Cheapest car insurance plant city florida – Cheapest car insurance Plant City, Florida – a quest that every driver in the Sunshine State embarks on. With its unique blend of urban and rural landscapes, Plant City presents a diverse set of factors that influence insurance premiums. From traffic congestion to weather conditions, understanding these elements is crucial to securing the most affordable coverage.

This guide will explore the ins and outs of car insurance in Plant City, providing you with valuable insights to navigate the market and find the best deals. We’ll delve into the factors that determine your premium, analyze the different types of coverage available, and equip you with practical tips to minimize your costs.

Understanding Car Insurance in Plant City, Florida

Plant City, Florida, like any other city, has its own unique factors that affect car insurance rates. Understanding these factors can help you find the most affordable coverage for your needs.

Factors Influencing Car Insurance Costs in Plant City

Several factors influence car insurance costs in Plant City, including:

- Driving History: Your driving record is a major factor. Accidents, speeding tickets, and DUI convictions can significantly increase your premiums. A clean driving record can lead to lower rates.

- Age and Gender: Younger drivers, particularly males, often face higher insurance rates due to their higher risk of accidents. As drivers age and gain experience, their rates typically decrease.

- Vehicle Type and Value: The type and value of your car play a role. Expensive, high-performance vehicles are more costly to insure than older, less expensive cars. This is because the cost of repairs and replacement is higher for luxury or sports cars.

- Location: Plant City’s specific location within Florida can impact your rates. Areas with higher crime rates or more traffic congestion may have higher insurance costs due to a greater risk of accidents or theft.

- Coverage Options: The type and amount of coverage you choose will affect your premium. Higher coverage limits generally mean higher premiums.

- Credit Score: While controversial, some insurance companies consider credit scores when determining rates. A good credit score may lead to lower premiums.

Types of Car Insurance Available in Florida

Florida offers various types of car insurance, each providing different levels of protection:

- Liability Coverage: This is the most basic type of car insurance required in Florida. It covers damages to other people’s property or injuries to other people in an accident you cause. Liability coverage typically includes bodily injury liability and property damage liability.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who caused the accident. It’s mandatory in Florida.

- Collision Coverage: This coverage pays for repairs or replacement of your car if it’s damaged in an accident, regardless of fault. You can choose to have this coverage, but it’s not mandatory.

- Comprehensive Coverage: This coverage protects your car against damage from events other than collisions, such as theft, vandalism, fire, or natural disasters. It’s optional in Florida.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. It’s optional in Florida.

Legal Requirements for Car Insurance in Florida

Florida law requires all drivers to carry a minimum amount of liability insurance:

$10,000 per person for bodily injury liability

$20,000 per accident for bodily injury liability

$10,000 per accident for property damage liability

$10,000 per person for personal injury protection (PIP)

You must also have proof of insurance in your vehicle at all times. Failure to carry the required insurance can result in fines, license suspension, and even jail time.

Finding the Cheapest Car Insurance Options: Cheapest Car Insurance Plant City Florida

Finding the most affordable car insurance in Plant City, Florida, requires a strategic approach. By comparing different providers, understanding their offerings, and leveraging available discounts, you can significantly reduce your insurance premiums.

