- Understanding Florida’s Car Insurance Market

- Finding the Cheapest Car Insurance Options

- Factors Affecting Car Insurance Rates: Cheapest Car Insurance Florida

- Strategies for Lowering Car Insurance Costs

- Essential Car Insurance Coverage in Florida

- Choosing the Right Car Insurance Provider

- Ultimate Conclusion

- Question Bank

Cheapest car insurance Florida can seem like a daunting search, especially considering the unique factors that impact premiums in the Sunshine State. From the high number of accidents to the state’s no-fault insurance laws, Florida’s car insurance market is distinct. This guide will equip you with the knowledge to navigate this landscape, helping you find affordable coverage without sacrificing the protection you need.

Understanding the factors influencing car insurance costs in Florida is crucial. These include your driving history, age, vehicle type, location, credit score, and coverage levels. We’ll explore how these factors impact your premiums and provide strategies for lowering your costs.

Understanding Florida’s Car Insurance Market

Florida’s car insurance market is unique and complex, influenced by a variety of factors that drive costs higher than in many other states. Understanding these factors is crucial for drivers seeking the best coverage at the most affordable price.

Factors Influencing Car Insurance Costs in Florida

Several factors contribute to Florida’s higher car insurance costs, including:

- High Frequency of Accidents and Claims: Florida has a high rate of car accidents, which leads to more claims and ultimately higher insurance premiums. This is partly attributed to the state’s large population, heavy traffic, and warm weather, which encourages more driving.

- Fraudulent Claims: Florida has a history of insurance fraud, which drives up costs for legitimate policyholders. The state has implemented measures to combat fraud, but it remains a significant issue.

- High Litigation Costs: Florida’s legal system is known for being favorable to plaintiffs in personal injury cases, leading to higher litigation costs for insurance companies. This, in turn, translates to higher premiums for drivers.

- No-Fault Insurance System: Florida’s no-fault insurance system requires drivers to file claims with their own insurer, regardless of who is at fault in an accident. This can lead to higher premiums as insurers cover more claims.

- High Property Values: Florida’s coastal location and desirable climate lead to high property values, which can impact insurance costs as insurers factor in the potential for damage from natural disasters.

- Cost of Living: Florida’s cost of living, particularly in urban areas, is higher than in many other states. This can affect insurance costs as insurers consider factors such as repair costs and medical expenses.

Key Differences Between Florida’s Car Insurance Market and Other States

Florida’s car insurance market stands out from other states in several ways:

- Personal Injury Protection (PIP): Florida mandates PIP coverage, which covers medical expenses and lost wages following an accident, regardless of fault. This requirement differs from many other states, which may have optional PIP coverage.

- No-Fault System: Florida’s no-fault system, as mentioned earlier, is a unique feature that distinguishes its car insurance market. This system, where drivers file claims with their own insurer, contrasts with other states that have fault-based systems.

- Higher Premiums: Florida generally has higher car insurance premiums compared to other states due to the factors discussed above. This is particularly noticeable in urban areas with high traffic and population density.

- Limited Choice of Insurers: Florida’s car insurance market has a limited number of major insurers compared to some other states. This can lead to less competition and potentially higher premiums.

Florida Department of Financial Services’ Role in Regulating Car Insurance

The Florida Department of Financial Services (DFS) plays a crucial role in regulating the state’s car insurance market. The DFS is responsible for:

- Licensing and Supervising Insurers: The DFS ensures that insurers operating in Florida meet specific financial and operational requirements.

- Enforcing Insurance Laws: The DFS investigates and enforces compliance with Florida’s insurance laws and regulations.

- Protecting Consumers: The DFS helps consumers resolve insurance disputes and provides resources for understanding their insurance rights and responsibilities.

- Monitoring Insurance Rates: The DFS reviews and approves insurance rate increases, ensuring they are justified and fair to consumers.

Finding the Cheapest Car Insurance Options

Finding the cheapest car insurance in Florida involves understanding the different types of coverage available and comparing quotes from various insurance companies. This guide will help you navigate the Florida car insurance market and find the best options for your needs and budget.

