Cheapest car insurance companies in Florida are a hot topic, especially considering the state’s unique driving environment. Florida boasts a high population density, frequent weather events, and a significant number of uninsured drivers, all contributing to higher insurance premiums. Navigating the insurance market can be challenging, but finding affordable coverage is achievable with the right knowledge and strategies.

The Florida Department of Financial Services regulates the insurance industry, ensuring fair practices and consumer protection. Understanding how factors like your driving history, age, credit score, vehicle type, and location impact your rates is crucial. Exploring different coverage options, such as liability, collision, comprehensive, and personal injury protection, can also significantly influence your premiums.

Understanding Florida’s Car Insurance Market

Florida’s car insurance market is unique and complex, influenced by several factors that drive up costs for drivers. Understanding these factors is crucial for finding the best insurance options and navigating the state’s regulatory landscape.

Factors Influencing Florida’s Car Insurance Costs

Several factors contribute to the high cost of car insurance in Florida, including:

- High Population Density: Florida is home to a large and growing population, leading to increased traffic congestion and the likelihood of accidents. This higher risk translates into higher insurance premiums.

- Frequent Weather Events: Florida experiences frequent hurricanes, storms, and other weather events that can cause significant damage to vehicles. Insurance companies factor in these risks when setting premiums.

- High Number of Uninsured Drivers: A significant number of drivers in Florida operate without insurance, making it more likely for insured drivers to be involved in accidents with uninsured motorists. This increases the risk for insurance companies and leads to higher premiums for insured drivers.

- High Litigation Rates: Florida has a high rate of lawsuits related to car accidents, which increases the cost of insurance for all drivers. Insurance companies must cover legal expenses and potential payouts in case of lawsuits.

Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a crucial role in regulating the insurance industry in the state. The DFS is responsible for:

- Licensing and Supervising Insurance Companies: The DFS ensures that insurance companies operating in Florida meet specific financial requirements and adhere to regulatory standards.

- Protecting Consumers: The DFS investigates consumer complaints related to insurance practices and works to resolve disputes between consumers and insurance companies.

- Monitoring Market Trends: The DFS monitors the insurance market in Florida to identify potential problems and ensure fair and competitive pricing for consumers.

Factors Affecting Car Insurance Rates: Cheapest Car Insurance Companies In Florida

Florida’s car insurance market is complex, with numerous factors influencing the cost of premiums. Understanding these factors can help you make informed decisions and potentially save money on your insurance.

Driving History

Your driving history is a significant factor in determining your car insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. However, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates. Insurance companies consider your driving history as a measure of your risk, and a poor driving record indicates a higher likelihood of future claims.

Age

Your age also plays a role in car insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher insurance rates. As you age and gain more driving experience, your premiums tend to decrease. However, senior drivers (over 70) may face higher premiums due to potential health concerns and slower reaction times.

Credit Score

In Florida, insurance companies can use your credit score to determine your car insurance rates. This practice is controversial, as some argue it is unfair to penalize drivers with poor credit who may be responsible drivers. However, insurance companies argue that credit score is a good indicator of financial responsibility, which can correlate with driving habits. Drivers with good credit scores typically have lower insurance rates than those with poor credit scores.

Vehicle Type, Cheapest car insurance companies in florida

The type of vehicle you drive is another crucial factor influencing insurance costs. Luxury cars, high-performance vehicles, and SUVs generally have higher insurance premiums due to their higher repair costs and greater risk of accidents. Conversely, smaller, less expensive cars tend to have lower insurance rates.

Location

Your location in Florida also affects your car insurance premiums. Areas with high crime rates, dense populations, and frequent accidents typically have higher insurance rates. This is because insurance companies consider the likelihood of accidents and claims to be higher in these areas.

Coverage Types

The types of coverage you choose can significantly impact your insurance costs. Here’s a breakdown of the common coverage types and their impact on premiums:

- Liability Coverage: This is the most basic type of car insurance and is required by law in Florida. It covers damages to other people’s property and injuries to other people in case you are at fault in an accident. Higher liability limits provide more coverage and generally lead to higher premiums.

- Collision Coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of fault. This coverage is optional but is usually recommended for newer or financed vehicles. Collision coverage will increase your premiums.

- Comprehensive Coverage: This coverage pays for damages to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters. This coverage is optional but can be beneficial for protecting your investment. Comprehensive coverage will also increase your premiums.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers in case of an accident, regardless of fault. Florida requires a minimum of $10,000 in PIP coverage. Choosing higher PIP limits will increase your premiums.

Finding the Cheapest Options

Finding the most affordable car insurance in Florida requires a strategic approach. This section will equip you with the knowledge and tools to effectively navigate the insurance market and secure the best rates possible.