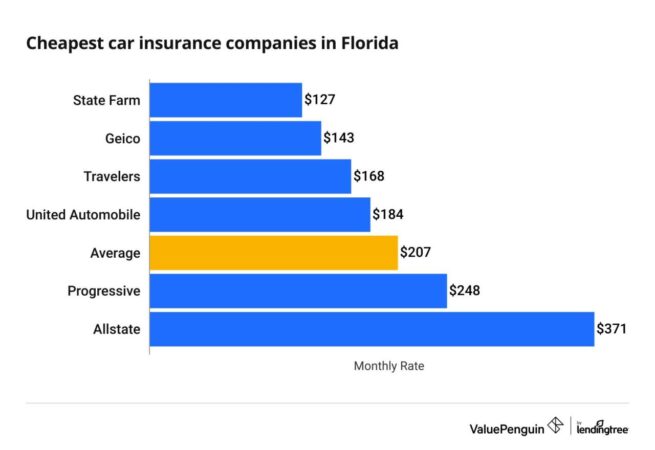

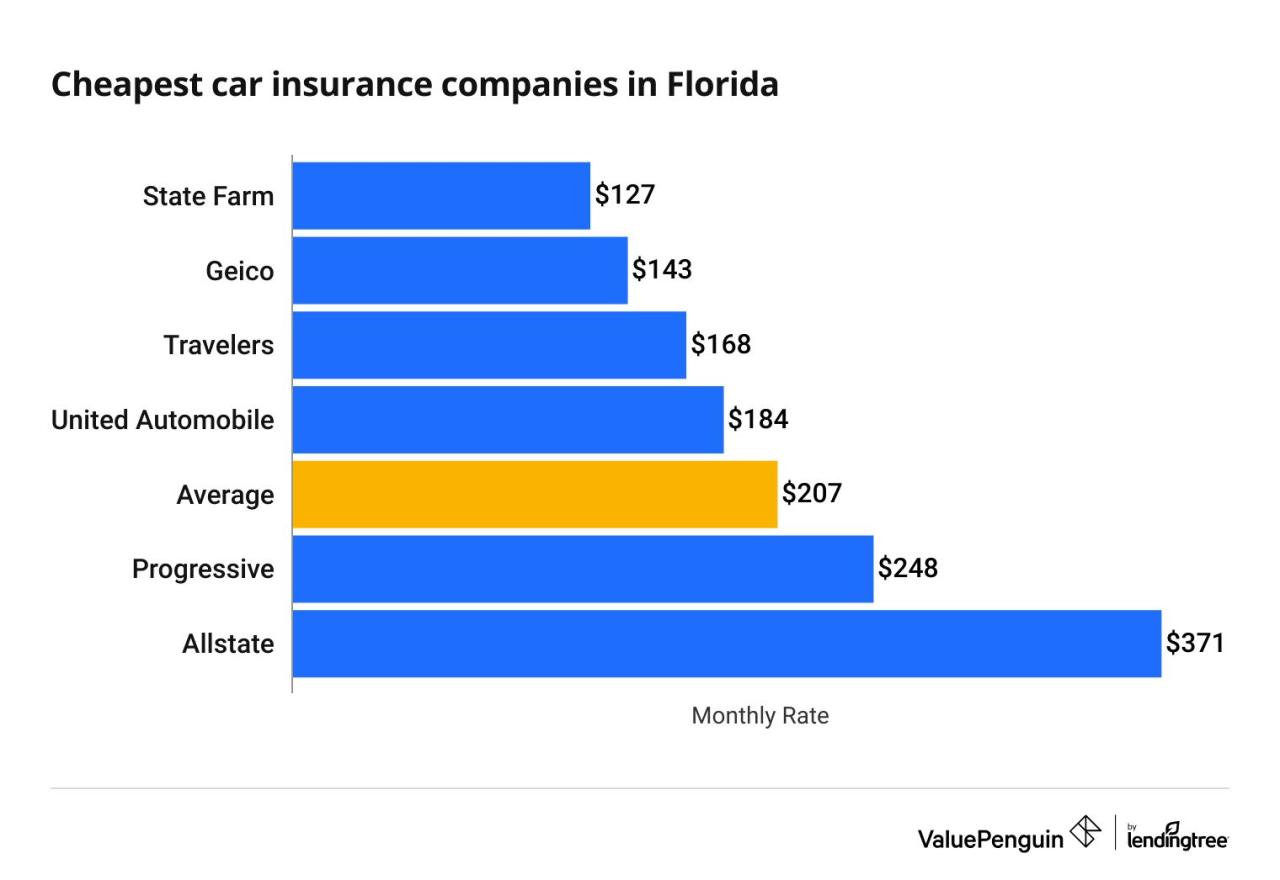

Comparing Car Insurance Providers in Plant City

It’s crucial to compare quotes from multiple insurance companies to find the best rates. Plant City offers a diverse range of insurance providers, each with its own strengths and weaknesses.

