Compare car insurance rates in Florida and find the best deal for your needs. Navigating the world of car insurance in the Sunshine State can be a complex task, but with the right information, you can find the best coverage at a price that fits your budget. Understanding Florida’s unique insurance requirements, the factors that influence rates, and the various insurance providers available is crucial to making informed decisions.

This guide will equip you with the knowledge you need to compare car insurance rates in Florida effectively. We’ll explore the state’s mandatory coverage, the factors that affect premiums, and provide tips for finding the best deals. Whether you’re a new driver, a seasoned motorist, or simply looking to save money, this comprehensive guide will help you navigate the car insurance landscape in Florida with confidence.

Understanding Florida Car Insurance Requirements

Driving in Florida requires you to be insured. The state has specific requirements for car insurance coverage to ensure financial protection in case of an accident. This guide will help you understand these requirements and navigate the complexities of Florida’s insurance system.

Mandatory Car Insurance Coverage in Florida

Florida mandates two essential types of car insurance coverage: Personal Injury Protection (PIP) and Property Damage Liability (PDL). These coverages provide financial protection for you and others involved in an accident.

Minimum Coverage Limits

The state mandates minimum coverage limits for PIP and PDL:

- Personal Injury Protection (PIP): $10,000 per person, covering medical expenses, lost wages, and other related costs.

- Property Damage Liability (PDL): $10,000 per accident, covering damage to another person’s vehicle or property.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system. This means that after an accident, your own insurance company covers your medical expenses and lost wages, regardless of who caused the accident. This system aims to expedite the claims process and reduce litigation.

The no-fault system in Florida is a unique aspect of the state’s insurance laws. It aims to simplify the claims process and minimize litigation after accidents.

Explanation of No-Fault System

Here’s how Florida’s no-fault system works:

- PIP Coverage: After an accident, your PIP coverage will cover your medical expenses, lost wages, and other related costs up to the policy limit, regardless of who caused the accident.

- Fault Determination: While your own insurance covers your initial expenses, fault for the accident is still determined. This information is crucial if you have sustained significant injuries or damages exceeding your PIP coverage.

- PDL Coverage: If you are at fault for the accident, your PDL coverage will pay for damages to the other party’s vehicle or property.

- Threshold for Legal Action: In Florida, you can sue the other driver for additional damages if your injuries meet certain thresholds, such as “serious injury” or “permanent injury.”

Factors Influencing Car Insurance Rates in Florida

Several factors influence car insurance rates in Florida, impacting the premiums you pay. Understanding these factors can help you make informed decisions about your insurance policy and potentially save money.

Driving History

Your driving history significantly affects your car insurance rates. Insurance companies consider your past driving record, including accidents, traffic violations, and DUI convictions. A clean driving record generally results in lower premiums, while a history of accidents or violations can significantly increase your rates.

Age

Age is another crucial factor in determining car insurance rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Therefore, insurance companies often charge higher premiums for younger drivers. As drivers age and gain experience, their rates typically decrease.

Credit Score

In Florida, insurance companies can use your credit score to calculate your car insurance rates. A good credit score is generally associated with responsible financial behavior, which insurance companies perceive as a lower risk. Individuals with poor credit scores may face higher premiums.

Vehicle Type

The type of vehicle you drive also impacts your car insurance rates. Luxury cars, sports cars, and vehicles with high performance capabilities are typically more expensive to repair or replace, leading to higher insurance premiums. Conversely, smaller, less expensive vehicles generally have lower insurance rates.

Location

Your location in Florida can influence your car insurance rates. Areas with higher crime rates, traffic congestion, and accident frequencies may have higher insurance premiums. This is because insurance companies assess the risk of accidents and claims based on the location where you drive.

Insurance Discounts

Insurance companies offer various discounts to lower your premiums. These discounts can significantly reduce your overall insurance costs. Some common discounts include:

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record and no accidents or violations. It can be a substantial discount, especially for those with a long history of safe driving.

- Good Student Discount: Students who maintain good grades in school are often eligible for this discount. It reflects the belief that good students are more responsible and less likely to be involved in accidents.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you may qualify for a multi-car discount. This discount is a reward for insuring multiple vehicles with the same provider.

- Other Discounts: Many other discounts are available, such as discounts for anti-theft devices, driver training courses, and paying your premiums in full.

