- Understanding Senior Car Insurance Needs in Florida

- Key Factors Affecting Senior Car Insurance Premiums

- Exploring Discount Opportunities for Seniors

- Choosing the Right Car Insurance Provider for Seniors

- Tips for Obtaining the Most Affordable Senior Car Insurance in Florida

- The Importance of Comprehensive Coverage for Seniors: Cheapest Car Insurance In Florida For Seniors

- Final Review

- FAQ

Cheapest car insurance in Florida for seniors is a topic that demands careful consideration, as seniors face unique challenges when it comes to finding affordable and comprehensive coverage. Florida’s unique climate, traffic patterns, and senior population create a distinct insurance landscape that requires specific knowledge and strategies to navigate.

This guide explores the key factors that influence senior car insurance premiums in Florida, including age, driving history, vehicle type, and coverage levels. We’ll delve into the intricacies of Florida’s insurance regulations, discuss common discounts available to seniors, and provide tips for finding the most affordable options. We’ll also examine the importance of comprehensive coverage for seniors, highlighting the unique risks they face and the benefits of having adequate protection.

Understanding Senior Car Insurance Needs in Florida

Seniors in Florida face unique challenges when it comes to car insurance. Factors like driving habits, health conditions, and safety features can significantly influence their premiums. Understanding these factors and how they impact insurance costs is crucial for seniors seeking the most affordable coverage.

Florida’s Laws and Regulations

Florida’s specific laws and regulations have a direct impact on car insurance premiums for seniors. The state’s no-fault insurance system, for example, requires drivers to carry personal injury protection (PIP) coverage, which can affect premiums. Additionally, Florida has a “fault” system for determining liability in accidents, which means the driver at fault is responsible for damages. This system can impact premiums for seniors involved in accidents, especially if they are found to be at fault.

Driving Habits and Accidents

Senior driving habits play a significant role in determining car insurance premiums. Seniors who drive less frequently or only for short distances typically pay lower premiums than those who drive more. However, statistics show that seniors are more likely to be involved in accidents than younger drivers. This is due to factors such as slower reaction times, reduced vision, and age-related health conditions. As a result, insurance companies often charge higher premiums to seniors, reflecting the increased risk of accidents.

Health Conditions and Safety Features, Cheapest car insurance in florida for seniors

Seniors with certain health conditions, such as vision problems or cognitive impairments, may face higher insurance premiums. This is because these conditions can increase the risk of accidents. However, seniors can mitigate these risks by installing safety features in their vehicles, such as backup cameras, blind spot monitoring systems, and lane departure warnings. These features can help seniors avoid accidents and potentially lower their insurance premiums.

“Seniors who drive less frequently or only for short distances typically pay lower premiums than those who drive more.”

Statistics on Senior Driving Accidents

According to the Florida Department of Highway Safety and Motor Vehicles, drivers aged 65 and older were involved in 12.3% of all fatal crashes in 2022. This highlights the increased risk of accidents associated with senior drivers. While the majority of seniors are safe drivers, these statistics underscore the importance of addressing factors that can increase the risk of accidents.

“Drivers aged 65 and older were involved in 12.3% of all fatal crashes in 2022.”

Key Factors Affecting Senior Car Insurance Premiums

Insurance companies in Florida carefully consider several factors when determining car insurance premiums for senior drivers. These factors help them assess the risk associated with insuring older drivers and ensure fair pricing for everyone.

Age

Age is a significant factor in determining car insurance premiums for seniors in Florida. While many people assume that insurance costs decrease with age, this is not always the case. Insurance companies often see an increase in premiums for drivers over the age of 65, due to factors such as:

- Increased Risk of Accidents: Studies show that while older drivers have more experience, they may also have slower reaction times, impaired vision, and reduced cognitive abilities, which can lead to a higher risk of accidents. This increased risk can result in higher premiums for seniors.

- Medical Expenses: Seniors are more likely to experience serious injuries in accidents, resulting in higher medical expenses for insurance companies. This increased cost is often reflected in higher premiums for older drivers.