Types of Car Insurance in Florida

Florida law requires drivers to carry a minimum amount of car insurance, known as “Financial Responsibility.” This includes Personal Injury Protection (PIP) and Property Damage Liability (PDL). However, you can purchase additional coverage to protect yourself and your vehicle from various risks.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of who is at fault. Florida’s PIP law requires a minimum coverage of $10,000.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s property if you are at fault in an accident. Florida law requires a minimum coverage of $10,000.

- Bodily Injury Liability (BIL): This coverage pays for the medical expenses and other costs of the other driver(s) if you are at fault in an accident. The minimum coverage required by Florida law is $10,000 per person and $20,000 per accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it is recommended if you have a financed or leased vehicle.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by events other than a collision, such as theft, vandalism, fire, or natural disasters. This coverage is also optional.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are injured in an accident caused by a driver who is uninsured or underinsured. This coverage is optional but highly recommended.

- Rental Reimbursement: This coverage pays for a rental car if your vehicle is damaged in an accident and is being repaired.

- Towing and Labor: This coverage pays for towing and labor costs if your vehicle breaks down or is disabled.

Comparing Car Insurance Options

The best type of car insurance for you will depend on your individual needs and circumstances.

- Minimum Coverage: If you have an older vehicle and are comfortable with the financial risk, you may choose to only carry the minimum coverage required by Florida law. However, this may not provide sufficient protection in the event of a serious accident.

- Full Coverage: This includes collision, comprehensive, and uninsured/underinsured motorist coverage. It provides the most comprehensive protection, but it is also the most expensive.

- Customized Coverage: This involves selecting specific coverage options based on your individual needs and budget. This approach allows you to balance affordability with adequate protection.

