Compare car insurance rates florida – Compare car insurance rates in Florida and find the best deal for your needs. Florida’s unique driving environment, with its high population density and frequent storms, makes car insurance a significant expense. Understanding the factors that influence rates, comparing quotes, and choosing the right policy can save you a substantial amount of money.

This comprehensive guide will walk you through the process of navigating the Florida car insurance market, providing insights into key considerations, tips for saving, and strategies for securing the best possible coverage.

Understanding Florida Car Insurance

Florida’s car insurance landscape is unique, influenced by factors like the state’s high population density, frequent severe weather events, and a significant number of uninsured drivers. Understanding these factors and the specific regulations governing car insurance in Florida is crucial for drivers to make informed decisions about their coverage.

Factors Influencing Car Insurance Rates

Several factors contribute to the cost of car insurance in Florida. These include:

- Driving Record: Your driving history, including accidents, traffic violations, and DUI convictions, heavily impacts your insurance premiums. A clean driving record generally leads to lower rates.

- Vehicle Type and Value: The make, model, and year of your vehicle influence your insurance costs. Luxury cars or vehicles with high repair costs typically have higher premiums.

- Age and Gender: Insurance companies often consider age and gender in their rate calculations. Younger drivers and males tend to have higher premiums due to higher risk profiles.

- Location: Your zip code and the crime rate, traffic density, and number of uninsured drivers in your area can influence your insurance rates. Areas with higher risk factors generally have higher premiums.

- Coverage Levels: The type and amount of coverage you choose directly affect your insurance costs. Higher coverage limits generally mean higher premiums.

- Credit Score: In Florida, insurance companies can use your credit score to assess your risk profile. A good credit score generally translates to lower premiums.

Florida Car Insurance Regulations

Florida has specific laws and regulations governing car insurance. These include:

- Minimum Coverage Requirements: Florida requires all drivers to carry a minimum amount of liability insurance, known as “Financial Responsibility.” This includes:

- Bodily Injury Liability: $10,000 per person/$20,000 per accident

- Property Damage Liability: $10,000 per accident

- Personal Injury Protection (PIP): Florida’s “no-fault” insurance system requires all drivers to have PIP coverage. This coverage pays for medical expenses and lost wages for the policyholder, regardless of fault, up to $10,000.

- Uninsured Motorist Coverage (UM): This coverage protects you if you are involved in an accident with an uninsured or underinsured driver. It covers your medical expenses, lost wages, and property damage.

- Florida’s “No-Fault” System: Florida’s “no-fault” system allows drivers to file claims with their own insurance company for injuries and damages, regardless of who caused the accident. However, there are exceptions, such as when the other driver is at fault and the damages exceed the PIP coverage limit.

Types of Car Insurance Coverage

Florida offers various car insurance coverages to protect drivers and their vehicles. These include:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged due to non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured Motorist Coverage (UM): This coverage protects you if you are involved in an accident with an uninsured or underinsured driver.

- Underinsured Motorist Coverage (UIM): This coverage protects you if you are involved in an accident with a driver who has insufficient liability insurance to cover your damages.

- Medical Payments Coverage (Med Pay): This coverage supplements your PIP benefits and pays for medical expenses for you and your passengers, regardless of fault.

- Personal Injury Protection (PIP): This coverage is mandatory in Florida and pays for your medical expenses and lost wages, regardless of fault, up to $10,000.

Factors Affecting Car Insurance Rates

Your car insurance premiums in Florida are determined by a complex interplay of factors. Understanding these factors can help you make informed decisions to potentially lower your rates. Here’s a breakdown of some of the key influences on your car insurance costs.

Driving History

Your driving record is a significant factor in determining your car insurance rates. A clean driving history with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will significantly increase your rates. Insurance companies view these incidents as indicators of higher risk, leading to higher premiums.

- Accidents: Even a single accident can lead to a substantial increase in your insurance rates. The severity of the accident and the extent of the damage play a crucial role. For instance, an at-fault accident with significant damage will likely result in a higher premium increase than a minor fender bender.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations also negatively impact your rates. The severity of the violation and the frequency of occurrences can significantly influence the premium increase.

