Cheapest car insurance in Florida Reddit is a popular search term for drivers looking to save money on their premiums. Florida’s car insurance market is unique, with factors like high population density, frequent accidents, and a high cost of living impacting rates. This guide explores the complexities of finding affordable car insurance in Florida, leveraging the insights and experiences shared on Reddit.

We’ll delve into the intricacies of Florida’s car insurance landscape, examining the key factors that influence rates, exploring different coverage options, and providing tips for securing the best deals. We’ll also navigate the world of Reddit, analyzing discussions, identifying relevant subreddits, and understanding the pros and cons of using this platform as a source for car insurance information.

Understanding Florida’s Car Insurance Landscape: Cheapest Car Insurance In Florida Reddit

Florida is renowned for its warm climate and beautiful beaches, but it also has a unique and complex car insurance market. Understanding the factors that influence car insurance rates and the different coverage options available is crucial for finding the best deal.

Factors Influencing Car Insurance Rates, Cheapest car insurance in florida reddit

Florida’s car insurance rates are influenced by a combination of factors, including:

- Demographics: Age, gender, and marital status can affect insurance rates. Younger drivers and unmarried individuals are generally considered higher risk, leading to higher premiums.

- Driving History: A clean driving record with no accidents or violations is essential for keeping premiums low. A history of accidents, speeding tickets, or DUI convictions can significantly increase rates.

- Vehicle Type: The type of vehicle you drive plays a significant role in determining insurance costs. Luxury cars, high-performance vehicles, and newer models often have higher premiums due to their value and potential for repair costs.

- Coverage Levels: The amount of coverage you choose directly impacts your premium. Higher coverage limits, such as comprehensive and collision coverage, offer greater protection but come at a higher cost.

- Location: Your zip code and the overall risk profile of your area influence rates. Areas with higher crime rates, traffic congestion, and a greater number of accidents typically have higher insurance premiums.

- Credit Score: In some states, including Florida, insurers may consider your credit score when setting rates. A higher credit score generally leads to lower premiums.

Types of Car Insurance Coverage

Florida law requires all drivers to carry a minimum amount of car insurance coverage, known as “Financial Responsibility.” These minimum requirements include:

- Bodily Injury Liability: Covers medical expenses and lost wages for injuries you cause to others in an accident.

- Property Damage Liability: Covers damages to another person’s property in an accident.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for injuries you sustain in an accident, regardless of fault. This is a unique Florida requirement.

In addition to these mandatory coverages, you can also choose to purchase optional coverages, such as:

- Collision Coverage: Covers damages to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Covers damages to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Provides protection if you are involved in an accident with a driver who does not have sufficient insurance or is uninsured.

- Rental Car Coverage: Covers the cost of a rental car if your vehicle is damaged or stolen.

