Cheapest insurance Florida car is a search term many Floridians are typing into their search engines. Florida’s unique insurance landscape, driven by its no-fault system and high accident rates, can make finding affordable car insurance a challenge. However, with the right knowledge and strategies, you can find competitive rates and secure the coverage you need.

This guide will break down the key factors that influence car insurance costs in Florida, providing insights into how to find the cheapest car insurance options available. We’ll also delve into essential coverage requirements, explore ways to save money, and highlight common mistakes to avoid when buying car insurance.

Understanding Florida Car Insurance Costs

Car insurance premiums in Florida are influenced by various factors, making it crucial to understand these elements to secure the most affordable coverage. This section delves into the key factors that impact your car insurance costs in Florida, providing examples and insights to help you navigate the process effectively.

Demographics

Demographics play a significant role in determining car insurance premiums. Insurance companies consider factors such as age, gender, and marital status to assess risk.

- Age: Younger drivers, particularly those under 25, often face higher premiums due to their higher risk of accidents. As drivers gain experience and age, premiums tend to decrease.

- Gender: Historically, insurance companies have observed a higher risk of accidents among young male drivers compared to young female drivers. This disparity can result in higher premiums for young men.

- Marital Status: Statistically, married individuals tend to have lower accident rates than single individuals. As a result, insurance companies may offer lower premiums to married drivers.

Driving History

Your driving history is a critical factor in determining your car insurance costs. Insurance companies review your driving record to assess your risk profile.

- Accidents: Having a history of accidents, even minor ones, can significantly increase your premiums. Each accident is recorded on your driving record and impacts your insurance rates.

- Traffic Violations: Speeding tickets, DUI convictions, and other traffic violations can also lead to higher premiums. These violations indicate a higher risk of future accidents.

- Driving Record: A clean driving record with no accidents or violations is highly beneficial and can result in lower premiums. Maintaining a safe driving record is essential for keeping your insurance costs down.

Vehicle Type

The type of vehicle you drive also plays a role in determining your insurance premiums. Insurance companies consider factors such as the vehicle’s make, model, year, and safety features.

- Vehicle Value: More expensive vehicles typically have higher insurance premiums due to the higher cost of repairs or replacement in case of an accident.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are often considered safer and may qualify for lower premiums.

- Theft Risk: Some vehicle models are more prone to theft than others. This increased risk can lead to higher insurance premiums.

Coverage Levels

The level of coverage you choose for your car insurance policy significantly affects your premiums.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. Higher liability limits provide more protection but also increase premiums.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of who’s at fault. Collision coverage is optional and can significantly impact your premiums.

- Comprehensive Coverage: This coverage protects your vehicle against damages from non-collision events, such as theft, vandalism, or natural disasters. Comprehensive coverage is also optional and can influence your premiums.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, meaning that drivers are required to file claims with their own insurance companies, regardless of who caused the accident. This system aims to streamline the claims process and reduce litigation.

- Personal Injury Protection (PIP): Under Florida’s no-fault system, all drivers are required to have PIP coverage, which covers medical expenses and lost wages for injuries sustained in an accident.

- Impact on Premiums: The no-fault system can influence car insurance costs by impacting the frequency and severity of claims. The state’s requirement for PIP coverage can contribute to higher premiums, as insurance companies need to cover these costs.

Finding the Cheapest Car Insurance in Florida

Finding the cheapest car insurance in Florida requires research and comparison. With numerous insurance providers vying for your business, navigating the options can feel overwhelming. This guide will help you understand how to find the best car insurance rates in Florida by comparing providers, negotiating discounts, and reviewing coverage options.