- DUI Convictions: Driving under the influence (DUI) convictions are considered extremely serious offenses by insurance companies. These convictions can result in substantial premium increases, sometimes even leading to policy cancellation.

Vehicle Type and Age

The type and age of your vehicle are also significant factors in determining your car insurance rates. Insurance companies consider the cost of repairs, safety features, and the likelihood of theft when assessing these factors.

- Vehicle Type: Sports cars, luxury vehicles, and high-performance vehicles are generally considered higher risk due to their higher repair costs and potential for higher speeds. As a result, insurance premiums for these vehicles tend to be higher.

- Vehicle Age: Older vehicles may have lower repair costs but are often associated with a higher risk of breakdowns or accidents. Newer vehicles, on the other hand, typically have more safety features, which can lead to lower premiums. However, newer vehicles also have higher repair costs, which can influence premiums.

Other Factors

Several other factors can influence your car insurance rates. These include:

- Credit Score: In many states, including Florida, insurance companies use credit scores as a proxy for risk assessment. A higher credit score is often associated with responsible financial behavior, which can translate into lower insurance premiums.

- Location: Your location plays a role in determining your car insurance rates. Areas with higher crime rates, traffic congestion, and accident frequency tend to have higher premiums. Insurance companies consider the likelihood of theft, accidents, and other risks based on your location.

- Coverage Levels: The amount of coverage you choose will significantly impact your premiums. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, will generally result in higher premiums. However, higher coverage limits provide greater financial protection in case of accidents or other incidents.

- Deductible: Your deductible is the amount you agree to pay out of pocket in case of an accident or other covered event. A higher deductible generally leads to lower premiums, as you are taking on more financial responsibility. However, it is important to choose a deductible you can comfortably afford in case of an incident.

Deductible Impact on Premiums

The deductible you choose can significantly impact your insurance premiums. A higher deductible means you pay more out of pocket in case of an accident, but your monthly premiums will be lower. Conversely, a lower deductible means you pay less out of pocket, but your monthly premiums will be higher. It is important to weigh the financial implications of each option and choose a deductible that fits your budget and risk tolerance.

For example, a $500 deductible might result in a lower monthly premium than a $1000 deductible. However, you would need to pay $500 out of pocket in case of an accident with the $500 deductible, while you would only pay $1000 with the $1000 deductible.

Comparing Car Insurance Quotes

Getting multiple quotes from different insurance companies is crucial for finding the best deal on car insurance in Florida. By comparing quotes, you can identify the policy that offers the most comprehensive coverage at the most competitive price. This process involves carefully examining the details of each quote and understanding the factors that influence pricing.

Essential Information in Quotes

When comparing quotes, it’s essential to focus on key details to ensure you’re making an informed decision. The following table Artikels the critical information to consider:

| Feature | Description | Importance |

|---|---|---|

| Coverage Limits | The maximum amount the insurer will pay for a covered claim. | Higher limits provide greater financial protection in case of a major accident. |

| Deductibles | The amount you pay out-of-pocket before your insurance coverage kicks in. | Higher deductibles typically lead to lower premiums, but you’ll have to pay more in case of a claim. |

| Premiums | The cost of your car insurance policy. | Compare premiums from different insurers to find the most affordable option. |

| Discounts | Potential savings offered by insurers based on factors like good driving history, safety features, and bundling policies. | Check if you qualify for any discounts to reduce your overall premium. |

| Customer Service | The quality of support and responsiveness provided by the insurer. | Choose a company with a reputation for excellent customer service for a smooth experience. |

Steps to Getting Multiple Quotes

The following flowchart Artikels the steps involved in obtaining multiple quotes:

Step 1: Gather Your Information

– Personal details (name, address, date of birth)

– Driving history (license details, accidents, violations)

– Vehicle information (make, model, year, VIN)

– Coverage preferences (desired limits, deductibles)

Step 2: Contact Multiple Insurers

– Visit insurer websites

– Use online quote tools

– Call insurance agents

Step 3: Compare Quotes

– Review coverage details

– Analyze premiums and discounts

– Consider customer service reputation

Step 4: Choose the Best Policy

– Select the insurer that offers the most comprehensive coverage at the most competitive price.

