Cheapest Florida car insurance might seem like a distant dream in a state known for its high premiums. But with a little research and strategic planning, finding affordable coverage is achievable. Florida’s unique driving environment, with its high population density and frequent severe weather events, significantly impacts insurance costs. Understanding the factors that influence premiums and exploring available discounts can help you secure the best possible rate.

This guide will delve into the intricacies of Florida’s car insurance market, providing insights into finding affordable options and maximizing your savings. We’ll explore key factors that impact premiums, discuss reputable insurance companies, and offer tips for navigating the insurance process effectively.

Understanding Florida’s Car Insurance Market

Florida is known for its sunshine, beaches, and… high car insurance rates. While the state offers a beautiful backdrop for life, its unique characteristics make car insurance more expensive than in many other parts of the country. Understanding the factors contributing to these costs is crucial for Florida residents seeking affordable coverage.

Factors Contributing to High Car Insurance Costs in Florida

Florida’s car insurance market is influenced by a combination of factors that drive up premiums.

- High Number of Accidents and Claims: Florida has a high rate of car accidents, which leads to a large number of insurance claims. This high claim frequency directly impacts insurance companies’ costs, ultimately reflected in higher premiums.

- High Cost of Healthcare: The state has a high cost of healthcare, particularly for accident-related injuries. When insurance companies have to pay out more for medical expenses, they pass those costs on to policyholders.

- Fraudulent Claims: Florida has a history of insurance fraud, which can be costly for insurance companies. They have to factor in the potential for fraudulent claims when setting premiums.

- No-Fault Insurance System: Florida operates under a no-fault insurance system, where drivers are required to carry personal injury protection (PIP) coverage. This system can lead to higher premiums as it encourages more claims.

Florida’s Driving Environment and its Impact on Insurance Premiums

Florida’s driving environment is characterized by factors that contribute to the high cost of car insurance.

- Large Population and Tourist Traffic: The state has a large and diverse population, along with significant tourist traffic. This leads to increased congestion on roads, raising the risk of accidents.

- Severe Weather Conditions: Florida experiences hurricanes, severe thunderstorms, and other extreme weather events. These conditions can lead to accidents and damage to vehicles, increasing insurance claims.

- High Number of Elderly Drivers: Florida has a large population of elderly drivers, who are statistically more likely to be involved in accidents. This factor contributes to higher premiums.

Florida’s No-Fault Insurance System and its Impact on Insurance Costs

Florida’s no-fault insurance system requires drivers to carry personal injury protection (PIP) coverage. This system has a significant impact on car insurance costs.

“The no-fault system in Florida is designed to ensure that injured drivers can access medical care and lost wages, regardless of fault. However, it can also lead to higher premiums due to increased claims and potential for fraud.”

- Increased Claims: The no-fault system encourages more claims, as injured drivers are entitled to benefits even if they are partially at fault for the accident.

- Potential for Fraud: The no-fault system can be susceptible to fraud, as some individuals may attempt to file false claims for medical treatment or lost wages.

Finding Affordable Car Insurance Options

Finding the cheapest car insurance in Florida requires a strategic approach. You need to understand the market, compare different options, and consider factors that influence your premium.

Reputable Car Insurance Companies in Florida

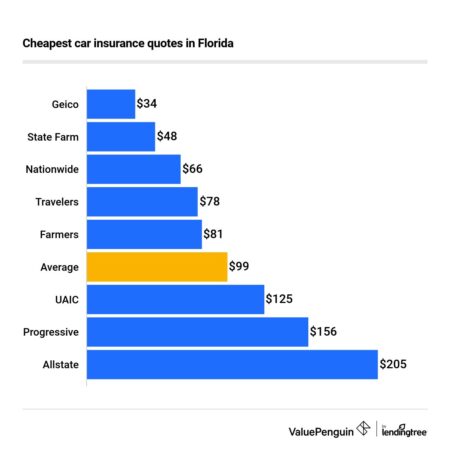

Choosing a reputable car insurance company is crucial for ensuring reliable coverage and competitive rates. Several well-known insurers offer competitive rates in Florida.

- State Farm: State Farm is a leading national insurer with a strong presence in Florida. They are known for their competitive rates, comprehensive coverage options, and excellent customer service.

- Geico: Geico is another popular national insurer with a reputation for affordability. They offer a wide range of coverage options and convenient online tools for managing your policy.

- Progressive: Progressive is a well-known insurer that offers a variety of discounts and personalized insurance plans. They are known for their innovative features, such as their Name Your Price tool.

- USAA: USAA is a highly-rated insurer that specializes in serving military members and their families. They offer competitive rates, excellent customer service, and a wide range of coverage options.

