Cheapest car insurance quotes Florida can be a challenge to find, given the state’s unique insurance market. Florida boasts a high concentration of drivers, making insurance costs significantly higher than in other states. However, with careful planning and research, you can find affordable coverage that meets your needs.

Navigating the Florida car insurance landscape requires understanding factors that influence pricing, including your driving record, vehicle type, coverage levels, and even your credit score. Additionally, Florida’s unique insurance regulations and laws can further impact your premiums. This guide will equip you with the knowledge and strategies to secure the most affordable car insurance in Florida.

Understanding Florida’s Car Insurance Market

Florida’s car insurance market is unique and complex, influenced by various factors that contribute to its high premiums. Understanding these factors can help you navigate the market effectively and find the best coverage at a reasonable price.

Factors Influencing Car Insurance Costs in Florida, Cheapest car insurance quotes florida

The cost of car insurance in Florida is influenced by a combination of factors, including:

- High Number of Accidents and Claims: Florida has a high number of car accidents and insurance claims, leading to increased costs for insurance companies. This is attributed to factors like a large population, a high number of tourists, and a significant number of uninsured drivers.

- High Litigation Rates: Florida has a high rate of car accident lawsuits, further driving up insurance costs. This is partly due to the state’s “no-fault” insurance system, which allows drivers to sue even for minor accidents.

- High Property Values: Florida’s real estate market is characterized by high property values, which can result in higher insurance claims for damage to vehicles and property.

- Natural Disasters: Florida is prone to hurricanes and other natural disasters, increasing the risk of damage to vehicles and property. Insurance companies factor in these risks when calculating premiums.

- Fraudulent Claims: Florida has a significant problem with fraudulent insurance claims, which increases costs for legitimate claimants.

- High Cost of Living: Florida’s high cost of living, including medical expenses, contributes to higher insurance premiums.

Florida’s Unique Insurance Laws and Regulations

Florida has specific insurance laws and regulations that impact car insurance costs:

- No-Fault Insurance: Florida is a “no-fault” insurance state, meaning drivers are required to carry Personal Injury Protection (PIP) coverage, which covers their own medical expenses and lost wages after an accident, regardless of fault.

- Mandatory Coverage: Florida requires drivers to carry a minimum amount of liability insurance, which covers damage to other vehicles and injuries to other people in an accident.

- PIP Coverage Limits: PIP coverage limits are set by the state, which can affect the amount of benefits available to drivers.

- “Fault” System for Property Damage: While Florida has a no-fault system for personal injury, it uses a “fault” system for property damage, meaning the driver at fault is responsible for covering the cost of repairs.

- “Limited Tort” Option: Florida drivers have the option to choose “limited tort” coverage, which limits their right to sue for pain and suffering in a car accident.

Impact of Florida’s Insurance Laws and Regulations on Premiums

Florida’s insurance laws and regulations have a significant impact on car insurance premiums:

- Higher PIP Premiums: Florida’s mandatory PIP coverage contributes to higher premiums, as insurers have to cover medical expenses and lost wages, even for minor accidents.

- Increased Litigation Costs: The no-fault system can lead to increased litigation costs, as drivers may still sue for pain and suffering, even if they are at fault.

- Limited Tort Option: Choosing the “limited tort” option can lead to lower premiums, but it also limits the driver’s right to sue for pain and suffering.

- Higher Premiums for Uninsured Motorists: Florida’s high number of uninsured drivers leads to higher premiums for those who carry uninsured motorist coverage.

Key Factors Affecting Car Insurance Quotes

Car insurance companies in Florida, like elsewhere, employ a complex system to determine your premium. This system involves a multitude of factors, each playing a significant role in influencing the final cost of your insurance. Understanding these factors can empower you to make informed decisions that could potentially lower your premiums.

Factors Influencing Premium Pricing

The factors that influence your car insurance premium can be broadly categorized into two main groups:

* Driver-related factors – These factors pertain to you, the driver, and your driving history.

