Cheapest car insurance in South Florida: navigating the insurance landscape of the Sunshine State can be a challenge, especially when you’re looking for affordable coverage. South Florida, with its dense population, heavy traffic, and unique weather patterns, presents a unique set of challenges for drivers seeking the best car insurance rates. From understanding the factors that contribute to higher premiums to exploring cost-saving strategies, this guide provides a comprehensive overview of the car insurance market in South Florida.

Whether you’re a new resident or a seasoned driver, finding the right car insurance provider can be a daunting task. This guide will equip you with the knowledge and tools you need to make informed decisions and secure the most affordable car insurance in South Florida.

Understanding South Florida’s Unique Insurance Landscape

South Florida’s unique geographic location and demographic makeup contribute to a car insurance landscape that differs significantly from other regions of the United States. Several factors drive the higher insurance premiums in the region, making it crucial for drivers to understand the nuances of the market to secure the most affordable coverage.

Factors Contributing to Higher Premiums

The high population density and congested traffic in South Florida contribute to a higher frequency of accidents, leading to increased insurance claims. The region’s proximity to the coast exposes drivers to risks associated with hurricanes and other severe weather events. Additionally, South Florida’s high cost of living, including expensive car repairs and medical expenses, further impacts insurance premiums.

South Florida’s insurance market is a complex ecosystem influenced by various factors, including population density, traffic congestion, weather risks, and higher car theft rates.

Comparison with Other Regions

Compared to other regions of the United States, South Florida generally has higher car insurance premiums. The cost of living, including car repairs and medical expenses, is significantly higher in the region. Furthermore, the prevalence of expensive vehicles and the high value of property in South Florida contribute to increased insurance costs.

The cost of car insurance in South Florida is often higher than in other parts of the United States, primarily due to the factors discussed above.

Crucial Insurance Coverage for South Florida Drivers

Given the unique risks associated with driving in South Florida, specific types of insurance coverage are particularly important. Comprehensive coverage protects against damage caused by events other than collisions, such as theft, vandalism, or natural disasters. Collision coverage is crucial for covering repairs or replacement costs in case of an accident. Uninsured/underinsured motorist coverage provides protection in cases where the other driver involved in an accident is uninsured or underinsured.

In addition to the standard liability coverage, comprehensive and collision coverage are highly recommended for drivers in South Florida, considering the high risk of damage from weather events, theft, and accidents.

Exploring Cost-Saving Strategies

Navigating the high cost of car insurance in South Florida can be daunting. However, with a strategic approach and a willingness to explore different options, you can significantly reduce your premiums.

Improving Driving Record

A clean driving record is crucial for obtaining affordable car insurance in South Florida. A history of traffic violations, accidents, or even speeding tickets can significantly increase your premiums.

- Avoid traffic violations: Driving safely and adhering to traffic laws is paramount. Even minor infractions like speeding can lead to higher insurance rates.

- Defensive driving courses: Consider taking a defensive driving course to learn strategies for avoiding accidents and improving your driving skills. Many insurance companies offer discounts for completing these courses.

- Maintain a safe driving record: Be cautious and prioritize safe driving habits. Avoid distractions while driving and stay alert to potential hazards.

Maintaining a Good Credit Score

While it may seem surprising, your credit score can play a role in determining your car insurance premiums. Insurance companies use credit scores to assess your financial responsibility, believing that those with good credit are more likely to be responsible drivers.

- Monitor your credit score: Regularly check your credit score and address any errors or inconsistencies.

- Pay bills on time: Consistent and timely bill payments demonstrate financial responsibility and positively impact your credit score.

- Reduce credit utilization: Keeping your credit utilization ratio low (the amount of credit used compared to the total credit available) can improve your credit score.

Choosing a Higher Deductible

A higher deductible, the amount you pay out of pocket before your insurance coverage kicks in, can result in lower premiums.

- Assess your risk tolerance: Consider your financial situation and determine how much you are comfortable paying out of pocket in case of an accident.

- Calculate potential savings: Compare the potential premium reductions with the increased deductible amount to determine if it is financially beneficial.

- Consider a high-deductible plan: If you are confident in your driving ability and have sufficient savings to cover a higher deductible, this can significantly lower your premiums.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as home, renters, or life insurance, can lead to significant discounts.

- Compare bundled quotes: Request quotes from multiple insurance providers for bundled policies and compare the savings offered.

- Evaluate coverage needs: Ensure that the bundled policies meet your specific insurance needs and provide adequate coverage.

- Consider long-term benefits: Bundling policies can offer convenience and potential long-term cost savings.