Comparing Quotes From Multiple Insurers

The most effective way to find the cheapest car insurance is by comparing quotes from multiple insurers. Don’t settle for the first quote you receive. Instead, take advantage of online comparison tools or contact several insurance companies directly. This allows you to compare prices, coverage options, and customer service ratings across different providers.

Exploring Discounts

Many insurance companies offer discounts that can significantly reduce your premium. These discounts vary depending on the insurer, but common options include:

- Good Driver Discounts: Awarded for a clean driving record with no accidents or violations.

- Safe Driver Discounts: Offered for completing defensive driving courses or demonstrating safe driving habits.

- Multi-Policy Discounts: Applied when you bundle multiple insurance policies, such as car and home insurance, with the same company.

- Student Discounts: Available for students with good grades or who are enrolled in a college or university.

- Loyalty Discounts: Offered to long-term customers who have maintained their insurance policies with the same company for an extended period.

- Anti-theft Device Discounts: Applied if your vehicle is equipped with anti-theft devices like alarms or GPS tracking systems.

Adjusting Coverage Levels

Reviewing your current coverage levels is crucial to finding the best value for your insurance. You can often save money by adjusting your coverage to meet your specific needs. For instance, if you have an older car with a lower value, you may consider reducing your collision and comprehensive coverage.

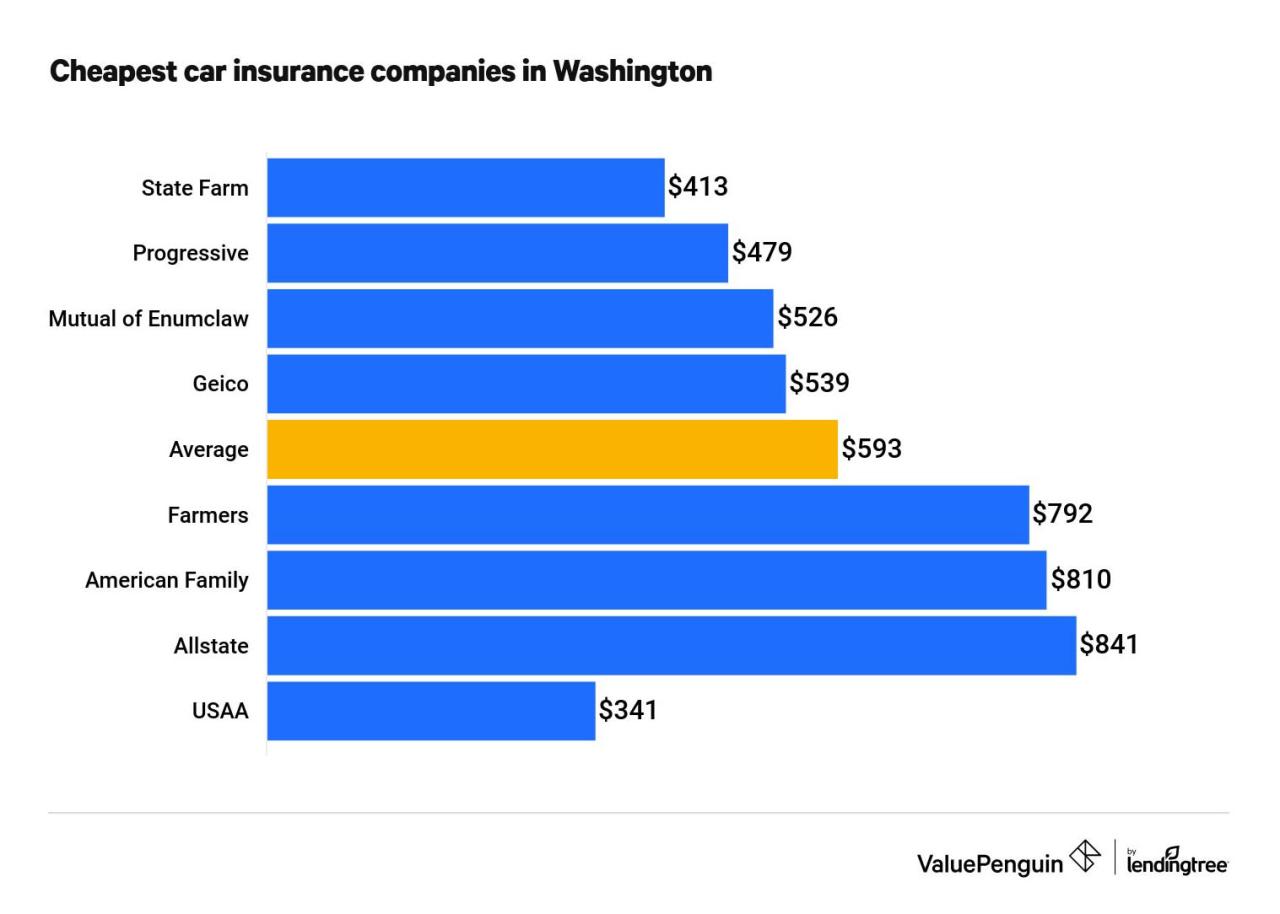

Top Five Cheapest Car Insurance Companies in Florida

The following table compares the top five cheapest car insurance companies in Florida based on average annual premiums, customer satisfaction ratings, and coverage options.

