Cheapest full coverage car insurance Florida can be a challenge to find, considering the state’s unique factors that influence premiums. From its high population density and frequent weather events to its unique legal considerations, Florida’s car insurance market presents both opportunities and obstacles for drivers seeking affordable coverage.

Navigating the complex world of car insurance in Florida requires understanding the key components of full coverage, including liability, collision, and comprehensive coverage. You’ll also need to consider various factors that can significantly impact your premium, such as your age, driving history, credit score, and vehicle type.

Understanding Florida’s Car Insurance Landscape

Florida presents a unique landscape for car insurance due to several factors that contribute to higher premiums compared to other states. These factors include a high concentration of drivers, a large number of uninsured motorists, and the state’s susceptibility to severe weather events.

Factors Influencing Car Insurance Costs in Florida

Florida’s car insurance market is influenced by a unique set of factors, resulting in higher premiums than the national average.

- High Concentration of Drivers: Florida has a large population, leading to a high concentration of drivers on the roads, increasing the likelihood of accidents.

- High Number of Uninsured Motorists: Florida has a significant number of uninsured drivers, which poses a risk to insured drivers as they may be financially responsible for damages in accidents with uninsured motorists.

- Severe Weather Events: Florida’s location makes it vulnerable to hurricanes, tornadoes, and other severe weather events, increasing the risk of car damage and leading to higher insurance premiums.

- Legal Considerations: Florida’s “no-fault” insurance system, where drivers are responsible for their own injuries, can result in higher claims and premiums. Additionally, Florida law allows for “bad faith” lawsuits against insurance companies, which can lead to higher premiums.

Average Cost of Full Coverage Car Insurance in Florida

The average cost of full coverage car insurance in Florida is significantly higher than the national average.

The average annual premium for full coverage car insurance in Florida is around $2,500, while the national average is approximately $1,700.

These figures can vary depending on individual factors such as driving history, age, and vehicle type.

Components of Full Coverage Car Insurance

Full coverage car insurance in Florida typically includes the following components:

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or their property.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by events other than an accident, such as theft, vandalism, or natural disasters.

Finding the Cheapest Full Coverage Options: Cheapest Full Coverage Car Insurance Florida

Finding the cheapest full coverage car insurance in Florida requires careful research and comparison. Many factors influence your premium, including your driving history, the type of car you drive, and your location.

