- Understanding Florida Car Insurance Requirements

- Factors Influencing Car Insurance Quotes in Florida

- Exploring Different Types of Car Insurance Coverage

- Strategies for Obtaining Competitive Quotes

- Understanding Discount Opportunities

- Tips for Saving on Car Insurance: Compare Car Insurance Quotes In Florida

- Final Thoughts

- Key Questions Answered

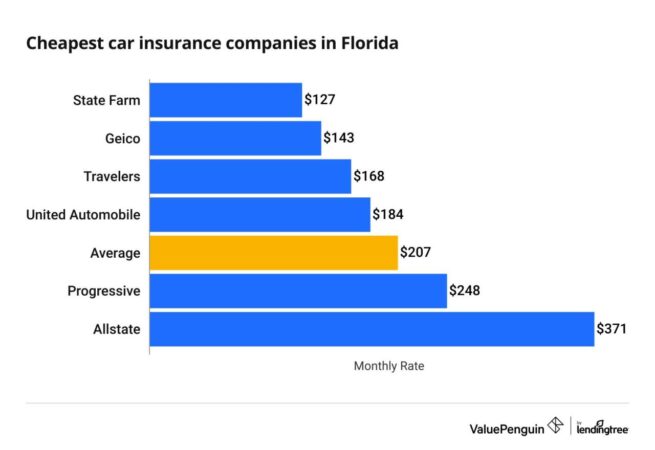

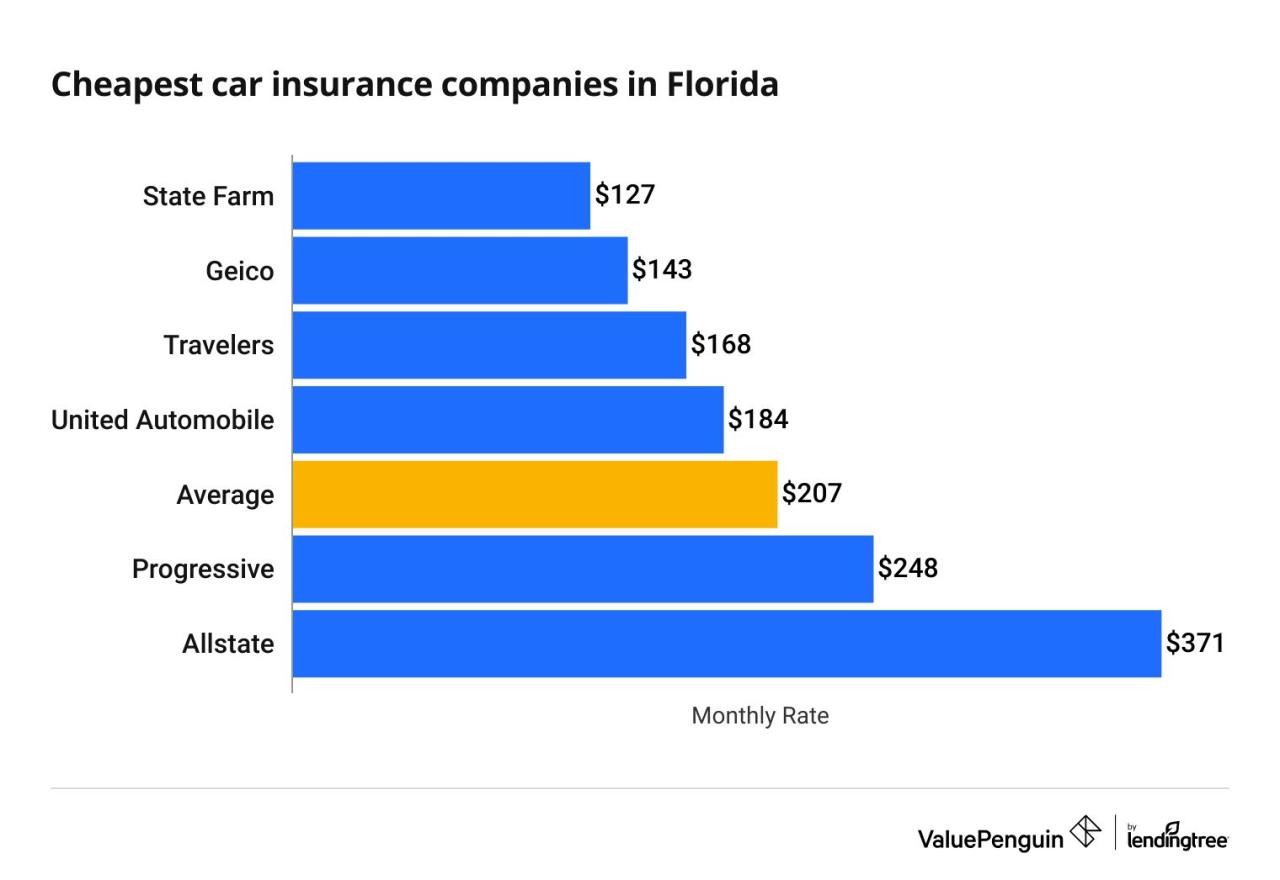

Compare car insurance quotes in Florida, a state known for its sunny weather and bustling cities, is a crucial step in protecting yourself financially. Florida’s unique driving environment and regulations demand careful consideration when choosing car insurance. From understanding mandatory coverage requirements to exploring various types of coverage, navigating the world of car insurance in Florida can seem overwhelming. But fear not, we’re here to guide you through the process and equip you with the knowledge to make informed decisions.

This comprehensive guide delves into the intricacies of car insurance in Florida, covering everything from essential coverage requirements to strategies for securing competitive quotes. We’ll explore factors that influence premiums, uncover potential discounts, and provide practical tips for saving on your car insurance. By the end, you’ll have a clear understanding of how to compare car insurance quotes effectively and find the best deal that meets your specific needs and budget.

Understanding Florida Car Insurance Requirements

Driving a car in Florida comes with certain responsibilities, and one of the most crucial is having the right car insurance coverage. The state mandates that all drivers carry a minimum level of insurance to protect themselves and others on the road. Understanding these requirements is essential to ensure you are legally compliant and financially prepared in case of an accident.

Minimum Liability Coverage

Florida’s minimum liability coverage requirements are designed to provide financial protection to others in the event of an accident caused by you. These requirements include:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to individuals injured in an accident you caused. The minimum required limit is $10,000 per person and $20,000 per accident. This means that if you injure one person in an accident, your insurance will cover up to $10,000 of their medical expenses and lost wages. If multiple people are injured, the total coverage for all injured individuals cannot exceed $20,000.

- Property Damage Liability: This coverage pays for damage to another person’s vehicle or property in an accident you caused. The minimum required limit is $10,000. If you cause an accident that damages another person’s vehicle, your insurance will cover up to $10,000 of the repair costs.

It’s important to note that these minimum limits may not be enough to cover all potential damages in a serious accident. You may want to consider higher liability limits to ensure you are adequately protected.