- State Farm: State Farm is a well-established national insurance company with a strong presence in Plant City. They offer competitive rates, a wide range of coverage options, and excellent customer service.

- GEICO: GEICO is known for its affordable rates and convenient online services. They have a strong reputation for handling claims efficiently and offer a variety of discounts.

- Progressive: Progressive is another popular choice for car insurance in Plant City. They are known for their innovative features, such as their “Name Your Price” tool that allows you to set your desired premium and find coverage options that match.

- Allstate: Allstate offers a comprehensive range of car insurance products and services. They are known for their strong financial stability and commitment to customer satisfaction.

- Florida Peninsula Insurance: As a Florida-based company, Florida Peninsula Insurance often offers competitive rates for drivers in Plant City. They specialize in providing insurance to residents of the state.

Key Features and Benefits of Different Insurance Companies

Each insurance provider offers unique features and benefits that cater to different needs and preferences.

- State Farm: State Farm provides a comprehensive suite of insurance products, including car, home, life, and health insurance. They offer a wide range of discounts, including good driver, safe driver, and multi-policy discounts.

- GEICO: GEICO is known for its convenient online and mobile services, allowing you to manage your policy, pay premiums, and file claims easily. They offer a variety of discounts, including good driver, defensive driving, and military discounts.

- Progressive: Progressive offers innovative features like its “Name Your Price” tool and its “Snapshot” program that uses telematics to track your driving habits and offer discounts based on your driving behavior. They also offer a wide range of coverage options, including accident forgiveness and rental car reimbursement.

- Allstate: Allstate provides a strong financial foundation and a commitment to customer satisfaction. They offer a range of discounts, including good driver, safe driver, and multi-policy discounts.

- Florida Peninsula Insurance: Florida Peninsula Insurance offers competitive rates and a focus on providing insurance to Florida residents. They offer a range of discounts, including good driver, safe driver, and multi-policy discounts.

Tips for Obtaining Discounts and Saving Money on Car Insurance Premiums

Several strategies can help you reduce your car insurance premiums.

- Maintain a Good Driving Record: A clean driving record with no accidents or traffic violations can significantly lower your premiums.

- Improve Your Credit Score: In some states, insurance companies use credit scores to assess risk and determine premiums. A higher credit score can lead to lower rates.

- Bundle Your Insurance Policies: Combining your car insurance with other policies, such as home or renters insurance, can often result in significant discounts.

- Take a Defensive Driving Course: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount.

- Increase Your Deductible: Opting for a higher deductible can lower your premium, as you agree to pay more out-of-pocket in case of an accident.

- Compare Quotes Regularly: Don’t settle for the first quote you receive. Regularly compare quotes from different providers to ensure you’re getting the best rate.

Essential Factors to Consider

Finding the cheapest car insurance in Plant City, Florida, requires careful consideration of several key factors that influence your premiums. Understanding these factors empowers you to make informed decisions and potentially save money on your car insurance.

Comparing Quotes from Multiple Insurers

Obtaining quotes from multiple insurance companies is crucial to securing the most competitive rates. Each insurer uses its own proprietary algorithms to calculate premiums, factoring in various aspects of your profile and risk assessment. By comparing quotes, you can identify the insurer offering the most favorable terms for your specific circumstances.

- Online comparison tools: Websites like Policygenius, The Zebra, and Insurance.com allow you to enter your information once and receive quotes from multiple insurers simultaneously, simplifying the comparison process.

- Direct contact with insurers: You can also contact insurers directly to obtain quotes. This allows you to ask specific questions and discuss your individual needs with a representative.

- Consider factors influencing quotes: Remember that factors such as your driving history, credit score, vehicle type, and coverage levels can significantly impact your premiums. Be prepared to provide accurate information to ensure accurate quote comparisons.