Comparing Car Insurance Companies in Florida

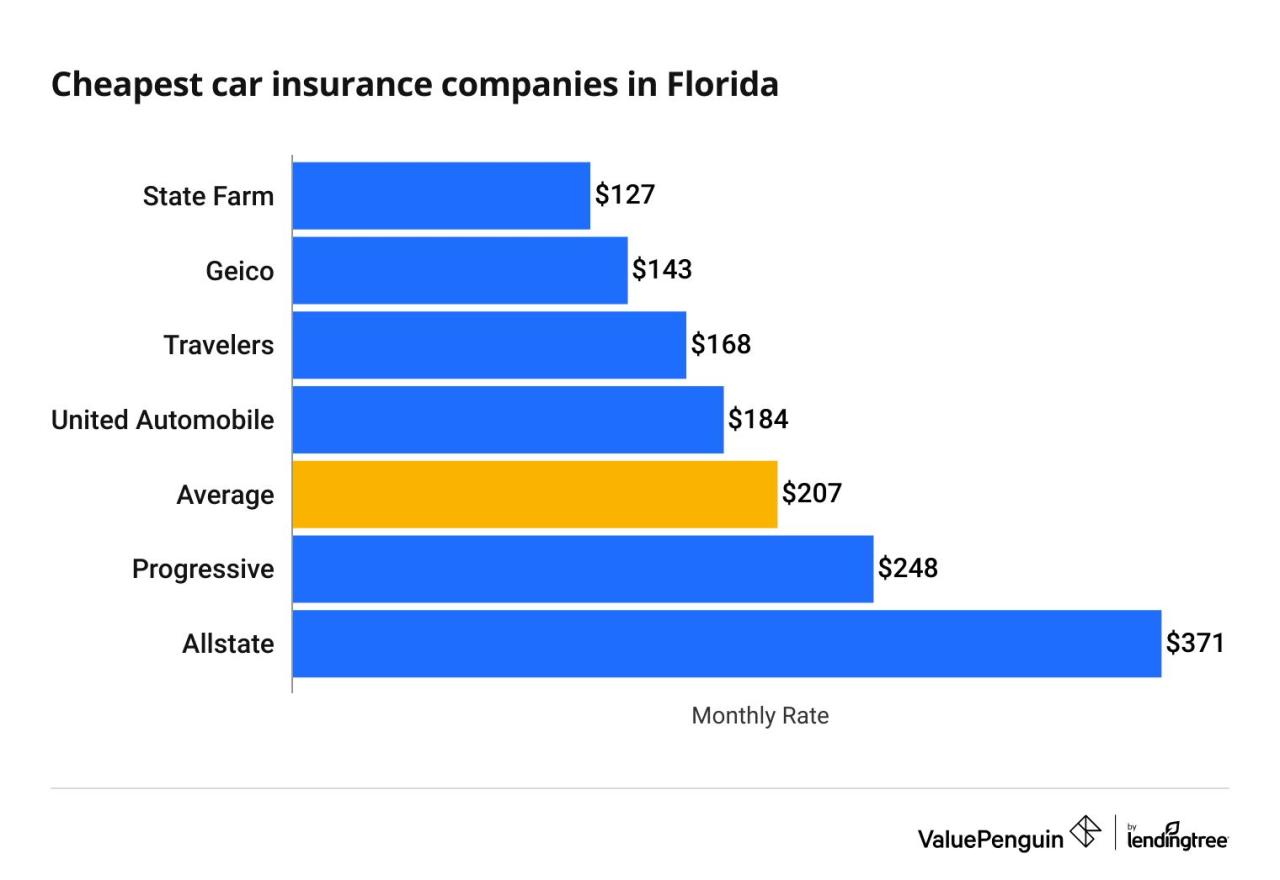

Understanding the features and benefits offered by different car insurance companies is crucial to finding the most affordable option. Here are some of the top insurance companies in Florida known for offering competitive rates:

- State Farm: State Farm is a well-established company with a strong reputation for customer service. They offer a wide range of discounts, including safe driver, good student, and multi-policy discounts. State Farm also provides 24/7 customer support and online tools for managing your policy.

- GEICO: GEICO is known for its competitive rates and convenient online tools. They offer a variety of discounts, including multi-car, good driver, and military discounts. GEICO also provides 24/7 customer service and mobile app access for policy management.

- Progressive: Progressive is a popular choice for its customizable coverage options and discounts. They offer a wide range of discounts, including safe driver, good student, and multi-policy discounts. Progressive also provides online tools for managing your policy and 24/7 customer service.

- USAA: USAA is a military-focused insurance company that offers competitive rates and excellent customer service. They offer a variety of discounts, including military, safe driver, and good student discounts. USAA also provides online tools for managing your policy and 24/7 customer support.

- Florida Peninsula Insurance Company: Florida Peninsula is a regional insurance company specializing in Florida. They offer competitive rates and a variety of discounts, including safe driver, good student, and multi-policy discounts. Florida Peninsula also provides online tools for managing your policy and 24/7 customer support.

- Auto-Owners Insurance: Auto-Owners is a national insurance company with a strong reputation for financial stability. They offer a variety of discounts, including safe driver, good student, and multi-policy discounts. Auto-Owners also provides online tools for managing your policy and 24/7 customer support.

Average Monthly Premiums for Full Coverage Car Insurance in Florida, Cheapest full coverage car insurance florida

The following table provides an estimated average monthly premium for full coverage car insurance in Florida, based on different car models and driver profiles:

| Car Model | Driver Profile | State Farm | GEICO | Progressive | USAA | Florida Peninsula | Auto-Owners |

|---|---|---|---|---|---|---|---|

| 2020 Honda Civic | Single, 30-year-old male with a clean driving record | $150 | $140 | $135 | $125 | $145 | $160 |

| 2021 Toyota Camry | Married couple, 40-year-old with a clean driving record | $180 | $170 | $165 | $155 | $175 | $190 |

| 2022 Ford F-150 | Single, 25-year-old male with a speeding ticket | $220 | $210 | $205 | $195 | $215 | $230 |

Note: These are just estimates and actual premiums may vary depending on your individual circumstances. It’s important to get quotes from multiple insurance companies to compare rates and find the best deal for you.