Typical Car Insurance Rates in Florida

The following table shows typical car insurance rates for different car types in Florida:

| Car Type | Average Annual Premium |

|---|---|

| Compact Car | $1,500 – $2,000 |

| Mid-Size Sedan | $1,800 – $2,500 |

| SUV | $2,200 – $3,000 |

| Luxury Car | $3,000 – $4,500 |

| Sports Car | $3,500 – $5,000 |

Note: These are just estimates, and actual rates may vary depending on individual factors. It’s crucial to obtain quotes from multiple insurance companies to compare rates and find the best coverage for your needs.

Choosing the Right Car Insurance Provider

Finding the best car insurance provider in Florida can be a challenging task, as numerous companies offer various coverage options and pricing strategies. To make an informed decision, it’s essential to consider factors like customer satisfaction, financial stability, and the specific coverage needs you have.

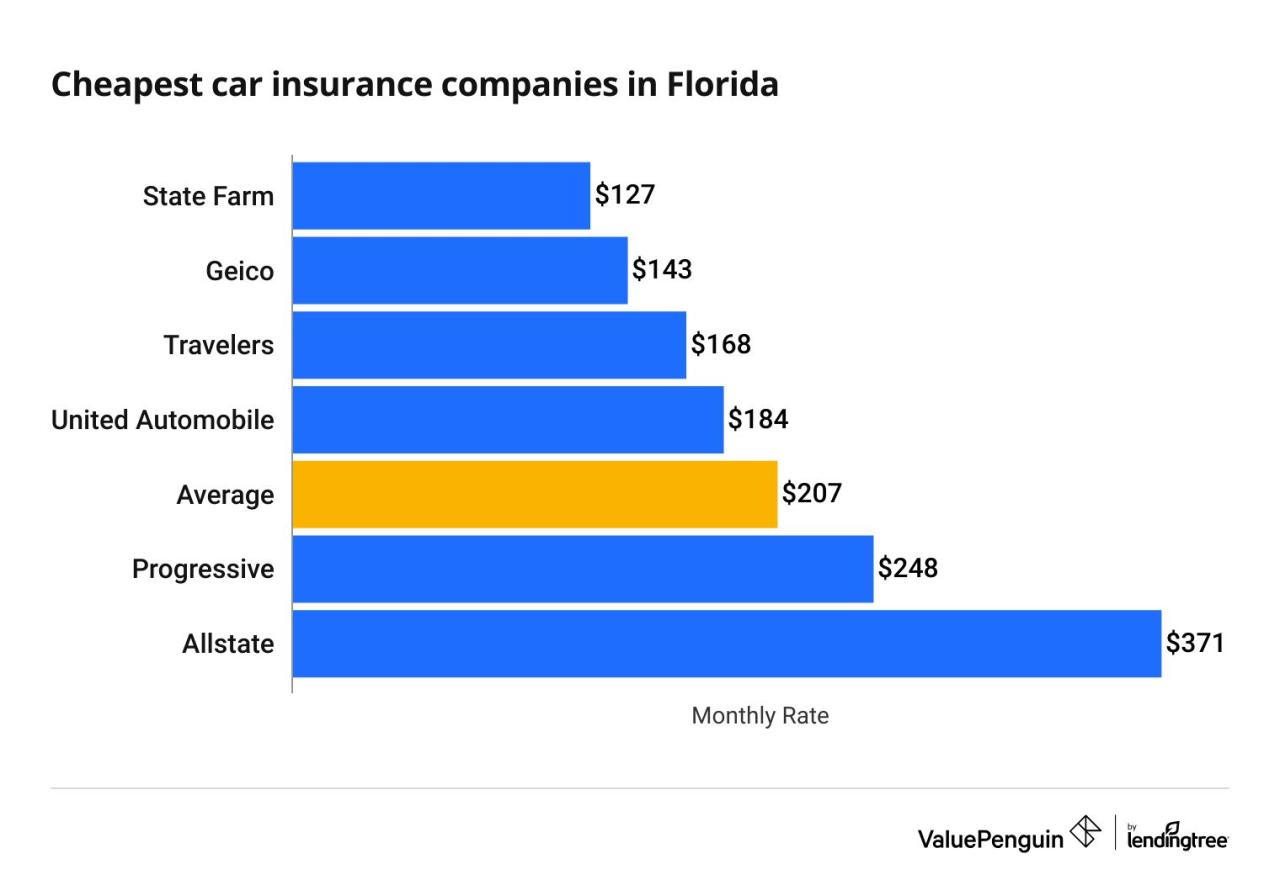

Top Car Insurance Companies in Florida

Choosing a car insurance provider involves careful consideration of factors like customer satisfaction, financial stability, and the specific coverage needs you have. Here are some of the top car insurance companies in Florida, known for their strong performance in these areas:

- State Farm: A well-established company with a strong reputation for customer service and financial stability. State Farm consistently ranks high in customer satisfaction surveys and offers a wide range of coverage options.