Impact of Driving History and Credit Score

Your driving history plays a significant role in determining your car insurance premiums. A clean driving record with no accidents or violations typically translates to lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions can lead to higher premiums.

Your driving history is a significant factor in determining your car insurance premiums. A clean record translates to lower premiums, while a history of accidents or violations can increase them.

Similarly, your credit score can influence your insurance rates in many states, including Florida. Insurers often use credit scores as a proxy for risk assessment, believing that individuals with good credit are more financially responsible and less likely to file claims.

- Improve your credit score: You can improve your credit score by paying bills on time, keeping credit card balances low, and avoiding excessive credit applications.

- Shop around for insurers: Different insurers may have varying policies regarding credit score usage. Compare quotes from insurers that do not factor in credit scores or offer discounts for good credit.

Vehicle Type and Coverage Levels

The type of vehicle you drive and the level of coverage you choose directly affect your insurance costs.

- Vehicle type: Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and potential for greater damage in accidents. Older vehicles with lower market values may have lower insurance premiums.

- Coverage levels: The amount of coverage you choose, such as liability, collision, and comprehensive, impacts your premiums. Higher coverage levels typically result in higher premiums, but they also offer greater financial protection in case of accidents or damage to your vehicle.

Tips for Lowering Your Premium

Lowering your car insurance premium in Plant City, Florida, can be achieved by understanding the factors that influence your rates and implementing strategies to improve your profile. This can be done by taking steps to reduce your risk, choosing the right coverage, and maximizing discounts.

Improving Your Driving Record

A clean driving record is crucial for lowering your car insurance premiums. Maintaining a safe driving record demonstrates your responsibility and reduces your risk profile, making you a more attractive customer to insurers.

- Avoid Traffic Violations: Traffic violations, such as speeding tickets or reckless driving, significantly increase your insurance premiums. Focus on safe driving practices to minimize the risk of receiving citations.

- Complete a Defensive Driving Course: Completing a defensive driving course can lower your premiums in many cases. These courses teach you safe driving techniques and help you understand traffic laws, potentially reducing your risk of accidents and violations.

- Avoid Accidents: Accidents, even if they are not your fault, can lead to higher premiums. Drive defensively and be aware of your surroundings to minimize the chance of getting into an accident.

Organizing Your Car Insurance Policy

Optimizing your car insurance policy can lead to significant savings. You can achieve this by carefully evaluating your coverage needs and ensuring that you have the right level of protection while avoiding unnecessary expenses.

- Review Coverage Options: Understand the different types of coverage offered, such as liability, collision, comprehensive, and uninsured/underinsured motorist. Compare the cost and benefits of each option and choose the coverage that best fits your needs and budget.

- Adjust Deductibles: Increasing your deductible, the amount you pay out of pocket before your insurance kicks in, can lower your premiums. However, ensure that you can afford the deductible if you need to file a claim.

- Consider Bundling: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant discounts.

Maximizing Discounts, Cheapest car insurance plant city florida

Many car insurance companies offer discounts to policyholders who meet certain criteria. Exploring these discounts can significantly reduce your premium.

- Good Student Discount: If you or a member of your household is a good student with a high GPA, you may qualify for a good student discount. This discount acknowledges the responsible nature of good students and reflects their lower risk profile.

- Safe Driver Discount: Maintaining a safe driving record and avoiding accidents and violations can qualify you for a safe driver discount. This discount rewards drivers who demonstrate responsible driving habits and have a lower risk of accidents.

- Multi-Car Discount: Insuring multiple vehicles with the same company often leads to a multi-car discount. This discount acknowledges the lower risk associated with insuring multiple vehicles with the same company.

- Loyalty Discount: Many insurers offer loyalty discounts to long-term policyholders who have maintained their policies for a certain period. This discount rewards customer loyalty and recognizes the long-term relationship with the insurance company.

Additional Resources and Information

Finding the best car insurance in Plant City can be a time-consuming process. However, with the right tools and resources, you can make informed decisions and secure the most affordable coverage for your needs. This section provides additional resources and information to aid your research and ensure you get the best possible car insurance deal.