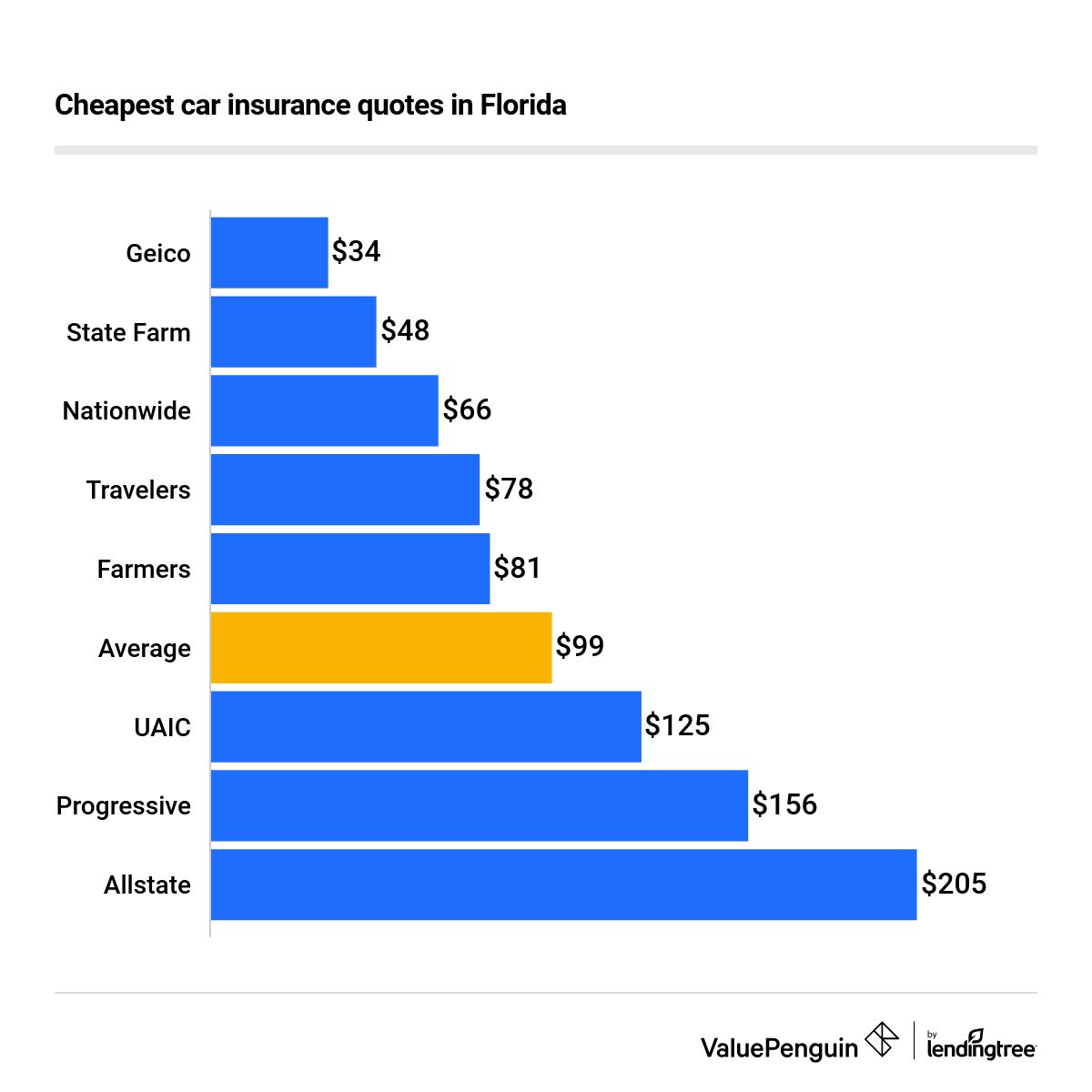

Comparing Car Insurance Providers in Florida

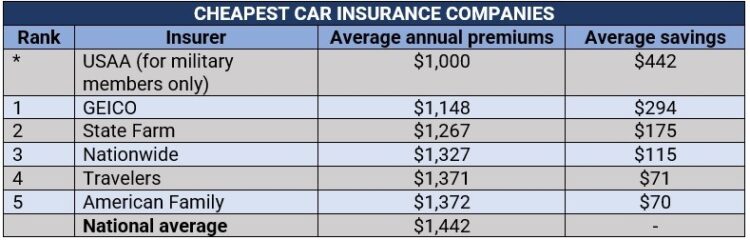

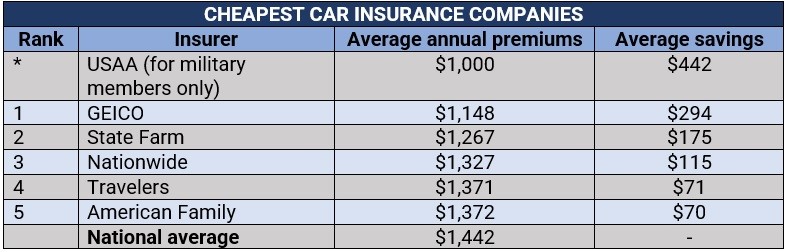

Florida boasts a diverse range of car insurance providers, each offering unique benefits and drawbacks. Comparing these providers is crucial to finding the best deal.

