Epic stocks, they’re the stuff of legends, the unicorns of the financial world. They’re not just any old stock, they’re the ones that make headlines, break records, and leave investors saying, “I told you so!” They’re the companies that not only dominate their industries, but also shape the future of entire markets.

But how do you spot an epic stock before it takes off? What kind of moves can you make to capitalize on their explosive growth? And what risks should you be aware of? Buckle up, because we’re about to dive into the world of epic stocks and explore the strategies, risks, and rewards of riding the wave of these market titans.

Epic Stock Strategies

Epic stocks are companies that have the potential to grow exponentially, creating massive returns for investors. While they carry higher risk than traditional investments, their potential rewards can be significant. To leverage epic stocks effectively, investors need to employ specific strategies and manage their risk carefully.

Strategies for Leveraging Epic Stocks

Epic stocks often represent companies in emerging sectors with disruptive technologies or business models. These companies are characterized by rapid growth, innovation, and the potential to capture significant market share. To leverage epic stocks, investors can use various strategies, including:

- Growth Investing: Focus on companies with high growth potential, often in sectors like technology, healthcare, and renewable energy. This approach involves identifying companies with strong fundamentals, such as increasing revenue, expanding market share, and a solid track record of innovation.

- Value Investing: Look for undervalued companies with strong fundamentals that are currently trading below their intrinsic value. This strategy involves identifying companies with strong earnings, robust cash flow, and a competitive advantage in their industry.

- Momentum Investing: Identify stocks that are experiencing a strong upward price trend. This strategy focuses on identifying companies with positive news flow, strong earnings, and a growing investor base.

- Long-Term Investing: Adopt a long-term perspective, investing in epic stocks for the long haul, potentially for years or even decades. This strategy allows investors to ride out short-term market fluctuations and benefit from the long-term growth potential of these companies.

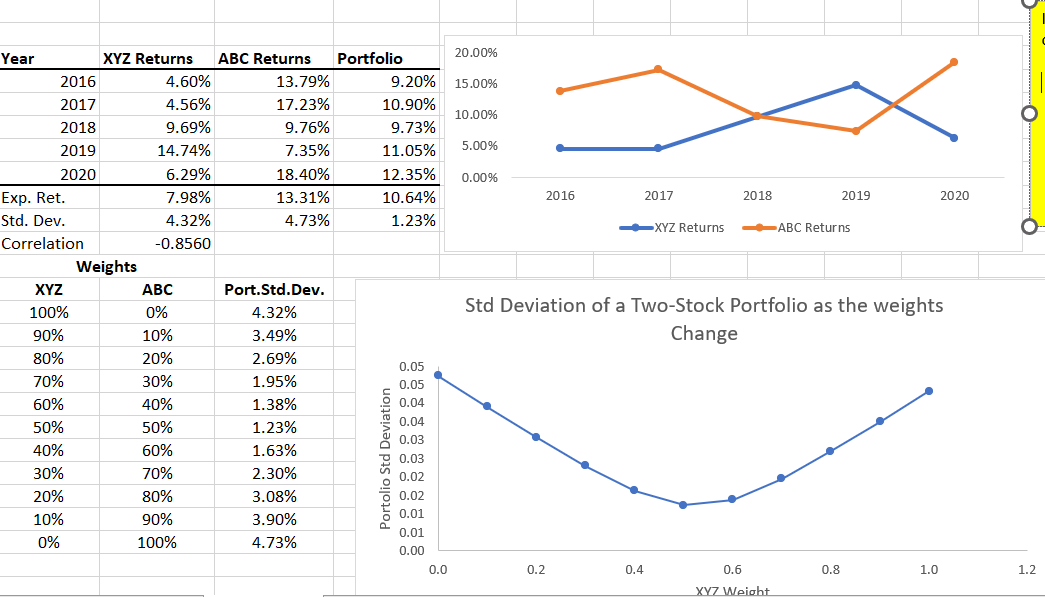

Portfolio Allocation Strategies

Incorporating epic stocks into a portfolio requires a strategic approach to risk management. Investors should consider the following:

- Diversification: Allocate a portion of the portfolio to epic stocks while maintaining a diversified portfolio across different asset classes, sectors, and geographic regions. This helps mitigate risk and reduce the impact of potential losses in any single sector.