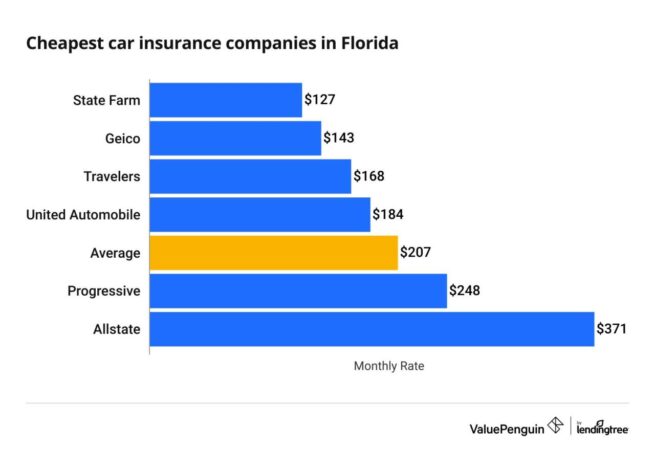

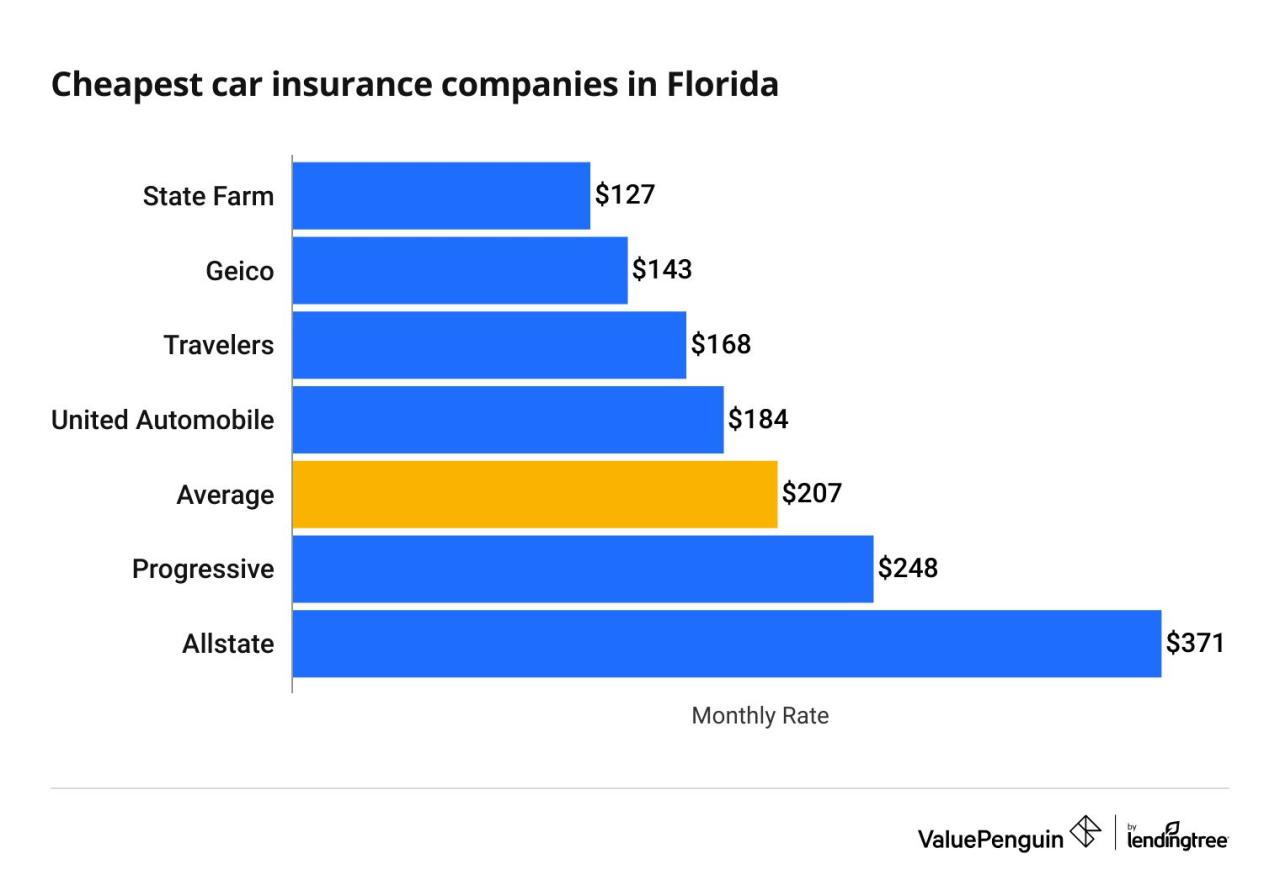

Popular Car Insurance Companies in Florida

Here is a table listing popular car insurance companies in Florida, their average rates, and their key features:

| Company | Average Rate | Key Features |

|---|---|---|

| State Farm | $1,500 | Wide coverage options, excellent customer service, strong financial stability |

| Geico | $1,400 | Competitive rates, convenient online and mobile options, good customer service |

| Progressive | $1,300 | Personalized discounts, innovative features like Name Your Price tool, strong financial stability |

| Allstate | $1,600 | Wide range of coverage options, good customer service, strong financial stability |

| USAA | $1,200 | Exclusive for military members and their families, excellent customer service, strong financial stability |

Factors Affecting Car Insurance Rates: Cheapest Car Insurance Florida

Car insurance premiums in Florida are determined by a complex interplay of factors, each influencing the final cost you pay. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history is a major factor in determining your car insurance rates. Insurance companies use your driving record to assess your risk as a driver. A clean driving record with no accidents or violations will generally lead to lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely result in higher premiums.

Age

Age plays a significant role in car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This higher risk is reflected in higher insurance premiums for younger drivers. As drivers age and gain experience, their risk profile generally decreases, leading to lower premiums.

Vehicle Type

The type of vehicle you drive also influences your car insurance rates. Higher-performance vehicles with powerful engines or luxurious features are often considered riskier to insure due to their potential for higher repair costs and greater likelihood of accidents. Conversely, smaller, less expensive vehicles typically have lower insurance premiums.

Location

Your location in Florida can significantly impact your car insurance rates. Areas with higher crime rates or traffic congestion may have higher insurance premiums due to a greater risk of accidents or theft.

Credit Score

While it may seem surprising, your credit score can also influence your car insurance rates. Insurance companies use your credit score as a proxy for your financial responsibility. Individuals with lower credit scores are often perceived as higher risk, leading to potentially higher insurance premiums.