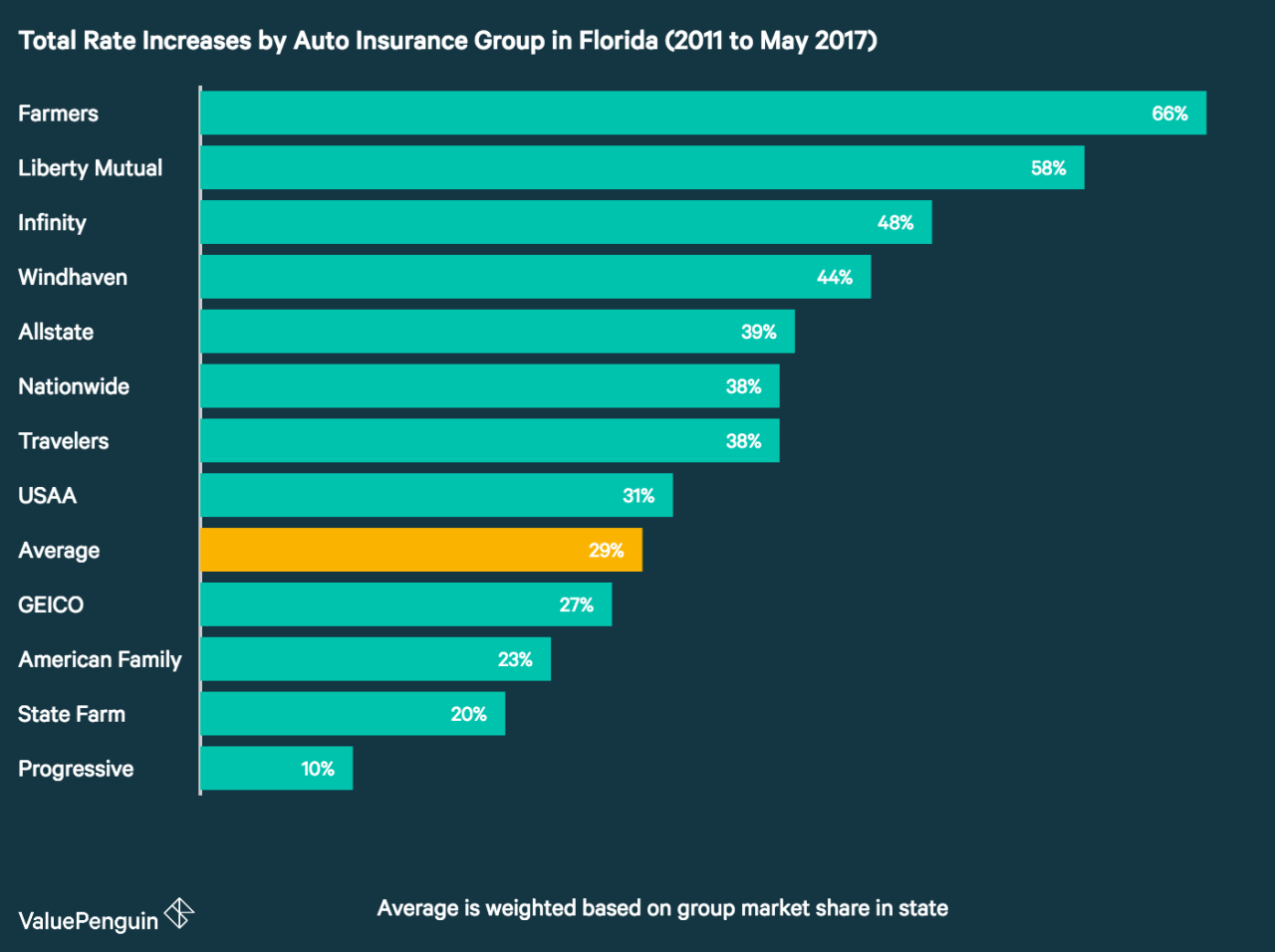

Factors Influencing Car Insurance Quotes in Florida

Car insurance premiums in Florida are influenced by a variety of factors that insurance companies consider when assessing risk. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history plays a significant role in determining your car insurance premium. A clean driving record with no accidents or traffic violations generally results in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

Insurance companies use a system called a “risk score” to assess your driving history. This score is based on factors like:

- Number of accidents

- Severity of accidents

- Traffic violations

- Years of driving experience

The higher your risk score, the higher your insurance premiums will be.

Vehicle Type

The type of vehicle you drive also influences your car insurance premiums. Insurance companies consider factors such as:

- Make and Model: Certain car models are known to be more expensive to repair or replace, leading to higher insurance premiums. For example, luxury vehicles or high-performance sports cars generally have higher premiums than standard sedans.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, often have lower insurance premiums. These features reduce the risk of accidents and injuries, making the vehicle less risky to insure.

- Vehicle Value: The value of your vehicle is also a factor. Newer or more expensive cars are generally more costly to insure than older or less expensive vehicles.

Location

Your location in Florida can impact your car insurance rates. Insurance companies consider factors like:

- Population Density: Areas with high population density tend to have more traffic congestion and a higher risk of accidents. This can lead to higher insurance premiums in those areas.