- Higher Mortality Rates: Insurance companies consider mortality rates when calculating premiums. Seniors have a higher mortality rate than younger drivers, which can impact the cost of insurance.

Driving History

A driver’s history is another crucial factor that insurance companies use to determine premiums. Seniors with a clean driving record, free from accidents, tickets, or violations, typically receive lower premiums than those with a history of driving offenses.

Here’s a table showing how different driving history factors can impact insurance premiums for seniors:

| Driving History Factor | Impact on Premiums |

|---|---|

| Clean driving record (no accidents, tickets, or violations) | Lower premiums |

| Minor traffic violations (speeding tickets, parking tickets) | Moderate increase in premiums |

| Accidents, even if not at fault | Significant increase in premiums |

| Driving under the influence (DUI) | Very significant increase in premiums |

Vehicle Type

The type of vehicle you drive also plays a role in determining your insurance premium. Seniors driving expensive, high-performance cars, SUVs, or trucks may face higher premiums due to:

- Higher Repair Costs: These vehicles often have more expensive parts and repairs, leading to higher insurance costs for the insurance company.

- Higher Risk of Accidents: Some vehicle types, such as SUVs and trucks, may have a higher risk of accidents due to their size and weight. This increased risk can result in higher premiums.

Coverage Levels

The amount of coverage you choose can significantly impact your insurance premiums. Seniors who opt for higher coverage levels, such as comprehensive and collision coverage, will generally pay higher premiums than those who choose more basic coverage.

- Comprehensive Coverage: Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Collision Coverage: Covers damage to your vehicle in case of an accident, regardless of fault.

Exploring Discount Opportunities for Seniors

Securing the most affordable car insurance as a senior in Florida involves not only understanding the factors that influence premiums but also actively seeking out and leveraging available discounts. Many insurance companies offer a variety of discounts tailored specifically for senior drivers, potentially leading to significant savings on your annual insurance costs.

Discounts for Safe Driving

Safe driving discounts are among the most common and valuable benefits offered by insurance companies to senior drivers in Florida. These discounts recognize and reward drivers with a proven history of safe driving, often based on factors like accident-free driving records and the absence of traffic violations.

Seniors who maintain a clean driving record and demonstrate responsible driving habits can significantly reduce their insurance premiums through safe driving discounts.

Here are some examples of safe driving discounts offered by prominent insurance companies in Florida:

- State Farm offers a Safe Driver Discount to policyholders with a clean driving record, rewarding those who haven’t been involved in accidents or received traffic violations for a specified period.

- Geico provides a Defensive Driving Discount for senior drivers who complete an approved defensive driving course, demonstrating their commitment to safe driving practices.

- Progressive offers a Good Driver Discount to policyholders with a history of safe driving, rewarding those who have maintained a clean driving record for a specific duration.

Multi-Car Discounts

Senior drivers who own multiple vehicles may be eligible for multi-car discounts, which can provide substantial savings on their insurance premiums. These discounts are designed to incentivize customers to insure multiple vehicles with the same insurance company, offering a bundled rate that is typically lower than insuring each vehicle separately.

Seniors who insure multiple vehicles with the same company can benefit from multi-car discounts, often leading to significant savings on their overall insurance costs.

Examples of multi-car discounts offered by prominent insurance companies in Florida include:

- Allstate provides a Multi-Car Discount to policyholders who insure two or more vehicles with the company, rewarding those who choose to bundle their insurance policies.

- Liberty Mutual offers a Multi-Vehicle Discount to customers who insure multiple vehicles with the company, providing a discounted rate for bundling their insurance needs.

- USAA provides a Multi-Policy Discount to policyholders who insure multiple vehicles and other insurance products, such as homeowners or renters insurance, with the company.

Senior-Specific Programs

Several insurance companies in Florida offer senior-specific programs designed to provide discounts and benefits tailored to the unique needs of older drivers. These programs often incorporate elements like safe driving courses, accident forgiveness, and specialized coverage options.

Senior-specific programs can offer significant savings and benefits to older drivers, addressing their unique needs and driving habits.

