- Understanding Florida’s Car Insurance Market

- Finding the Cheapest Car Insurance Providers in Florida

- Factors Influencing Car Insurance Premiums

- Strategies for Lowering Car Insurance Costs

- Important Considerations When Choosing Car Insurance

- Closing Summary

- Key Questions Answered: Cheapest Car Insurance In Florida

Navigating the world of car insurance in Florida can feel like driving through a maze. With a high concentration of drivers, a no-fault insurance system, and a unique blend of factors influencing premiums, finding the cheapest car insurance in Florida requires careful consideration and strategic planning.

This guide will help you understand the key factors that determine car insurance costs in Florida, explore the best strategies for finding affordable coverage, and equip you with the knowledge to make informed decisions about your insurance needs.

Understanding Florida’s Car Insurance Market

Florida’s car insurance market is complex and unique, influenced by various factors that contribute to the state’s high average premiums. Understanding these factors is crucial for drivers seeking the cheapest car insurance in Florida.

Factors Influencing Car Insurance Costs

Several factors contribute to the cost of car insurance in Florida, including:

- Demographics: Age, gender, and marital status can influence insurance premiums. Younger drivers, especially those under 25, are generally considered higher risk due to their inexperience and higher likelihood of accidents. Similarly, unmarried individuals may face higher premiums compared to married individuals.

- Driving History: Your driving record significantly impacts your insurance rates. Accidents, traffic violations, and DUI convictions can significantly increase your premiums. A clean driving history can lead to lower rates.

- Vehicle Type: The type of vehicle you drive plays a crucial role in determining your insurance cost. Luxury cars, high-performance vehicles, and newer models generally have higher premiums due to their higher repair costs and potential for greater damage.

- Location: The geographic location where you reside can affect your insurance rates. Areas with higher crime rates, traffic congestion, and accident frequency tend to have higher insurance premiums.

- Coverage Levels: The amount of coverage you choose will directly impact your premium. Higher coverage limits, such as higher liability limits, comprehensive, and collision coverage, will generally result in higher premiums.

Impact of Florida’s No-Fault Insurance Law

Florida operates under a no-fault insurance system, where drivers are required to carry Personal Injury Protection (PIP) coverage. This coverage pays for medical expenses and lost wages regardless of fault in an accident. While no-fault insurance aims to reduce lawsuits and expedite claims processing, it can also contribute to higher premiums.

The no-fault system allows injured parties to seek compensation from their own insurance company, even if the other driver was at fault. This can lead to increased claims costs for insurers, ultimately affecting premiums.

Prevalence of Uninsured Drivers in Florida

Florida has a significant problem with uninsured drivers. According to the Insurance Research Council, the state has the highest percentage of uninsured drivers in the nation. This means that drivers in Florida are more likely to be involved in accidents with uninsured motorists, potentially leading to financial hardship if they are responsible for the accident.

The prevalence of uninsured drivers in Florida puts a strain on the insurance system, as insured drivers may end up paying higher premiums to cover the costs of uninsured motorists’ accidents.

Finding the Cheapest Car Insurance Providers in Florida

Finding the most affordable car insurance in Florida can be a daunting task, given the diverse range of insurance companies and their complex pricing strategies. However, with a bit of research and understanding of the market dynamics, you can navigate this process effectively and secure a policy that fits your budget.

Comparing Pricing Strategies of Major Car Insurance Companies in Florida

Major car insurance companies in Florida utilize various factors to determine their pricing strategies. These factors include:

- Driving History: Companies analyze your driving record, considering factors like accidents, violations, and years of driving experience. A clean record often translates to lower premiums.

- Vehicle Type: The make, model, and year of your car play a significant role in premium calculations. High-performance vehicles or luxury cars are typically associated with higher premiums due to their repair costs and potential for theft.

- Coverage Options: The level of coverage you choose directly impacts your premium. Comprehensive and collision coverage provide broader protection but come with higher costs.

- Location: Your geographic location in Florida influences your premium. Areas with higher crime rates or traffic congestion may see higher insurance costs.

- Credit Score: Some insurance companies consider your credit score as an indicator of your financial responsibility. A higher credit score may result in lower premiums.

While the factors above are common across most companies, each insurer may weigh them differently, resulting in varying premium quotes. For instance, some companies may prioritize driving history, while others may give more weight to your credit score.

Benefits and Drawbacks of Using Online Insurance Comparison Websites

Online insurance comparison websites have revolutionized the way people shop for car insurance. These platforms allow you to compare quotes from multiple insurers simultaneously, saving you time and effort.

- Convenience: Online comparison websites offer a user-friendly interface and allow you to get quotes from multiple companies within minutes, eliminating the need for multiple phone calls or visits to insurance offices.

- Transparency: These platforms provide detailed information about each insurance company, including their coverage options, pricing structures, and customer reviews. This transparency allows you to make informed decisions.