- Crime Rates: Areas with higher crime rates often have a greater risk of car theft or vandalism, which can increase insurance premiums.

- Weather Conditions: Florida is known for its hurricanes and severe weather. Areas with a higher risk of hurricanes or other natural disasters may have higher insurance premiums to cover potential damage.

Credit Score

In Florida, insurance companies can use your credit score as a factor in determining your car insurance premiums. This practice is legal and common in many states. The rationale behind this is that individuals with good credit history are considered more financially responsible and less likely to file fraudulent claims.

A good credit score can help you qualify for lower premiums. Conversely, a poor credit score can result in higher rates. It is important to note that credit score is only one factor among many that insurance companies consider.

Insurance History

Your insurance history, including your claims history and lapse in coverage, can also affect your premiums. If you have a history of filing claims, you may be considered a higher risk and therefore pay higher premiums. Likewise, gaps in your insurance coverage can also lead to higher rates.

Insurance companies may offer discounts for:

- Safe Driving: Maintaining a clean driving record with no accidents or traffic violations can qualify you for discounts.

- Good Student: If you are a good student with a high GPA, you may be eligible for a discount.

- Safety Features: Having safety features in your vehicle, such as anti-lock brakes or airbags, can qualify you for a discount.

- Multi-Policy Discounts: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in a discount.

- Loyalty Discounts: Staying with the same insurance company for a long period can sometimes qualify you for a discount.

Exploring Different Types of Car Insurance Coverage

In Florida, like most states, you have a variety of car insurance coverage options to choose from. Understanding the different types of coverage and their benefits is crucial to making informed decisions about your insurance policy.

Collision Coverage

Collision coverage pays for damage to your car if you are involved in an accident, regardless of who is at fault. It covers repairs or replacement costs up to the actual cash value of your vehicle, minus your deductible.

- Benefits: Collision coverage protects you financially if you are involved in an accident, ensuring you can repair or replace your car.

- Drawbacks: Collision coverage can be expensive, especially for newer or more expensive vehicles. You may consider dropping this coverage if your car is older and has a lower value.

- Cost: The cost of collision coverage varies based on factors such as your vehicle’s age, make, model, and value, as well as your driving record and location.

Comprehensive Coverage

Comprehensive coverage protects you against damage to your car caused by events other than accidents, such as theft, vandalism, natural disasters, or falling objects.

- Benefits: Comprehensive coverage provides peace of mind knowing that your car is protected from various non-accident-related damages.

- Drawbacks: Comprehensive coverage can be costly, especially for luxury or high-performance vehicles. It may not be necessary if your car has a low value or if you live in an area with minimal risk of these events.

- Cost: The cost of comprehensive coverage is influenced by factors like your car’s value, location, and your driving history.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you in case you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your damages.

- Benefits: UM/UIM coverage provides financial protection if you are injured by an uninsured or underinsured driver, ensuring you can cover medical expenses and other losses.

- Drawbacks: While essential, UM/UIM coverage may have a higher cost, but the potential financial burden of an accident with an uninsured driver outweighs this cost.

- Cost: The cost of UM/UIM coverage varies depending on your location, driving record, and the coverage limits you choose.

Summary of Car Insurance Coverages in Florida

| Coverage Type | Features | Potential Benefits |

|---|---|---|

| Collision Coverage | Covers damage to your car in an accident, regardless of fault. | Protects you financially in case of an accident, allowing you to repair or replace your car. |

| Comprehensive Coverage | Covers damage to your car caused by events other than accidents, such as theft, vandalism, or natural disasters. | Provides peace of mind knowing your car is protected from various non-accident-related damages. |

| Uninsured/Underinsured Motorist (UM/UIM) Coverage | Protects you in case of an accident with an uninsured or underinsured driver. | Offers financial protection if you are injured by an uninsured or underinsured driver, covering medical expenses and other losses. |

Strategies for Obtaining Competitive Quotes

In the competitive Florida car insurance market, obtaining competitive quotes is crucial for securing the best coverage at an affordable price. By actively shopping around and leveraging various resources, you can significantly reduce your insurance premiums.