- State Farm: Known for its strong customer service and wide range of discounts, State Farm is a popular choice in Florida. It also offers various coverage options to suit different needs.

- GEICO: GEICO is renowned for its competitive rates and user-friendly online platform. Its strong advertising campaigns have made it a household name, attracting many customers in Florida.

- Progressive: Progressive stands out with its personalized pricing options and its “Name Your Price” tool, allowing customers to set a budget and find coverage within their range. It also offers a wide range of discounts, making it attractive to many Floridians.

- USAA: USAA primarily serves military personnel and their families. If you qualify, USAA offers excellent rates and exceptional customer service, making it a highly regarded option.

- Florida Peninsula Insurance Company: This company specializes in providing insurance to Florida residents, particularly those who have been denied coverage by other insurers. It’s known for its focus on affordable rates, though it may not offer the same range of coverage options as larger national providers.

Tips for Getting the Best Car Insurance Rates

Finding the cheapest car insurance in Florida involves more than just comparing providers. Several strategies can help you secure the best rates.

- Compare Quotes Online: Numerous online comparison websites, such as Policygenius, The Zebra, and Insurify, allow you to compare quotes from multiple providers simultaneously. This saves time and effort, enabling you to quickly identify the most competitive rates.

- Negotiate Discounts: Most insurance providers offer various discounts. These can include safe driving discounts, good student discounts, multi-car discounts, and more. By highlighting your eligibility for these discounts, you can potentially lower your premium.

- Review Coverage Options: Carefully review the coverage options offered by each provider. While comprehensive coverage may be desirable, it can also be expensive. Consider your individual needs and risk tolerance when choosing your coverage level. For example, if you have an older car with lower value, you may not need comprehensive coverage.

- Maintain a Good Driving Record: A clean driving record is a significant factor in determining your insurance rates. Avoiding traffic violations and accidents will keep your premiums lower.

- Shop Around Regularly: Don’t settle for the same insurer year after year. Rates can fluctuate, so it’s wise to shop around periodically to ensure you’re getting the best deal.

Resources for Finding Cheap Car Insurance in Florida

Besides online comparison websites, other resources can assist you in finding affordable car insurance in Florida.

- Insurance Brokers: Insurance brokers act as intermediaries, working with multiple insurance providers to find the best rates for you. They can provide personalized advice and negotiate on your behalf, potentially saving you time and money.

- Consumer Reports: Consumer Reports offers independent reviews and ratings of car insurance providers, providing valuable insights into their performance and customer satisfaction.

- Florida Office of Insurance Regulation: This government agency provides information about insurance regulations and consumer protection. You can access resources and file complaints if you experience issues with your insurance provider.

Essential Car Insurance Coverage in Florida: Cheapest Insurance Florida Car

Driving a car in Florida requires you to have the minimum amount of car insurance coverage mandated by the state. Understanding these requirements is crucial to ensure you are legally compliant and financially protected in case of an accident.

Mandatory Car Insurance Coverage in Florida

Florida law mandates two primary types of coverage for all drivers: personal injury protection (PIP) and property damage liability (PDL).

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs incurred by the insured person, regardless of who caused the accident. Florida requires a minimum PIP coverage of $10,000, although you can choose higher limits.

- Property Damage Liability (PDL): This coverage protects you from financial liability if you damage someone else’s property, such as their car or other belongings. The minimum PDL coverage required in Florida is $10,000.

Optional Car Insurance Coverage in Florida

While not mandated by law, additional coverage options can offer valuable financial protection in various situations. These include:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. This coverage is essential if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged due to events other than an accident, such as theft, vandalism, or natural disasters. This coverage is particularly helpful if your car is new or has a high value.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance to cover your damages. This coverage is particularly important in Florida, where a significant number of drivers operate without adequate insurance.