* Vehicle-related factors – These factors relate to the car you drive, including its make, model, and safety features.

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Driving History | This includes your driving record, such as accidents, traffic violations, and DUI convictions. | A clean driving record typically results in lower premiums. Conversely, a history of accidents or violations can significantly increase your premium. | A driver with a clean record might receive a 10% discount on their premium, while a driver with a recent DUI conviction could see their premium increase by 20% or more. |

| Age and Gender | Insurance companies generally consider younger drivers, especially those under 25, as statistically riskier. This is because younger drivers often have less experience and are more prone to accidents. Gender can also play a role, with some studies showing that young men tend to be involved in more accidents than young women. | Younger drivers typically pay higher premiums than older drivers. Gender can also impact premiums, with young men often paying more than young women. | A 20-year-old male driver might pay significantly higher premiums than a 40-year-old female driver with the same driving record. |

| Credit Score | While not directly related to driving, your credit score can be used as a proxy for risk by some insurance companies. A lower credit score might indicate a higher risk of financial instability, which could lead to an inability to pay premiums. | A good credit score can lead to lower premiums, while a poor credit score can result in higher premiums. | A driver with a credit score of 750 might receive a 5% discount on their premium, while a driver with a credit score of 550 might see their premium increase by 10%. |

| Driving Experience | Insurance companies often reward drivers with more experience, as they tend to be safer drivers with a lower risk of accidents. | Drivers with more experience typically pay lower premiums than those with less experience. | A driver with 10 years of driving experience might pay a lower premium than a driver with only 2 years of experience. |

| Vehicle Type | The type of vehicle you drive plays a crucial role in determining your premium. For example, sports cars and luxury vehicles are often associated with higher risk due to their performance and potential for more severe accidents. | Higher-risk vehicles typically have higher premiums. | A driver with a sports car might pay a significantly higher premium than a driver with a compact sedan. |

| Safety Features | Vehicles equipped with safety features like anti-lock brakes, airbags, and stability control are considered safer and less likely to be involved in accidents. | Vehicles with more safety features typically have lower premiums. | A driver with a car equipped with advanced safety features might receive a 10% discount on their premium compared to a driver with a car without those features. |

| Location | Your location can significantly impact your premium. Areas with higher crime rates or more traffic congestion are generally associated with a higher risk of accidents, resulting in higher premiums. | Drivers in high-risk areas typically pay higher premiums than drivers in low-risk areas. | A driver living in a city with a high crime rate might pay a 15% higher premium than a driver living in a rural area with a low crime rate. |

| Coverage Levels | The amount of coverage you choose, such as liability limits and collision coverage, can also affect your premium. | Higher coverage levels typically result in higher premiums. | A driver with higher liability limits and comprehensive coverage might pay a 20% higher premium than a driver with lower limits and only basic coverage. |

Finding the Cheapest Car Insurance Quotes: Cheapest Car Insurance Quotes Florida

In the vast landscape of Florida’s car insurance market, navigating the complexities of finding the most affordable coverage can feel overwhelming. Fortunately, online car insurance comparison websites provide a convenient and efficient way to compare quotes from multiple insurers, empowering you to make informed decisions.

Reliable Online Car Insurance Comparison Websites

Online car insurance comparison websites play a crucial role in helping Florida residents find the cheapest car insurance quotes. These platforms act as intermediaries, connecting you with various insurance providers and presenting you with a comprehensive list of quotes tailored to your specific needs. Here are some reputable websites known for their user-friendly interfaces and comprehensive coverage:

- Insurify: This platform aggregates quotes from over 20 leading insurance companies, offering a wide selection of options to compare. Insurify leverages its extensive database to analyze your driving history, vehicle details, and other factors, providing personalized quotes based on your unique profile.

- QuoteWizard: QuoteWizard boasts a user-friendly interface and a comprehensive network of insurance providers. It allows you to compare quotes from various insurers, including regional and national companies, enabling you to explore a diverse range of options.