Examples of senior-specific programs offered by prominent insurance companies in Florida include:

- AARP, in partnership with insurance companies like The Hartford, offers a variety of discounts and benefits specifically designed for AARP members, including discounts on car insurance, home insurance, and other insurance products.

- Nationwide offers a Senior Advantage Program, providing discounts and benefits tailored to the needs of older drivers, including safe driving courses, accident forgiveness, and specialized coverage options.

- AAA, through its partnership with insurance companies like Nationwide, offers discounts and benefits to AAA members, including discounts on car insurance, home insurance, and other insurance products.

Choosing the Right Car Insurance Provider for Seniors

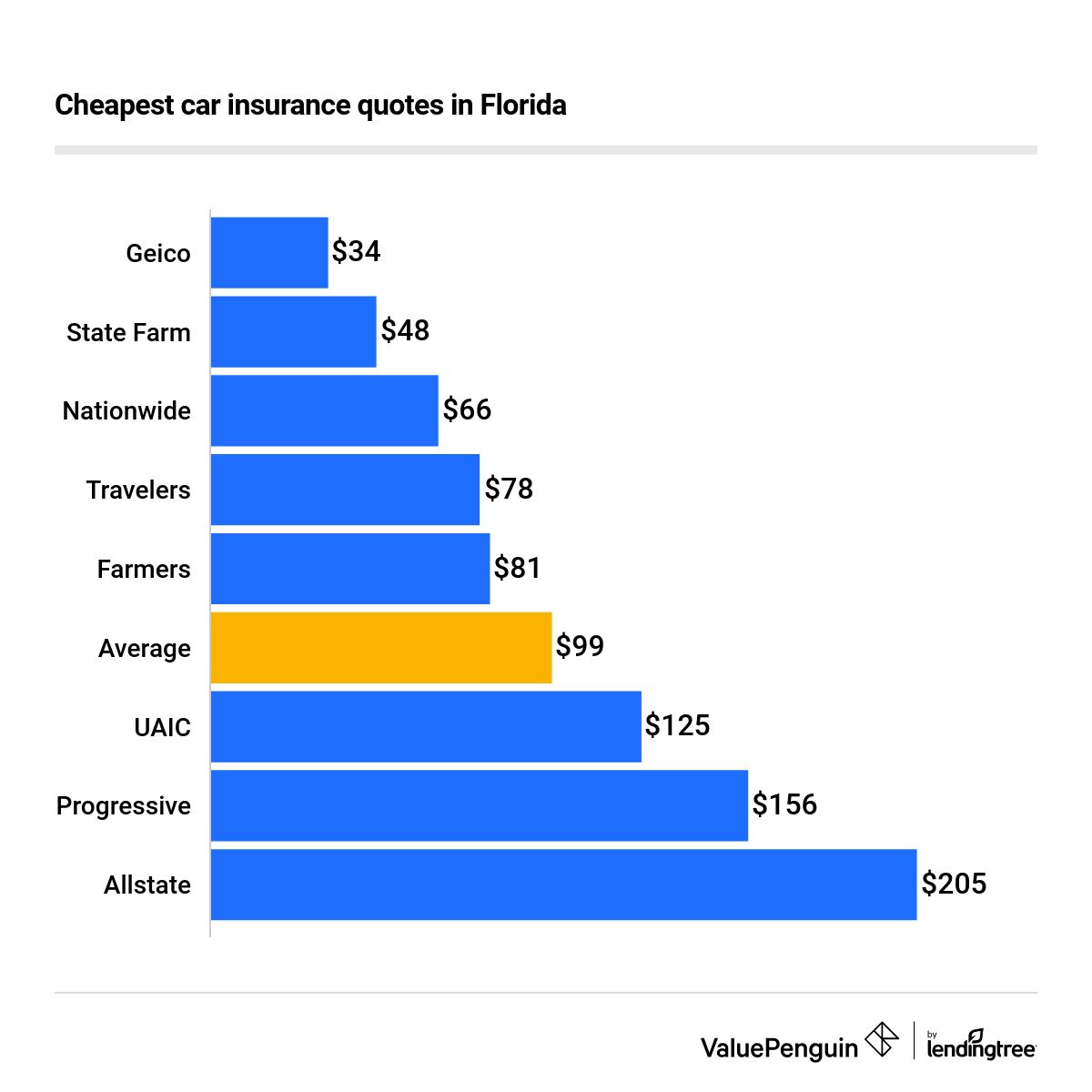

Selecting the right car insurance provider is crucial for seniors, as it can significantly impact their financial well-being and peace of mind. Florida offers a wide range of insurance companies catering to senior citizens, each with its own set of features, benefits, and pricing structures.

Comparing Insurance Companies for Seniors

It’s essential to compare and contrast different insurance companies specializing in senior car insurance in Florida. This involves evaluating their offerings based on key factors such as coverage options, pricing, customer service, and claims handling processes. Here’s a breakdown of some prominent insurance companies in Florida and their strengths and weaknesses:

- State Farm: State Farm is a well-known and reputable insurance company with a strong presence in Florida. It offers a wide range of coverage options, including comprehensive and collision coverage, liability coverage, and uninsured motorist coverage. State Farm is known for its competitive pricing and excellent customer service. However, its claims handling process can be slow at times.

- Geico: Geico is another popular insurance company with a strong focus on affordability. It offers competitive rates for senior drivers and a user-friendly online platform for managing policies. Geico’s customer service is generally good, but it may not be as comprehensive as some other companies.

- Progressive: Progressive is known for its innovative features, such as its “Name Your Price” tool, which allows customers to set their desired premium and find coverage options that match their budget. Progressive also offers a variety of discounts for seniors, including safe driver discounts and multi-policy discounts. However, its claims handling process can be complex.

