Does insurance company file sr1 – Does insurance company file SR-1? It’s a question that might pop up if you’ve been in a car accident. Think of the SR-1 form as a “car accident report card,” and it’s something insurance companies use to keep track of accidents and potential liability. This form can have some serious implications for your insurance rates and even your driving privileges, so it’s important to know the scoop.

The SR-1 form is filed by the insurance company after an accident, and it details the who, what, when, where, and why of the incident. This includes information about the drivers, vehicles, injuries, and even witness statements. Insurance companies use this information to determine fault and liability, which can impact your insurance premiums and even your ability to get insurance in the future.

SR-1 Forms and Their Purpose: Does Insurance Company File Sr1

Imagine you’re driving down the road, feeling like a total rockstar, when BAM! You get into a fender bender. It’s not your fault, but the other driver decides to ditch the scene like a scaredy-cat. What happens next? Well, that’s where the SR-1 form comes in, like a superhero swooping in to save the day.

The SR-1 form, also known as the “Report of Accident,” is basically a way for insurance companies to keep track of accidents that involve hit-and-run drivers or drivers who don’t have insurance. It’s like a detective’s notebook, recording all the important details about the accident so they can investigate and hopefully catch the culprit.

Information Included in an SR-1 Form

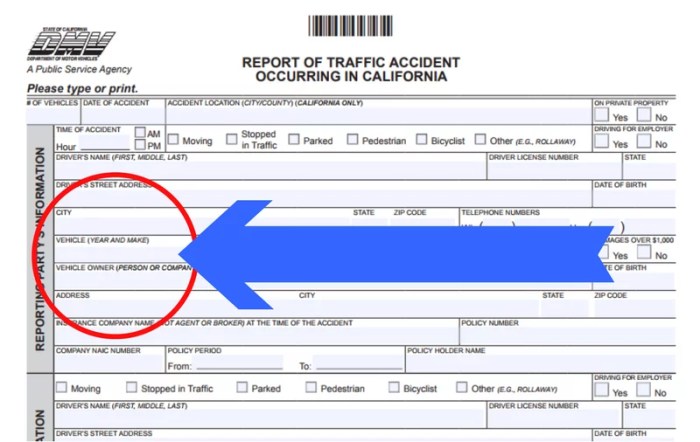

The SR-1 form is packed with information, kind of like a gossip magazine. It includes details like the date, time, and location of the accident, along with a description of what happened, including any injuries. It also includes information about the vehicles involved, like the make, model, and license plate number. The form also requires information about the driver and passengers, like their names, addresses, and insurance information.

When an Insurance Company Might File an SR-1 Form

Here’s where it gets interesting. An insurance company might file an SR-1 form in a few different scenarios.

- Hit-and-Run Accidents: If you’re the victim of a hit-and-run, your insurance company will file an SR-1 form to report the accident to the authorities. This helps them track down the driver and possibly get you compensated for the damage.

- Uninsured Motorists: If you’re involved in an accident with a driver who doesn’t have insurance, your insurance company might file an SR-1 form to help you file a claim. They can use the information on the form to track down the uninsured driver and potentially recover some of your losses.

- Other Accidents: In some cases, even if the other driver is insured, your insurance company might file an SR-1 form if the accident involves a serious injury or significant damage. This helps them gather information and potentially prevent future accidents.

Filing an SR-1

Imagine you’re a driver caught in a fender bender, and the insurance company needs to report the incident to the state. That’s where the SR-1 form comes in. This document, also known as the “Accident Report” or “Motor Vehicle Accident Report,” details the crucial information about the collision. It’s a critical step in the insurance claim process and helps ensure everyone’s on the same page.

Filing Process, Does insurance company file sr1

Insurance companies file SR-1 forms to report accidents to the state’s Department of Motor Vehicles (DMV). The process usually involves these steps:

- The insurance company gathers all the necessary information from the policyholder, including the driver’s information, vehicle details, and accident specifics. This might include details about the other vehicles involved, witnesses, and the location of the accident.

- The insurance company reviews the collected information for accuracy and completeness. They’ll double-check that all the details are correct and that they meet the state’s reporting requirements.

- The insurance company then prepares and files the SR-1 form electronically or through mail with the DMV. This usually involves filling out a standardized form with all the essential details about the accident.

- The DMV receives the SR-1 form and processes it, adding it to the driver’s record. This information is used to track accident history and potentially adjust insurance premiums or license status.

Timeline

The time it takes to file an SR-1 form can vary depending on several factors. It might take anywhere from a few days to a few weeks.

- If the insurance company has all the necessary information quickly, the process can be completed within a few days. But, if they need to gather additional information or verify details, it might take longer.

- The DMV also has its own processing time. If they’re dealing with a high volume of applications or need to verify information, the process can take a few weeks.

Potential Delays

While filing an SR-1 form is usually a straightforward process, several factors can cause delays:

- Missing Information: If the insurance company doesn’t have all the necessary information, they’ll need to contact the policyholder or other parties involved to gather it. This can delay the filing process.

- Disputed Details: If there’s a dispute about the details of the accident, it can delay the filing process. For example, if the drivers disagree on who was at fault or the severity of the damage, the insurance company may need to investigate further before filing the SR-1 form.

- DMV Processing Time: The DMV may experience delays due to staff shortages, technical issues, or a high volume of applications. This can affect the time it takes to process the SR-1 form.