- GEICO: Known for its competitive rates and convenient online and mobile services. GEICO has gained popularity for its ease of use and affordability, making it a popular choice for many drivers.

- Progressive: Progressive is known for its innovative features, including its Name Your Price tool, which allows customers to set their desired premium and find policies that match their budget.

- Allstate: Allstate is a well-known company with a strong focus on customer service and personalized insurance solutions. Allstate offers a variety of coverage options and discounts to cater to individual needs.

- USAA: While primarily serving military personnel and their families, USAA has a strong reputation for customer satisfaction and financial stability. USAA offers competitive rates and excellent customer service.

Comparing Coverage Options and Pricing Strategies

Car insurance providers in Florida offer a range of coverage options and pricing strategies. Understanding these differences is crucial for finding a policy that meets your specific needs and budget.

- Liability Coverage: This is the most basic type of car insurance, covering damages to other people and their property in case of an accident you cause. Liability coverage is typically divided into two parts: bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Collision coverage is usually optional, but it can be beneficial if you have a financed or leased vehicle.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, or natural disasters. Comprehensive coverage is also optional but can be valuable if you have a newer or more expensive vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. Uninsured/underinsured motorist coverage is essential, as it can help cover your medical expenses and vehicle damage in such situations.

- Personal Injury Protection (PIP): This coverage covers your medical expenses and lost wages if you’re injured in an accident, regardless of fault. PIP is mandatory in Florida, and it’s crucial for ensuring financial protection in case of an accident.

Key Features and Benefits Offered by Providers, Compare car insurance rates in florida

Different insurance providers offer unique features and benefits that can influence your decision. Here’s a table outlining some key features and benefits offered by some of the top car insurance companies in Florida:

| Provider | Key Features | Benefits |

|---|---|---|

| State Farm |

|

|

| GEICO |

|

|

| Progressive |

|

|

| Allstate |

|

|

| USAA |

|

|

Obtaining Car Insurance Quotes: Compare Car Insurance Rates In Florida

Getting car insurance quotes is the first step in finding the best coverage for your needs and budget. This process allows you to compare prices and features from different insurance companies, helping you make an informed decision.

Obtaining Quotes Online

Online quote requests are convenient and efficient, allowing you to compare quotes from multiple insurers without leaving your home. Here’s a step-by-step guide:

- Visit the websites of various insurance companies.

- Enter your personal and vehicle information, such as your name, address, date of birth, driving history, and vehicle details.

- Select the coverage options you desire, such as liability, collision, and comprehensive coverage.

- Review the quote and compare it with quotes from other insurers.

Obtaining Quotes Through Agents

Working with an insurance agent can be beneficial, especially if you have complex insurance needs or prefer personalized assistance. Here’s how to obtain quotes through agents:

- Contact multiple insurance agents in your area.

- Provide them with your personal and vehicle information.

- Discuss your insurance needs and budget.

- Compare the quotes and coverage options presented by the agents.

Comparing Quotes

Once you have obtained quotes from multiple insurers, it’s essential to compare them thoroughly. Here are some factors to consider:

- Price: Compare the annual premiums offered by each insurer.

- Coverage: Ensure that the coverage options offered by each insurer meet your needs.

- Deductibles: Consider the deductibles you are willing to pay in case of an accident.

- Discounts: Check if the insurer offers discounts for safe driving, good grades, or bundling multiple policies.

- Customer service: Research the insurer’s reputation for customer service and claims handling.

- Financial stability: Ensure the insurer is financially stable and can pay claims in the event of an accident.

Reviewing Policy Details

Before purchasing a policy, it’s crucial to carefully review the policy details. Pay attention to:

- Coverage limits: Understand the maximum amount the insurer will pay for different types of claims.

- Exclusions: Note any situations or events that are not covered by the policy.