Coverage Levels

The level of coverage you choose for your car insurance policy directly affects your premiums. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, will generally result in higher premiums. Conversely, choosing lower coverage limits can help reduce your premiums, but it also means you will have less financial protection in the event of an accident.

Average Car Insurance Costs by Age Group

| Age Group | Average Annual Premium |

|---|---|

| 18-24 | $2,500 – $3,500 |

| 25-34 | $1,800 – $2,800 |

| 35-44 | $1,500 – $2,500 |

| 45-54 | $1,200 – $2,200 |

| 55-64 | $1,000 – $2,000 |

| 65+ | $800 – $1,800 |

Strategies for Lowering Car Insurance Costs

In Florida, car insurance rates can vary significantly. Understanding the factors that influence these rates and implementing effective strategies can help you save money on your premiums.

Obtaining Multiple Car Insurance Quotes

Getting quotes from multiple insurance companies is crucial for finding the best rates. Here’s a step-by-step guide to obtaining quotes efficiently:

- Gather your information: Before you start, have your driver’s license, vehicle information (make, model, year), and current insurance policy details readily available.

- Use online comparison tools: Websites like Insurance.com, Bankrate, and NerdWallet allow you to compare quotes from various insurers in a single location.

- Contact insurance companies directly: Call or visit the websites of major insurance companies in Florida to request quotes. Be sure to ask about any available discounts.

- Provide accurate information: When filling out quote forms, be truthful and accurate with your information to ensure you receive the most accurate rates.

- Compare quotes carefully: Once you have multiple quotes, review them closely, paying attention to coverage details, deductibles, and premium amounts.

Improving Driving History and Reducing Risk Factors

Your driving record is a major factor in determining your insurance rates. Here are some ways to improve your driving history and reduce risk:

- Maintain a clean driving record: Avoid traffic violations, accidents, and speeding tickets. Every infraction can increase your premiums.

- Take a defensive driving course: Completing a defensive driving course can lower your insurance rates by demonstrating your commitment to safe driving practices.

- Consider a telematics device: Some insurers offer discounts for using telematics devices that track your driving habits. These devices can monitor your speed, braking, and acceleration, providing feedback and potential discounts for safe driving.

- Increase your deductible: A higher deductible means you pay more out-of-pocket in the event of an accident, but it can lower your premium. Choose a deductible you can comfortably afford in case of an accident.

Leveraging Discounts and Negotiating Lower Premiums

Insurance companies offer various discounts to incentivize safe driving practices and customer loyalty. Here are some strategies for leveraging discounts and negotiating lower premiums:

- Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

- Ask about discounts: Inquire about discounts for good student, safe driver, multi-car, and other available options. Be sure to document any applicable discounts in your policy.

- Negotiate your premium: Once you have a quote, don’t hesitate to negotiate. Explain your situation, highlight your good driving record, and inquire about any possible rate adjustments.

- Shop around regularly: Insurance rates can change over time. Review your policy annually and compare quotes from other insurers to ensure you are getting the best rate.

Essential Car Insurance Coverage in Florida

Driving in Florida requires you to have specific car insurance coverages to comply with the state’s laws. Understanding these coverages and their implications is crucial for every driver in the Sunshine State.

Mandatory Car Insurance Coverages in Florida, Cheapest car insurance florida

Florida law mandates that all drivers carry specific car insurance coverages to protect themselves and others on the road. These mandatory coverages are designed to cover potential financial losses arising from accidents.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs incurred by the insured person, regardless of who caused the accident. Florida’s PIP law mandates a minimum coverage of $10,000.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s property if you are at fault in an accident. Florida law requires a minimum PDL coverage of $10,000.

Optional Car Insurance Coverages in Florida

While mandatory coverages are essential, you can choose to add optional coverages to enhance your protection and peace of mind. These optional coverages offer broader financial protection and can be customized based on your individual needs.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. Collision coverage is essential if you want to protect your vehicle’s value.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, natural disasters, and falling objects. Comprehensive coverage helps safeguard your vehicle against unforeseen events.