- The Zebra: The Zebra prides itself on its user-friendly interface and transparent pricing. It offers a comprehensive comparison tool that considers factors like your driving history, vehicle type, and coverage needs, providing a clear picture of the available options.

- Policygenius: Policygenius offers a personalized approach to car insurance shopping. It analyzes your individual needs and preferences, recommending the best insurance plans from its network of trusted insurers. Policygenius provides a dedicated team of licensed insurance advisors to guide you through the process and answer any questions you may have.

Benefits and Drawbacks of Using Comparison Platforms

Using online car insurance comparison websites offers several advantages, but it’s essential to understand their limitations:

Benefits:

- Convenience: These platforms eliminate the need to contact multiple insurers individually, saving you time and effort. You can easily compare quotes from various providers within minutes, all from the comfort of your home.

- Transparency: Comparison websites provide a clear and unbiased view of different insurance options, allowing you to easily compare prices, coverage details, and policy features.

- Competition: The presence of multiple insurers on these platforms creates healthy competition, potentially driving down prices and offering more favorable terms.

Drawbacks:

- Limited Customization: While comparison websites offer a broad overview of insurance options, they may not always capture all your specific needs or preferences. Some insurers may offer unique features or discounts not reflected on these platforms.

- Potential for Inaccurate Information: Occasionally, comparison websites may display outdated or inaccurate information due to data inconsistencies or delays in updates from insurance providers.

- Limited Personalization: Comparison websites rely on automated processes to generate quotes, which may not always account for your unique circumstances or specific risk factors.

Effectively Using Comparison Websites to Find the Best Deals

To maximize the effectiveness of online car insurance comparison websites and find the best deals, follow these steps:

- Gather Essential Information: Before you start comparing quotes, gather all the necessary information, including your driving history, vehicle details, coverage needs, and personal details.

- Use Multiple Comparison Websites: Don’t limit yourself to a single website. Use multiple platforms to compare quotes from a wider range of insurers and ensure you’re getting the most competitive rates.

- Review Coverage Details Carefully: Don’t solely focus on price. Pay close attention to coverage details, deductibles, and policy features to ensure you’re getting the right protection for your needs.

- Consider Discounts: Many insurers offer discounts for good driving records, safety features, and other factors. Explore these discounts and factor them into your decision-making process.

- Read Reviews: Before choosing an insurer, read customer reviews and ratings to gain insights into their reputation and customer service quality.

- Contact Insurers Directly: After comparing quotes, consider contacting insurers directly to discuss your specific needs and negotiate better rates or additional discounts.

End of Discussion

Finding the cheapest car insurance quotes in Florida is a journey that involves understanding the market, exploring various options, and making informed decisions. By carefully comparing quotes from multiple insurers, understanding coverage options, and utilizing strategies to lower your premiums, you can secure affordable car insurance that provides the necessary protection without breaking the bank.