Florida Car Insurance Market

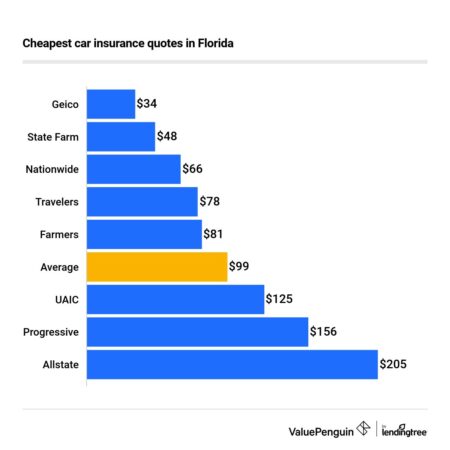

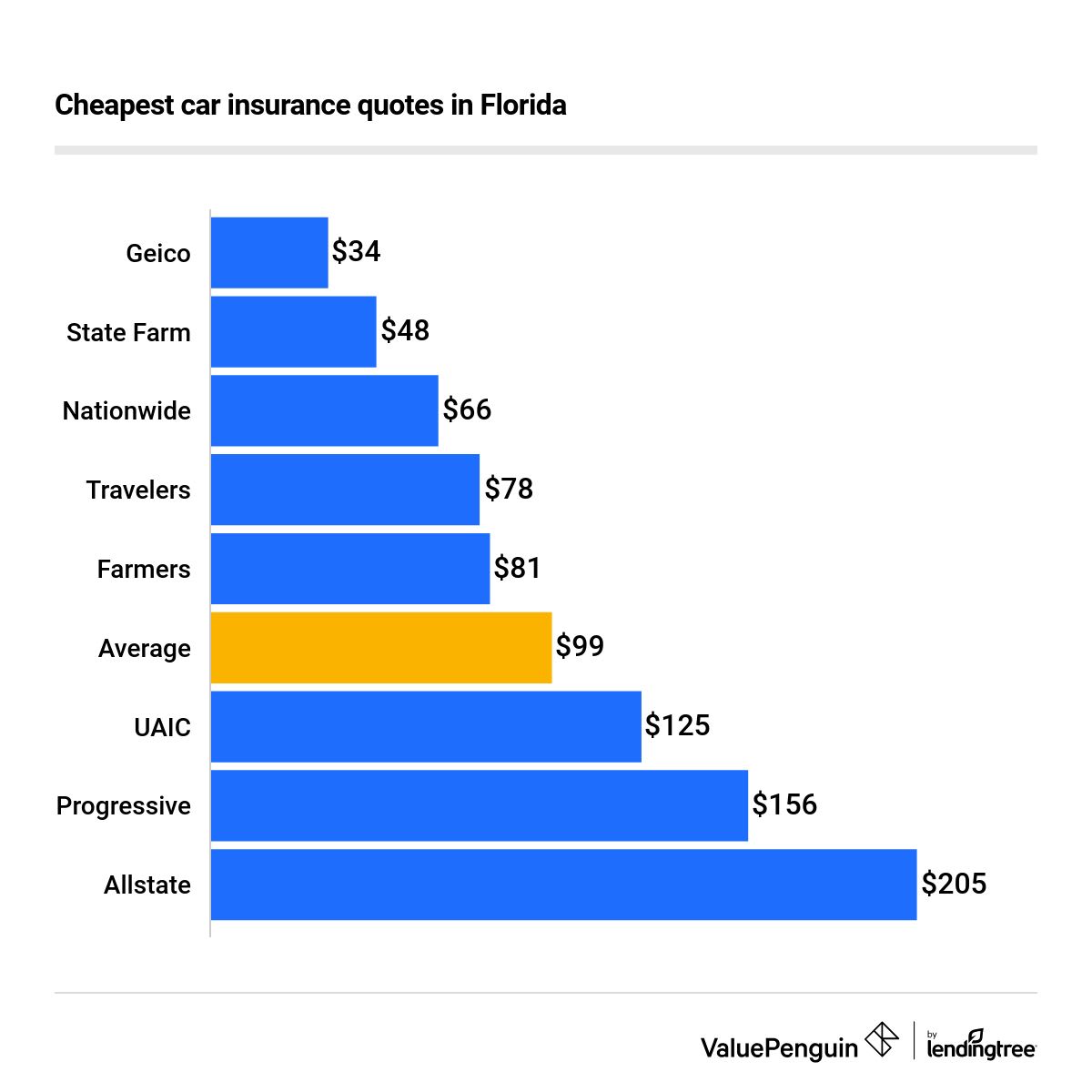

The Florida car insurance market is highly competitive, with a wide range of insurance companies operating in the state. Some of the prominent insurance companies in Florida include:

- State Farm: Known for its extensive network of agents and competitive rates.

- Geico: Offers a wide range of coverage options and is known for its affordable rates.

- Progressive: Offers a variety of discounts and is known for its innovative insurance products.

- Allstate: Known for its comprehensive coverage options and customer service.

- USAA: A military-focused insurer known for its competitive rates and exceptional customer service.

The reputation of insurance companies can vary, and it’s important to research and compare quotes from multiple providers to find the best deal for your needs.

Navigating Reddit for Car Insurance Information

Reddit is a treasure trove of information, and for those seeking car insurance insights, it can be a valuable resource. The platform offers a unique opportunity to tap into a vast community of users sharing their experiences, opinions, and advice. While Reddit can be a helpful tool, it’s crucial to approach it with a critical eye, recognizing the potential for bias and inaccurate information.

Popular Subreddits for Car Insurance Information

Reddit hosts a variety of subreddits dedicated to car insurance, financial advice, and Florida-specific topics. These communities offer a platform for users to discuss their experiences, ask questions, and share insights on car insurance.

Here are some of the most popular subreddits relevant to car insurance in Florida:

- r/personalfinance: This subreddit focuses on all aspects of personal finance, including insurance. Users often discuss their experiences with different insurance providers, share tips on saving money, and offer advice on navigating the insurance landscape.

- r/insurance: This subreddit is specifically dedicated to insurance, covering a wide range of topics, including car insurance. Users can find discussions about different insurance companies, coverage options, and tips for getting the best rates.

- r/floridaman: While not directly focused on car insurance, this subreddit often features stories related to Florida’s unique culture and lifestyle, including car-related incidents. Users can find anecdotes about accidents, traffic violations, and insurance claims, providing insights into the Florida driving experience.

- r/AskReddit: This subreddit is a general question-and-answer forum where users can ask anything, including questions related to car insurance. While the answers may not be specifically focused on Florida, they can offer valuable insights and perspectives on the insurance industry.

Pros and Cons of Using Reddit for Car Insurance Information

Reddit can be a helpful resource for gathering information about car insurance, but it’s essential to be aware of the potential pitfalls.