Impact of Coverage Levels on Premiums and Financial Protection

The level of coverage you choose directly impacts your insurance premiums and the amount of financial protection you have in case of an accident.

- Higher Coverage Levels: Generally, higher coverage levels mean higher premiums. This is because you are paying for greater financial protection in case of a major accident. However, this can be beneficial in the long run if you are involved in a serious accident with significant damages or injuries.

- Lower Coverage Levels: Lower coverage levels mean lower premiums but offer less financial protection. This can be a suitable option if you have a lower-value vehicle or are comfortable with a higher level of personal risk. However, in the event of a major accident, you may not have enough coverage to fully compensate for your losses.

Example: Imagine you are involved in an accident that causes $10,000 in damages to your vehicle. If you have only the minimum PDL coverage of $10,000, you will be responsible for any additional costs exceeding this amount. However, if you have collision coverage with a higher limit, your insurer will cover the full cost of repairs or replacement, up to your coverage limit.

Saving Money on Car Insurance in Florida

Car insurance in Florida can be expensive, but there are several ways to save money on your premiums. By understanding the factors that influence your rates and taking advantage of available discounts, you can significantly reduce your insurance costs.

Common Car Insurance Discounts in Florida

Many insurance companies offer discounts to policyholders who meet certain criteria. Here is a table comparing some common car insurance discounts available in Florida:

| Discount Type | Description |

|—|—|

| Safe Driver Discount | Awarded to drivers with a clean driving record, typically with no accidents or traffic violations. |

| Good Student Discount | Offered to students who maintain a certain GPA or academic standing. |

| Multi-Car Discount | Available to policyholders who insure multiple vehicles with the same company. |

| Defensive Driving Course Discount | Offered to drivers who complete an approved defensive driving course. |

| Anti-theft Device Discount | Awarded to vehicles equipped with anti-theft devices, such as alarms or immobilizers. |

| Loyalty Discount | Offered to long-term policyholders who have maintained continuous coverage with the same insurer. |

| Payment Discount | May be available for paying your premiums in full or setting up automatic payments. |

Tips for Reducing Car Insurance Costs

Here are some practical tips to help you save money on your car insurance in Florida:

- Maintain a Good Driving Record: This is one of the most significant factors that affect your insurance premiums. Avoid accidents, traffic violations, and other driving infractions to keep your rates low.

- Choose a Safe Car: Insurance companies assess the safety features and crashworthiness of vehicles when determining rates. Opting for a car with advanced safety features and a good safety rating can lower your premiums.

- Bundle Insurance Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can lead to lower premiums.

- Shop Around for Quotes: Compare quotes from multiple insurance companies to find the best rates for your specific needs.

- Consider a Telematics Program: Some insurance companies offer programs that track your driving habits and reward safe driving behavior with lower premiums.

- Ask About Discounts: Be sure to ask your insurance agent about all available discounts you may qualify for, such as safe driver, good student, multi-car, or other discounts.

Using Online Tools to Compare Quotes

The internet provides a wealth of resources to help you compare car insurance quotes and find the best deals. Many websites allow you to enter your information and receive quotes from multiple insurers instantly.

- Insurance Comparison Websites: These websites act as intermediaries, allowing you to compare quotes from various insurance companies simultaneously. Popular examples include:

- Insurance.com: Offers comprehensive insurance comparisons, including car insurance.

- QuoteWizard: Provides instant quotes from multiple insurance providers.

- The Zebra: A user-friendly platform that allows you to compare quotes from various insurers.

- Individual Insurance Company Websites: Most insurance companies have websites where you can get a personalized quote. This allows you to explore specific coverage options and discounts offered by each insurer.

Common Mistakes to Avoid When Buying Car Insurance

Navigating the world of car insurance can be overwhelming, especially in a state like Florida, known for its unique driving conditions and insurance regulations. Many individuals make common mistakes that can lead to higher premiums or inadequate coverage in the event of an accident. Understanding these pitfalls and taking proactive steps to avoid them can significantly impact your financial well-being and ensure you have the right protection on the road.

Choosing Inadequate Coverage Levels

Selecting the right car insurance coverage levels is crucial for safeguarding your financial interests in the event of an accident. Inadequate coverage can leave you financially vulnerable, facing significant out-of-pocket expenses for repairs, medical bills, or legal fees.