Using a Car Insurance Broker

Car insurance brokers can help you navigate the complex world of insurance and find the best coverage at the most competitive rates.

- Access to multiple insurers: Brokers have relationships with numerous insurance providers, giving you access to a wider range of options.

- Expert advice: Brokers can provide personalized advice and guidance based on your specific needs and circumstances.

- Negotiation power: Brokers can leverage their relationships with insurers to negotiate better rates and coverage terms.

Advantages of Using a Broker, Cheapest car insurance in south florida

- Time-saving: Brokers handle the tedious process of comparing quotes and finding the best coverage, saving you time and effort.

- Personalized service: Brokers work with you to understand your needs and recommend the most suitable insurance options.

- Negotiation expertise: Brokers can negotiate better rates and coverage terms on your behalf.

Disadvantages of Using a Broker

- Potential fees: Some brokers may charge fees for their services, which should be factored into the overall cost.

- Limited insurer selection: Brokers may have limited relationships with specific insurance providers, potentially limiting your options.

- Potential conflicts of interest: Brokers may have preferred insurers, which could influence their recommendations.

Analyzing Car Insurance Providers in South Florida: Cheapest Car Insurance In South Florida

South Florida’s unique driving environment, characterized by high traffic density, diverse demographics, and a susceptibility to hurricanes, necessitates a careful approach to selecting car insurance. Understanding the strengths and weaknesses of various insurance providers is crucial for finding the most suitable and cost-effective coverage.