Comparing Quotes from Multiple Providers

It’s essential to request quotes from multiple insurance providers to compare their offerings and identify the most favorable options. This practice allows you to assess different coverage levels, deductibles, and pricing structures, ultimately leading to a more informed decision.

Utilizing Online Comparison Websites

Online comparison websites offer a convenient and efficient way to gather quotes from multiple insurance providers simultaneously. These platforms allow you to input your personal information and vehicle details, generating personalized quotes from various companies within minutes.

Working with Insurance Brokers

Insurance brokers act as intermediaries, connecting you with multiple insurance providers. They have extensive knowledge of the market and can provide personalized recommendations based on your specific needs and preferences. Brokers can streamline the quote comparison process, saving you time and effort.

Steps to Effectively Compare Quotes, Compare car insurance quotes in florida

- Gather Your Information: Before contacting insurance providers, assemble all relevant information, including your driving history, vehicle details, and desired coverage levels. This will expedite the quote process.

- Explore Multiple Providers: Contact a variety of insurance companies, both large and small, to obtain a comprehensive range of quotes. Consider a mix of online comparison websites, brokers, and direct interactions with insurers.

- Compare Coverage Levels: Pay close attention to the coverage levels offered by each provider. Ensure that the policies meet your specific needs and provide adequate protection in case of an accident or other unforeseen events.

- Analyze Deductibles and Premiums: Carefully review the deductibles and premiums associated with each quote. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums. Choose a balance that aligns with your financial situation and risk tolerance.

- Consider Discounts and Bundling Options: Inquire about available discounts, such as safe driver, good student, or multi-car discounts. Explore the possibility of bundling your car insurance with other insurance policies, such as homeowners or renters insurance, for potential savings.

- Review Policy Details: Before making a final decision, thoroughly review the policy details of each quote. Pay attention to exclusions, limitations, and any additional fees or charges.

- Seek Professional Advice: If you’re unsure about the best options, consider seeking advice from an independent insurance agent or broker. They can provide unbiased guidance and help you make an informed decision.

Understanding Discount Opportunities

In Florida, car insurance companies offer various discounts to help policyholders save money. These discounts can significantly reduce your premium, making it crucial to understand the available options and how to qualify for them.

Discounts Based on Driving Record

A clean driving record is one of the most significant factors influencing your car insurance rates. Several discounts are available for safe drivers, including:

- Accident-Free Discount: This discount is offered to drivers who haven’t been involved in any accidents for a specific period. The length of time required for eligibility varies by insurer.

- Defensive Driving Course Discount: Completing a certified defensive driving course can demonstrate your commitment to safe driving and earn you a discount. These courses typically cover topics like safe driving techniques and traffic laws.

- Good Driver Discount: This discount is awarded to drivers with a history of safe driving, often based on a certain number of years without accidents or violations. This discount is a reflection of your overall driving behavior.

Discounts Based on Vehicle Features

Your vehicle’s safety features can also influence your insurance premiums.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms, immobilizers, or tracking systems, can deter theft and qualify you for a discount. This discount is offered as a reward for taking proactive steps to protect your vehicle.

- Airbag Discount: Vehicles equipped with airbags, which are now standard in most cars, can earn you a discount. Airbags provide an extra layer of safety in case of an accident.

- Anti-lock Brake Discount: Anti-lock braking systems (ABS) help prevent skidding and improve vehicle control during emergency braking situations. Insurance companies often offer discounts for vehicles equipped with ABS.

Discounts Based on Other Factors

Beyond driving record and vehicle features, other factors can impact your car insurance premiums.

- Good Student Discount: Maintaining good grades in school can demonstrate responsibility and earn you a discount. This discount is often available to students with a GPA of 3.0 or higher.

- Multi-Policy Discount: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can result in a significant discount. This is a common strategy to save money on multiple insurance premiums.

- Loyalty Discount: Staying with the same insurance company for an extended period can often lead to a loyalty discount. This rewards customers for their long-term commitment.