FAQ Compilation

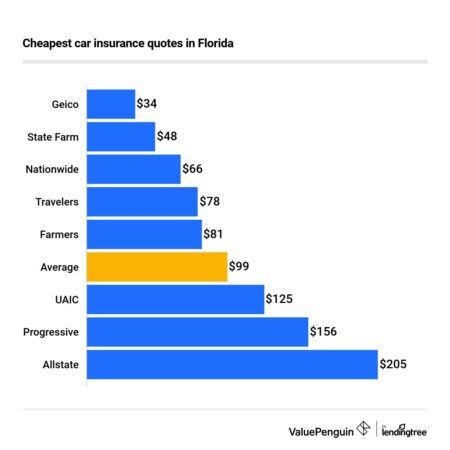

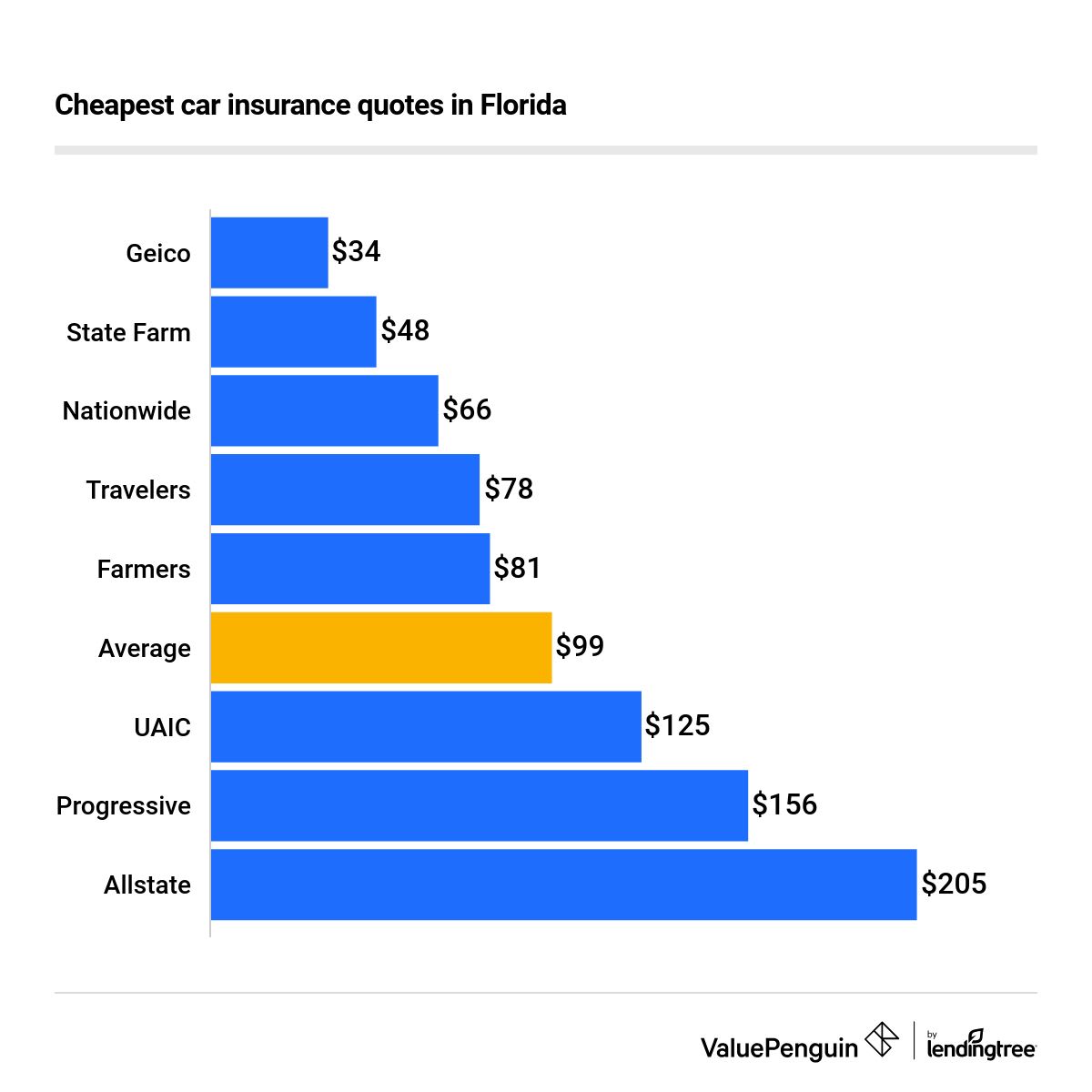

What is the average car insurance cost in Florida?

The average car insurance cost in Florida is higher than the national average. However, it varies significantly based on factors like driving history, vehicle type, and coverage levels.

How often should I compare car insurance quotes?

It’s recommended to compare car insurance quotes at least once a year, or even more frequently if you experience any significant life changes like a new car, a change in your driving record, or a move to a new location.

What are the best car insurance companies in Florida?

The best car insurance company for you depends on your individual needs and preferences. It’s important to compare quotes from multiple insurers and consider factors like customer service, coverage options, and pricing.