Factors Affecting Your Premium

In Florida, your car insurance premium is determined by a multitude of factors, each playing a significant role in shaping the final cost. Understanding these factors empowers you to make informed decisions and potentially lower your premium.

Your Age

Your age is a crucial factor in determining your car insurance premium. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to inexperience and risk-taking behavior. As a result, insurance companies often charge higher premiums for younger drivers. Conversely, older drivers, particularly those over 65, generally pay lower premiums as they tend to have more driving experience and a lower risk profile.

Your Driving History

Your driving history is another significant factor that insurance companies consider when calculating your premium. A clean driving record with no accidents, traffic violations, or DUI convictions will generally result in lower premiums. However, any incidents involving accidents, speeding tickets, or reckless driving can significantly increase your premium.

Maintaining a good driving record is crucial for securing affordable car insurance.

Your Credit Score

In Florida, insurance companies are allowed to use your credit score as a factor in determining your premium. This practice is based on the assumption that individuals with good credit are more likely to be responsible and reliable, including on the road. A higher credit score can often lead to lower premiums, while a lower credit score may result in higher premiums.

Your Vehicle Type

The type of vehicle you drive also influences your car insurance premium. Luxury cars, sports cars, and high-performance vehicles are often more expensive to repair or replace in case of an accident. As a result, insurance companies tend to charge higher premiums for these types of vehicles. Conversely, smaller, less expensive vehicles typically attract lower premiums.

Your Location

Your location in Florida can also affect your car insurance premium. Areas with higher rates of traffic accidents, theft, or vandalism may have higher premiums due to the increased risk.

Your Coverage

The level of coverage you choose can significantly impact your premium. Full coverage insurance typically includes comprehensive and collision coverage, which protects you against damage to your vehicle from various events, such as accidents, theft, or natural disasters. While full coverage offers greater protection, it comes with a higher premium compared to liability-only coverage, which only covers damages to other vehicles or individuals in case of an accident.

Other Factors

Other factors that can influence your premium include:

- Your marital status: Married individuals tend to pay lower premiums than single individuals.

- Your occupation: Some occupations may be considered riskier than others, potentially leading to higher premiums.

- Your driving habits: Your driving habits, such as the distance you drive, the time of day you drive, and whether you use your vehicle for work or personal use, can also affect your premium.

Understanding Coverage Options

A full coverage car insurance policy in Florida offers a comprehensive suite of protections to safeguard you and your vehicle in the event of an accident or other unforeseen circumstances. This type of policy goes beyond the minimum state-mandated coverage, providing greater peace of mind and financial security.

Liability Coverage

Liability coverage is a crucial component of a full coverage policy, offering financial protection in case you cause an accident that results in injuries or property damage to others. This coverage typically includes two main components:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other party due to injuries caused by your negligence. The coverage limits are expressed as a per-person limit and a per-accident limit. For example, a 25/50/10 policy means you have up to $25,000 for injuries to one person, $50,000 for all injuries in an accident, and $10,000 for property damage.

- Property Damage Liability: This coverage pays for damages to the other party’s property, such as their vehicle, if you are at fault in an accident. The coverage limit is expressed as a single amount, such as $10,000.

Uninsured/Underinsured Motorist Coverage

Florida law requires all drivers to carry personal injury protection (PIP) coverage, which covers medical expenses for the insured and their passengers, regardless of fault. However, not all drivers carry adequate liability insurance, and some may be uninsured altogether. Uninsured/underinsured motorist (UM/UIM) coverage helps protect you in these situations.

- Uninsured Motorist Coverage (UM): This coverage pays for your medical expenses, lost wages, and other damages if you are injured in an accident caused by an uninsured driver. This coverage can be particularly valuable in Florida, where uninsured drivers are prevalent.

- Underinsured Motorist Coverage (UIM): This coverage kicks in when the other driver’s liability coverage is insufficient to cover your losses. For example, if you are injured in an accident caused by a driver with a $25,000 liability limit and your medical expenses exceed that amount, UIM coverage can help pay the difference.