- Conditions: Review any conditions that must be met to receive coverage, such as reporting accidents promptly.

Saving Money on Car Insurance

Car insurance in Florida can be expensive, but there are ways to lower your premiums. By taking advantage of discounts, improving your driving habits, and carefully considering your coverage needs, you can save money on your car insurance.

Improving Driving Habits

Your driving record significantly impacts your insurance premiums. A clean driving record with no accidents or traffic violations can earn you lower rates. Here are some tips to improve your driving habits and reduce your risk of accidents:

- Drive defensively: Be aware of your surroundings and anticipate potential hazards. This means maintaining a safe distance from other vehicles, avoiding distractions like cell phones, and being extra cautious in bad weather conditions.

- Avoid speeding: Speeding is a leading cause of accidents and can result in higher insurance premiums. Stick to the speed limit and avoid aggressive driving.

- Take a defensive driving course: Many insurance companies offer discounts to drivers who complete a defensive driving course. These courses can help you learn safe driving techniques and reduce your risk of accidents.

Increasing Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally means lower premiums. However, it’s crucial to ensure you can afford the deductible if you have an accident.

- Consider your financial situation: If you have a comfortable emergency fund and can afford to pay a higher deductible, it can save you money on your premiums.

- Review your coverage needs: Evaluate your coverage levels and determine if you can afford a higher deductible without jeopardizing your financial stability.

- Don’t increase the deductible too much: A very high deductible could leave you financially vulnerable in the event of an accident. It’s best to strike a balance between affordability and risk.

Bundling Insurance Policies

Many insurance companies offer discounts when you bundle multiple policies, such as car insurance, home insurance, and renters insurance. This can be a significant cost-saving measure.

- Compare quotes from different insurers: Get quotes from multiple insurance companies to compare their bundled policies and find the best deal.

- Consider the benefits of bundling: Evaluate the potential savings and determine if bundling is right for you.

- Review your coverage needs: Ensure that the bundled policies meet your specific coverage requirements.

Comparing Comprehensive and Collision Coverage

Comprehensive and collision coverage are two important components of car insurance. Comprehensive coverage protects you from damages caused by events like theft, vandalism, and natural disasters. Collision coverage protects you from damages caused by accidents with another vehicle or object.

- Evaluate the value of your car: If your car is older and has a lower value, comprehensive and collision coverage might not be necessary. The cost of repairs could exceed the value of the car, making it more cost-effective to self-insure.

- Consider your financial situation: If you can afford to pay for repairs out-of-pocket, you might choose to waive comprehensive and collision coverage, saving you money on premiums.

- Review your coverage needs: Determine if comprehensive and collision coverage are essential for your specific situation. Factors like the value of your car, your financial stability, and your driving habits should be considered.

Real-Life Examples of Saving Money on Car Insurance

Many individuals have successfully saved money on car insurance by implementing strategies like improving their driving habits, increasing deductibles, and bundling policies. Here are some examples:

- John, a safe driver with a clean record, increased his deductible and bundled his car insurance with his home insurance, saving over $200 per year.

- Sarah, a young driver, enrolled in a defensive driving course and received a discount on her premiums, lowering her monthly payments by $15.

- Michael, a homeowner, compared quotes from different insurance companies and found a bundled policy that saved him $300 annually.

Conclusion

By understanding the intricacies of Florida’s car insurance market and utilizing the tips and strategies Artikeld in this guide, you can confidently compare car insurance rates and find the best policy for your needs. Remember, taking the time to research and compare quotes from multiple providers is essential to securing the most affordable and comprehensive coverage. With the right knowledge and a proactive approach, you can save money and drive with peace of mind in the Sunshine State.

Frequently Asked Questions

What are the main types of car insurance coverage required in Florida?

In Florida, you are legally required to have Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage. PIP covers medical expenses and lost wages for you and your passengers, while PDL covers damage to another person’s vehicle or property.

How can I lower my car insurance premiums in Florida?

There are several ways to reduce your car insurance premiums, including improving your driving record, increasing your deductibles, bundling your insurance policies, and taking advantage of discounts like safe driver, good student, and multi-car discounts.

What are some of the top car insurance companies in Florida?

Some of the top-rated car insurance companies in Florida include State Farm, Geico, Progressive, and USAA. It’s important to compare quotes from multiple providers to find the best rates and coverage options for your specific needs.