Top Car Insurance Providers in South Florida

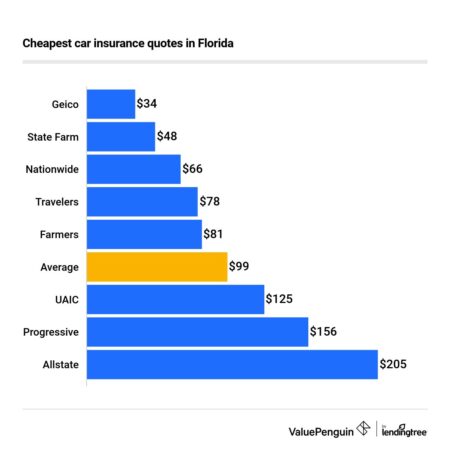

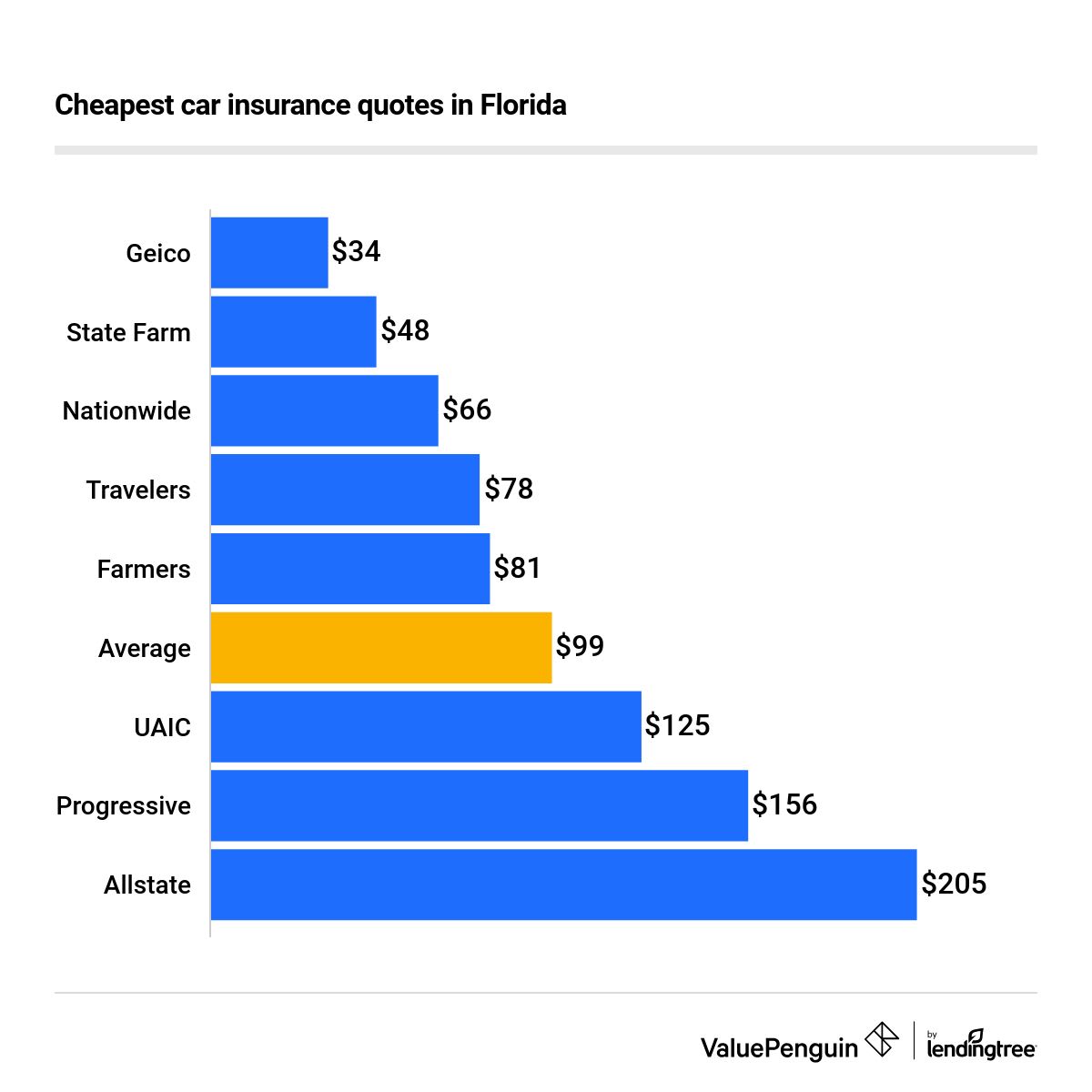

This table compares the top car insurance providers in South Florida based on average premiums, coverage options, and customer service ratings.

| Provider | Average Premium (Annual) | Coverage Options | Customer Service Rating |

|---|---|---|---|

| State Farm | $1,500 – $2,000 | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, medical payments | 4.5/5 |

| Geico | $1,400 – $1,900 | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, medical payments | 4.2/5 |

| Progressive | $1,300 – $1,800 | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, medical payments, roadside assistance | 4.0/5 |

| Allstate | $1,600 – $2,100 | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, medical payments, accident forgiveness | 3.8/5 |

| USAA | $1,200 – $1,700 (military members only) | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection, medical payments, roadside assistance, discounts for military members | 4.7/5 |

Pros and Cons of Each Provider

Understanding the pros and cons of each insurance provider helps in making an informed decision.

- State Farm:

- Pros: Strong customer service, extensive network of agents, wide range of coverage options, discounts for good driving records and safety features.

- Cons: Premiums may be higher than some competitors, claims processing can be slow.

- Geico:

- Pros: Competitive premiums, convenient online and mobile services, 24/7 customer support.

- Cons: Limited coverage options compared to some competitors, may have difficulty reaching a live agent.

- Progressive:

- Pros: Innovative features like Name Your Price tool, customizable coverage options, strong online presence.

- Cons: Customer service can be inconsistent, claims processing can be slow.

- Allstate:

- Pros: Strong financial stability, accident forgiveness program, wide range of discounts.

- Cons: Premiums may be higher than some competitors, customer service can be inconsistent.

- USAA:

- Pros: Excellent customer service, competitive premiums for military members, comprehensive coverage options.

- Cons: Only available to military members and their families.

Reputable Online Car Insurance Comparison Websites

Utilizing online car insurance comparison websites can streamline the process of finding the best rates.

- Policygenius: Offers personalized quotes from multiple insurers, user-friendly interface, and helpful customer support.

- Insurify: Compares quotes from over 20 insurance providers, provides insights on coverage options, and offers a free insurance analysis.

- The Zebra: Offers side-by-side comparisons of quotes, provides detailed coverage information, and allows for customization of quotes.

Conclusive Thoughts

In conclusion, securing the cheapest car insurance in South Florida requires a proactive approach. By understanding the unique insurance landscape, exploring cost-saving strategies, comparing providers, and taking advantage of discounts, you can find the most affordable coverage that meets your individual needs. Remember to regularly review your policy and make adjustments as necessary to ensure you’re getting the best value for your money.

Commonly Asked Questions

What are the main factors that contribute to higher car insurance premiums in South Florida?

Higher car insurance premiums in South Florida are often attributed to factors such as high population density, heavy traffic, increased risk of accidents, higher car theft rates, and potential for severe weather events like hurricanes.

What are some tips for lowering car insurance premiums in South Florida?

To lower your car insurance premiums in South Florida, consider improving your driving record, maintaining a good credit score, increasing your deductible, bundling insurance policies, and exploring discounts offered by insurance providers.

How can I find the cheapest car insurance in South Florida?

To find the cheapest car insurance in South Florida, compare quotes from multiple insurance providers, use online comparison websites, and consider factors like coverage options, discounts, and customer service ratings.