- Pros:

- Real-world experiences: Reddit users often share their personal experiences with different insurance providers, providing valuable insights into customer service, claims handling, and overall satisfaction.

- Community support: Reddit communities offer a supportive environment where users can ask questions, share concerns, and receive advice from others who have been through similar situations.

- Variety of perspectives: Reddit users represent a diverse range of demographics, providing a variety of perspectives on car insurance, including different needs, experiences, and opinions.

- Cons:

- Bias and subjectivity: Reddit discussions can be heavily influenced by personal opinions and experiences, which may not always be objective or representative of the broader market.

- Inaccurate information: While many Reddit users share valuable insights, some may provide inaccurate or outdated information. It’s essential to verify information from multiple sources before making any decisions.

- Lack of professional expertise: Reddit users are not insurance professionals and may not have the necessary knowledge or experience to provide accurate and comprehensive advice.

Finding the Cheapest Car Insurance Options

Once you understand the basics of Florida’s car insurance requirements and how to navigate Reddit for helpful information, the next step is to start comparing quotes from different insurance providers. This process can be overwhelming, but with a strategic approach, you can find the cheapest option that meets your needs.

Comparing Car Insurance Quotes

The best way to find the cheapest car insurance is to compare quotes from multiple providers. You can do this online, over the phone, or by visiting an insurance agent in person. When comparing quotes, be sure to consider the following factors:

- Coverage Levels: The amount of coverage you need will depend on your individual circumstances. If you have a newer car or a lot of assets to protect, you may need more comprehensive coverage. However, if you have an older car and are on a tight budget, you may be able to get by with a more basic policy.

- Deductibles: Your deductible is the amount of money you’ll have to pay out of pocket before your insurance company starts covering your claim. A higher deductible will generally mean a lower premium, but you’ll have to pay more if you need to file a claim.

- Discounts: Most insurance companies offer a variety of discounts, such as good driver discounts, safe driver discounts, and multi-car discounts. Be sure to ask about any discounts you may be eligible for.

Factors That Impact Car Insurance Costs

Several factors can significantly impact your car insurance costs. Some of these factors are within your control, while others are not.

- Driving History: Your driving history is one of the most important factors that insurance companies consider. If you have a history of accidents or traffic violations, you can expect to pay higher premiums. On the other hand, a clean driving record can help you get a lower rate.

- Credit Score: In many states, including Florida, insurance companies use your credit score to determine your insurance rates. A higher credit score generally means lower premiums.

- Location: Where you live can also impact your car insurance rates. Areas with higher crime rates or more traffic accidents tend to have higher insurance premiums.

- Vehicle Type: The type of car you drive can also affect your insurance rates. Sports cars and luxury vehicles are typically more expensive to insure than economy cars.

Example Car Insurance Quote Comparison

Here is an example of a car insurance quote comparison table. This table shows the monthly premiums for a 30-year-old driver with a clean driving record who is looking for coverage for a 2018 Honda Civic in Miami, Florida.

| Insurance Company | Monthly Premium | Coverage Details | Notable Features/Discounts |

|---|---|---|---|

| Company A | $120 | $50,000 liability, $25,000 property damage, $10,000 medical payments, uninsured motorist coverage | Good driver discount, multi-car discount |

| Company B | $105 | $50,000 liability, $25,000 property damage, $10,000 medical payments, uninsured motorist coverage | Safe driver discount, multi-car discount |

| Company C | $135 | $50,000 liability, $25,000 property damage, $10,000 medical payments, uninsured motorist coverage | Good driver discount, multi-car discount, accident forgiveness |

As you can see, the monthly premiums for the same coverage can vary significantly from one insurance company to another. It’s essential to compare quotes from several companies to ensure you’re getting the best rate.

Outcome Summary

Finding the cheapest car insurance in Florida Reddit can be a challenging but rewarding endeavor. By understanding the factors that influence rates, exploring different coverage options, and utilizing resources like Reddit for insights and comparisons, you can navigate the market effectively and secure a policy that meets your needs without breaking the bank. Remember, while price is an important consideration, don’t solely focus on the cheapest option. Prioritize reputable providers with excellent customer service and claims processing, ensuring you have adequate coverage and reliable support in case of an accident.

Answers to Common Questions

What are some common car insurance discounts available in Florida?

Florida insurance companies offer various discounts, including good driver discounts, safe driver courses, multi-car discounts, bundling discounts, and more. Contact your chosen insurer to explore the discounts they offer.

Is it better to get car insurance quotes online or through an agent?

Both methods have their pros and cons. Online quotes are quick and convenient, but an agent can provide personalized advice and help you understand your options better.

What are some common car insurance scams to be aware of?

Be cautious of unsolicited calls or emails offering low rates, and never provide personal information to unknown sources. Always verify the legitimacy of any insurance company or offer before proceeding.