It’s important to understand the different types of coverage and their implications.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It’s essential to have sufficient liability coverage to cover potential damages and legal costs.

- Collision Coverage: This coverage pays for repairs to your vehicle if you’re involved in an accident, regardless of fault. While it’s not mandatory, it’s highly recommended, especially for newer or financed vehicles.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by non-collision events, such as theft, vandalism, or natural disasters. It’s essential for safeguarding your vehicle against unforeseen circumstances.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage. It helps cover your medical expenses and property damage.

Avoid choosing the minimum coverage levels just to save money. Consult with an insurance agent to determine the appropriate coverage levels based on your individual needs, the value of your vehicle, and your financial situation.

Neglecting to Shop Around for Better Rates, Cheapest insurance florida car

In today’s competitive insurance market, it’s crucial to shop around for the best rates. Many drivers assume their current insurer offers the most competitive rates, but this isn’t always the case. Neglecting to compare quotes from multiple insurers can result in overpaying for car insurance.

“Don’t settle for the first quote you receive. Take the time to compare rates from at least three different insurers.”

Utilize online comparison tools, contact insurance agents directly, or use a broker to gather quotes from various insurers. Consider factors like discounts, coverage options, and customer service when comparing rates.

Failing to Review Your Policy Regularly

Car insurance policies are not static. Your needs and circumstances may change over time, requiring adjustments to your coverage levels. Failing to review your policy regularly can result in overpaying for unnecessary coverage or being underinsured in the event of an accident.

- Life Changes: Significant life changes, such as marriage, a new baby, or a change in driving habits, can impact your insurance needs.

- Vehicle Changes: Purchasing a new car or selling an old one can also affect your insurance requirements.

- Rate Adjustments: Insurance companies regularly adjust their rates based on factors like driving history, claims history, and market conditions.

Make it a habit to review your policy at least annually or whenever you experience a significant life change. Contact your insurer to discuss any necessary adjustments to your coverage levels or to explore potential savings.

Not Taking Advantage of Discounts

Insurance companies offer various discounts to help lower your premiums. Failing to take advantage of these discounts can cost you money.

- Safe Driving Discounts: Many insurers offer discounts for drivers with clean driving records, such as no accidents or traffic violations.

- Good Student Discounts: Students with good academic performance may qualify for discounts.

- Multi-Policy Discounts: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often lead to significant savings.

- Vehicle Safety Discounts: Cars equipped with safety features, such as anti-theft devices or airbags, may qualify for discounts.

- Payment Discounts: Paying your premiums in full or opting for automatic payments may result in discounts.

Contact your insurer to inquire about available discounts and ensure you’re taking advantage of all eligible savings.

Providing Inaccurate Information

Providing inaccurate information to your insurer can lead to serious consequences, including policy cancellation or denial of claims.

- Driving History: Failing to disclose all driving violations or accidents can result in policy cancellation or denial of claims.

- Vehicle Information: Providing inaccurate information about your vehicle, such as its year, make, or model, can lead to coverage issues.

- Usage Information: Misrepresenting your driving habits, such as the number of miles you drive annually, can result in incorrect premium calculations.

Always be truthful and accurate when providing information to your insurer. If you’re unsure about any details, contact your insurer for clarification.

Summary

Navigating the world of Florida car insurance can be overwhelming, but armed with the right information and strategies, you can find the cheapest insurance Florida car options that suit your needs and budget. Remember to compare quotes, negotiate discounts, and understand the coverage you require. By being proactive and informed, you can ensure you’re getting the best value for your car insurance in Florida.

FAQ Insights

What is the minimum car insurance coverage required in Florida?

Florida requires all drivers to have a minimum of $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). This means that if you are in an accident, your insurance will cover up to $10,000 in medical expenses and $10,000 in damages to the other driver’s vehicle.

What are some common car insurance discounts available in Florida?

Common car insurance discounts in Florida include safe driver, good student, multi-car, and bundling discounts. You may also be eligible for discounts for having a car with anti-theft devices or for completing a defensive driving course.

How often should I shop around for car insurance?

It’s a good idea to shop around for car insurance at least once a year, or even more frequently if your driving habits or financial situation changes. Insurance rates can fluctuate, and you may be able to find better deals by comparing quotes from different insurers.