willing to walk away if you’re not satisfied with the offer.

How can I improve my driving record to get lower insurance premiums?

Maintain a clean driving record by following traffic laws, avoiding speeding, and driving defensively.

What are some common car insurance discounts?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts for combining home and auto insurance.