Coverage Limits and Deductibles

When comparing quotes, carefully examine the coverage limits and deductibles offered by each insurer. These factors significantly impact your out-of-pocket expenses in case of an accident.

Coverage Limits

– Liability Coverage: Covers damages to other people and property in case of an accident.

– Collision Coverage: Covers repairs or replacement of your vehicle if you’re involved in an accident.

– Comprehensive Coverage: Covers damages to your vehicle from events other than collisions, such as theft or vandalism.

Deductibles

– The higher the deductible, the lower your premium will be.

– However, you’ll have to pay more out-of-pocket if you need to file a claim.

– Choose a deductible you can comfortably afford in case of an accident.

Tips for Navigating the Quote Process

Here are some tips to help you navigate the insurance quote process effectively:

- Be honest and accurate when providing information to insurers. Misrepresenting information can lead to policy cancellation or higher premiums.

- Shop around with multiple insurers to compare prices and coverage options.

- Use online quote tools for quick and convenient comparisons.

- Ask questions about coverage details and discounts.

- Read policy documents carefully before making a decision.

Choosing the Right Car Insurance Policy

Selecting the right car insurance policy is crucial in Florida, where driving conditions can be unpredictable. By understanding your needs, comparing quotes, and asking the right questions, you can find a policy that provides the coverage you require at a competitive price.

Questions to Ask Potential Insurance Providers

It’s essential to ask detailed questions to potential insurance providers to ensure you fully understand the coverage offered and the terms and conditions of the policy.

- Inquire about the different types of coverage available, including liability, collision, comprehensive, and personal injury protection (PIP).

- Ask about the specific deductibles and coverage limits for each type of insurance.

- Request clarification on the claims process, including the time frame for processing claims and the availability of 24/7 support.

- Investigate the provider’s financial stability and customer service reputation.

- Ask about any discounts available, such as safe driving discounts, multi-policy discounts, or good student discounts.