Other Coverage Options

In addition to liability and UM/UIM coverage, full coverage policies often include several other valuable options:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. This coverage is particularly important if you have a financed or leased vehicle.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Rental Reimbursement: This coverage pays for a rental car while your vehicle is being repaired after an accident.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of fault, up to a certain limit. This coverage is supplemental to PIP and can be helpful for covering expenses not covered by PIP.

Finding the Right Insurance Provider

Choosing the right car insurance provider in Florida is crucial to ensuring you have adequate coverage at a competitive price. This decision should not be taken lightly, as your choice can significantly impact your financial well-being in the event of an accident.

Factors to Consider When Choosing a Car Insurance Company

- Customer Service: A responsive and helpful customer service team is essential for resolving issues and addressing your concerns promptly. Look for companies with positive customer reviews and readily available support channels, such as phone, email, and online chat.

- Claims Handling: The claims process can be stressful, so you want to ensure your chosen insurer handles claims efficiently and fairly. Research their claims history, including customer reviews and independent ratings, to assess their track record.

- Financial Stability: It’s important to select a financially stable company that can pay out your claims in the event of a major accident. Check the insurer’s financial ratings from agencies like A.M. Best and Standard & Poor’s to gauge their financial strength.

- Coverage Options: Ensure the company offers the coverage options you need, including comprehensive, collision, liability, and personal injury protection (PIP). Some insurers may offer additional benefits like roadside assistance or rental car coverage.

- Discounts: Many insurers offer discounts for safe driving, good grades, multiple vehicles, and other factors. Compare the available discounts and see which company offers the most favorable options for your situation.

Comparing Key Features and Benefits

| Company | Customer Service Rating | Claims Handling Rating | Financial Stability Rating | Coverage Options | Discounts |

|---|---|---|---|---|---|

| Company A | 4.5/5 | 4/5 | A+ | Comprehensive, collision, liability, PIP, roadside assistance | Safe driver, good student, multi-car |

| Company B | 3.8/5 | 3.5/5 | A | Comprehensive, collision, liability, PIP, rental car coverage | Safe driver, good student, multi-car, loyalty |

| Company C | 4/5 | 4.2/5 | A- | Comprehensive, collision, liability, PIP | Safe driver, good student, multi-car, bundling |

*Note: These ratings are hypothetical and based on general market trends. Actual ratings may vary depending on the specific company and independent rating agencies.

Obtaining Quotes and Comparing Offerings

- Gather Your Information: Before requesting quotes, gather your driving history, vehicle information, and personal details. This will expedite the quote process.

- Use Online Quote Tools: Many insurance companies offer online quote tools that allow you to compare prices and coverage options quickly and easily.

- Contact Multiple Insurers: Don’t rely solely on online quotes. Contact several insurance companies directly to discuss your specific needs and get personalized quotes.

- Compare Quotes Carefully: Once you have multiple quotes, compare the coverage, deductibles, premiums, and discounts offered by each insurer.

- Ask Questions: Don’t hesitate to ask questions about the policy details, coverage limitations, and claims process.

- Choose the Best Option: After careful consideration, select the insurance provider that offers the best combination of coverage, price, and customer service.

Final Wrap-Up

Finding the cheapest full coverage car insurance Florida doesn’t have to be an overwhelming task. By understanding the nuances of Florida’s insurance landscape, comparing quotes from multiple providers, and leveraging available discounts, you can secure the best possible coverage at a price that fits your budget. Remember to prioritize reputable companies with excellent customer service and claims handling, ensuring peace of mind in the event of an accident.

Quick FAQs

What is the average cost of full coverage car insurance in Florida?

The average cost of full coverage car insurance in Florida varies depending on several factors, including your driving history, age, vehicle type, and location. However, you can expect to pay a higher premium than the national average due to the state’s unique circumstances.

What are some tips for lowering my car insurance premium in Florida?

There are several ways to reduce your car insurance premium in Florida. Consider bundling your car insurance with other policies like homeowners or renters insurance, increasing your deductible, and taking advantage of available discounts for good driving records, safety features, and memberships.

How can I find the best car insurance company in Florida?

To find the best car insurance company in Florida, research and compare quotes from multiple providers. Consider factors like customer service, claims handling, financial stability, and the company’s reputation. You can also check independent ratings and reviews to get a better understanding of each company’s performance.