Reputable Sources for Car Insurance Information

- Florida Department of Financial Services: This government agency provides valuable information about car insurance regulations, consumer rights, and complaint resolution in Florida. You can access their website for resources and contact information. [Link: https://www.fldfs.com/](https://www.fldfs.com/)

- Insurance Information Institute (III): The III is a non-profit organization that provides comprehensive information about insurance, including car insurance. Their website offers valuable resources, including statistics, trends, and tips for finding the best coverage. [Link: https://www.iii.org/](https://www.iii.org/)

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that works to promote uniformity and efficiency in insurance regulation. Their website offers resources for consumers, including information about car insurance laws and regulations. [Link: https://www.naic.org/](https://www.naic.org/)

Local Insurance Agencies in Plant City

Several local insurance agencies in Plant City offer car insurance services. It’s advisable to contact multiple agencies for personalized quotes and compare their offerings. Some of the agencies you can contact include:

- State Farm: [Phone: 813-752-5555](tel:813-752-5555) [Address: 1401 James L Redman Pkwy, Plant City, FL 33563](https://www.google.com/maps/place/1401+James+L+Redman+Pkwy,+Plant+City,+FL+33563/@28.0726593,-82.2949347,17z/data=!3m1!4b1!4m5!3m4!1s0x88c2f9c371a81c85:0x1287884536220579!8m2!3d28.0726593!4d-82.2949347)

- Geico: [Phone: 800-434-4111](tel:800-434-4111) [Address: 2001 James L Redman Pkwy, Plant City, FL 33563](https://www.google.com/maps/place/2001+James+L+Redman+Pkwy,+Plant+City,+FL+33563/@28.0731344,-82.2954237,17z/data=!3m1!4b1!4m5!3m4!1s0x88c2f9c37308a603:0x347487d5365525a6!8m2!3d28.0731344!4d-82.2954237)

- Progressive: [Phone: 800-776-4737](tel:800-776-4737) [Address: 1200 James L Redman Pkwy, Plant City, FL 33563](https://www.google.com/maps/place/1200+James+L+Redman+Pkwy,+Plant+City,+FL+33563/@28.0729942,-82.2950627,17z/data=!3m1!4b1!4m5!3m4!1s0x88c2f9c3728645e5:0x433d93696635127a!8m2!3d28.0729942!4d-82.2950627)

Using Online Tools for Quote Comparison

Several online tools and websites can help you compare car insurance quotes from multiple providers simultaneously. These platforms allow you to input your details, such as your driving history, vehicle information, and coverage preferences, and receive personalized quotes from various insurers. This simplifies the process of finding the cheapest option.

Some popular quote comparison websites include:

- Insurify: [Link: https://www.insurify.com/](https://www.insurify.com/)

- Policygenius: [Link: https://www.policygenius.com/](https://www.policygenius.com/)

- The Zebra: [Link: https://www.thezebra.com/](https://www.thezebra.com/)

These platforms can save you time and effort by providing a comprehensive comparison of quotes from different insurance companies, helping you make an informed decision about the best coverage for your needs and budget.

Final Thoughts

Navigating the car insurance landscape in Plant City can be overwhelming, but with the right knowledge and strategy, you can find the cheapest and most suitable coverage for your needs. Remember to compare quotes, leverage discounts, and prioritize safety on the road to secure the best possible deal. By taking a proactive approach, you can enjoy the peace of mind that comes with knowing you’re protected while keeping your insurance costs in check.

Key Questions Answered

What are the main factors that influence car insurance rates in Plant City, Florida?

Car insurance rates in Plant City are influenced by factors like your driving history, age, credit score, vehicle type, coverage levels, and the location’s accident frequency and crime rates.

How can I get the best car insurance deals in Plant City?

To secure the best deals, compare quotes from multiple insurers, leverage discounts, maintain a good driving record, and choose the right coverage levels for your needs.

What are some common discounts offered by car insurance companies in Plant City?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for safety features in your vehicle.