Tips for Maximizing Discounts

- Review Your Policy Regularly: Make sure you’re taking advantage of all the discounts you qualify for. Contact your insurance company to inquire about available discounts and update your policy accordingly.

- Maintain a Clean Driving Record: This is the most important factor in securing lower premiums. Avoid speeding tickets, accidents, and other violations.

- Consider Bundling Policies: Bundling your insurance policies can lead to significant savings. Ask your insurer about available discounts and compare quotes from different companies.

- Explore Discounts for Safety Features: If your vehicle has safety features, such as airbags, anti-theft devices, or anti-lock brakes, ensure your insurer is aware of them and you are receiving the corresponding discounts.

- Maintain Good Grades: If you’re a student, maintaining good grades can earn you a discount. Provide your insurer with proof of your academic achievements.

Tips for Saving on Car Insurance: Compare Car Insurance Quotes In Florida

Saving money on car insurance in Florida is achievable with a strategic approach. By understanding the factors influencing your premiums and implementing smart strategies, you can significantly reduce your insurance costs.

Increasing Deductibles

Raising your deductible, the amount you pay out of pocket before your insurance kicks in, can lead to lower premiums. This is because a higher deductible means the insurance company has to pay less in claims, resulting in a lower premium for you. However, make sure you can comfortably afford the higher deductible in case of an accident.

Maintaining a Good Driving Record

A clean driving record is crucial for obtaining affordable car insurance. Avoid traffic violations like speeding tickets, reckless driving, and DUI offenses, as these can significantly increase your premiums. Maintaining a good driving record demonstrates your responsible driving behavior, making you a less risky driver in the eyes of insurance companies.

Considering Car Safety Features

Modern cars are equipped with advanced safety features that can help prevent accidents and reduce the severity of injuries. These features, such as anti-lock brakes, airbags, and electronic stability control, can lower your premiums as they demonstrate a reduced risk of accidents and claims.

Choosing a Safe Vehicle

The type of car you drive significantly influences your insurance premiums. Vehicles with high safety ratings, such as those awarded by the Insurance Institute for Highway Safety (IIHS) or the National Highway Traffic Safety Administration (NHTSA), tend to have lower insurance costs. This is because these vehicles are statistically less likely to be involved in accidents or result in severe injuries.

Parking in a Secure Location

Where you park your car can also affect your insurance premiums. Parking your car in a secure location, such as a garage or a gated parking lot, reduces the risk of theft or damage, making you a less risky driver in the eyes of insurance companies. This can lead to lower insurance premiums.

Driving Habits and Mileage

Your driving habits and the number of miles you drive annually play a significant role in determining your car insurance rates. Driving less frequently and avoiding risky behaviors, such as speeding or aggressive driving, can reduce your premiums. Additionally, if you drive a low mileage, you can often qualify for discounts offered by insurance companies.

Final Thoughts

In conclusion, comparing car insurance quotes in Florida is a vital step in ensuring you have the right coverage at an affordable price. By understanding the key factors that influence premiums, exploring different types of coverage, and utilizing strategies for obtaining competitive quotes, you can navigate the complex world of car insurance with confidence. Remember to shop around, leverage available discounts, and prioritize your needs to find the best policy that protects you and your finances.

Key Questions Answered

What is the minimum car insurance coverage required in Florida?

Florida requires all drivers to have Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage. PIP covers medical expenses and lost wages for the insured driver and passengers, while PDL covers damages to another person’s vehicle or property.

How often should I compare car insurance quotes?

It’s recommended to compare car insurance quotes at least once a year, or even more frequently if you experience significant life changes, such as a new car purchase, a change in driving habits, or a move to a new location.

What are some common discounts offered by car insurance companies in Florida?

Common discounts include good driver discounts, safe driving courses, bundling multiple insurance policies, and good student discounts. You can also get discounts for installing safety features in your car, such as anti-theft devices or airbags.

Can I get car insurance without a credit check?

While not all insurance companies use credit scores to determine premiums, many do. If you are concerned about your credit score impacting your car insurance rates, you can contact insurance companies directly to inquire about their policies and find out if they offer options without a credit check.