Impact of SR-1 Filing on Policyholders

An SR-1 form, also known as a “Notice of Accident,” is a document that insurance companies file with state authorities to report accidents involving their policyholders. While this may seem like a routine administrative process, it can have a significant impact on the policyholder’s insurance status and future premiums.

Impact on Future Insurance Premiums

An SR-1 filing can have a significant impact on future insurance premiums. Insurance companies use SR-1 forms to assess the risk associated with a policyholder. When an insurance company receives an SR-1, it indicates that the policyholder has been involved in an accident, which increases the likelihood of future accidents. This increased risk is reflected in higher premiums.

The impact of an SR-1 filing on premiums can vary depending on several factors, including:

- The severity of the accident: Accidents resulting in significant damage or injuries are more likely to lead to higher premium increases than minor fender benders.

- The policyholder’s driving record: Policyholders with a history of accidents or violations are more likely to see a larger increase in premiums after an SR-1 filing.

- The insurance company’s underwriting practices: Different insurance companies have different underwriting policies and may assess SR-1 filings differently.

Legal Implications of an SR-1 Filing

An SR-1 filing can also have legal implications. While it is not a criminal record, it can be used as evidence in court cases related to accidents. For example, if a policyholder is involved in a lawsuit arising from the accident, the SR-1 form could be used to demonstrate the policyholder’s involvement in the incident.

It’s important to remember that an SR-1 filing is not necessarily a reflection of fault. It simply indicates that an accident occurred.

In some cases, an SR-1 filing can also lead to the suspension of a policyholder’s driver’s license. This is typically the case if the policyholder is found to be at fault for an accident that resulted in serious injuries or death.

SR-1 Forms and Accident Investigations

The SR-1 form is a crucial document in the accident investigation process. It serves as a primary source of information for insurance companies, enabling them to determine fault, liability, and potential insurance claims.

SR-1 Form Details Crucial for Accident Investigations

The SR-1 form contains specific details that are essential for accident investigations. These details help insurance companies to reconstruct the accident, identify contributing factors, and assess the severity of the incident.

- Date, Time, and Location of the Accident: These details establish the context of the accident and help investigators to understand the environmental factors that may have contributed to the incident.

- Description of the Accident: This section provides a narrative account of the accident, including the sequence of events, the vehicles involved, and any injuries sustained.

- Vehicle Information: The SR-1 form includes details about the vehicles involved, such as make, model, year, license plate number, and VIN (Vehicle Identification Number). This information is essential for identifying the vehicles involved and verifying their insurance coverage.

- Driver Information: The SR-1 form includes details about the drivers involved, such as name, address, driver’s license number, and contact information. This information is crucial for contacting the drivers and obtaining their statements.

- Witness Information: If any witnesses were present at the scene of the accident, their names, addresses, and contact information are included in the SR-1 form. Witness statements can provide valuable insights into the accident and help investigators to determine fault.

- Diagram of the Accident: The SR-1 form often includes a diagram of the accident scene, showing the positions of the vehicles, the direction of travel, and any other relevant details. This diagram helps investigators to visualize the accident and understand the spatial relationships between the vehicles.

- Police Report Number: If a police report was filed for the accident, the SR-1 form will include the report number. This number allows investigators to access the police report for additional information.

SR-1 Forms and Legal Proceedings

SR-1 forms, often referred to as “accident reports,” play a crucial role in legal proceedings related to accidents. They serve as a record of the incident, providing valuable information to all parties involved, including insurance companies, legal representatives, and the courts.

SR-1 Forms as Evidence in Court

SR-1 forms can be used as evidence in court, particularly in cases involving personal injury or property damage claims. The information contained in an SR-1 form can help establish key facts about the accident, such as:

- Date, time, and location of the accident

- Names and contact information of the drivers involved

- Descriptions of the vehicles involved

- Details of the accident, including the sequence of events

- Witness statements

- Sketches or diagrams of the accident scene

This information can be crucial in determining liability and damages in a legal case.

Legal Implications of SR-1 Filing

Filing an SR-1 form can have significant legal implications. It’s important to understand that:

- Accuracy is paramount: A misrepresented or incomplete SR-1 form can be detrimental to your case. It can lead to complications and potential legal repercussions.

- Impact on insurance claims: The information provided in an SR-1 form can influence the outcome of insurance claims. For instance, if the SR-1 form indicates a driver’s fault, it can impact their coverage and insurance premiums.

- Potential for litigation: An SR-1 form can serve as a foundation for a legal claim, either as a plaintiff or a defendant. In some cases, an inaccurate or incomplete SR-1 form might even be used against you in court.

Conclusion

So, what can you do? First, make sure you understand your rights and responsibilities as a driver. Be honest and cooperative with your insurance company. And, if you have any concerns, don’t hesitate to talk to an attorney. Knowing the facts about SR-1 forms can help you navigate the aftermath of an accident and protect your driving record.

Expert Answers

What happens if my insurance company files an SR-1 form?

If your insurance company files an SR-1 form, it means they are reporting the accident to the state. This can impact your insurance rates and driving record.

Can I dispute an SR-1 form?

Yes, you can dispute an SR-1 form if you believe it contains inaccurate information. You’ll need to provide evidence to support your claim.

How long does an SR-1 form stay on my record?

The length of time an SR-1 form stays on your record varies by state. It can range from 3 to 5 years.

Does filing an SR-1 form affect my ability to get insurance?

Yes, an SR-1 form can make it more difficult to get insurance, especially if you have multiple accidents on your record. Insurance companies may consider you a higher risk and charge you higher premiums.