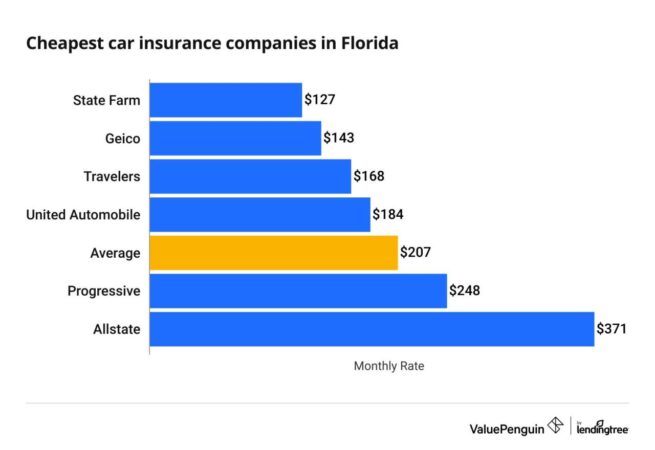

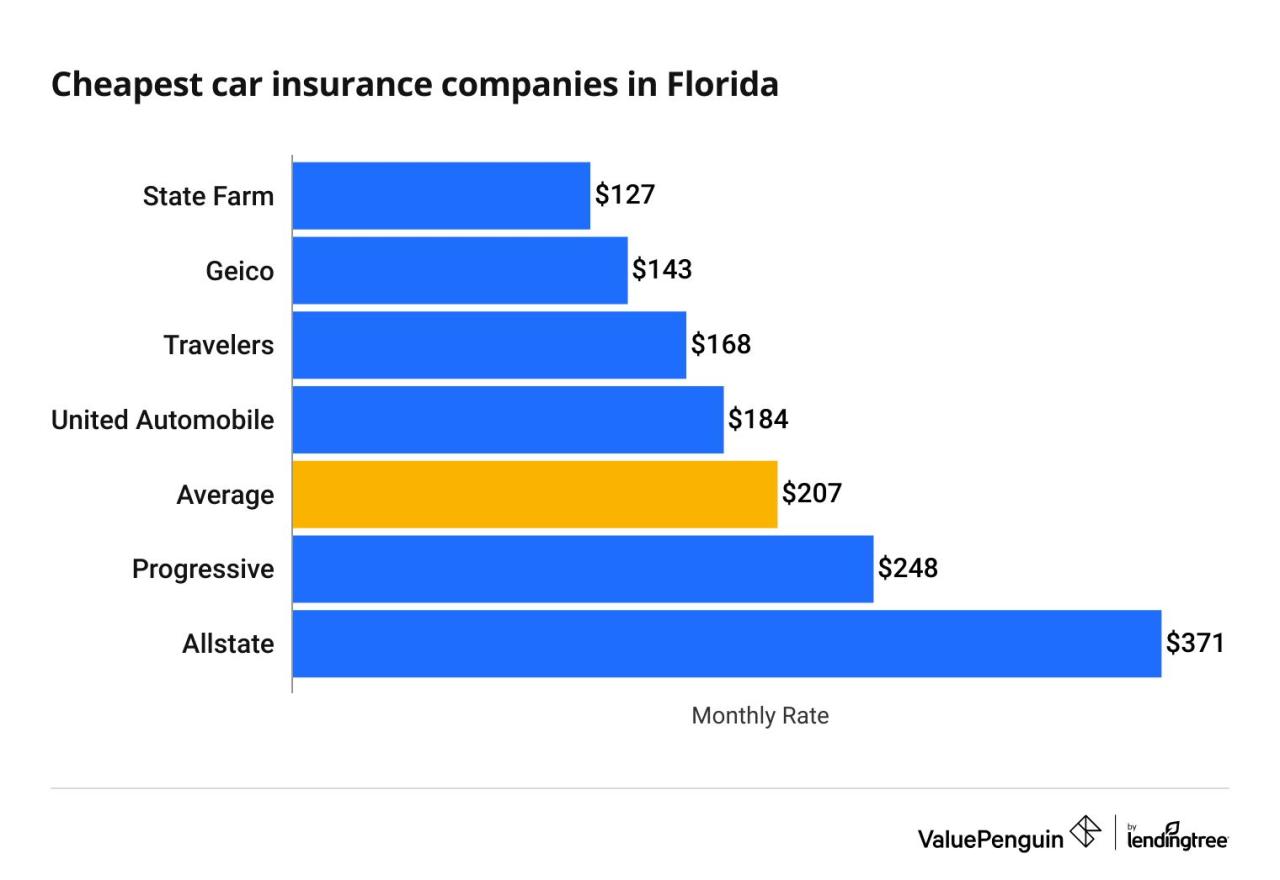

Benefits and Drawbacks of Different Insurance Companies in Florida

Different insurance companies in Florida offer varying benefits and drawbacks, which can impact your overall experience.

- Some companies may offer lower premiums but have a reputation for slow claim processing or poor customer service.

- Other companies may have higher premiums but provide excellent customer service and faster claim settlements.

It’s essential to research different companies and compare their offerings to find the best fit for your needs and budget.

Reviewing Policy Terms and Conditions

Before signing any insurance policy, carefully review the terms and conditions.

- Pay close attention to the coverage limits, deductibles, and exclusions.

- Understand the process for filing claims and the time frame for processing.

- Review any specific endorsements or riders included in the policy.

Understanding Policy Exclusions and Limitations

Every insurance policy has exclusions and limitations, which are specific situations or events not covered by the policy.

- For example, most policies exclude coverage for damage caused by wear and tear, intentional acts, or driving under the influence of alcohol or drugs.

- It’s crucial to understand these limitations to avoid surprises when filing a claim.

Saving on Car Insurance Costs

Finding the right car insurance policy in Florida can be a challenge, but it doesn’t have to break the bank. With a little effort, you can save money on your premiums and ensure you have adequate coverage. This section explores effective strategies for negotiating lower insurance premiums, maintaining a clean driving record, bundling insurance policies, and taking advantage of discounts offered by insurers.