- Florida Peninsula Insurance Company: This Florida-based company offers competitive rates for drivers with good driving records. They are known for their commitment to customer satisfaction and their focus on providing affordable coverage.

Tips for Finding the Cheapest Car Insurance Quotes

- Compare Quotes from Multiple Providers: Obtaining quotes from several insurance companies is essential for finding the best deal. Online comparison websites like Insurify, Policygenius, and The Zebra can help you compare quotes from multiple providers simultaneously.

- Utilize Online Tools: Many insurance companies offer online tools that allow you to get a personalized quote in minutes. These tools can help you compare different coverage options and identify potential discounts.

- Shop Around Regularly: Car insurance rates can fluctuate, so it’s essential to shop around for quotes periodically, even if you’re happy with your current insurer. You might be surprised at the savings you can find.

- Consider Bundling Policies: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in significant discounts.

- Explore Discounts: Insurance companies offer various discounts, such as good driver discounts, safe driver discounts, and multi-car discounts. Make sure to ask your insurer about available discounts and provide any relevant documentation.

Understanding Your Insurance Needs

It’s crucial to understand your insurance needs and select the appropriate coverage levels.

- Liability Coverage: This coverage protects you financially if you are responsible for an accident that causes damage to another person’s property or injuries. Florida requires a minimum liability coverage of $10,000 for property damage and $10,000 for personal injury per person, or $20,000 per accident.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other expenses related to injuries you sustain in an accident, regardless of fault. Florida requires a minimum PIP coverage of $10,000.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage pays for damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

Factors Influencing Car Insurance Premiums: Cheapest Florida Car Insurance

Understanding the factors that influence car insurance premiums in Florida is crucial for securing the most affordable coverage. Several factors contribute to the cost of your car insurance, and it’s essential to be aware of them to make informed decisions about your policy.

Driving History

Your driving history is a significant factor in determining your insurance premiums. A clean driving record with no accidents, violations, or DUI convictions will result in lower premiums. Conversely, a history of accidents, speeding tickets, or other violations will lead to higher premiums.

Age

Insurance companies often consider age as a factor in determining premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Therefore, they may face higher premiums. However, as drivers gain experience and age, their premiums generally decrease.

Vehicle Type, Cheapest florida car insurance

The type of vehicle you drive plays a crucial role in your insurance costs. Certain vehicles, like sports cars and luxury vehicles, are more expensive to repair and replace, leading to higher insurance premiums. Conversely, smaller and less expensive vehicles generally have lower insurance rates.

| Vehicle Type | Average Annual Premium |

|---|---|

| Sedan | $1,500 – $2,000 |

| SUV | $1,800 – $2,500 |

| Truck | $2,000 – $3,000 |

These figures are estimates and may vary depending on other factors like driving history, location, and coverage levels.

Location

Your location in Florida can significantly impact your insurance premiums. Areas with higher crime rates, traffic congestion, and accident frequencies generally have higher insurance costs. For example, urban areas like Miami or Tampa might have higher premiums compared to rural areas.

Credit Score

Surprisingly, your credit score can influence your car insurance premiums in Florida. Insurance companies use credit scores as a proxy for risk assessment, believing that individuals with good credit are more likely to be responsible drivers. A higher credit score can lead to lower premiums, while a lower credit score may result in higher premiums. You can improve your credit history by paying bills on time, reducing debt, and avoiding unnecessary credit applications.

“A good credit score can save you money on car insurance in Florida. By taking steps to improve your credit history, you can potentially lower your premiums.”

Discounts and Savings Opportunities

In Florida’s competitive car insurance market, numerous discounts and savings opportunities are available to help drivers lower their premiums. By understanding these discounts and employing smart strategies, you can significantly reduce your annual car insurance costs.

Common Car Insurance Discounts

Car insurance companies in Florida offer a variety of discounts to reward safe driving habits, responsible choices, and loyalty. These discounts can significantly impact your premium, making it essential to explore all available options.

- Safe Driving Discount: This discount is awarded to drivers with a clean driving record, demonstrating their responsible driving behavior. It typically involves a reduction in premium for each year without accidents or traffic violations.

- Good Student Discount: Students maintaining a high GPA can qualify for this discount, reflecting their commitment to academic excellence and responsible behavior. This discount incentivizes good academic performance and encourages students to prioritize their education.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you can benefit from this discount. It recognizes your loyalty to the company and rewards you for insuring multiple vehicles with them.

- Anti-theft Device Discount: Installing anti-theft devices like alarms or tracking systems can make your car less appealing to thieves. This discount reflects the reduced risk of theft and rewards you for taking proactive measures to protect your vehicle.