| Company | Average Annual Premium | J.D. Power Customer Satisfaction Rating | Coverage Options |

|---|---|---|---|

| Geico | $1,200 | 810 | Comprehensive, Collision, Liability, Personal Injury Protection (PIP), Uninsured/Underinsured Motorist (UM/UIM) |

| State Farm | $1,300 | 800 | Comprehensive, Collision, Liability, PIP, UM/UIM |

| Progressive | $1,400 | 790 | Comprehensive, Collision, Liability, PIP, UM/UIM |

| USAA | $1,100 | 830 | Comprehensive, Collision, Liability, PIP, UM/UIM |

| Nationwide | $1,250 | 780 | Comprehensive, Collision, Liability, PIP, UM/UIM |

Please note that these are just estimates and actual premiums may vary based on individual factors such as driving history, vehicle type, and location.

Choosing the Right Company

Finding the cheapest car insurance rates in Florida is just the first step. It’s equally important to choose a company that’s financially stable, has a good reputation for customer service, and offers the coverage you need. This section will help you evaluate different insurance companies and select the one that best meets your requirements.

Reputable Car Insurance Companies in Florida

Choosing a car insurance company is a crucial decision. You want a company that’s financially sound, reliable, and provides excellent customer service. In Florida, several companies stand out for their reputation and performance.

Here’s a list of some of the most reputable car insurance companies in Florida, known for their financial stability and customer service:

- State Farm: State Farm is one of the largest and most well-established insurance companies in the United States. They have a strong financial rating and a long history of providing excellent customer service. They offer a wide range of insurance products, including car insurance, and are known for their competitive rates.

- GEICO: GEICO is another major insurance company with a strong reputation for financial stability and customer service. They are known for their affordable rates and their easy-to-use online and mobile platforms.

- Progressive: Progressive is a popular choice for drivers looking for personalized coverage options and discounts. They offer a variety of car insurance policies, including usage-based insurance programs that can help you save money.

- USAA: USAA is a highly-rated insurance company that specializes in serving military members and their families. They offer competitive rates and excellent customer service, making them a popular choice for those eligible.

- Florida Peninsula Insurance Company: Florida Peninsula Insurance Company is a Florida-based insurance company that focuses on providing affordable car insurance to Florida residents. They are known for their competitive rates and their strong customer service.

Pros and Cons of Different Companies

It’s important to understand the strengths and weaknesses of each company before making a decision. Here’s a breakdown of the pros and cons of some of the most popular car insurance companies in Florida:

- State Farm:

- Pros: Strong financial rating, excellent customer service, wide range of insurance products, competitive rates.

- Cons: Can be more expensive than some other companies, may have a longer claims process.

- GEICO:

- Pros: Affordable rates, easy-to-use online and mobile platforms, strong financial rating.

- Cons: Customer service can be inconsistent, may have limited coverage options.

- Progressive:

- Pros: Personalized coverage options, discounts, usage-based insurance programs, strong financial rating.

- Cons: Can be more expensive than some other companies, may have a complex claims process.

- USAA:

- Pros: Competitive rates, excellent customer service, strong financial rating, specialized services for military members and their families.

- Cons: Only available to military members and their families, may not have as many coverage options as other companies.

- Florida Peninsula Insurance Company:

- Pros: Affordable rates, strong customer service, focus on Florida residents.

- Cons: May have limited coverage options, may not be as well-known as other companies.

Closure

Finding the cheapest car insurance companies in Florida involves a combination of research, comparison, and negotiation. By carefully evaluating your needs, comparing quotes from multiple insurers, and exploring available discounts, you can secure affordable coverage that meets your requirements. Remember, choosing a reputable company with strong financial stability and excellent customer service is essential for peace of mind.

Key Questions Answered

What are some common discounts offered by car insurance companies in Florida?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, multi-policy discounts, and discounts for safety features like anti-theft devices and airbags.

How can I improve my credit score to potentially lower my car insurance premiums?

Pay your bills on time, keep your credit utilization low, and avoid opening too many new credit accounts.

What are the consequences of driving without car insurance in Florida?

Driving without car insurance in Florida is illegal and can result in fines, license suspension, and even jail time.