Negotiating Lower Insurance Premiums

Negotiating with your insurance provider can be a powerful way to secure a lower premium. While it may seem daunting, a well-prepared and polite approach can yield positive results. Here’s how to approach the negotiation process:

- Review Your Policy Regularly: Check your policy annually to ensure you’re still paying the best rate. Factors like your driving record, credit score, and even your car’s value can change over time, potentially impacting your premium.

- Shop Around for Quotes: Don’t be afraid to compare quotes from multiple insurance providers. This can help you identify potential savings and leverage competitive offers during negotiations.

- Highlight Positive Factors: Emphasize any positive aspects of your driving history, such as a clean record or a long period without accidents or violations. You can also mention any safety features in your vehicle, such as anti-theft devices or airbags.

- Be Prepared to Switch: If your current insurer isn’t willing to negotiate, be prepared to switch to another provider. The threat of losing your business can often motivate them to offer a better rate.

Maintaining a Clean Driving Record, Compare car insurance rates florida

A clean driving record is arguably the most significant factor in determining your car insurance premiums. Avoid any traffic violations or accidents, as these can significantly increase your rates. Here’s how to maintain a clean record:

- Obey Traffic Laws: Always adhere to speed limits, stop signs, and traffic signals. Avoid distractions while driving, such as texting or using your phone.

- Be Defensive: Practice defensive driving techniques to anticipate potential hazards and avoid accidents. This includes maintaining a safe distance from other vehicles, being aware of your surroundings, and staying alert.

- Take a Defensive Driving Course: Many insurance providers offer discounts for completing a defensive driving course. These courses can help you improve your driving skills and reduce your risk of accidents.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant savings. Insurance providers often offer discounts for bundling multiple policies, recognizing the value of customer loyalty and the reduced risk associated with multiple policies under one provider.

Potential Discounts Offered by Insurance Providers in Florida

Insurance providers in Florida offer a variety of discounts to their policyholders. These discounts can help you save money on your premiums, so it’s worth exploring them.

- Good Student Discount: Many insurers offer discounts to students who maintain a good academic record. This recognizes the lower risk associated with young drivers who demonstrate responsibility and focus.

- Safe Driver Discount: Insurers often reward drivers with a clean record and no accidents or violations with a safe driver discount. This incentivizes safe driving practices and recognizes the reduced risk associated with experienced drivers.

- Anti-Theft Device Discount: If your vehicle is equipped with anti-theft devices, such as alarms or immobilizers, you may be eligible for a discount. This acknowledges the reduced risk of theft associated with vehicles that are better protected.

- Multi-Car Discount: If you insure multiple vehicles under the same policy, you may qualify for a multi-car discount. Insurers often offer this discount to encourage customers to insure all their vehicles with them, recognizing the potential for increased loyalty and reduced risk.

- Loyalty Discount: Many insurance providers offer discounts to long-term policyholders who have consistently maintained their policies. This recognizes the value of customer loyalty and rewards those who have remained with the provider for an extended period.

Final Thoughts: Compare Car Insurance Rates Florida

Armed with the knowledge and tools provided in this guide, you can confidently compare car insurance rates in Florida, identify the best policy for your individual needs, and secure the most favorable premiums. Remember, a little research and planning can go a long way in saving you money on your car insurance while ensuring you have the necessary protection.

FAQ Compilation

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP) coverage, $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person, with a $20,000 total for all people involved in an accident.

How can I get a free car insurance quote in Florida?

Most insurance companies offer free online quotes. Simply visit their websites, enter your information, and receive a customized quote within minutes. You can also contact insurance agents directly for personalized assistance.

Is it cheaper to bundle car insurance with other policies in Florida?

Yes, bundling your car insurance with homeowners or renters insurance often leads to significant discounts. Insurance companies reward loyalty and bundled policies are a great way to save money.

What factors affect car insurance rates in Florida?

Factors like your driving history, age, credit score, vehicle type, location, and coverage options all play a role in determining your car insurance rates.