- Defensive Driving Course Discount: Completing a defensive driving course demonstrates your commitment to safe driving practices. Insurance companies often reward this commitment with a discount, reflecting your willingness to improve your driving skills and reduce your risk of accidents.

Maximizing Savings on Car Insurance

Several strategies can help you maximize savings on your car insurance premiums, ensuring you get the best value for your money.

- Bundle Insurance Policies: Combining your car insurance with other policies like homeowners or renters insurance can lead to significant savings. This bundling strategy rewards you for your loyalty and demonstrates your commitment to the insurance company.

- Negotiate with Insurance Providers: Don’t be afraid to negotiate with your insurance provider. Explain your needs and explore potential discounts or adjustments to your policy. This proactive approach can lead to a more favorable premium.

- Shop Around for Quotes: Comparing quotes from multiple insurance companies is crucial to finding the best deal. This competitive process ensures you get the most competitive rate and helps you avoid overpaying for your car insurance.

- Consider Increasing Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can lead to lower premiums. Carefully consider your financial situation and risk tolerance before making this decision.

- Review Your Coverage: Regularly review your coverage to ensure you have the right amount of protection for your needs. Avoid unnecessary coverage that increases your premium without providing significant benefits.

Benefits of Car Insurance Comparison Websites

Car insurance comparison websites offer a convenient and efficient way to find the best deals. These platforms allow you to compare quotes from multiple insurers simultaneously, saving you time and effort.

- Convenient and Time-Saving: Instead of contacting each insurer individually, comparison websites streamline the process, allowing you to get multiple quotes within minutes.

- Access to a Wide Range of Insurers: These websites connect you with a broad network of insurance providers, ensuring you have access to a diverse range of options and competitive rates.

- Potential for Hidden Discounts: Comparison websites can uncover hidden discounts or special offers that you might miss when contacting insurers directly. They often have access to exclusive deals and promotions.

Navigating the Insurance Process

Obtaining car insurance in Florida can seem daunting, but it’s a straightforward process when you understand the steps involved. By following these steps, you can easily obtain a quote and secure a policy that fits your needs and budget.

Obtaining a Car Insurance Quote

Before you can secure a car insurance policy, you need to get quotes from different insurance companies. This allows you to compare prices, coverage options, and find the best deal for your specific needs.

- Gather your information: You’ll need to provide basic information, such as your driver’s license number, vehicle information (make, model, year), and your driving history.

- Contact insurance companies: You can obtain quotes online, over the phone, or by visiting an insurance agent in person. Many insurance companies have user-friendly websites that allow you to get instant quotes by entering your information.

- Compare quotes: Once you have quotes from multiple companies, compare them carefully, paying attention to coverage, deductibles, premiums, and any discounts offered.

Understanding Insurance Policy Terms and Conditions

Once you’ve chosen a policy, it’s crucial to understand the terms and conditions. This ensures you know what’s covered and what’s not, and you can avoid any surprises down the road.

- Deductible: The amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically means a lower premium.

- Coverage Limits: The maximum amount your insurance company will pay for a covered claim.

- Exclusions: Situations or events that are not covered by your policy. For example, your policy might not cover damage caused by driving under the influence or driving without a valid license.

Managing Your Insurance Policy

After securing your policy, you need to manage it effectively to ensure you have the right coverage and avoid any potential issues.

- Keep your contact information updated: If you change your address, phone number, or email address, inform your insurance company immediately. This ensures they can reach you in case of an emergency or to send important policy updates.

- Review your policy periodically: It’s good practice to review your policy at least once a year to ensure it still meets your needs and you’re not paying for coverage you don’t require.

- Report any changes: If you add a new driver to your policy, change your vehicle, or experience a significant change in your driving history, inform your insurance company. These changes could affect your premium and coverage.

Final Conclusion

Finding the cheapest Florida car insurance doesn’t have to be a daunting task. By taking a proactive approach, comparing quotes, and understanding your insurance needs, you can secure affordable coverage that provides peace of mind. Remember, it’s crucial to weigh coverage levels against your budget and driving habits to ensure you have the right protection without overspending.

Question Bank

How do I find the cheapest car insurance in Florida?

Start by comparing quotes from multiple insurance companies. Utilize online comparison tools, contact insurance providers directly, and consider seeking advice from an independent insurance agent.

What factors affect car insurance premiums in Florida?

Factors like your driving history, age, vehicle type, location, credit score, and coverage levels significantly influence your insurance premiums.

What are some common car insurance discounts available in Florida?

Common discounts include safe driving discounts, good student discounts, multi-car discounts, and bundling discounts for combining home and auto insurance.