- Allstate: Allstate is a large insurance company with a strong reputation for its customer service and claims handling processes. It offers a wide range of coverage options and discounts for seniors, including accident forgiveness and good driver discounts. However, Allstate’s premiums can be higher than some other companies.

Evaluating Customer Service and Claims Handling

Customer service and claims handling are crucial aspects of car insurance, especially for seniors. Seniors may require more assistance with navigating insurance policies and handling claims. It’s essential to choose an insurance company with a proven track record of excellent customer service and efficient claims handling processes.

- Customer Service: Look for insurance companies with responsive customer service channels, such as phone lines, email support, and online chat. Check customer reviews and ratings to gauge the overall customer satisfaction level.

- Claims Handling: Consider the company’s claims handling process, including the time it takes to process claims and the level of support provided to customers. Look for companies with a transparent claims process and a dedicated team to assist seniors.

Real-Life Examples of Senior Benefits

Numerous seniors have benefited from specific insurance companies in Florida. For example, a 72-year-old woman named Mary was able to save significantly on her car insurance premiums by switching to Geico. She was also impressed with Geico’s user-friendly online platform and responsive customer service. Another senior, John, who had been with State Farm for over 20 years, found that State Farm’s accident forgiveness program helped him avoid a premium increase after an at-fault accident. These real-life examples demonstrate the value of choosing the right insurance company for your specific needs.

Tips for Obtaining the Most Affordable Senior Car Insurance in Florida

Securing affordable car insurance as a senior in Florida requires a proactive approach and a thorough understanding of available options. This section provides practical advice for seniors seeking the cheapest car insurance options, including negotiating rates, comparing quotes from multiple providers, and understanding policy terms.

Using Online Comparison Tools for Best Deals

Online comparison tools are invaluable resources for seniors seeking affordable car insurance in Florida. These platforms allow you to input your personal information and vehicle details, then generate quotes from multiple insurance providers simultaneously.

- By comparing quotes from different companies, you can identify the most competitive rates and potentially save hundreds of dollars annually.

- These tools are user-friendly and can be accessed from any computer or mobile device.

- Ensure you provide accurate information to ensure the quotes are tailored to your specific needs.