- Potential for Savings: By comparing quotes from multiple insurers, you can potentially identify the most competitive rates and save money on your premiums.

However, there are also some drawbacks to using online comparison websites:

- Limited Customization: While online platforms offer a wide range of options, they may not be able to accommodate all your specific needs or preferences. It’s essential to review the policy details carefully to ensure they meet your requirements.

- Potential for Bias: Some comparison websites may prioritize certain insurers based on referral fees or partnerships, which could influence the results you see.

- Limited Customer Support: Online platforms often have limited customer support compared to traditional insurance brokers. You may face challenges if you encounter issues or need personalized assistance.

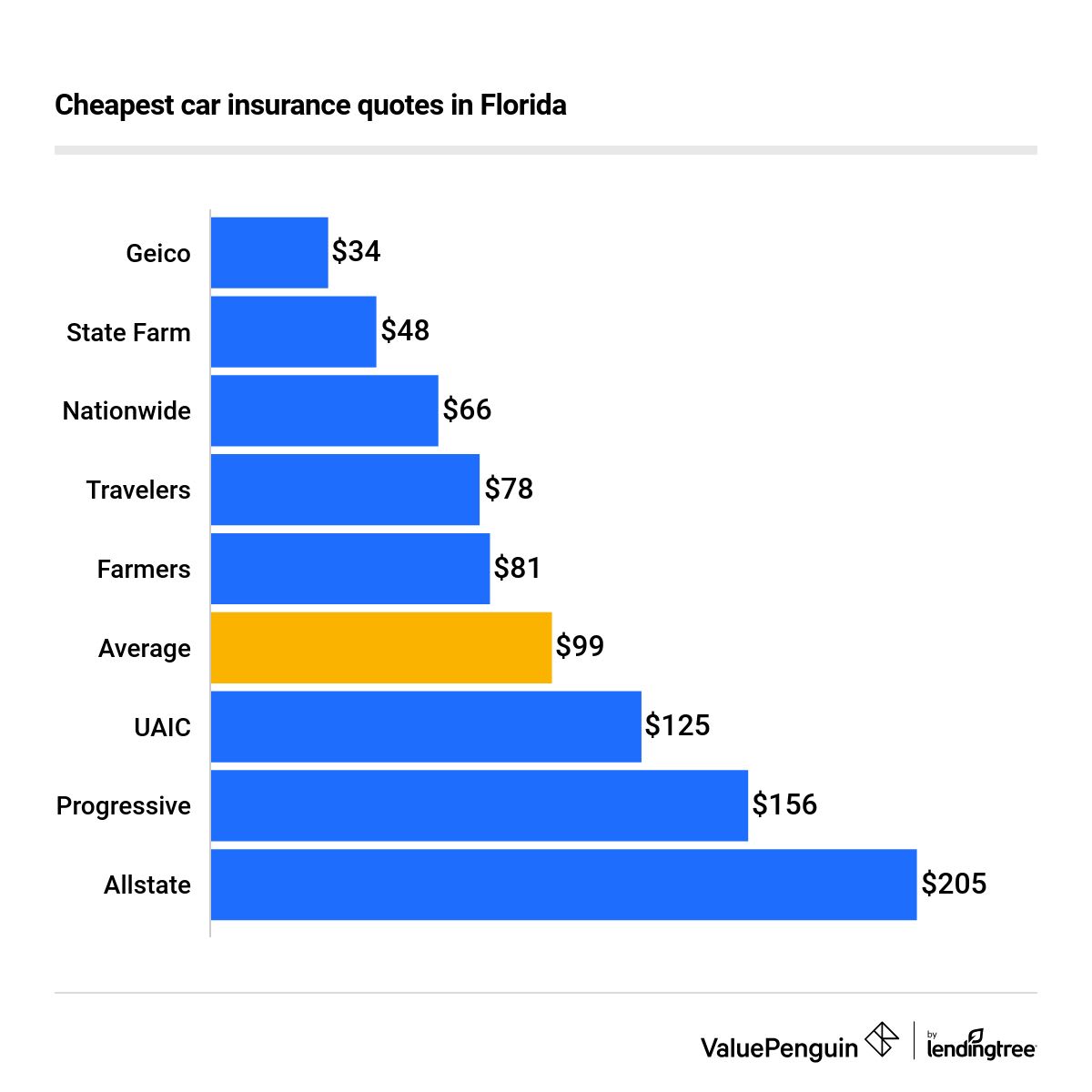

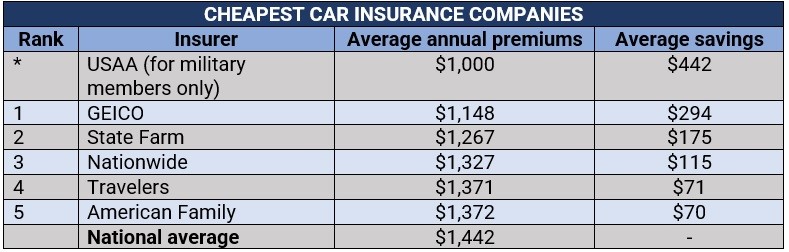

Reputable Insurance Companies Offering Competitive Rates in Florida, Cheapest car insurance in florida

Several insurance companies are known for offering competitive car insurance rates in Florida. Some of these include:

- State Farm: State Farm is a well-established national insurer with a strong presence in Florida. They offer a wide range of coverage options and have a reputation for providing excellent customer service.