- Uninsured Motorist Coverage (UM): This coverage protects you if you are involved in an accident with an uninsured or underinsured driver. UM coverage can help cover medical expenses, lost wages, and property damage.

- Underinsured Motorist Coverage (UIM): This coverage protects you if you are involved in an accident with a driver who has insufficient liability insurance to cover your losses. UIM coverage can help bridge the gap between the other driver’s liability limits and your actual damages.

Benefits of Adding Optional Coverage

Adding optional car insurance coverage can significantly benefit you in various ways, providing financial security and peace of mind in unforeseen situations.

- Collision Coverage: If your vehicle is damaged in an accident, collision coverage helps pay for repairs or replacement, ensuring you can get back on the road quickly.

- Comprehensive Coverage: This coverage protects your vehicle against unexpected events, such as theft or vandalism, minimizing financial burdens and allowing you to replace or repair your vehicle.

- Uninsured Motorist Coverage (UM): UM coverage safeguards you against drivers who are uninsured or underinsured, ensuring you are compensated for your losses.

- Underinsured Motorist Coverage (UIM): UIM coverage helps bridge the gap when the other driver’s liability limits are insufficient, protecting you from significant financial hardship.

Choosing the Right Car Insurance Provider

Finding the cheapest car insurance in Florida is only half the battle. Choosing the right provider ensures you get the best value for your money and peace of mind in case of an accident. This involves considering factors beyond just price, such as the insurer’s financial stability, customer service, and claims processing efficiency.

Financial Stability and Customer Satisfaction

The financial strength of an insurance company is crucial. A financially sound insurer is more likely to be able to pay claims promptly and fairly. You can check the financial stability of insurance companies through rating agencies like AM Best and Standard & Poor’s.

- AM Best assigns financial strength ratings to insurance companies, with A+ being the highest. A higher rating indicates a company is financially stable and has a good track record of paying claims.

- Standard & Poor’s also provides financial ratings for insurance companies, with AAA being the highest. A strong rating signifies a company’s ability to meet its financial obligations.

Customer satisfaction ratings are another important factor. Companies with high customer satisfaction scores are more likely to provide excellent service and handle claims efficiently. You can find customer satisfaction ratings from organizations like J.D. Power and Consumer Reports.

Customer Support and Claims Processing

- 24/7 Customer Support: Look for an insurance provider that offers 24/7 customer support, especially if you’re prone to late-night emergencies or have an unpredictable schedule.

- Claims Processing Efficiency: A company with a streamlined claims process can make a significant difference during stressful times. Investigate how long it typically takes for claims to be processed and whether the company offers online claim filing options.

Popular Car Insurance Providers in Florida

| Provider | Strengths | Weaknesses |

|---|---|---|

| State Farm | Wide network of agents, strong financial stability, competitive rates | Customer service can vary by agent |

| Geico | Competitive rates, easy online quoting, 24/7 customer service | Limited agent network, fewer discounts available |

| Progressive | Innovative features like Name Your Price tool, strong financial stability | Can be more expensive than other providers, complex pricing structure |

| Allstate | Wide range of discounts, strong financial stability, good customer service | Rates can be higher than competitors |

| USAA | Excellent customer service, competitive rates for military members | Only available to military members and their families |

Ultimate Conclusion

By understanding the nuances of Florida’s car insurance market, you can make informed decisions about your coverage. Remember, the cheapest car insurance isn’t always the best. Consider your individual needs and risk factors when comparing quotes. Armed with this knowledge, you can confidently navigate the Florida car insurance market and find the best coverage at a price that fits your budget.

Question Bank

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Uninsured Motorist Coverage (UM).

How often should I review my car insurance policy?

It’s generally recommended to review your car insurance policy at least annually, or even more frequently if your driving situation changes (e.g., new car, change in address, etc.).

What are some common car insurance discounts in Florida?

Some common discounts include good driver discounts, multi-car discounts, safe driver discounts, and discounts for having safety features like anti-theft devices or airbags.

What are the consequences of driving without car insurance in Florida?

Driving without car insurance in Florida is illegal and can result in fines, license suspension, and even vehicle impoundment. You could also be held personally liable for any damages or injuries you cause in an accident.