Negotiating Rates with Insurance Providers

While online comparison tools provide a good starting point, negotiating rates directly with insurance providers can further reduce your premiums.

- Be prepared to discuss your driving history, safety features in your vehicle, and any relevant discounts you qualify for.

- Consider bundling your car insurance with other policies, such as homeowners or renters insurance, for potential savings.

- Don’t be afraid to ask for a lower rate, especially if you’ve been a loyal customer with a clean driving record.

Understanding Policy Terms and Coverage

Choosing the right car insurance policy involves understanding the different types of coverage and their implications.

- Liability coverage is mandatory in Florida and protects you financially if you’re involved in an accident that causes damage to another person’s property or injuries.

- Collision coverage covers damage to your vehicle in an accident, regardless of who’s at fault.

- Comprehensive coverage protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage provides financial protection if you’re hit by a driver without adequate insurance.

Maintaining a Good Driving Record

Your driving record is a significant factor in determining your car insurance premium. Maintaining a clean driving record can save you money on your insurance.

- Avoid traffic violations, as these can lead to higher premiums.

- Consider taking defensive driving courses to improve your driving skills and potentially earn discounts.

- Maintain a safe driving record to minimize the risk of accidents.

Shopping Around for the Best Rates

Don’t settle for the first quote you receive. Take the time to shop around and compare rates from multiple insurance providers.

- Use online comparison tools and contact insurance agents directly to get quotes.

- Consider factors like customer service, claims handling, and financial stability when choosing an insurer.

- Don’t be afraid to switch providers if you find a better deal.

The Importance of Comprehensive Coverage for Seniors: Cheapest Car Insurance In Florida For Seniors

Florida, a state known for its sunshine and vibrant lifestyle, also presents unique challenges for senior drivers. With an aging population and an increasing number of vehicles on the road, senior drivers in Florida face a higher risk of accidents and potential health complications. In such circumstances, comprehensive coverage becomes a vital safety net, offering financial protection against unforeseen events.

Comprehensive Coverage Benefits for Senior Drivers

Comprehensive coverage is a crucial component of car insurance that protects policyholders against various risks beyond collisions, including theft, vandalism, natural disasters, and damage caused by animals. For senior drivers in Florida, this type of coverage offers several key benefits:

- Financial Security in Case of Accidents: Senior drivers are more susceptible to accidents due to factors such as declining reflexes, reduced vision, and potential health conditions. Comprehensive coverage provides financial protection for repairs or replacement of the vehicle, easing the financial burden in case of an accident.

- Protection Against Unforeseen Events: Florida is prone to natural disasters like hurricanes and tornadoes. Comprehensive coverage can cover damage caused by these events, ensuring peace of mind for senior drivers.

- Liability Coverage for Accidents: If a senior driver is involved in an accident that results in injuries or property damage to others, comprehensive coverage provides liability protection. This coverage helps pay for legal fees, medical expenses, and property repairs, protecting senior drivers from significant financial losses.

Final Review

Navigating the world of car insurance as a senior in Florida can feel overwhelming, but with the right information and strategies, finding affordable and comprehensive coverage is achievable. By understanding the factors that influence premiums, exploring discount opportunities, and choosing the right insurance provider, seniors can secure the protection they need without breaking the bank. Remember, taking the time to compare quotes, understand policy terms, and prioritize comprehensive coverage can make a significant difference in your overall financial well-being.

FAQ

What are the most common discounts available to senior drivers in Florida?

Senior drivers in Florida can often qualify for discounts such as safe driver discounts, multi-car discounts, and senior-specific programs offered by various insurance companies. These discounts can significantly reduce premiums, making it easier for seniors to find affordable coverage.

How can I compare car insurance quotes from different companies?

You can compare car insurance quotes online using comparison websites or by contacting insurance companies directly. Be sure to provide accurate information about your driving history, vehicle, and desired coverage levels to receive accurate quotes.

Is it worth it to bundle my car insurance with other insurance policies?

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often lead to significant savings. Insurance companies frequently offer discounts for bundling multiple policies, making it a worthwhile consideration for seniors.