- Geico: Geico is another major insurer with a focus on affordability. They often offer competitive rates, particularly for drivers with good driving records.

- Progressive: Progressive is known for its innovative features, including its “Name Your Price” tool, which allows you to set a budget and find policies that fit within your price range.

- USAA: USAA is a military-focused insurer that offers competitive rates to active and retired military personnel and their families.

- Florida Peninsula Insurance Company: Florida Peninsula specializes in providing insurance to Florida residents and often offers competitive rates for those with high-risk profiles.

It’s crucial to note that insurance rates vary based on individual factors, so it’s always recommended to get quotes from multiple companies to compare and find the best deal.

Factors Influencing Car Insurance Premiums

Car insurance premiums in Florida, like in any other state, are influenced by a variety of factors. Understanding these factors can help you find the best deals and ensure you’re paying a fair price for your coverage.

Driving History

Your driving history is one of the most significant factors determining your car insurance premium. Insurance companies assess your risk based on your past driving behavior, considering factors like accidents, tickets, and DUI convictions.

- Accidents: Each accident you’ve been involved in, regardless of fault, can increase your premium. The severity of the accident, such as the number of vehicles involved or the extent of damage, also influences the premium increase. For instance, a minor fender bender might result in a smaller premium increase compared to a serious accident involving injuries.

- Tickets: Traffic violations, such as speeding tickets or running a red light, can also lead to higher premiums. The severity of the violation and the frequency of tickets influence the impact on your premium. A single speeding ticket might have a smaller impact than multiple tickets within a short period.

- DUI Convictions: Driving under the influence (DUI) convictions are considered very serious offenses and significantly increase your insurance premium. The impact of a DUI conviction can last for several years, depending on the insurance company’s policy and the specific circumstances of the conviction.

Vehicle Age, Make, and Model

The characteristics of your vehicle also play a role in determining your insurance premium. Insurance companies consider the age, make, and model of your car to assess its safety features, repair costs, and theft risk.

- Age: Newer cars generally have more safety features and are considered less risky, leading to lower premiums. Older cars, especially those with outdated safety features, are often associated with higher premiums. For example, a 2023 model car with advanced safety features might have a lower premium compared to a 1998 model car without those features.

- Make and Model: Certain car makes and models are known for their safety ratings and repair costs. Cars with high safety ratings and lower repair costs tend to have lower premiums. Conversely, cars with poor safety ratings or expensive repairs might have higher premiums. For instance, a Toyota Camry with a high safety rating might have a lower premium compared to a sports car known for its high repair costs.

Other Factors

Besides driving history and vehicle characteristics, other factors can influence your car insurance premium.

- Credit Score: In many states, including Florida, insurance companies use credit scores as a proxy for risk assessment. A higher credit score generally indicates better financial responsibility and lower risk, leading to lower premiums.

- Coverage Options: The type and amount of coverage you choose will impact your premium. Comprehensive and collision coverage, which protect against damage from non-accidents and accidents, respectively, will generally increase your premium compared to liability-only coverage. Choosing higher coverage limits will also lead to higher premiums.

- Location: Your location, specifically the zip code, can influence your premium. Areas with higher crime rates or a greater frequency of accidents tend to have higher premiums. For instance, a driver living in a densely populated urban area might pay a higher premium compared to a driver in a rural area with fewer accidents.

Strategies for Lowering Car Insurance Costs

In Florida, where car insurance premiums are often higher than in other states, finding ways to reduce your costs is crucial. Fortunately, there are several strategies you can employ to lower your premiums and save money.

Obtaining Multiple Quotes from Different Insurance Companies

Getting multiple quotes from different insurance companies is essential to finding the most competitive rates. A simple online search can reveal a wide range of providers offering different coverage options and price points. Here’s a step-by-step guide to help you obtain quotes effectively:

- Gather your information: Before you start, ensure you have all the necessary information on hand, such as your driving history, vehicle information, and desired coverage levels. This will streamline the quoting process.