- Risk Tolerance: Assess individual risk tolerance and allocate capital accordingly. Investors with a higher risk tolerance may allocate a larger portion of their portfolio to epic stocks, while those with a lower risk tolerance may choose a smaller allocation.

- Time Horizon: Consider the investment time horizon. Epic stocks typically require a longer time horizon to realize their full potential. Investors with a shorter time horizon may be better suited to more conservative investments.

Hypothetical Case Study, Epic stock

Imagine an investor with a long-term investment horizon and a moderate risk tolerance. They decide to allocate 10% of their portfolio to epic stocks, focusing on companies in the electric vehicle (EV) sector. They identify two companies:

- Company A: A well-established EV manufacturer with a strong brand, established supply chain, and growing market share.

- Company B: A newer EV startup with innovative technology, a strong focus on sustainability, and a growing customer base.

The investor decides to allocate 5% of their portfolio to each company, recognizing that Company A carries less risk due to its established position, while Company B offers higher growth potential. They monitor both companies closely, evaluating their financial performance, market share, and innovation. They also consider the broader EV market trends and potential disruptions to their investments.

Epic Stock Risks

Investing in epic stocks, while potentially rewarding, comes with its fair share of risks. These risks can be significant and should be carefully considered before making any investment decisions.

Common Pitfalls to Avoid

Understanding common pitfalls is crucial for navigating the world of epic stocks effectively. These pitfalls can lead to significant losses if not addressed proactively.

- Overvaluation: Epic stocks often experience rapid price increases due to hype and speculation. This can lead to overvaluation, making the stock price unsustainable in the long run. A classic example is the dot-com bubble of the late 1990s, where many internet companies saw their stock prices skyrocket, only to crash dramatically when the bubble burst.

- Competition: The epic stock market is highly competitive, with new players constantly entering the scene. Established companies may face fierce competition from disruptors, leading to market share erosion and reduced profitability. For instance, the rise of streaming services like Netflix and Amazon Prime Video has significantly impacted traditional cable television providers.

- Regulatory Risks: Governments and regulatory bodies often intervene in rapidly growing sectors to address concerns about consumer protection, competition, or other issues. This can lead to changes in regulations that negatively impact epic stock companies. For example, the rise of social media platforms has led to increased scrutiny and regulations regarding data privacy and content moderation.

- Execution Risk: Epic companies often operate in uncharted territory, facing challenges in executing their ambitious plans. They may struggle to scale their operations, manage rapid growth, or navigate complex technological advancements. For instance, many promising startups fail to achieve their goals due to poor execution, inadequate funding, or unforeseen technical hurdles.

Final Conclusion

In the end, investing in epic stocks is a game of high stakes and high rewards. It requires a keen eye for opportunity, a stomach for risk, and a bit of luck. But for those who are willing to do their homework, take calculated risks, and hold onto their conviction, the potential for epic returns is undeniable. So, keep your eyes peeled, stay informed, and who knows, you might just be the next one to discover the next epic stock that changes the game.

Quick FAQs

What are some examples of epic stocks?

Think of companies like Apple, Amazon, Google, Tesla, and Microsoft. These are just a few examples of companies that have achieved epic status through innovation, growth, and market dominance.

Is it too late to invest in epic stocks?

It’s never too late to invest in a company with strong fundamentals and growth potential. However, timing the market is difficult, and you should always do your own research and invest based on your own risk tolerance.

What are the biggest risks associated with epic stocks?

One of the biggest risks is valuation. Epic stocks often trade at high valuations, making them vulnerable to market corrections or changes in investor sentiment. It’s also important to be aware of the risk of competition, technological disruption, and regulatory changes.