- Use online comparison tools: Many websites allow you to compare quotes from multiple insurers simultaneously. These tools are convenient and save you time. Reputable comparison websites include:

- Insurance.com

- QuoteWizard

- The Zebra

- Contact individual insurance companies directly: While online tools are helpful, you may also want to contact insurance companies directly to get personalized quotes and discuss specific coverage options.

- Compare quotes carefully: Once you have gathered quotes from several insurers, compare them side-by-side, considering factors like coverage levels, deductibles, and overall cost. Remember, the cheapest quote may not always be the best option if it lacks adequate coverage.

Negotiating Lower Insurance Premiums

Once you’ve identified a provider that offers a competitive quote, you can try negotiating a lower premium. Here are some tips:

- Shop around: Let your chosen provider know you’ve received quotes from other insurers. This demonstrates you’re willing to switch providers if necessary.

- Ask about discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features in your vehicle, and bundling multiple insurance policies.

- Negotiate your deductible: A higher deductible generally leads to lower premiums. If you’re comfortable with a higher out-of-pocket expense in the event of an accident, you may be able to negotiate a lower premium by increasing your deductible.

- Be polite and persistent: Approach the negotiation process with a polite and professional attitude. Be persistent in seeking a lower premium, but avoid being aggressive or demanding.

Bundling Insurance Policies

Bundling your home and auto insurance policies with the same provider can often lead to significant discounts. This strategy is known as “multi-policy discounting” and is offered by many insurance companies. The discounts vary depending on the insurer and the specific policies bundled. However, you can typically expect to save 5% to 15% on your premiums by bundling.

“Bundling your home and auto insurance policies can be a smart way to save money on your premiums. It’s a simple strategy that can yield substantial savings.”

Important Considerations When Choosing Car Insurance

Choosing the right car insurance policy in Florida involves more than just finding the cheapest option. You need to carefully consider your individual needs and circumstances to ensure you have adequate coverage that protects you financially in case of an accident or other unforeseen events.

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage available is crucial to making an informed decision.

- Liability Coverage: This is the most basic type of car insurance and is required by law in Florida. It covers damages to other people’s property and injuries to other people in an accident if you are at fault. It is divided into two parts:

- Bodily Injury Liability: Pays for medical expenses, lost wages, and pain and suffering for other people injured in an accident caused by you.

- Property Damage Liability: Pays for repairs or replacement of other people’s vehicles or property damaged in an accident caused by you.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It is optional, but if you have a car loan or lease, your lender may require you to have collision coverage.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, fire, hail, and other natural disasters. It is optional, but it is often a good idea to have it if your vehicle is relatively new or has a high value.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, pays for your medical expenses and lost wages, regardless of who is at fault in an accident. It is required in Florida. PIP coverage is limited to $10,000 per person, and it may not cover all your medical expenses.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It pays for your medical expenses, lost wages, and property damage, up to the limits of your coverage.

Minimum Required Car Insurance Coverage in Florida

| Coverage | Minimum Required Limit |

|---|---|

| Bodily Injury Liability per Person | $10,000 |

| Bodily Injury Liability per Accident | $20,000 |

| Property Damage Liability | $10,000 |

| Personal Injury Protection (PIP) | $10,000 |

Factors to Consider When Determining Coverage Levels

- Your Financial Situation: If you have a high net worth or significant assets, you may want to consider higher liability limits to protect yourself from financial ruin in case of a serious accident.

- Your Vehicle’s Value: If your vehicle is new or has a high value, you may want to consider collision and comprehensive coverage to ensure you are adequately protected in case of an accident or damage.

- Your Driving Record: If you have a history of accidents or traffic violations, you may need to pay higher premiums for insurance. This can also affect your ability to obtain coverage in some cases.

- Your Location: The cost of car insurance can vary significantly depending on where you live. In areas with high accident rates, insurance premiums are generally higher.

- Your Age and Gender: Younger and male drivers generally pay higher premiums than older and female drivers because they are statistically more likely to be involved in accidents.

- Your Driving Habits: Your driving habits, such as the number of miles you drive each year, can also affect your insurance premiums. If you drive fewer miles, you may be eligible for a discount.

Closing Summary

Ultimately, finding the cheapest car insurance in Florida is about striking a balance between affordability and adequate coverage. By understanding the factors that influence premiums, exploring various providers, and leveraging available resources, you can find a policy that fits your budget and provides the protection you need on the road.

Key Questions Answered: Cheapest Car Insurance In Florida

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BI) per person and $20,000 per accident.

How can I lower my car insurance premiums in Florida?

Consider bundling your home and auto insurance, maintaining a clean driving record, taking a defensive driving course, and choosing a higher deductible.

What are some reputable car insurance companies in Florida?

Some well-known and competitive car insurance companies in Florida include State Farm, Geico, Progressive, Allstate, and USAA.

How does my credit score affect my car insurance premiums?

In Florida, insurers can use your credit score to determine your insurance rates. A higher credit score generally leads to lower premiums.